With Mortgage Rates Rising Is It Now Cheaper To Rent Or Buy

The latest figures show that the average tenant across the UK is currently paying £1,143 per month to rent within the private rental sector. With mortgage rates accelerating at terrifying speed, does this now mean that renting is the more financially viable option?

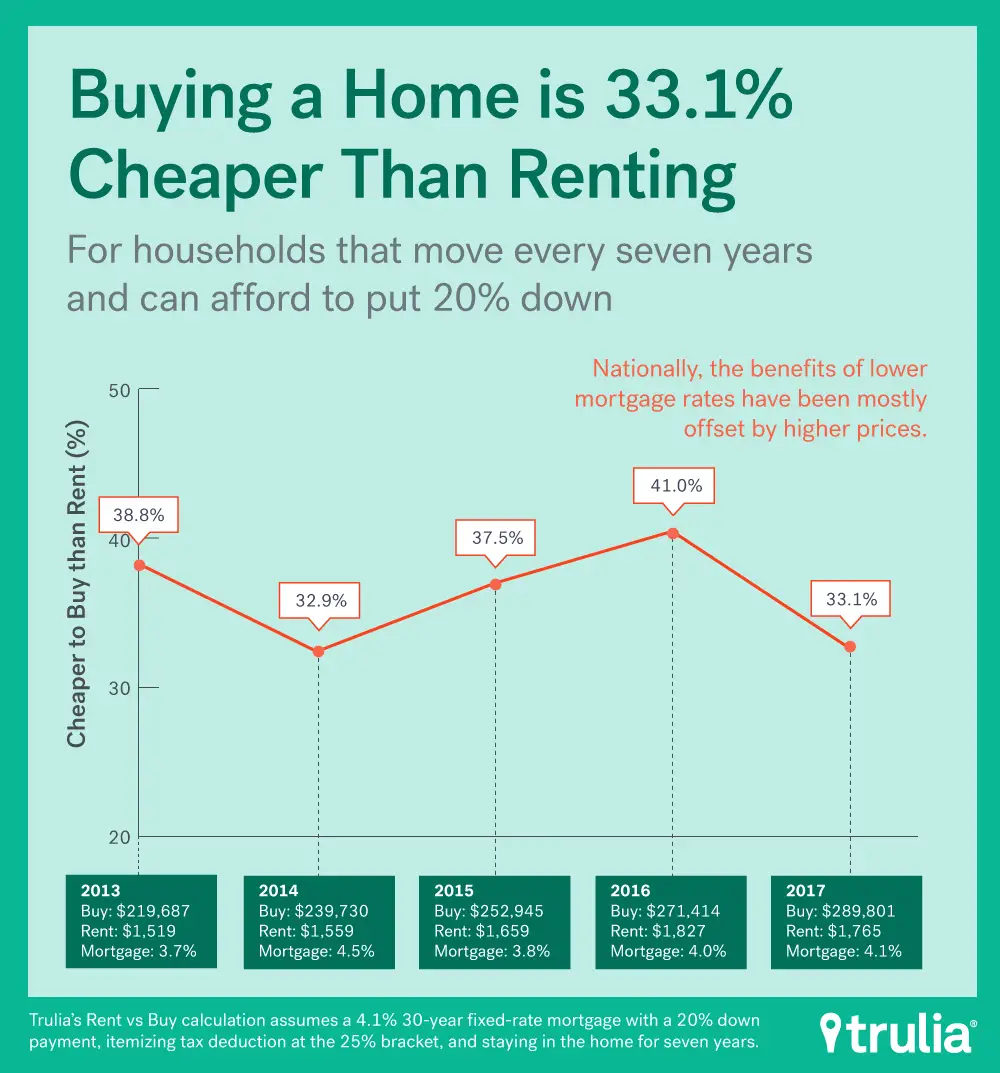

According to research by mortgage experts, Revolution Brokers, the short answer is no. Despite the increasing cost of borrowing currently hitting homebuyers across the property market, it still remains less expensive to buy when compared to the cost of renting.

Revolution Brokers looked at the current cost of buying in todays market, both with respect to a full mortgage repayment and an interest-only repayment plan and how this cost compares to those still residing within the private rental sector.

