How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

Early Renewal Option: Blend

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. If you choose this option, you dont have to pay a prepayment penalty. Lenders call this option the blend-and-extend, because your old interest rate and the new terms interest rate are blended. You may need to pay administrative fees.

Your lender must tell you how it calculates your interest rate. To find the renewal option that best suits your needs, consider all the costs involved. This includes any prepayment penalty and other fees that may apply.

Cost To Break Your Mortgage Contract

The cost to break your mortgage contract depends on whether your mortgage is open or closed. An open mortgage allows you to break the contract without paying a prepayment penalty.

If you break your closed mortgage contract, you normally have to pay a prepayment penalty. This can cost thousands of dollars.

Before breaking your mortgage contract, find out if you must pay:

- a prepayment penalty and, if so, how much it will cost

- administration fees

- appraisal fees

- reinvestment fees

- a mortgage discharge fee to remove a charge on your current mortgage and register a new one

You may also have to repay any cash back you received when you got your mortgage. Cash back is an optional feature where your lender gives you a percentage of your mortgage amount in cash.

Don’t Miss: How 10 Year Treasury Affect Mortgage Rates

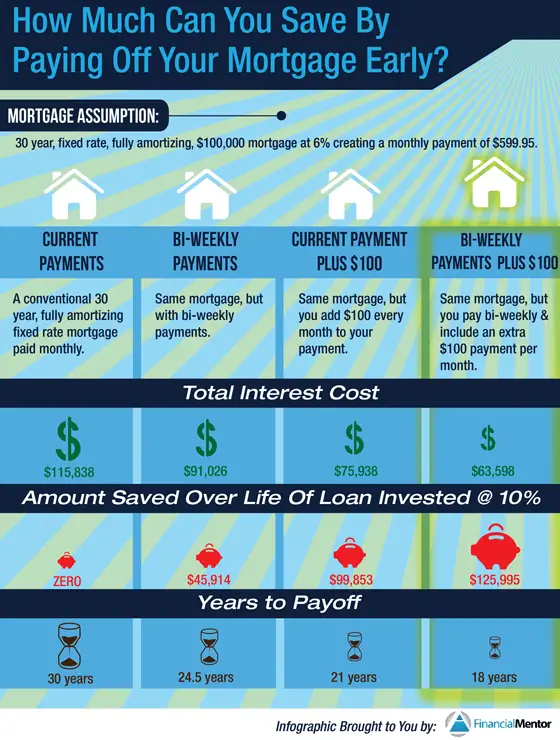

How Much Can I Save Prepaying My Mortgage

The benefit of paying additional principal on a mortgage isnt just in reducing the monthly interest expense a tiny bit at a time. It comes from paying down your outstanding loan balance with additional mortgage principal payments, which slashes the total interest youll owe over the life of the loan.

Heres an example of how prepaying saves money and time:

Kaylyn takes out a $120,000 mortgage at a 4.5 percent interest rate. The monthly mortgage principal and interest total $608.02. Heres what happens when Kaylyn makes extra mortgage payments:

| Payment method | |

|---|---|

| $89,864 | $9,024 |

Bankrates mortgage amortization schedule calculator can help you determine the impact of extra payments on your mortgage. Click Show amortization schedule to reveal the section that allows you to calculate the effect of additional payments.

Do You Pay More Interest On A 15

The average interest rate for a 30-year mortgage was around 0.51% higher than a 15-year mortgage for the past several years.1,2

One percentage point may not seem like much of a differencebut keep in mind, a 30-year mortgage has you paying that difference for twice the amount of time compared to a 15-year mortgage. Thats why the 30-year mortgage ends up being so much more expensive.

Also Check: How Can I Mortgage My House

Youll Build Equity In Your Home Faster

One way to build equity is to pay back the principal balance of your loan, rather than just the interest.

Since youre making bigger monthly payments on a 15-year mortgage, youll pay down the interest a lot faster, which means more of your payment will go to the principal every month.

On the flip side, the smaller monthly payments of a 30-year mortgage will have you paying down the interest a lot slower. So less of your monthly payment will go to the principal.

How Can I Avoid Paying Interest On My Mortgage

5. Putting little to nothing down. Most lenders require 20% down to get their best rates and avoid paying mortgage insurance an extra cost that typically adds $100 or more to your monthly payments. Although borrowers must pay the premiums, mortgage insurance protects the lender, not you.

How long does it take to pay off interest on a 30 year mortgage?

When It Ends Though interest represents a smaller share of each successive payment, youre still going to pay interest for as long as you have an outstanding mortgage balance. In other words, if you take out a 30year mortgage and make payments for the full 30 years, youll pay interest for the full 30 years, too.

Don’t Miss: How Does A 5 1 Arm Mortgage Work

What Is A Good 30

In July 2020, the average 30-year fixed mortgage rate fell below 3% for the first time since the Federal Reserve began tracking mortgage rates. Since then, rates have climbed back above 3%. So if you can qualify for a 30-year fixed rate mortgage anywhere between 3% to 3.5% youre getting a solid deal.Certain mortgages typically have higher rates, like loans for investment properties, jumbo loans, and cash-out refinance mortgages. So a slightly higher rate for one of these types of loans can still be a great deal.

