How Do I Find The Best Mortgage Rate

Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done. The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you plan on living in your home will impact your decision.

If you plan on living in your new home long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages, and being able to lock in low rates is a smart choice. But you can get lower mortgage rates with some adjustable-rate loans. So if you plan on only keeping your home for three to 10 years, then you may be able to pay less interest with an ARM.

Home Equity Lines Of Credit And Adjustable Rate Loans

The fed funds rate guides adjustable-rate loans. These include home equity lines of credit and mortgages. As the fed funds rate rises, so will the cost of these loans. Pay them down as much as you can to avoid any surprises. Since 2021 rates are low, you could talk to your bank about switching to a fixed-rate loan to protect yourself from future rate increases.

Looking For A Great Mortgage Rate

Check out the lowest mortgage rates available.

What does Canada have to do with this?

So far weve looked at what the U.S. central bank may do. But what does Canada have to do with it?

Theres an old adage that when America sneezes, Canada catches a cold. But in the financial context, a better saying might be: Where the U.S. goes, Canada tends to follow. Simply put, when interest rates in the U.S. go up or down, Canadian rates tend to follow. However, that hasnt been the case for the past few years.

Its important to distinguish between two kinds of interest rates. Theres the rates set by central banks, which are very short term in nature. But then theres the rates for longer-term investments such as bonds, which are more heavily influenced by investors. These ratesfor five- and 10-year fixed-income investmentsare still somewhat affected by what the central bank does, but they also reflect investors expectations of things like growth and inflation.

In other words, if youre wondering where Canadian mortgage rates are going, youll want to keep an eye on what the Fed are doing. But your attention should also be on the government bond market.

Now is a particularly important time to be paying attention to the bond market. Investors have piled into U.S. government bonds this year, sending yields to low levels . But lately, these yields have started to creep up a bit, suggesting that change is afoot.

Also read:

Don’t Miss: What To Watch For When Refinancing Mortgage

When Is The Right Time To Get A Mortgage

Before you apply for a mortgage, you should have a proven reliable source of income and enough saved up to cover the down payment and closing costs. If you can save at least 20% for a down payment, you can skip paying for private mortgage insurance and can qualify for better interest rates.

At the end of the day, the best time to apply is when youre ready. But there are other details to consider when timing your home purchase. Because home sales slow down during the winter, you may be able to get a better price in the spring. However, general nationwide trends wont necessarily apply to your local real estate market. To get a better sense of the nuances of your area its important to talk with local experts.

Mortgage Rates In Canada

By | Submitted On June 25, 2010

Mortgage rates in Canada have been at historic lows for quite awhile now. This helps to fuel the recovery of the Canadian economy. During the first 4 months of 2010, housing sales in Canada rose dramatically, with increases in both the average selling price and number of homes sold. The next four months over the summer were somewhat softer.

The real estate market is now becoming more balanced. There is increased inventory tempered by increased demand. The Canadian government is trying to tighten the rules to qualify for a mortgage, which caused several buyers to jump into the real estate market before the new rules went into effect. The HST tax which went into effect July 1st, caused buyers in Ontario and British Columbia to rush to buy homes. Pent up demand from the recent economic recession also spurred home sales.

Interest rates have come off their historic lows, but are still relatively low. All of the major banks in Canada are forecasting that interest rates will rise over the next 18 months. While forecasts differ as to the exact amount of an increase in mortgage rates, the consensus seems to be, that the overnight lending rate will be between 2.5% and 3.5% by the end of 2011. Fixed interest rates are also expected to rise since they are tied to bond yields. By the end of 2011, borrowers with a great credit score may be looking at a five year fixed rate of 5.36%.

You May Like: What Is Rocket Mortgage Interest Rate

United States Housing Price Index 2021

In today’s housing market, buyers are driving up property prices, leading homes to sell rapidly. Some hyperactive buyers make offers without seeing the property and forego contingencies to win bidding wars in the highly competitive housing market. The historically low mortgage rates have fueled an increase in demand, particularly among millennials. However, they are running into a shortage of available housing. Many buyers are still in the hope of finding a home that fits their budget and needs.

Despite popular belief that now is not a good time to buy, many home buyers are looking to lock in their monthly housing payments by taking advantage of still-low mortgage rates. However, in this hot real estate market, it’s difficult for buyers to find a good deal, especially with the typical asking price rising by double digits. Although the housing market is still expected to favor sellers we appear to be at a tipping point in the housing market, where prices have risen so dramatically that buyers are backing off and home sales are slowing down.

