How Much Does Pmi Cost

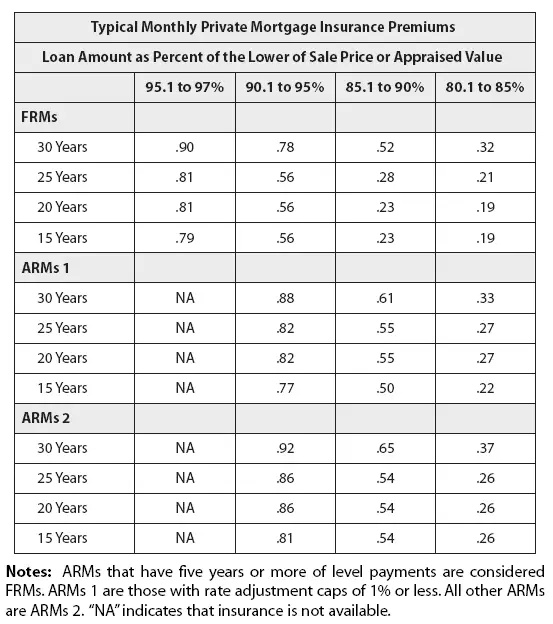

PMI rates on average can range from0.55% to 2.25% of the original loan amount. At those rates, for a $300,000 30-year fixed rate mortgage, PMI would cost anywhere from $1,650 to $6,750 per year, or approximately $137.50 to $562.50 per month. PMI can be paid upfront or it is included in the monthly mortgage payments.

Fha Mortgage Insurance Premium

If you cant qualify for a conventional loan product, you might consider an FHA loan. Like some conventional loan products, FHA loans have a low-down payment optionas little as 3.5% downand more relaxed credit requirements.

Lenders require mortgage insurance for all FHA loans, which are paid in two parts: an up-front mortgage insurance premium, or UFMIP, and an annual mortgage insurance premium, or annual MIP. Both costs are listed on the first page of your loan estimate and closing disclosure.

What Is The Ltv Ratio

The LTV or loan to value ratio is the portion of the value of the house that you are borrowing through a mortgage. In other words, the percentage of your homes value that is financed by the mortgage.

Example – Imagine that you want to purchase a house that costs $100,000 and you can only afford to make a 10% down payment. What is your LTV ratio?

Down Payment = 10% * House Price = 10% * $100,000 = $10,000

Mortgage Amount = House Price Down Payment = $100,000 – $10,000 = $90,000

LTV ratio = Mortgage Amount /Home Value = $90,000/ $100,000 = 90%

You pass the halfway point of your mortgage term – On a 30-year mortgage, for example, PMI must be removed 15 years into the loan. This is true even if the mortgage balance exceeds 78% of the original purchase price of the house.

You refinance your mortgage –The last way to get rid of PMI is torefinance your mortgagesuch that the new loan balance is less than 80% of the homes current value. This will allow you to avoid paying PMI after the refinancing of the mortgage.

Don’t Miss: How Much Mortgage Can I Afford With 100k Salary

Can You Negotiate Out Of Pmi

Whether you have an FHA loan or a conventional loan, mortgage insurance is ordinarily not negotiable. With conventional loans, your PMI rate is partially dependent on your credit, so optimizing your credit score may lower your payments. Otherwise, mortgage insurance is automatically determined based on your loan amount, loan term, and LTV.

Read Also: What Car Loan Can I Afford Calculator

How Do You Calculate Mortgage Default Insurance

To understand how mortgage default insurance is calculated and paid for quickly, watch the video below. Scroll down further for more details on the calcultions.

Lets say you just purchased a home for $300,000 and made a $40,000 down payment. Your mortgage default insurance premium would be calculated as follows:

Recommended Reading: Can I Sell My House Back To The Mortgage Company

How Can You Calculate Monthly Pmi

If you plan to make all your PMI payments monthly, find your annual cost and divide by 12 months.

