How Long Does It Take To Be Prequalified#

It depends on the lender, but it can be a very quick process, particularly if you go online in some cases, you can become prequalified in as little as an hour. Youll likely need to wait a few days to receive the prequalification letter, however, and bear in mind that your prequalified status will usually expire after 90 days if its lapsed, youll need to go through the process again.

What Is The Difference Between Preapproved And Prequalified

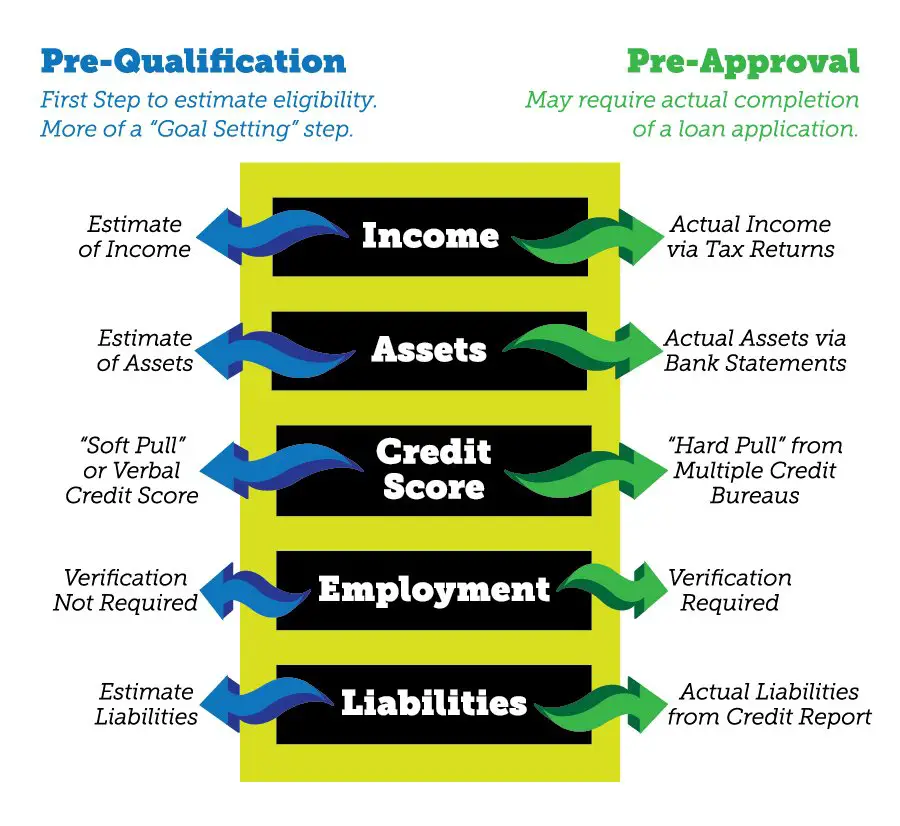

Getting prequalified for a loan is easier than receiving a preapproval, which also means prequalification means less to home sellers regarding your ability to get the mortgage.

Prequalifying involves submitting some basic financial info and getting your credit checked to get a general idea of whether you can get a mortgage, how much you could borrow, and the interest rate.

For a preapproval, lenders will do a deeper dive into your financial situation and will require more documentation of the financial details you provide as well as a formal loan application. Preapprovals hold more weight and are more useful when trying to buy a home.

Whats The Difference Between Mortgage Prequalification Vs Preapproval

Quick quiz: Youre thinking of buying a home Whats the first thing you do?

A. Look online for open houses you can tour

B. Find a real estate agent

C. Talk to a loan officer

The answer is C and not just because were a bank. A loan officer helps pin down your financial profile and supports you in taking the first steps toward home ownership by getting you pre-qualified or pre-approved for a mortgage.

Read Also: What Are The Fees For A Reverse Mortgage

What Do You Need To Get Pre

To get pre-approved, youll need to provide the lender with supporting financial documents. This differs from the pre-qualification process in that the lender will take a much closer look into your financial profile before offering you a mortgage loan.

Heres a snapshot of what you need to get pre-approved versus pre-qualified:

| Pre-Qualification Requirements | |

| Financial documentation required | |

| Down payment amount | Down payment amount |

The above snapshot isnt one-size-fits-all. Lenders may differ in what documents they require and what tools they use in the pre-approval process.

For example, some lenders may require a paper application and actual signatures, while others may offer a more streamlined approach with an online application and e-signatures.