The 12-month changes ranged from +15.4 percent in the West South Central division to +23.2 percent in the Mountain division. The FHFA HPI is the nation’s only collection of public, freely available house price indexes that measure changes in single-family home values based on data from all 50 states and over 400 American cities that extend back to the mid-1970s.

The top five states with the highest annual house appreciation were:

Shop Around And Negotiate

When youre shopping for a mortgage, its important to get quotes from multiple lenders. Rates vary widely, and the difference between the most expensive and least expensive lenders can be as high as 0.75%, according to a recent study by the fintech startup Haus. But you cant just focus on the rate, the closing costs are also important.

Two loans may have the exact same interest rate, but one could have thousands of dollars in extra fees. So its important to read each lenders Loan Estimate carefully, and to pay attention to both the mortgage interest rate and annual percentage rate .

If you have multiple offers to compare, it may be easier to talk to a lender and negotiate the rate or fees.

You May Like: Does Navy Federal Sell Their Mortgages

Loandepot Best For Repeat Borrowers

Overview

The Foothill Ranch, California-headquartered loanDepot was founded in 2010. It has more than 200 locations throughout the U.S. and is licensed to lend in all 50 states.

What to keep in mind

LoanDepot offers an entirely online application process, including proprietary software that allows you to digitally verify your information. Although, it also has physical locations if you prefer face-to-face interactions. Once youve taken out a mortgage with this lender, it offers incentives if you refinance with it. It will waive lender fees and reimburse you for the appraisal fees if you qualify for its Lifetime Guarantee offer.

Here We Will Take A Close Look At Where Rates Are Likely Headed And How You Can Benefit From These Analysis

As we settle in to 2021, in a brutal era of COVID, the housing market in Ontario continues to strengthen mainly due to historically low and economically stimulating mortgage interest rates. To this extent, many leading economic thinkers are equating the availability of such low-interest rates to a sort of borderline free money phenomenon. In addition to low rates, a rebounding job market and a lower supply of homes available for sale in Canada and Ontario continue to provide upside pricing pressure.

This strength can be seen across the province in GTA where most regions are showing accelerating growth and substantial month over month increases in value and in other areas across Ontario such as Waterloo Region, Barrie and Ottawa where all-time housing price records are seen.

As we look ahead into 2021, 2022, and even 2023 we can a continuation of this driven by dynamic economic stimulation, that overall point to an era not a trend but an era of low mortgage rates. Specifically, we can see the prime rate in Canada remaining at low levels of .25% until 2023, but as importantly, mortgage rate trends show fixed rates within a 0.25% 0.40% bandwidth of late 2020 rates.

In other words, the lowest mortgage rates offered today are in the 1.49% range for 5 year fixed rates, and should not exceed 2.00% for the best mortgage rates as we move into 2021 and 2022.

Here we will expand on these ideas and others, concerning this era of ULTRA low-interest rates.

Get Started

You May Like: What’s A Conventional Mortgage

What Are Todays Mortgage Rates

Low mortgage rates are still available. You can get a rate quote within minutes with just a few simple steps to start.

1Todays mortgage rates based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

Popular Articles

Resources

What Is The Best Mortgage Loan Type

The best mortgage is the one that helps you meet your housing needs for as little financing costs as possible. There are a few factors to consider when it comes to getting the right mortgage.

Some experts recommend getting a 15-year mortgage because youll pay far less interest and be debt free in half the time compared to a 30-year loan. With a 30-year loan, your monthly payments can be significantly lower, but youll pay much more in interest over the course of your term. So its a tradeoff.

There are also tradeoffs in choosing a government-backed versus a conventional loan. For example, FHA mortgages can have lower credit score requirements than conventional loans. But unlike conventional loans, FHA loans require mortgage insurance even if your loan-to-value ratio drops below 80%.

If you want a set interest rate for the life of the loan, and more stable monthly payments, then a fixed-rate mortgage is ideal. The interest rate on a fixed-rate mortgage never changes. In exchange for this security, the rate can be a bit higher than with a similar adjustable rate mortgage . ARMs have a set interest rate for a certain number of years , and then the rate adjusts annually. An ARM might make sense if you plan on refinancing your mortgage in the future, or you might sell the house before the rate adjusts.

Read Also: Is Biweekly Mortgage Payments A Good Idea

What Is A Good Va Interest Rate

VA loan interest rates are typically lower than the interest on conventional loans, but the average interest rate on VA mortgages is still connected to real-estate trends and the state of the economy.

Since VA mortgage rates are so closely tied to the housing market, the opportunity for a good VA interest rate comes when lenders reduce their rates for mortgages overall.