Estimate your PMI: Find your LTV and credit score range

| Base LTV |

|---|

| 0.38â0.44% |

| PMI is based on your overall loan amount. |

Say you have a $200,000 loan. With a 96.5% LTV and a 705 credit score, you can expect to pay between $1,980 and $2,420 in PMI per year.

| Note: If you pay PMI using a split-premium plan, youâll pay part of your premiums at closing and the rest through monthly payments. |

How Does Mip Work

If you have an FHA loan, you pay a portion of the premium up front at the close of the loan and then continue to pay mortgage insurance premiums on a monthly basis. The upfront premium is always 1.75% of the loan amount. If you cant afford to pay this at closing, it can be financed into your loan amount.

In addition to the upfront premium, theres an annual premium thats based on your loan type as well as your down payment or equity amount. If you have a standard FHA loan with a 3.5% down payment on a loan of no more than $625,500, the annual MIP is 0.85% broken into monthly payments.

If you have an FHA Streamline where you go from one FHA loan to another for the purpose of lowering your rate and/or changing your term, the MIP rates are a little better. In this case, theres an upfront rate of 0.01% of your loan amount and an annual MIP rate of 0.55%.

Don’t Miss: What Is The Average 20 Year Fixed Mortgage Rate

How Long Do You Have To Buy Private Mortgage Insurance

Borrowers can request that monthly mortgage insurance payments be eliminated once the loan-to-value ratio drops below 80%. Once the mortgageâs LTV ratio falls to 78%, the lender must automatically cancel PMI as long as youâre current on your mortgage. That happens when your down payment, plus the loan principal youâve paid off, equals 22% of the homeâs purchase price. This cancellation is a requirement of the federal Homeowners Protection Act, even if your homes market value has gone down.

Read Also: What Is The Maximum Fha Loan Amount In Texas

How To Calculate Mortgage Insurance

This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status. This article has been viewed 362,183 times.

Private mortgage insurance is insurance that protects a lender in the event that a borrower defaults on a conventional home loan. Mortgage insurance is usually required when the down payment on a home is less than 20 percent of the loan amount. Monthly mortgage insurance payments are usually added into the buyer’s monthly payments.

Read Also: What Is The Interest Rate On A Reverse Mortgage Loan

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

How Much Is Private Mortgage Insurance

Private mortgage insurance costs vary by loan program . But in general, the cost of PMI is about 0.5-1.5% of the loan amount per year. This is broken into monthly installments and added to your monthly mortgage payment.

So for a $250,000 loan, mortgage insurance would cost around $1,250-$3,750 annually or $100-315 per month.

Some mortgage types also charge an upfront mortgage insurance fee, which can often be rolled into the loan balance so you do not have to pay it at closing.

Recommended Reading: Can I Borrow Extra On My Mortgage For Furniture

Getting Your Loan Reduced

Since your monthly fee is based on a percentage, as your loan amount decreases your monthly amount will go down as well. That being said, the actual loan factor, the percentage, will remain consistent. As well, in mortgage insurance, theres a law that says mortgage insurance has to be removed when the loan amount reaches 78% of the original value, which usually occurs around year 12.

Thats the basic nuts and bolts of PMI.

If you have any questions about this or if you have any questions youd like us to answer on our podcast, you can email your questions to or give us a call at . Be sure to ask us for a free quote on your next mortgage. Well personally work with you and help you through the whole process.

Thanks for listening and reading the Mortgage Brothers Show. Let us know if you have any questions youd like us to answer on this podcast. You can email your questions to or .

Be sure to ask us for a free quote on your next mortgage. Well personally work with you and help you through the whole process.

Signature Home Loans LLC does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Signature Home Loans NMLS 1007154, NMLS #210917 and 1618695. Equal housing lender.