Mortgage Preapproval Requires A Credit Check Proof Of 30 Days Worth Of Income Bank Accounts And The Statements From The Same Bank W

Buyers need to provide specific documentation of the claims and estimates they made in the prequalification process once they advance to preapproval. First, theyll consent to a credit check. Beyond that, supporting documents will provide a clear picture of the buyers financial health. Pay stubs for at least 30 days, sometimes 60, lead the list so that lenders can verify income. If the buyer is self-employed, the lender may require more documentation of income. A listing of bank accounts and statements for those bank accounts will be required. This feels invasive for many buyers: Why should they share their banking transactions with strangers? Because those strangers are preparing to lend the buyer a significant amount of money, the lender is entitled to see how the buyer manages their finances: Does the account sink to $10 before each new paycheck? Do large amounts of money transfer in and then out? This information is legitimately important when assessing a buyers likelihood to pay back a loan, so uncomfortable or not, the buyer must provide the information. Rounding out the list is a copy of the buyers W-2 tax statement for the previous year.

Some lenders will require more, depending on the buyers situation. If the buyer already owns another property, the lender will require copies of the mortgage documents or titles of those properties. A list of other assets and a list of monthly expenses not included elsewhere in the application package may also be required.

Don’t Miss: Can You Remove Someone’s Name From A Mortgage Without Refinancing

Preapproval Vs Prequalification Differences

The difference between being prequalified and preapproved is verification. Prequalifying for a mortgage means a loan provider has stated you are likely to be able to purchase a home based on the statements you made about your finances and credit. On the other hand, a preapproval is a much stronger indication of your ability to buy a home.

When seeking a mortgage preapproval the mortgage provider verifies the information provided by the borrower. This means the borrower needs to provide documentation to support his or her declared finances and income. Additionally, the lender will do a credit check.

When deciding whether to be prequalified or preapproved for a mortgage, aim for preapproval.

Should I Get Preapproved Or Prequalified For A Mortgage

Many people want to know is it better to be preapproved or prequalified? The answer depends on your goals.

A mortgage preapproval is better if you are actively searching for a home to purchase. If you intend to begin making offers on possible homes you should be preapproved. Home sellers want to see preapproved buyers.

However, if you are several months out from actively searching for and making offers on homes getting prequalified is probably sufficient. Preapprovals do not last forever. By getting preapproved now but delaying your home search you are just setting yourself up to have to do the work all over again in the future.

Read Also: Is 5.25 A Good Mortgage Rate

What Is Prequalify For Home Loan

Pre-qualifying for a home loan or a mortgage is the first step in the mortgage approval process. Pre-qualifying is simply the act of contacting a home loan or mortgage provider and giving them your basic financial information.

Pre-qualifying is an excellent way to work quickly with a lender to get an idea on what is possible for you. It is a low-investment act on your part. First, it is free. Second, get pre-qualified for a loan doesnt take very long at all. When you go to prequalify mortgage lenders will ask you some basic questions about your finances, credit, and current income or employment.

When you prequalify for a mortgage loan you will generally get three pieces of information.

Pre-qualifying is not the same as a pre-approval. Pre-qualifying is usually just a conversation with a mortgage provider, and none of your information is usually verified. Some people skip the pre-qualification step instead opting to move right to pre-approval.

Q: What Does Fully Underwritten Pre

Fully underwritten pre-approval is the most secure type of pre-approval it is essentially a guarantee from your lender that your loan will be approved once you make an offer on a house within your pre-approved budget.

If a buyer has underwritten pre-approval, it may help them appear more attractive to home sellers and able to close on a faster timeline.

You May Like: How Much Are Second Mortgage Rates

Secure Your Mortgage And Start Shopping For Your Next Home

Securing a home loan may seem complicated, but were here to help you every step of the way. Whether youre pre-qualified, pre-approved, or still at the starting line, youll want to secure the representation of a REALTOR® you can trust. Begin your home buying process by reaching out to Edina Realty or your agent today.

