What Is The Most Affordable State For Buying A House

According toBusiness Insider, the cheapest state to buy a house is West Virginia, with a median list price of $169,000. When looking at the most affordable city to buy a house,Forbessays that Detroit, Michigan is the most affordable, with a median listing price of just $59,000. That’s well below the third-place runner up city of Toledo, Ohio, which has a median listing price of $95,000.

However, housing prices dont reflect the total cost of living in any particular state. According toUS News, Mississippi has the lowestcost of living in the United States, but it does have a slightly higher average home price at $252,725.

Your Debt And Salary Limit What You Can Afford

Besides showing you how much income you need to afford the home you want, this calculator also shows how your debts can compromise your chance for a mortgage. You can see how paying down debts directly affects your buying power. The fewer debts you have, the more of your salary can go toward the home, allowing you to afford a more expensive property. At the same time, more debts mean less money available, based on your current salary, to pay for – and qualify for – the home you want.

You can use this calculator to visualize how a higher or lower salary could change your ability to afford the home of your dreams. What if you got a raise? Or took a weekend job? You can vividly see how you could afford different homes with more income, or less.

Get Expert Advice Immediately If

- You need to borrow more than 4.5 times your annual income

- You are only using one income on your application

- You earn income through sources such as Benefits, Commission or Rental income

- You consider yourself to be on low income

If one or more of the above apply to you, its important to get expert advice before making an application. The right broker can help maximise your chances of approval based on your circumstance.

Did you knowAn Online Mortgage Advisor broker has access to more deals than any comparison site.

Also Check: How To Estimate Your Mortgage Payment

How Much Savings Should I Have Before Buying A House

This depends on how much you intend to put up as a down payment. If you pay less than 20% of the sales price, you will have to pay PMI as part of your monthly repayments. You will also need to pay for mortgage closing costs. Its a good idea to have at least $3,000 to $10,000 saved up to cover these costs or unexpected expenses along the way.

How Much Do You Need To Qualify For The Biggest Mortgage

However, in order to qualify for the lowest mortgage rates and, thus, the largest loan amount you must also have a high credit score, few debts, and a substantial down payment. Most mortgage doors will be open to you if you have all of these variables in place and a yearly income of $100,000 or more.

Dont Miss: 10 Year Treasury Yield And Mortgage Rates

Read Also: Why Are Condo Mortgage Rates Higher

How Much Home Can I Afford If I Make 100k A Year

If you make $100,000 per year, you can afford a house worth between $350,000 and $500,000.

Again, the overall price will depend on many factors, such as your credit score, savings, current interest rates, monthly expenses, and other debts.

Instead of asking how much house can I afford with a 100k salary, ask yourself how much you can afford to spend on your monthly mortgage payment. This will give you a better idea of the price range you should be looking at.

What Your Monthly Mortgage Payment Includes

Once you get approved for a mortgage, youâll find out what your monthly payment will be. Mortgage payments consist of four parts:

- Principal. This is the amount that you borrow to purchase the home, and itâs paid off over the life of the loan

- Interest. This is the percentage that you pay to the mortgage lender in exchange for lending you the money. The interest amount you pay decreases over the life of the loan as you pay down the principal

- Taxes. Homeowners are required to pay property taxes, which are based on a percentage of the property value. Taxes vary from place to place and may change every year

- Insurance. Lenders require homeowners insurance to protect your home. You may also owe mortgage insurance, depending on your down payment amount and the type of loan youâre using to buy the home

If you buy a home in a community with a homeowners association , those fees will also be factored into your monthly mortgage payment. All of these thing will impact how much house you can afford on $100k a year.

You May Like: How To Determine What You Qualify For A Mortgage

Multiply Your Annual Income By 25

In this rule of thumb, you begin with your gross annual income. Thats the income from your W-2 . Multiply this number by 2.5 to estimate the maximum value of the home you can afford. However, keep in mind that the lower the interest rate you can obtain, the higher the home value you can afford on the same income. This is why your credit score is so important. Lets take a look at a few examples.

How much house can I afford if I make $50K per year?

On a 50k salary, how much mortgage could you afford? According to this rule of thumb, you could afford $125,000 . Lets say you have a 4.5 percent interest rate and choose a 30-year mortgage. Your monthly mortgage payment would be $633. With interest, youd pay a grand total of $228,008.

How much house can I afford if I make $70K per year?

Lets look at a mortgage on 70k salary. Assuming the same 4.5 percent interest rate and a 30-year term, you could afford a mortgage of $175,000 . This translates into $887 per month, totaling $319,212 after 30 years.

How much house can I afford if I make $100K per year?

If youre wondering with 100k salary how much house can I afford, the 2.5 rule gives you a mortgage of $250,000. Using a 4.5 percent interest rate and a 30-year term, this translates into $1267 monthly, which equals $456,017 over 30 years.

How much house can I afford if I make $200K per year?