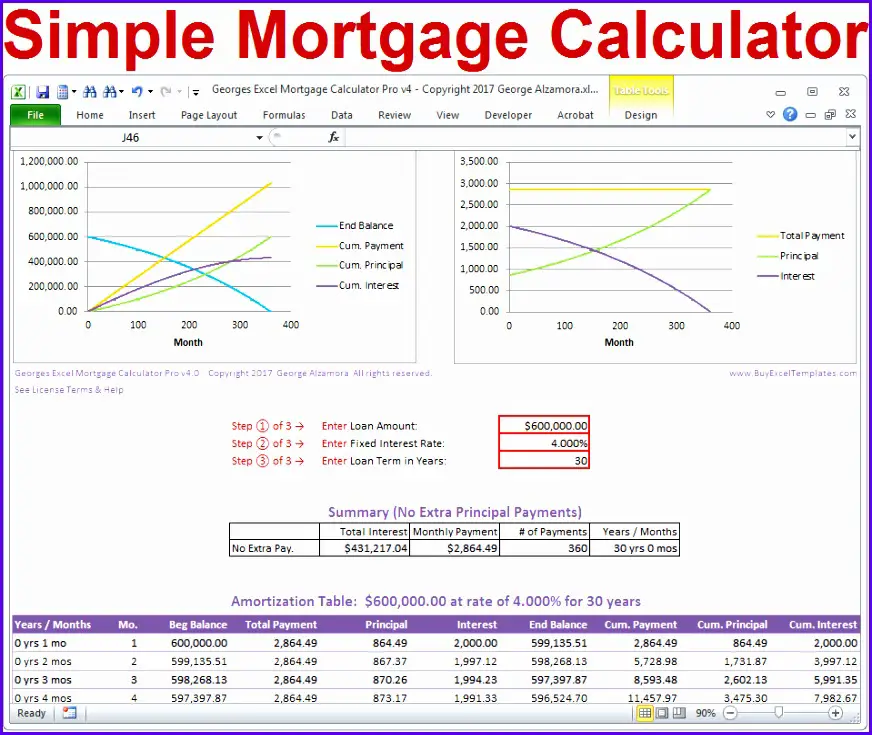

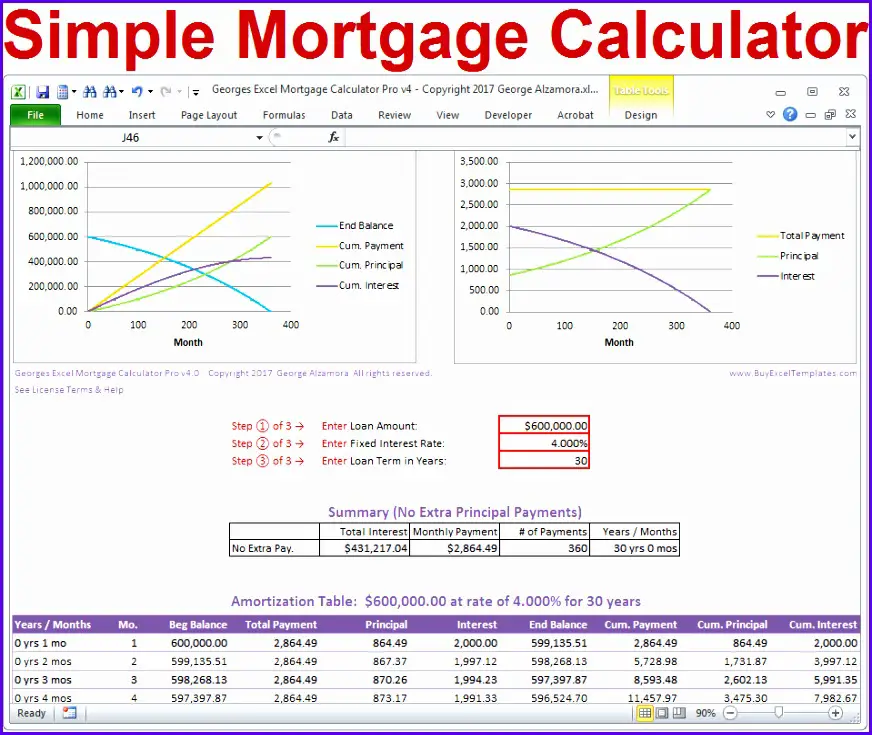

How The Pmi Calculator Works

NerdWallets PMI calculator uses your home price, down payment, mortgage interest rate, mortgage insurance rate and loan term to estimate the cost of PMI.

