What Is The Average Apr For A 15

The advertised loan is paid in full over 15 years at a fixed interest rate from the actual offers published by its partner network. Not available in all states. As of Monday, September 13, 2021, the national 15-year average annual interest rate on fixed-rate mortgages will be lower than the week before.

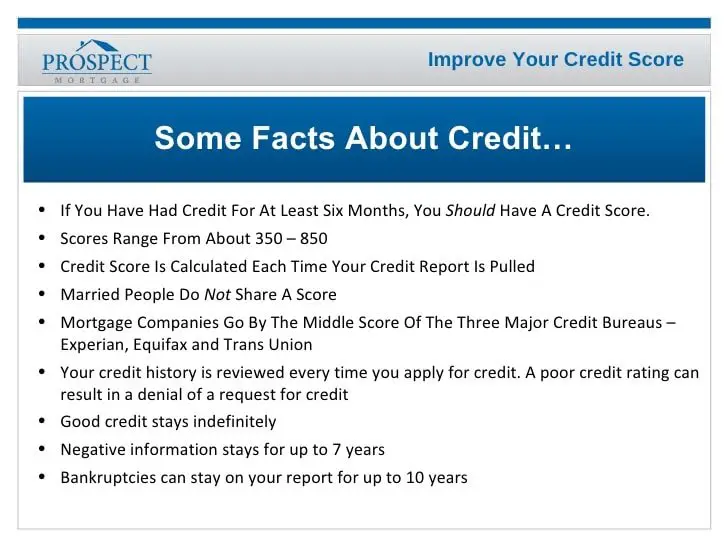

Whose Score Will Lenders Use

When you make a joint mortgage application, lenders could be evaluating as many as six credit scores — three for each of you. While most lenders consider the applicant with the highest monthly income as the primary borrower, they often take the lowest middle credit score of both borrowers as their benchmark. While frustrating, this is just another example of conservative lending policy.

Why Your Credit Score Matters To Lenders

Your credit score helps lenders determine your ability or inability to repay the mortgage. As part of your scores, they examine your debt-to-income ratio. It is the percentage of monthly debt obligations relative to how much you make.

To illustrate, if you earn $4,000 per month, and have $1,250 in credit card, loans, housing, and other payments, your ratio would be 31 percent. The ideal ratio is less than 36 percent, though some lenders will accept more with a higher down payment.

Recommended Reading: What Information Do You Need To Prequalify For A Mortgage

What Is Credit Scoring Models Do Most Lenders Use The Internet

While there are many different valuation models and valuation models, there is light at the end of this tangled tunnel. Of all credit scoring models, the FICO credit score is used by over 90% of the major lenders. You may have a different score that is calculated using a different scoring model with a different provider.

How Credit Scores Work During Mortgage Process

Many consumers do not understand why they have three different credit scores. Clients and our viewers often contact us at Gustan Cho Associates and want an explanation and purpose of having three different credit scores.

There are three main credit bureaus in the United States:

- Transunion

- Experian

- Equifax

Each one of the three main credit bureaus has its own way of calculating a consumers credit score. Each consumer will have a different credit score from each of the three credit bureaus. Each consumer will have a different credit score because each bureau has its own algorithms on how they determine each consumers credit score.

Mortgage lenders use the middle scores of an applicant to determine a qualifying credit score for mortgage borrowers. So if Experian yields the middle credit score of the mortgage applicant, the Experian credit score will be used. The qualifying credit score for a mortgage will be the middle credit score. That middle credit score will be used throughout the entire mortgage process until the loan closes. The qualifying credit score is good for 120 days.

Read Also: What’s Taking Out A Second Mortgage

How Do You Keep The Bad Credit From Ruining Everything

If your partner has bad credit, you may be concerned about qualifying for a loan. Here are some simple ways you can keep bad credit from ruining your chances of getting a good deal on a loan:

Improve your partners credit

Check your partners credit report for mistakes. Having an error on a credit report can hurt your , so thats a great place to start.

If its credit cards that are causing the problem, then get them paid off. Make sure the balances are under 30% of their high-limit because that plays a significant role in your credit score. You can also improve your spouses credit by making them an authorized user on an account with good standing.

Leave your partner off the loan

This sounds harsh, but sometimes it has to be done. When your partner has bad credit, having him/her on the mortgage can often do more harm than good. While combining your incomes can help you get a better rate, sometimes its best for the person with the best credit to sign on their own. The good news is, if its your spouse youre leaving out, you can both still be on the deed regardless of who is on the loan.

Find a co-signer

If your partner has problems with his/her credit, you can always ask a relative who has excellent credit to co-sign can help you get approved. However, there are different rules regarding co-signers with every lender.

Do you have anything to add about whose credit score is used on a joint mortgage? Let us know! We can help with your credit issues at Go Clean Credit.

How Your Credit Scores Are Made And Why They Matter

Since there are few numbers that matter as much to your financial well-being as your credit score, it helps to know what your scores mean and how they work.

First, know that theres a big difference between a credit report and a credit score.