Also Check: What Can I Do To Lower My Mortgage Payments

How Much Of A Down Payment Do You Need For A House

A 20% down payment is standard, if you can afford it. Though some mortgage loans may only require as little as 3.5 percent down, or none at all, a larger down payment will have a greater impact on your monthly mortgage payment.Your down payment effectively reduces the total amount of your home loan, which increases your home affordability estimate, and at the same time, decreases your mortgage payment each month. For example, below is a chart showing how a certain level of down payments, based on a percentage of the sale price, directly impacts your monthly mortgage payment :

| Percentage |

|---|

List out your expenses and then add them together to get your total monthly spending.

Don’t Miss: What Credit Score Do I Need For A Mortgage

Is It Worth Buying Expensive Car

Quality and Worth: It is true that the value of a car depreciates with time and mileage. However, the resale value of luxury cars depreciates at a steady pace than new average or above-average cars. Also, the trust that luxury car brands, like Audi and BMW, have gained makes them a personal favourite of many.

What Determines How Much House You Can Afford

Mortgage lenders do a deep dive into your personal finances when you apply for a home loan, they use that information to determine how much they will lend you for purchasing a home.

Lenders require you to show proof of income and typically verify your employment. They also factor in your creditworthiness and how many assets you have, such as savings and investment accounts that can go toward your down payment.

So how much house you can afford when you earn $100,000 a year varies from person to person. The only way to know for sure how much you can afford is to get preapproved by a lender.

But you can get a ballpark idea by plugging your income, down payment, and other details into a home affordability calculator like the one below.

Here are factors that determine how much home you can afford on $100,000 a year.

You May Like: Can You Write Off Points On A Mortgage

Why Affordability Matters

Unless you can pay cash for a house, youll rely on a mortgage lender to cover the expense. Youll then have to pay that lender for 15 or 30 years, depending on the terms you choose.

Read more: 15-year mortgages vs. 30-year mortgages: how to choose

As with any loan, mortgage lenders like to keep their risk low. Youll complete an application and wait for approval, and that approval will typically limit your loan to a certain amount. This limit is based on various factors, including your credit score and debt-to-income ratio .

But even if a lender says youre approved for a $500,000 or $1 million house, that doesnt mean you should go for it. You also need to look at what you can reasonably afford to pay each month.

Thats where the three rules of home affordability can help out.

Understand The 28/36 Rule

Lenders may determine your ability to afford a new home by using the 28/36 rule. This rule states that:

- Housing expenses should be no more than 28% of your total pre-tax income. This includes your monthly principal and mortgage interest rate, home insurance, annual property taxes, and private mortgage insurance payments .

- Total debt should not exceed 36% of your total pre-tax income. This includes the housing expenses mentioned above as well as credit cards, car loans, personal loans, and student loans, so long as these monthly debt payments are expected to continue for 10 months or more. This does not include other monthly expenses such as groceries, gas or your current rent payments.

In concrete numbers, the 28/36 rule means that a borrower who makes $5,000 a month should not spend more than $1,400 on housing costs every month.

If youre a renter making $5,000 a month, its a good rule of thumb to spend a maximum of $1,400 on rent. However, for a homeowner making the same amount, $1,400 should cover your monthly mortgage payment, as well as homeowners insurance premiums and property taxes.

You May Like: Is It Hard To Get Approved For A Second Mortgage

Ugh This Is Making My Head Hurt

Yup. Mortgages arent fun. Still, a house is one of, if not the, most expensive thing youll ever spend money on so its best to give it a ton of consideration. Being saddled with an unruly mortgage will affect you for years and years. To that end, the more thought you give it now, the less worry youll have later. So remember, the question isnt just How much mortgage can I afford? but How much mortgage do I want? for the long term.

More from SmartAsset

Improve The Dti Ratio

Most mortgage lenders will offer loans to borrowers with a low DTI ratio. Maintain your DTI at 36% when applying for a mortgage loan. However, the strategy can be difficult if you are dealing with many debts.

If debts are hampering your efforts to get a good mortgage, try:

- Consolidating your debts into a single payment to improve your credit score and lower the debt interest rate, reducing your monthly expenses.

- Increasing your income so you have more money left over, even after making your monthly debt payments.

Also Check: Can You Get A Mortgage With Less Than 20 Down

How Much House Can I Afford With A Conventional Loan

If you are taking out a conventional loan and you put down less than 20%, private mortgage insurance will take up part of your monthly budget. The PMIs cost will vary based on your lender, how much money you end up putting down, as well as your credit score. It is calculated as a percentage of your total loan amount, and usually ranges between 0.58% and 1.86%.

What You Need To Know About Buying A House On A $100k Salary

Not only does your salary affect how much you can borrow in a mortgage, it also impacts the types of loans you can take out.

Income limits on mortgage programs

Some programs, such as the zero-down USDA mortgage, have income limits on who can qualify.

In most parts of the country, income cannot be more than $86,850 to take out a USDA loan. But in areas with high home values, that limit increases to $212,550.

Note that these limits apply to household income, not just that of the borrower. If you earn $50,000 a year and your spouse earns $40,000, youd be disqualified from the USDA program because your combined income exceeds $86,850.

