Can You Get A Home Mortgage Loan Without A Credit Score

The answer is, yes! If you apply for a mortgage without a credit score, youll need to go through a process called manual underwriting. Manual underwriting simply means youll be asked to provide additional paperworklike paystubs and bank statementsfor the underwriter to review. This is so they can evaluate your ability to repay a loan. Your loan process may take a little longer, but buying a home without the strain of extra debt is worth it! Keep in mind, not having a credit score is different than having a low credit score. A low credit score means you have debt, but having no credit score means you dont like debt!

Mortgage Payment Frequency Example

Let’s compare mortgage payment frequencies by looking at a $500,000 mortgage in Ontario with a 25-year amortization, and assume that it has a fixed mortgage rate of 1.5% for a 5-year term.

The monthly mortgage payment would be $2,000. Now, lets see how much it would be with semi-monthly, bi-weekly, and weekly mortgage payments.

Average Monthly Payments On A Mortgage

How much should you pay on a mortgage each week or month? Of course, it depends on the size of the mortgage, your deposit, the house value and your own incomings and outgoings.

Its really important to make sure you budget, and check you can afford your own repayments our mortgage affordability calculator can help you out.

Read Also: Can You Get A Mortgage On Disability

Principal And Interest: Mortgage Payment Basics

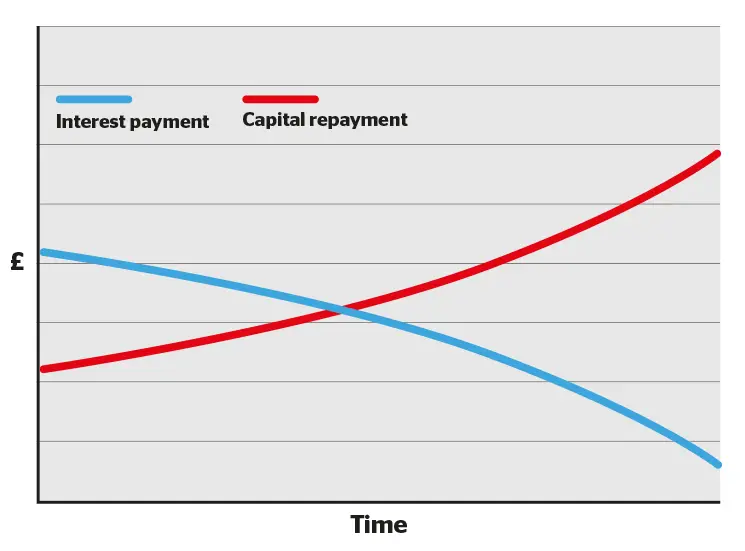

There are two basic components that make up every mortgage payment: principal and interest. The principal is the amount of funding borrowed for your home loan, and the interest is the money paid monthly for use of the loan. Understanding both principal and interest can help you choose the best mortgage option for you.

In this article, well share everything you need to know about principal and interest. Well cover the differences between the two and help you determine what you owe, or will pay, on your mortgage. Keep in mind, there may be other expenses that could find their way into your monthly payment as well.

Monthly Payments For A $100000 Mortgage

When you buy a house, your monthly mortgage payments go toward both your loan balance and other costs, like interest, insurance, and taxes.

Generally speaking, you can expect your monthly payment to cover:

- Principal: This is part of your payment that goes straight toward your loan balance. Due to how loans are amortized, you usually pay less toward your principal at the beginning of your loans life and more at the end of it.

- Interest: Interest is what you pay the lender for borrowing the funds, and youll pay more toward this cost at the start of your loan than at the end of it. Your interest rate will determine how much youll pay here.

- Escrow costs: Escrow accounts are often used to store funds for future home insurance premiums, property taxes, and mortgage insurance. Your servicer will then use that money later when those bills come due.

Assuming principal and interest only, the monthly payment on a $100,000 loan with an of 3% would come out to $421.60 on a 30-year term and $690.58 on a 15-year one.

Credible is here to help with your pre-approval. Answer a few quick questions below to get started.

Heres a breakdown of what the monthly payments principal and interest only would look like on a $100,000 mortgage with varying interest rates:

| Annual Percentage Rate |

|---|

Recommended Reading: How To Qualify For More Money For A Mortgage

Your Down Payment Determines The Amount Of Cmhc Insurance You Pay

Your CMHC insurance premium, calculated as a percent of your mortgage amount, gets smaller as you increase your down payment. To learn more about CMHC insurance and how it is calculated, please visit our CMHC insurance page.

| Down Payment |

|---|

| 5% – 9.99% |

| Total Payments over 25 Years | $402,726 | $377,991 |

|---|

Under Scenario B, the additional $15,000 put towards the mortgage down payment lowers CMHC insurance by $2,423 and saves the homebuyer around $25,000 in interest over the life of the mortgage. However, it is also important to consider the opportunity cost, or alternative uses for the additional outlay under Scenario B. You must look at your expected returns associated with RRSP contributions, stock investments, and/or debt repayments, for example, to make an informed decision.