Many borrowers dont mind paying PMI if it means they can buy a house sooner. But if the added cost of PMI pushes you over your monthly budget, you may want to shop in a lower price range or postpone homebuying until your financial situation improves.

Read Also: How Can I Remove Pmi From My Fha Mortgage

Pay Down Your Mortgage

The federal Homeowners Protection Act provides rights for homebuyers over the termination of PMI payments. But it does not apply to FHA and USDA loans and isnt needed for VA ones.

Under that law, your PMI payment obligations must automatically terminate when your mortgage balance is scheduled to reach 78% of the original valuation of your home. The only condition is that your payments must be current at that time.

This has nothing to do with rising home prices. Its your homes original appraised value on purchase thats used. And the date is exactly predictable: You can find it on your amortization table.

You can also request in writing that PMI payments stop when that figure reaches 80%. But that earlier cancellation brings some extra conditions that dont apply to automatic terminations at 78%. These include:A good payment history.No second mortgages. So no home equity loan or home equity line of credit .You may be asked for a fresh appraisal to confirm that your home hasnt lost value since you bought it.

If your PMI payments are a burden, your payments are up to date and you can fulfill those conditions, it may be worth the hassle of making your application.

What Is Private Mortgage Insurance

Private mortgage insurance is designed to protect a lender in case of a default on the loan. It is generally required by the creditor in case the borrower has less than 20% down payment percent from the home price, which means it is mandatory when the loan amount divided by the property value is greater than 80.00%.

Our PMI calculator takes account of the LTV ratio explained below.

You May Like: Where To Buy Mortgage Insurance

Is There Any Advantage To Paying Pmi

Paying PMI comes with one major benefit: the ability to buy a home without waiting to save up for a 20 percent down payment. Home prices are continuing to climb, hitting an all-time high of more than $353,000 for an existing property as of October 2021, according to the National Association of Realtors. A 20 percent down payment at that price would be more than $70,000, which can seem like an impossible figure for many first-time homebuyers.

Instead of waiting while saving, paying PMI allows you to stop renting sooner. Homeownership is generally an effective long-term wealth-building tool, so owning your own property as soon as possible allows you to start building equity sooner, and your net worth will expand as home prices rise. If home prices in your area rise at a percentage thats higher than what youre paying for PMI, then your monthly premiums are helping you get a positive return on your investment on your home purchase.

Calculating Your Mortgage Payment

Redfin’s mortgage calculator estimates your monthly mortgage payment based on a number of factors. Your mortgage payment includes your principal and interest, , loan term, homeowners insurance, property taxes, and HOA fees. This gives you the ability to compare a number of different home loan scenarios and how it will impact your budget.

Also Check: What Are The 3 Types Of Mortgages

How To Estimate Pmi

To calculate your PMI, ask your lender for your PMI percentage or use the range listed below. Then follow these steps:

- Identify the property value. You can get the exact figure from a recent appraisal or estimate it by using the amount you plan to offer for the house.

- Find the total loan amount. To estimate your PMI for a refinance, start with your current mortgage balance. For a new mortgage, subtract your down payment from the home price.

- Calculate the LTV. Divide the loan amount by the property value. Then multiply by 100 to get the percentage. If the result is 80% or lower, your PMI is 0%, which means you don’t have to pay PMI. If it’s higher than 80%, move on to the next step.

- Estimate your annual PMI premium. Take the PMI percentage your lender provided and multiply it by the total loan amount. If you don’t know your PMI percentage, calculate for the high and low ends of the standard range. Use 0.22% to figure out the low end and use 2.25% to calculate the high end of the range. The result is your annual premium. To estimate your monthly premium, divide the result by 12.