Fannie Maes HomeReady loan and Freddie Macs Home possible loan both of which allow 3% down also enforce income limits.

Income limits for down payment assistance

Earning $100k a year can also put you out of bounds for some down payment assistance programs.

There are many DPA programs across the country, including at the state and local level, so eligibility criteria varies from place to place.

But some programs cap assistance at a certain income threshold. So if you were counting on DPA to help you buy a home, make sure you know the requirements before factoring that into your plan.

There are loan limits to consider, too

One final word on limits. Even if you apply for a conventional loan that doesnt have income limits, your homes value cannot exceed a certain amount of money known as conforming loan limits.

Also Check: What Do You Need To Refinance Your Mortgage

Loan Limits To Consider

Even conventional loans without income limits may have a cap on the home value you can purchasethese are conforming loan limits.

The federal government sets these limits annually. A mortgage exceeding the limits are jumbo mortgage and does not receive a government guarantee. The limit for most counties is just above $647,000, but it increases to $970,800 in some high-cost areas.

How To Calculate Your Home Affordability

There are several methods for figuring out your home affordability. The easiest way is to enter your information into our calculator above. Our home affordability calculator works with either your debt-to-income ratio or your proposed housing budget.

For the first method, youll need your gross monthly income and monthly debts for the second, youll need your desired monthly payment amount. Both methods will require your down payment amount, state, credit rating, and home loan type.

Once youve input all the information according to the method you chose, our calculator will let you know the maximum amount you can pay for a house, as well as your estimated monthly payment.

You May Like: Will A Cosigner Help Me Get A Higher Mortgage

How Much House Can I Afford 100k Salary

Asked by: Nicole Lemke I

When attempting to determine how much mortgage you can afford, a general guideline is to multiply your income by at least 2.5 or 3 to get an idea of the maximum housing price you can afford. If you earn approximately $100,000, the maximum price you would be able to afford would be roughly $300,000.

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

You May Like: What’s The Longest Mortgage You Can Get

How Much Income Do I Need To Buy A $400k Home

This answer isnt just about your income. Your interest rate and your plans for a down payment play an important role. For example, if youre planning to secure an FHA loan and put down 3.5 percent on a $400,000 home, youll need to earn just over $102,000 per year for a 30-year mortgage with a 5 percent interest rate.

If youre sitting on the money you need for a 20 percent down payment, your income needs look a lot different. For example, if you can put down $80,000 and lock in a 4.75 percent interest rate on a 30-year mortgage, you only need to earn $78,000 per year.

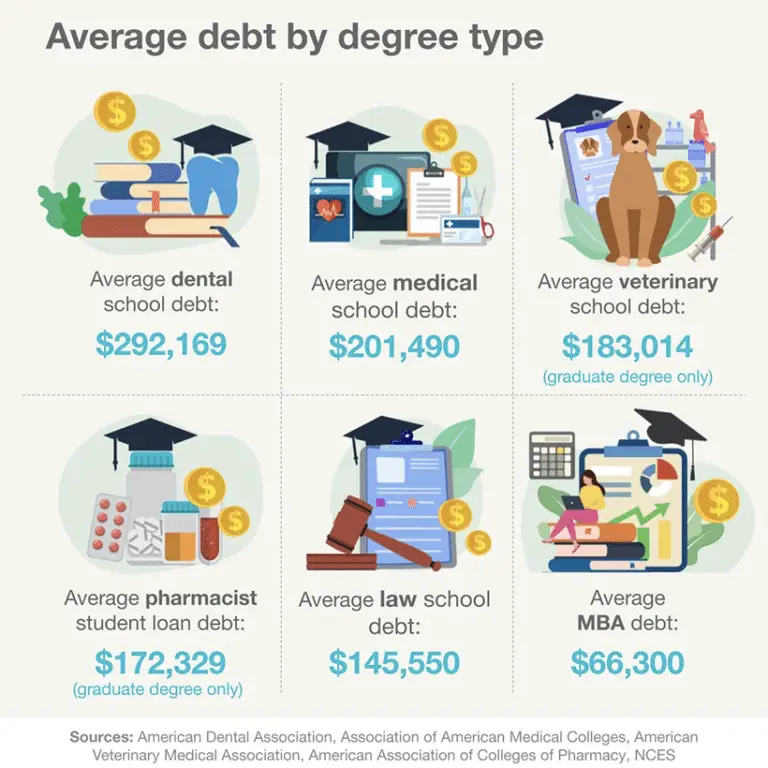

Your Maximum Monthly Debt Payments

Finally, your total debt payments, including your housing, auto, or student loan, and credit cards, should not exceed 40% of your gross monthly income.

In the above example, the couple with an $80k income could not have total monthly debt payments exceeding $2,667. If, say, they paid $500 per month in other debt , their monthly mortgage payment would be capped at $2,167.

This rule means that if you have a big car payment or a lot of credit card debt, you wont be able to afford as much in mortgage payments. In many cases, banks wont approve a mortgage until you reduce or eliminate some or all other debt.

Read Also: What Percentage Of Income Towards Mortgage