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

> Related:How to buy a house with $0 down: First-time home buyer

Read Also: Can You Get A Second Mortgage With An Fha Loan

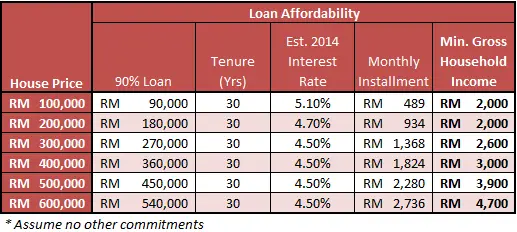

What Percentage Of Your Income Should Go Towards Your Mortgage

Your salary makes up a big part in determining how much house you can afford. On one hand, you may want to see how much you could afford with your current salary. Or, you may want to figure out how much income you need to afford the house you really want. Either way, this guide will help you determine how much of your income you should put toward your mortgage payments every month.

What Are The Drawbacks Of Prepaying My Mortgage

There are potential downsides to prepaying. For starters, tying up your cash in your home means you have less liquidity and wiggle room in your budget. In other words, youll have less readily available cash to put toward increasing your 401 contributions or paying down high-interest debt, for example. These financial goals could offer a higher return on your investment.

Another consideration is the opportunity cost of not having that extra money invested elsewhere. Over the past four decades, the stock market has returned an average of 13 percent a year.

When asking yourself, Can I prepay my mortgage? look at your entire financial picture. Here are some important questions to consider:

- Is your monthly budget tight after meeting necessary expenses?

- Is your income variable or unpredictable?

- How long do you plan to stay in your home?

- Do you have an adequate emergency savings fund of three to six months of household living expenses?

- Do you have a lot of high-interest credit cards or loans?

Assessing your financial goals, income and budget can help you decide whether it makes more sense to address other pressing financial concerns before paying ahead on your mortgage.

Don’t Miss: Is Fico Score 8 Used For Mortgages

Where To Get A $300000 Mortgage

To get a $300,000 home loan, youll want to get quotes from at least a few different lenders. Though this can be done by reaching out to each mortgage company directly, you can also use an online marketplace like Credible.

Once you receive your quotes, youll want to compare them line by line. You should look at the interest rate, total costs on closing day, any origination fees, mortgage points youre being charged, and more.

After you determine the best offer, you can move forward with that lenders application and submit any required documentation.

Credible makes the process of finding the right mortgage rate easier and more efficient. You can get tailored prequalified rates from our partner lenders simultaneously all with just one form and it only takes a few minutes.

Learn More: How to Know If You Should Buy a House

How A Mortgage Calculator Can Help

Buying a home is the largest purchase most people will make in their lifetime, so you should think carefully about how youre going to finance it. Setting a budget upfront long before you look at homes can help you avoid falling in love with a home you cant afford. Thats where a simple mortgage calculator like ours can help.

A mortgage payment includes four components that together are known as PITI : principal, interest, taxes and insurance. Many homebuyers know about these costs but are not prepared for are the hidden expenses of homeownership. These include homeowners association fees, private mortgage insurance, routine maintenance, larger utility bills and major repairs.

Read Also: What’s The Average Mortgage Payment

Taking Out A 30 Year Mortgage Over 15 Years

Buying a house is a big step. Most consumers need to take out a mortgage in order to get the house of their dreams. That loan can be draining on your bank account, and worst of all, you will be paying it off for decades. Decades of interest adds up to a lot more than the initial cost of the home. However, taking out a 30 year mortgage and paying it off over 15 years could turn a long-term financial decision into a shorter financial responsibility that costs less in the long run.

Example: Costs When You Break Your Mortgage Contract To Change Lenders

Suppose a different lender is offering you 3.75% interest. To break your mortgage contract with your current lender youll need to pay a prepayment penalty of $6,000.

You may also choose a blend-and-extend option with your current lender. This would give you a 4.6% interest rate.

Table 2: Example of costs to change lenders| Costs | |

|---|---|

| $40,350 | $38,005 |

In this example, you pay less when you choose a blend-and-extend option with your current lender.

Note that youll usually need to pay fees when you set up a new mortgage, including when you choose a blend-and-extend option. This example doesnt take into account any fees. Lenders may be willing to pay some or all of the fees. If this is the case, your costs to renegotiate your mortgage will be less.

Read Also: What Makes A Jumbo Mortgage

What Is The Average Monthly Mortgage Payment

The mean or average monthly mortgage payment for U.S. homeowners is $1,487, according to the latest American Housing Survey from the U.S. Census Bureau.

The Census also reports that the median monthly mortgage payment for U.S. homeowners is $1,200. Thats up slightly from the last study when the median monthly payment was $1,100.