While renters currently pay an average of £1,143 per month to rent within the PRS, average homebuyers currently looking to buy with a variable rate mortgage at a 75% loan to value and an average rate of 4.45%, the cost of a full mortgage repayment comes in at £1,223 per month, marginally more than the cost of renting.

However, those who are only making interest-only payments on their mortgage each month are currently paying an average of £829 per month – 27.5% less than the current cost of renting.

But with the average mortgage rate predicted to hit 6%, could renting soon become the better option?

Bonus: Reasons You May Want To Pay Rent Instead Of A Mortgage Payment

Of course, buying a home isnt the best option for everyone. Depending on your situation, renting may actually be a better choice than buying a home.

For example, if youre just starting your career and expect to move in the next few years, purchasing a home might not make sense. If you have bad credit or dont have enough funds for a down payment, now may not be the right time. You also may be paying far less in rent than you would for a mortgage payment, so the longer you wait, the more money you could potentially save for a down payment.

Finally, housing market fluctuations may mean youre fine with renting for a longer period of time and waiting for the market to cool off before you overpay for a home.

Remember, renting can come with benefits, too .

However, if your goal is to own a home one day, now is a great time to prepare and put money aside for a future down payment.

Should I Rent Or Buy Faqs

Buying a house is expensive in the short term and involves more than just a monthly mortgage payment. You will need to be able to afford legal fees and moving costs, and once you own the property, you will be paying for maintenance and upkeep. However, if the price of the property rises, you could end up benefiting, unlike renting, where you will never own the property.

Renting isnt a waste of money if you cant afford to or are not in a position to buy a house. Purchasing a property and then not being able to keep up the mortgage repayments could end up costing you more if the house is repossessed, which can put a black mark on your credit rating for years afterwards.

Financial advisers recommend considering your home as an asset – one that can save you money, rather than being an investment that makes money. For example, one reason many people choose to buy their home is so that they dont end up paying rent in later life. Owning your own home can mean you have an asset that can be used to help fund your retirement. You can also sell it, downsize and invest any money you may make.

Unless you are a professional landlord, any property you own and live in is an asset, not an investment. The most important consideration is whether you can afford to pay your mortgage.

Buying a property is a long-term investment, but it can often work out cheaper than renting for 20 to 25 years, the normal length of a mortgage term.

To buy a house, you normally will need:

Don’t Miss: How Do I Become An Underwriter For Mortgage

Should We Continue Renting

The answer for that question is increasingly Yes.

Economists are now obsessed with inflation and advising the government to push the economy into recessions to avoid bigger losses from inflation. The US money supply had grown so much that experts are saying liquidity is sloshing around in the markets like dirty water in a bath tub. Yet now the government is shrinking the balance sheet, stopping spending, and raising interest rates which actually adds to financing costs not good for homebuyers.

Housing is in short supply and theres little to suggest that housing supply in the major cities will improve. Without houses to buy, people will return to apartments to rent.

Where Are Renters Worst Off

Scotland and the North West of England have the biggest gaps between owning and renting, with renters paying an average of 22% more. The smallest gap is in Northern Ireland, where homeowners are just 3% better off.

Unsurprisingly, renters pay the biggest overall premium in London, where average rents of £1,703 dwarf ownership costs of £1,355.

The table below shows the difference in cost between owning and renting across the UK.

| Region |

Don’t Miss: What Credit Bureau Do Banks Use For Mortgage

Now Lets Add Some Utilities And Maintenance To The Equation

Renting is pretty awesome in that you arent responsible for much more than your own personal belongings.

Everything inside the unit thats bolted down is mostly the landlords problem, assuming it breaks.

For example, the landlord is on the hook if the fridge or washer/dryer malfunction, or if the HVAC system fails.

The renter simply calls the landlord and tells them it need to be fixed, on their dime.

If youre the homeowner, these problems become yours, and you better believe there will be something, each and every year.

As such, you should generally earmark a couple hundred bucks a month for potential repairs and maintenance. It could in fact be a lot more than that, but at least start there.

Then there are the monthly utilities, which may have been paid by your landlord, or perhaps baked into the rent.