Increase Your Down Payment

The smaller the amount of your mortgage, the smaller your monthly payments. If youre able to put at least 20% of the home price towards yourdown payment, youll be able to avoid PMI. Even if you cant afford a complete 20% down payment, boosting your down payment will help you get PMI removed sooner. In fact, boosting your down payment by 5% can lower your monthly PMI fees.

Don’t Miss: How To Get A Mortgage With Bad Credit

Private Mortgage Insurance Companies

MGIC Mortgage Guaranty Insurance Corporation

MGIC is a subsidiary of MGIC Investment Group and it provides private mortgage insurance to lenders of home mortgages across the U.S. The company offers primary coverage and pool insurance. Primary coverage gives the opportunity to people to become homeowners with less than 20% down payment and protects the lender against default. Pool insurance covers losses that are bigger than claim payments in the case of default. MGIC currently operates in all the states of the U.S., Puerto Rico, and Guam. MGIC is one of the largest private mortgage insurance companies which has more than 20% share in the market of PMI providers.

Radian Guaranty Inc.

Radian Guaranty Inc is the primary subsidiary of Radian Group. The subsidiary is in the business of providing private mortgage insurance to lenders and offers various mortgage, real estate, and title services. Radian Guaranty Inc. provides PMI on first-lien mortgage accounts and pool insurance. Currently, Radian works with more than 3,500 residential lenders to make homeownership possible for Americans. Its revenues account for half of the total revenues of its parent company.

Essent Guaranty Inc.

National Mortgage Insurance Corporation

Fhas Mortgage Insurance Premium Through The Years

The FHA has changed its MIP multiple times in recent years. Each time the FHA raised its MIP, FHA loans became more expensive for borrowers. Each increase also meant some prospective borrowers werenât able to qualify for or afford the higher monthly mortgage payments due to the MIP.

In January 2015, the FHA reversed course and cut its MIP to 0.85 percent for new 30-year, fixed-rate loans with less than 5 percent down. The FHA projected that this decrease would save new FHA borrowers $900 per year, or $75 per month, on average. The actual savings for individual borrowers depends on the type of property they own or purchase, their loan term, loan amount and down payment percentage.

Changes in FHAâs MIP apply only to new loans. Borrowers whoâve closed their loans donât need to worry that their MIP will get more expensive later.

Recommended Reading: What Is Coe In Mortgage

View Affordability From Two Perspectives:

- Your overallmonthly paymentswhich included household expenses,mortgage payment, home insurance, property taxes, auto loans and any other financial considerations

- How lenders determine what you can afford. Just like lenders, our Affordability Calculator looks at your Debt-to-Income Ratio to determine what home price you can afford.

Should I Pay Off My Pmi Early

Its very important that you cancel your mortgage insurance as soon as you can because the savings can be significant for your monthly payments. Lets take our previous example of a $300,000 loan amount and assume this is a one-unit primary property. Recall that you can request mortgage insurance termination when you reach 20% equity and it auto cancels at 22% equity.

On a 30-year fixed loan there are nine payments between the time you cross the 20% threshold and when the payments would auto cancel after breaking through the 22% barrier. If you had a mortgage insurance rate that was 0.5% of your loan amount, your savings would be $1,125. If you had a 1% mortgage insurance rate, you would save $2,250 in mortgage insurance payments over those 9 months.

Also Check: What Mortgage Rate With 650 Credit Score

Why Pmi Is Required

If a borrower defaults on their home loan, its assumed the lender will be set back about 20% of the homes purchase price.

If you put down 20%, that makes up for the lenders potential loss if your loan defaults and goes into foreclosure. Put down less than 20%, and the lender is likely to lose money if the loan goes bad.

Thats why mortgage lenders charge insurance on conventional loans with less than 20% down.

The cost of PMI covers that extra loss margin for the lender. If you ever default on your loan, the lender will receive a lump sum from the mortgage insurer to cover its losses.