This information is provided for informational purposes only and does not constitute tax, or financial advice.All first mortgage products are provided by Prosperity Home Mortgage, LLC dba Edina Realty Mortgage. 275-1762. Prosperity Home Mortgage, LLC products may not be available in all areas. Not all borrowers will qualify. Licensed by the NJ Department of Banking and Insurance. Licensed by the Delaware State Bank Commissioner. Also licensed in AL, AR, AZ, CO, CT, DC, FL, GA, IL, IN, KS, KY, LA, MA, MD, MI, MN, MO, MS, MT, NC, ND, NE, NH, OH, OK, OR, PA, RI, SC, SD, TN, TX, VA, WA, WI, WV and WY.NMLS #75164 ©2021 Prosperity Home Mortgage, LLC dba Edina Realty Mortgage. All Rights Reserved. Expires 01-2022

Should You Get Mortgage Pre

If you are serious about buying a home and have strong credit, low debt, high income, and a solid overall financial history, you can most likely skip the pre-qualification step and apply directly for pre-approval.

On the flip side, if you dont have great credit, significant debts, and unstable income, you may want to consider pre-qualification first to see if you will qualify for a loan. Skipping the pre-qualification step could mean a lot of wasted time and money , only to learn that you do not qualify for a mortgage.

Recommended Reading: What Do Points Mean On A Mortgage Refinance

Do Preapproval And Prequalification Offers Impact Credit Score

With credit cards, neither prequalification nor preapproval offers will impact your credit scores because with either process, if there’s a credit check, the credit check usually results in a soft inquiry. Auto loans and mortgages are different, however, and will typically result in a hard inquiry on your credit that may hurt your credit scores. Fortunately, if it does, it’s often a small impact that only lasts for a few months.

Also keep in mind that if you’re rate-shopping for an auto or home loan, credit scoring models will treat all hard inquiries as one if made in a 14-day period . So assuming you shop your loans in a short period of time, your credit will suffer little, if any, damage.

Does Mortgage Preapproval Affect Your Credit

A mortgage preapproval results in a hard inquiry on your credit report and can lower your credit score by a few points. This shouldnt deter you from shopping around to secure the best rate, though. The score impact is only temporary, and credit scoring models recognize hard credit pulls that are a result of applying with multiple lenders to secure the best possible rate . Mortgage inquiries that occur within a brief time period are consequently combined into one inquiry, which helps to minimize score effects. The FICO® Score models merge inquiries made within a 45-day window, and the VantageScore® model allows you two weeks to get rate shopping done.

So, youre free to explore what different lenders can offer you without fear of ruining your credit score. You can also opt for a prequalification instead of a preapproval to get a more basic idea of which lenders might be best.

You May Like: How Much Does A Loan Officer Make On A Mortgage

Why A Strong Pre

Sellers are always looking to select the strongest offer possible. No seller wants to go through the frustration of accepting an offer, and then have the deal fall through because the buyer couldnt secure proper financing. This is why so many home sellers favor cash: its a sure thing.

Say a home seller is assessing three offers. Two of the offers are from buyers with pre-qualification letters, and one buyer has gone through the pre-approval process. Theres a good chance the seller will choose the pre-approved buyer, because theyve already had their financials assessed. This takes an unknown out of the equation and gives the seller more certainty in closing the deal.

How Long Does Your Preapproval Last

You should wait to start the preapproval process until you feel youre ready to find a new home for you and your family. Generally speaking, youll have 90 days from the date the preapproval goes through to find and make an offer on a home while locking in the promised interest rate.

In fact, you may have to go through the entire preapproval process again if you wait too long. In a hot market, which aptly describes most of Washington state, you need to be prepared to move quickly and make offers on homes that meet your criteria before someone else does.

The beauty of the preapproval process is that it allows you to shop for your dream home with greater confidence and far less uncertainty than many others who hit the housing market without the document in hand.

Also Check: Can You Get A Mortgage With A Bankruptcy

Recommended Reading: Is It Better To Get Pre Approved For A Mortgage

Two Words That You Might Hear Frequently At The Beginning Stages Of Your Loan Search Are Preapproval And Prequalification

Both preapproval and prequalification can give you an estimate of how much you may ultimately be approved to borrow. But whats the difference between them?

In short, not much and any differences depend on each lenders process and definitions.

Learn more about what these terms mean, and how getting prequalified or preapproved can help when youre in the market for a loan.

Can I Opt Out Of Credit Card And Loan Offers

If you’re receiving prescreened credit or insurance offers, you can opt out for a five-year period or permanently by calling or visiting OptOutPrescreen.com. It can take up to 65 days for you to stop receiving these offers once you opt out.

Opting out will stop offers sent based on information in your , but it won’t stop all forms of prescreened offers. For example, some companies send offers based on marketing lists or mass mailings to residents of certain areas. You may be able to opt out of those lists by directly contacting the company that sent you the offer.