As a homeowner, youre now paying for trash, water, sewer, etc. out of your own pocket each month.

Lets add another $250 a month in utilities to the mix, along with the $200 in repair/maintenance.

Were now up to $1,900 a month all in for your house, a far cry from the $1,012 you may have seen advertised.

Its nearly double the original estimated payment you saw, which made homeownership look so enticing.

And remember, that monthly payment requires a hefty $60,000 down payment. If you dont have that, expect an even higher monthly outlay, and possibly mortgage insurance as well.

Will I Be Living Alone Or With Someone Else

If you are living with a partner or someone else, you may be able to afford to borrow more if you buy a house together. Here is how to get a joint mortgage and how they work.

You could buy a house with friends instead of renting. Here are the benefits and risks of buying a home with friends, and here is how joint mortgages work.

Read Also: Where To Refinance Mortgage With Bad Credit

Advantages Of Buying A Home

There are several advantages to owning your property. One of the main ones is that your property value is likely to go up over the long term.

This means when you pay off your mortgage, you may have the option to sell and downsize when you retire.

The main advantages to buying a house include:

-

Your monthly repayments all go towards buying your home, not into a landlord’s pocket

-

You fully own your home at the end of the mortgage’s term – typically 25 years

-

You could make a profit if house prices rise

-

You dont need anyones permission to have pets or redecorate

-

Any maintenance or changes you make to your house could increase its value

-

You cant be forced to move by a landlord

-

You have an asset that can be passed on when you die

Where Homebuyers Have It Better

Those looking to buy do better in smaller cities and more rural places, while renting remains more affordable in popular suburban and urban areas, according to ATTOMs analysis of fair market rent data from the U.S. Department of Housing and Urban Development and public records sales deed data from 855 U.S. counties.

Owning is cheaper in 57% of counties with less than 500,000 residents, but once the population surpasses that benchmark buying is only the better option in 31% of areas.

In places with more than 1 million residents, home buying affordability drops even further, with only 16% of such counties beating renting costs. If youre after a home with a city atmosphere, try places like Miami, Detroit, Philadelphia, Tampa, Cleveland and Pittsburgh, where renting costs more than owning a home.

Overall, homeownership tended to be cheaper in counties throughout the Midwest and Southeast, while renting was better in the Northeast, Texas, and on the West Coast.

Below are the five most populated counties in the country where it is cheaper to buy a home than rent:

Don’t Miss: What Does A Mortgage Lawyer Do

Should I Rent Or Buy A House

11 Min Read | Dec 13, 2022

Whether you should buy or rent a house depends on your financial situation and personal goalsnothing else.

Youre ready to buy if youre debt-free, have a full emergency fund and enough cash for a down payment, and know your mortgage payment wont cost more than 25% of your take-home pay. Well talk more about that a little later.

If youre working to pay off debt or expect to move for a job, its smarter to rent. You may have heard the myth that paying rent is throwing money away each month. Its not true. Housing is an essential expense. Now, buying lottery ticketsthats tossing money out the window.

Life is all about taking control of your finances and making smart choices!

Flashback: Rent Vs Buy Back In 2007

Back in 2007, house prices were rocketing and flocks of people including first-time buyers were launching into homeownership. It turned out that buying was the worst decision and one that cost many of them dearly. An unfortunate number had their home foreclosed and went bankrupt. Was it fear of missing out that drove buying in 2007?

You can certainly use a buy vs rent calculator to calculate the liability short term or long term.

Lets not forget about cost of living increases as food, transportation, utilities, fuel, and more are rising fast. Employment is not so certain either.

Its a volatile time where employment, business success, and survival are all uncertain.

Also Check: Where Can I Apply For A Reverse Mortgage

Does Buying Really Deliver Value

There are many with an unshakable belief that a home is also a retirement savings asset, while others suggest that you cant eat a house when youre 65. Many seniors today cant sell because theres nowhere to go. In Toronto, Vancouver, or in most cities in California, buying may never make good financial sense.

Lifestyle Renters Are A Big Target Market

For the non-financial aspects, renting may offer better results. Those who need to be mobile for work, or who cant really afford an expensive home, will be better off renting.