Average Total Cost Including Interest Of A Mortgage

When you think about your mortgage repayments, youll probably see it as paying for your home. But actually a lot of the money goes towards paying the interest.

This is for two reasons.

One, mortgages are for large sums of money, so the interest charges, especially when you first take out a mortgage, are large. For the same interest percentage rate, larger sums of money get higher interest charges than smaller sums.

Two, mortgages last for many years, so the interest has a long time to grow.

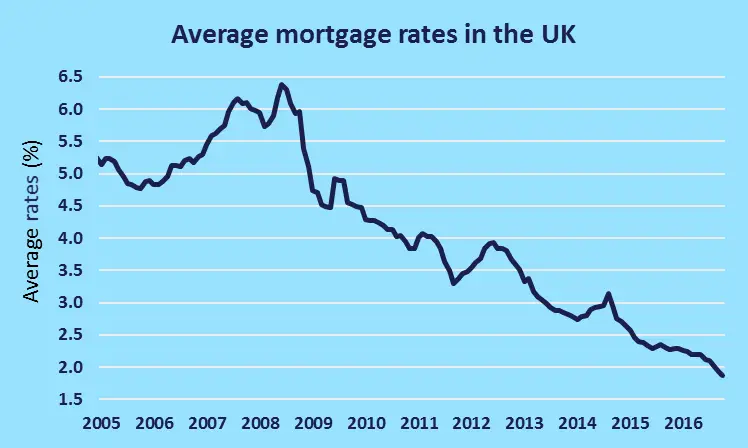

Thats why the interest rate is so important, and why a shorter mortgage can be better. But, no matter the deal you get, lots of your money will be spent on the interest on your mortgage.

Heres an example.

The average UK house price is ££255,535 according to HM Land Registry. If you had one of the average interest rates, say 3.53% for a Standard Variable Rate , heres how your mortgage costs would work out over a 25-year mortgage.

House price:£255,535

Total amount repaid: £327,570Total paid in interest:£72,035

In these examples, the interest totals are worked out as if the interest stays the same. In real life, the interest rates on your mortgage could go up every time you remortgage so every 2, 3 or 5 years, depending on when you change. If you dont get a new mortgage, the interest rate will reset to the Standard Variable Rate. All this means that in real life, the total amount you repay on your mortgage could be tens of thousands of pounds higher.

Also Check: What Can I Do To Lower My Mortgage Payments

How Much Does The Average Mortgage Cost

Knowing when youve got a good mortgage deal is hard, isnt it? Every house is different, every households income and outcomes are differentbut if you know some of the average costs and interest rates when it comes to mortgages, youd at least have a start.

So, thats what weve gone away and done collected some averages and written up some pointers to help you decide how to manage your mortgage.

What Are Mortgage Statements

A mortgage statement outlines important information about your mortgage. Mortgage statements are usually an annual statement, with it being sent out by mail between January and March rather than once every month. You may also choose to receive your mortgage statement online.

For example, TD only produces mortgage statements annually in January, while CIBC produces them between January and March. If you have an annual mortgage statement, it will usually be dated December 31. You may also request a mortgage statement to be sent.

Information on a mortgage statement are up to the end of your statement period and include:

- Current interest rate

Don’t Miss: What Is The Current Trend In Mortgage Rates

Loan Deposit And Credit Records

Most borrowers that qualify for financing save substantial funds for deposit. They also have a good credit history showing on-time payments without large outstanding balances. In the fourth quarter of 2020, only 0.37% of mortgages from borrowers with impaired credit history were approved by lenders.

What is Loan-to-value Ratio?

LTV stands for loan-to-value. Its a ratio that compares the size of the loan against the value of the dwelling.

For example, if you saved a £50,000 deposit for a £200,000 home, your loan amount would be £150,000. To calculate the LTV ratio, divide £150,000 by £200,000. In this example, the LTV ratio is 75%.

In the fourth quarter of 2020, a tiny 0.16% of gross advances went to loans with an LTV over 95%. Meanwhile, 1.06% went to loans with an LTV between 90% and 95%. An estimated 38.76% of advances were granted to loans between 75% and 90% LTV, while 60.02% of gross advances went to loans with an LTV below 75%.