Also Check: What Does Points Mean Mortgage

What Is The Difference Between Pre

The primary difference between pre-approval and pre-qualification in real estate is that pre-approval helps buyers know the mortgage amount they will most likely qualify for, whereas pre-qualification just provides buyers with a very rough estimate.

Also, depending on the mortgage lender, pre-approval typically has a fee involved. Pre-qualification, on the other hand, is free. Some lenders may waive the pre-approval fee to attract new buyers, while others may roll the pre-approval fee into the buyers closing costs. Prior to submitting an application for pre-approval to a mortgage lender, it is strongly advised that you obtain a detailed list of all applicable fees. It is also advised to ask your mortgage lender if the pre-approval fee is refundable, as some lenders will not refund the application fee is you choose to walk away from the deal. On average, most mortgage lenders application fees typically range between $300 to $400.

What Is A Mortgage Prequalification

A mortgage prequalification is a quick estimate of how much home you can probably afford.

Why is it a quick estimate? Because, honestly, you dont need to do much to get one. All you need is your name, phone number, and some numbers that show your income, assets and debts. Give these to your lender over the phone, online or in personand theyll give you a prequalification on the spot.

Recommended Reading: What Is A Prepayment Penalty On A Mortgage

Is It Better To Be Preapproved Or Prequalified

If youre ready to buy a house, theres no question a preapproval is the only option. Sellers dont accept pre-qualifications since those are just estimates of what you can afford.

A pre-qual isnt official, and it may not even include a letter. But, if you are just starting the process and wondering how much you can afford or what program youd be eligible for, a pre-qualification can be fine. It depends on the lender.

When youre ready to look at homes, its best to take that next step and get preapproved. If youve already been prequalified, you know what program you fit into.

All you need to do is provide your qualifying documents for the underwriter to review to turn the pre-qualification into a preapproval.

> > More: How to Choose the Best Mortgage Loan

Whats The Difference Between Pre

Pre-approval is a more in-depth process where lenders verify your credit and financial information before giving you a detailed loan estimate. Pre-qualification relies on self-reported information without taking any additional verification steps.

Heres a side-by-side comparison:

| Pre-Qualification | |

| Self-reported information used but not verified | |

| Can be useful in determining your home budget | Is more accurate for budgeting and is required to make a serious offer on a home |

As you can see, pre-qualification doesnt consider any verified documentation, meaning it doesnt get you any closer to getting a mortgage.

However, pre-approval means more to sellers, as it requires lenders to verify your financial information and approve you the buyer for a mortgage. Plus, it will pinpoint your home-buying budget.

The end goal is to get a full mortgage approval, not a full mortgage qualification. We always advise starting with a pre-approval because they are more accurate, give you more information, and are part of the mortgage process.

Pre-approvals mean more to sellers and allow you to fast-forward the mortgage process when you find a home you love.

Get pre-approved for a mortgage today.

Don’t Miss: How Much Do Banks Give For Mortgages

How Do I Get A Mortgage Pre

– Pre-Qualification Online:

Most lenders will allow buyers to complete the pre-qualification process online. If you prefer to complete the process over the phone or in-person, many will accommodate that as well. To complete the pre-qualification process online, research the lender you would like to work with. On their website, they should have a pre-qualification form that you will need to fill out.

– Pre-Approval Online:

Because pre-approval is a more rigorous process, some lenders may require that you submit the documentation in-person. If that is a deal-breaker for you, it is important to ask the lender if pre-approval can be completed online prior to working with them. If you are unsure where to find a trusted lender, your real estate agent, friends, or family may have some lender recommendations they can provide.

When Is The Best Time To Get A Mortgage Preapproval

The same as with mortgage prequalification, the best time to get a mortgage preapproval is when youre ready to start shopping for a house. In fact, were going to let you in on a little secretyou can skip prequalification and go straight for preapproval.

When you receive your preapproval, keep one important fact in mind: Your lender will likely approve you for way more money than you should consider spending on a home. Stick with these two guidelines and youll have a home you can truly afford, while you work toward bigger financial goals like saving for retirement or paying for your kids college:

Youll be tempted to look at more expensive homes, especially when you see how much your lender thinks you can afford. But a huge mortgage payment will ultimately make your home a curse, not the blessing it should be.

Read Also: How Do You Get A 2nd Mortgage