How Does One Payment Matter

Making an extra payment to your mortgage is something that you should consider because it can save youthousands ofdollars. The fact is that just one payment can make a considerably difference in the total that you payforyour home and what’s more, it can shave years off of that mortgage. Take a look at the followingexample.You can use a mortgage calculator to help you to find out this information specific to your currentloan.

If you currently have a $200,000 mortgage loan and you have secured an interest rate at 6.5 percent, yourmonthlypayment is likely to be $1264 dollars per month if your loan term is 30 years. This is a considerablepaymentand you may not realize that the real facts of what you will be paying on the home you are purchasing.It willcost you far more than $200,000.

Original mortgage amount: $200,000Total interest paid on your loan: $255,088.98How much you will really pay in fullat the end of your term: $455,088.98

This information is provided to you on your amortization statement which is what you will see at the timeof closingthe sale on your home. Your lender must provide this for you before you sign your paperwork, so itshould notbe too much of a surprise to you as to how much you will pay for your home when interest is factoredinto the cost.If you are still unsure, use a mortgage calculator to help you to see what these numbers are for yourparticularsituation.

You May Like: What Are The Best Mortgage Lenders

How Much Does A Mortgage Cost Over 30 Years

Reason No. 1 to avoid a 30-year mortgage: It’s costly

| Loan Amount | Total Interest Paid with 15-Year Loan at 4% | Total Interest Paid with 30–Year Loan at 4.5% |

|---|---|---|

| $200,000 |

Moreover, what is the age limit for a 30 year mortgage?

You can be 100 years old and still get a 30–year mortgage. Everybody laughs at it, but technically that’s true. If an elderly borrower were to die before their mortgage was paid off, the estate would handle the debt. The home may need to be sold to pay off the mortgage.

Likewise, is it better to have a 20 or 30 year mortgage? The interest rate is much better than a 30 year loan: Currently a 30 year mortgage has a 4.125% rate, a 20 year mortgage has a 3.75% rate, and a 15 year mortgage has a 3.375% rate. This is a . 375% advantage that a 20 year loan has over a 30 year loan. If the amortization timelines were the same, this .

Hereof, how do you calculate a 30 year fixed mortgage?

Multiply 30 — the number of years of the loan — by the number of payments you make each year. For example, 30 X 12 = 360. You are making 360 payments over the course of the loan. Divide your mortgage interest rate by your total payments.

What does a 30 year mortgage mean?

A 30–year mortgage is a home loan that will be paid off completely in 30 years if you make every payment as scheduled. Most 30–year mortgages have a fixed rate, meaning that the interest rate and the payments stay the same for as long as you keep the mortgage.

You May Like Also

Equation For Mortgage Payments

M = P

- M = the total monthly mortgage payment

- P = the principal loan amount

- r = your monthly interest rate. Lenders provide you an annual rate so youll need to divide that figure by 12 to get the monthly rate. If your interest rate is 5%, your monthly rate would be 0.004167 .

- n = number of payments over the loans lifetime. Multiply the number of years in your loan term by 12 to get the number of total payments for your loan. For example, a 30-year fixed mortgage would have 360 payments .

This formula can help you crunch the numbers to see how much house you can afford. Using our mortgage calculator can take the work out of it for you and help you decide whether youre putting enough money down or if you can or should adjust your loan term. Its always a good idea to rate-shop with several lenders to ensure youre getting the best deal available.

You May Like: How Much Money Do Mortgage Brokers Make

How Much Principal Gets Paid Off In The First Seven Years Of A 30

The amortization schedule of a 30-year mortgage distributes the payments so that, in the early years, interest repayment is given priority over that of principal. This relationship flips over near the end of the payment term, when the priority is on principal. This is due to the calculation method of mortgage interest, which determines interest due according to the current mortgage loan balance.

Tips

-

During the first seven years of your 30-year mortgage, you can expect to pay more toward the interest on the loan then the principal.

Early Loan Repayment: A Little Goes A Long Way

One of the most common ways that people pay extra toward their mortgages is to make bi-weekly mortgage payments. Payments are made every two weeks, not just twice a month, which results in an extra mortgage payment each year. There are 26 bi-weekly periods in the year, but making only two payments a month would result in 24 payments.

Instead of paying twice a week, you can achieve the same results by adding 1/12th of your mortgage payment to your monthly payment. Over the course of the year, you will have paid the additional month. Doing so can shave four to eight years off the life of your loan, as well as tens of thousands of dollars in interest.

However, you don’t have to pay that much to make an impact. Even paying $20 or $50 extra each month can help you to pay down your mortgage faster.

Calculating Your Potential Savings

If you have a 30-year $250,000 mortgage with a 5 percent interest rate, you will pay $1,342.05 each month in principal and interest alone. You will pay $233,133.89 in interest over the course of the loan. If you pay an additional $50 per month, you will save $21,298.29 in interest over the life of the loan and pay off your loan two years and four months sooner than you would have.

You can also make one-time payments toward your principal with your yearly bonus from work, tax refunds, investment dividends or insurance payments. Any extra payment you make to your principal can help you reduce your interest payments and shorten the life of your loan.

Also Check: How Long Is The Mortgage Process