Many of the new rental buildings offer extensive services and lifestyle benefits. Retiring Baby boomers are renting in the Chicago rental market, Miami market, Phoenix market and Las Vegas market to savor lifestyle benefits.

Working Millennials, after making their rent vs buy calculations are seeing the benefits of co-living and apartments in key neighborhoods in these cities. For California, the prospects for buying are unfortunately slim.

Whether for retirement lifestyle benefits or career benefits, many multifamily developments are catering to these groups. Read more about the new developments in Chicago and Denver.

If youre one of the many who are migrating to a new city, and have limited down payment funds, Austin, Oakland, Denver, Honolulu, Tampa, Miami, Dallas, or Charlotte, might offer better rental markets.

Read Also: When Can Pmi Be Removed From Mortgage

Five Reasons Why You May Want To Buy A House Vs Renting An Apartment

For both financial and personal reasons, you may discover that owning your own house outweighs the expenses. Here are five reasons why buying your own home might make sense:

Do I Have Enough To Pay For The Upfront Cost Of Buying A Home

Beyond the deposit, the main cost involved in buying a home is Stamp Duty. If you are a first-time buyer, you dont have to pay stamp duty if the property you are buying is under £500,000. For anyone else, stamp duty begins on properties over £125,000.

But Stamp Duty is one of several costs. There is also:

-

Valuation or survey fees – you will need to have a survey carried out of the property

-

Solicitors’ fees – the fee you pay to make sure the sale of the property is legal

-

Moving fees – you may need to hire a removal firm to move your belongings

-

Estate agent fees – if you list your property with an estate agent, you may have to pay fees

-

Mortgage fees – these are charged by a lender if you take out a mortgage

All these fees will vary, so you need to weigh up whether you can afford them.

Find out how much you may need to save to cover the other costs of buying a home.

Also Check: Should I Refinance My Jumbo Mortgage

Owning A Home Can Offer Financial Stability

Theres a certain amount of permanence to owning a home. Yes, you could decide to sell five or ten years down the road, but its not as easy as renting a new place.

That stability often translates to social, health, and community benefits for you . It provides a sense of security and safety.

Renting, on the other hand, comes with more flexibility. That can be a good thing if you arent settled in an area yet or are constantly moving as part of your career, but it can also mean uncertainty. When you rent, a landlord could raise your monthly payments or ask you to move before you wish.

With mortgages, there are no surprises. When you sign the initial paperwork, your terms and interest rates are spelled out.

Related: Dont get ripped off when buying your first home > >

What Are The Disadvantages Of Renting

Its no secret that there are plenty of downsides to renting, but lets run through them anyway in order to make a clear comparison.

- Youre paying your landlords mortgage rather than your ownEvery months rent payment goes to your landlord rather than being used to help you become a homeowner yourself and building up a potential nest egg for your future.

- You have to abide by the tenancy rulesThere are likely to be restrictions on things such as owning pets or modifying the property.

- Your rent can go up on the whim of your landlordYour monthly rent can be subject to sudden increases, which could unexpectedly impact your monthly budgeting.

- InsecurityWhen your tenancy comes to an end, your landlord may not carry you over on to the next lease or may suddenly decide to sell the property. Either way, you may have to quickly find somewhere else to live.

Read Also: What Is Better Fixed Or Adjustable Rate Mortgage

Other Considerations Before Deciding On Buying Or Renting:

- whether this is the right time to buy for you personally and emotionally do you really want to be tied down to a house and property with all the stress and responsibilities?

- will you be marrying and raising a family? can you raise children well in a high rise condo or a downscale neighborhood where you can afford to buy?

- how much house can you can afford, or can you really afford it all? purchase and rent prices are so high in cities such as San Francisco, New York, Miami, Dallas, Austin, San Antonio, Denver, Seattle, San Jose and Los Angeles for instance, it may take all your income to pay for the cheapest unit.

- how high will mortgage rates will climb can you pay your payments if they rise by 70%?

- how much other debt do you have? do you have student loans and to add to your mortgage payments?

- alternative investments what else could you invest in right now with your down payment ?

- should you buy to rent out yourself? rents are rising fast with very low vacancy rates ensuring a positive cash flow if you should rent out a portion of your house. This is a smart opportunity.