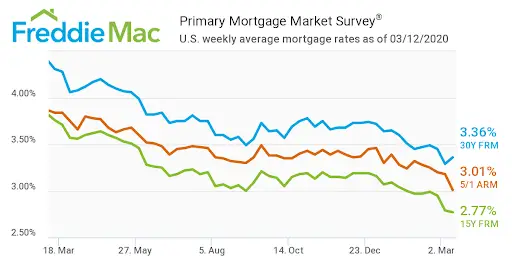

Mortgage interest rates remained fairly steady throughout 2018 to 2019, but the coronavirus outbreak and resulting economic shift greatly impacted the real estate market. According to FreddieMac, conventional 15-year fixed mortgages15-year fixed mortgages came with a national average 4% interest rate in 2018. In 2019, 15-year fixed mortgage rates dropped a bit, down to an average of 3.5%.

The steep drop following the 2020 pandemic brought the national average rate of financing a home purchase on a 15-year plan to 2.22%. In the early months of 2021, these trends began to reverse and interest rates were once again on the rise.

As of March 2021, national average interest rates for VA home loans sat at 2.25% with the number expected to rise as interest rates tick back up.In addition to keeping an eye out for these economic changes, you can find a good VA interest rate by meeting with multiple lenders to compare offers and get the best possible deal.

What’s Happened With House Prices In The 12 Months To October 2021

It will come as no surprise to anyone who has watched, read, or listened to a news article in the past few months that housing is up in a big way. The national median is up by 15.4%% to $795,000 with areas like Southland and Canterbury up by around 30%. Auckland remains the most expensive area with a median house price of $1,150,000 however this has been stagnant for a few months now . .

Read Also: What’s Taking Out A Second Mortgage

Whats Been Happening With Mortgage Interest Rates In 2021

After the turbulence of Covid-19 all but wrote off forecasts for 2020, we didnt even bother guessing what was going to happen in 2021. But, touch wood, everything has gone smoothly so far and our economy seems to be a steady ship.

Heres what has happened in 2021 for mortgage interest rates. .

- 1-year interest rates were trending down in the first half of the year but from July to October shot up at a rate that not many predicted. In January 2020, the 1-year rate was typically around 2.39%. Until July, we had been seeing 2.19% regularly given for 1 year. Now the advertised rates are as high as 3.34%. This is back to December 2019 levels within 3 months.

- 2-year interest rates are up also, unsurprisingly, to ~3.7%, after dipping as low as 2.45% in April 2020.

- Longer-term rates are up quite a bit. For quite some time you could get a 2.99% rate for 5 years with a lucky few achieving 2.85%. That rate will now cost you ~4.39%%.

- We have seen some amazing specials for new-build mortgages as low as 1.68% and now sitting at around 1.83%. These are floating rates but can be discounted for up to 3 years. Note that although other rates have jumped up by over 1%, these discounted rates are only up 0.15%.

Current Mortgage Rates Tick Lower

The 30-year fixed-rate loan is averaging 2.86% for the week ending September 16, down just 0.02 percentage points from last week, according to Freddie Mac’s benchmark survey.

Rates have been hovering between 2.86% and 2.88% since August 12. Earlier this year, there was more weekly movement, with the 30-year rate reaching a high of 3.18% on April 1. Since then, rates have been trending lower with occasional bumps.

“It’s Groundhog Day for mortgage rates, as they have remained virtually flat for over two months. The holding pattern in rates reflects the markets’ view that the prospects for the economy have dimmed somewhat due to the rebound in new COVID cases,” said Sam Kahet, Freddie Mac’s chief economist. “While our collective attention is on the pandemic, fundamental changes in the economy are occurring, such as increased migration, the extended continuation of remote work, increased use of automation, and the focus on a more energy-efficient and resilient economy. These factors will likely lead to significant investment and new post-pandemic economic models that will spur economic growth.”

The direction of rates for various types of loans continues to be mixed this week:

You May Like: What Would The Mortgage Be On A 500 000 House

Despite Increasing Talk About Interest Rates And Home Prices Mortgage Rates For Now Are Likely To Stay Relatively Steady

The Federal Reserve is finally planning to taper off its mortgage-bond buying, so investors and homebuyers might be anticipating some big swings in mortgage rates. But, as with just about everything in the home-lending business, things arent so simple.

The amount that any borrower pays can be as unique as the home they are buying. Still, there are some major inputs that typically influence mortgage rates direction beyond just underlying interest rates. Two of the biggest: The yields on bonds that package up mortgages for investors, and the potential profit on selling mortgages into those bonds.