Lenders prefer to extend credit to borrowers with relatively low LTV values. If a borrower obtained funding at 100% LTV, any weakness in the local property market could expose the lender to outright potential losses. For this reason, borrowers in the highest LTV quartile may pay 1% APR higher than borrowers in the lower half of the market.

Average Mortgage Interest Rates

When it comes to mortgages, as with any loan, the interest rate is one of the most important factors. Unlike most other loans though, mortgages are very big often theyll be the biggest loan youll ever take out in your life.

There are also different types of mortgage, which makes getting the average mortgage interest rate a little tricky.

Statista has a useful graph showing the most up to date mortgage rates depending on if you are going for a fixed or variable mortgage.

Loan to value is the relationship between the current value of the property that the mortgage is paying for, and the actual amount the mortgage is. The mortgage value divided by the property value = LTV. Dont be scared of the maths, pull out your phone or use the Which? LTV calculator.

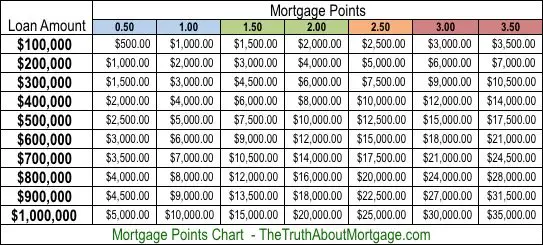

You also need to think about mortgage fees, which can be anything from £500 to £2,000 or more. Some mortgage providers will let you add the fees to the mortgage itself. This means you dont need to shell out the money when you first get the mortgage.

The con of doing this though is that the interest then applies to the fee, so you end up paying more overall, as well as more per month. Our advice: pay the fees upfront.

You May Like: What Is Rocket Mortgage Interest Rate

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.

What Controls A Variable Interest Rate

Variable interest rates change based on your lendersprime rate, which is controlled by your lender. If your lender increases their prime rate, then your variable interest rate will increase.

Lenders will usually only change prime rates to match movements in theBank of Canadas policy interest rate. If the lenders funding cost increases, such as through the Bank of Canada increasing their policy rate, then the lender will in turn increase variable mortgage rates. Prime rates are generally similar or identical between different lenders, with all Canadian banks currently having a prime rate of 2.45% as of July 2021.

Yourvariable mortgage rateis priced at a discount or a premium to your lenders prime rate.

Recommended Reading: What Changes Mortgage Interest Rates

What Percentage Of Your Income Should Go Towards Your Mortgage

Your salary makes up a big part in determining how much house you can afford. On one hand, you may want to see how much you could afford with your current salary. Or, you may want to figure out how much income you need to afford the house you really want. Either way, this guide will help you determine how much of your income you should put toward your mortgage payments every month.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: What Are Current 20 Year Mortgage Rates

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

Keep Your Payments The Same When Changing Your Mortgage

When you renew your mortgage, you may be able to get a lower interest rate.

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. Lenders call this early renewal option the blend-and-extend option. They do so because your old interest rate and the new terms interest rate are blended.

When your interest rate is lower, you have the option to reduce the amount of your regular payments. If you decide to keep your regular payments the same, you can pay off your mortgage faster.

Recommended Reading: How Much Do You Pay On A 30 Year Mortgage

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

How Much A $100000 Mortgage Will Cost You

A $100,000 mortgage comes with both upfront and long-term costs. Your total costs will depend on your lender, APR, and loan term.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Every mortgage comes at a cost several of them, actually. Upfront, there are your closing costs, and over the course of the loans life, theres your monthly payments, escrow costs, and finally, interest. Understanding these costs is critical before you take out a loan.

Learn more about how much a $100,000 mortgage will cost you throughout the life of the loan:

You May Like: Why Are Mortgages So Hard To Get

Mortgage Loan Calculator For Refinancing Or Home Purchase Payments

Get estimates for home loan payments to help you decide what you can afford.

This simple Mortgage Loan Calculator enables you to calculate what your monthly mortgage payments will be – including the principal, interest, property taxes and home insurance . The result you get will be relevant for a wide variety of different mortgage types. It will also display your projected repayment schedule, taking into account your principal loan amount, interest rate, and any additional prepayments you intend to make

Learn How Much Cash You May Be Able To Get Out Of Your Home

You can use the equity in your home to consolidate other debt or to fund other expenses. A cash-out refinance replaces your current mortgage for more than you currently owe, but you get the difference in cash to use as you need. This calculator may help you decide if it’s something worth considering, and give you a possible idea of a mortgage rate you might have after refinancing.

Don’t Miss: How Much Second Mortgage Can I Afford