- Your credit report is a record of your borrowing history Each loan or line of credit youve opened, dates on those accounts, payment history , and so on. Overall, it shows how reliably you manage and pay back your debts

- Your credit score sums up your credit report in a single number It weighs every item on your credit report to come up with an overall score that sums up how responsible of a borrower you are

The big three credit bureaus Equifax, Transunion, and Experian operate in the realm of credit reporting.

Each one keeps a separate record of your borrowing history, based on the information your creditors send them.

The other players in the game FICO and VantageScore are responsible for credit scoring. They determine your score based on whats included in those credit reports.

For example, keeping your credit utilization ratio low can help your credit scores, while repeatedly neglecting to pay your credit card bills on time can hurt them.

Also Check: How To Get A Mortgage Denial Letter

What Credit Score Do Most Credit Card Issuers Use

On the other hand, most credit card issuers use FICO Bankcard or FICO Score 8. According to Fair Isaac, FICO Score 8 is the most widely used. This is true even though the FICO Score 9 has been released. The lovely Isaac also gives the following advice:

Credit to buy a houseWhat is a good credit score to buy a house? These are the credit requirements for the most popular mortgages: Typically: 620 FHA: 500 to 580 VA: Usually low to medium USDA 600, depending on the lender: Usually around 580, depending on the lender.Do I need a good credit score to buy a house?In general, a good credit rating for buying a home is 620 or higher. With a of at least 6

How Your Credit Score Affects Your Interest Rates

Knowing your credit score is the first step in getting the best rates on your mortgage. While mortgage interest rates are currently at an all-time low, they drop even lower when your credit score is above 760.

According to FICO, the current interest rate for a 30-year fixed mortgage is 2.377% APR for a 760+ borrower, and 3.966% for a borrower with a score between 620 and 639 .

This 1.589% savings in APR may seem negligible. But it means saving about $260 per month on your mortgage, or $3,120 per year and roughly $93,600 over the lifetime of the loan.

If you currently have a mortgage and are interested in seeing if you can switch to a better rate, look into the pros and cons of refinancing your home.

Also Check: How Long Is The Mortgage Process

What Is A Fico Credit Score And How Does It Work

Most lenders use FICO credit scores to assess a borrower’s creditworthiness. The FICO scoring methodology has been updated over the years and lenders can choose which version they want to use. Industry FICO scores are also available for various loan types, such as mortgages, auto loans, and credit cards. What are FICO Points?

Want A Mortgage The Credit Score Used By Mortgage Companies Will Surprise You

Shutterstock

If you are applying for a mortgage, your credit score will be a critical part of the process. You could get rejected with a credit score that is too low. And once approved, your score will determine the interest rate charged. Someone with a 620 might have to pay an interest rate that is as much as 3% higher than someone with a 740. But what credit scores do mortgage lenders actually use? The answer might surprise you.

Much Older Versions Of FICO

Fannie Mae and Freddie Mac are government-agencies that purchase the majority of mortgages originated in the country. These agencies set the rules and underwriting criteria for the loans that they purchase, including what credit scores should be used. Surprisingly, the agencies require much older versions of the FICO credit score. According to a review of the agency Selling Guides by MagnifyMoney, these are the scores that matter:

- From the Equifax credit bureau: FICO Version 5

- From the Experian credit bureau: FICO Version 2

- From the TransUnion credit bureau: FICO Version 4

Even though FICO has just recently introduced Version 9 of its score, most mortgage lenders will still be using a much older credit score.

Watch on Forbes:

Which Older Version Of FICO Will Be Used?

How Do I Get A Good Credit Score ?

What If My Mortgage Is Not Purchased By Fannie Mae or Freddie Mac

Dont Miss: Does Paypal Credit Report To Credit Bureaus

Read Also: When Paying Off A Mortgage Early

What Else Do Mortgage Lenders Consider

Your credit score is a key factor in determining whether you qualify for a mortgage. But its not the only one lenders consider.

Income: Lenders will also look at your income. They want to make sure you make enough money each month to afford your payments.

Debt-To-Income Ratio: Lenders also look at your monthly debts. Lenders vary, but they generally want your total monthly debts, including your estimated new mortgage payment, to consume no more than 43% of your gross monthly income. If your debt-to-income ratio is higher, you might struggle to qualify for a mortgage.

Down Payment: The bigger your down payment, the more likely it is that youll qualify for a mortgage with a lower interest rate. Thats because lenders think you are less likely to stop making your payments if youve already invested a significant amount of your money into your loan. A higher down payment, then, makes your loan less risky for lenders.

Savings: Lenders want to make sure that you have funds available to make your mortgage payment if your income should unexpectedly dry up. Because of this, most will want to see that you have enough money saved to cover at least two months of mortgage payments.

Employment History: Lenders vary, but they usually like to see that youve worked at the same job, or at least in the same industry, for at least 2 years. They believe youre less likely to lose that job, and that stream of income, if youve built up a longer work history.

What Credit Score Does Mortgage Lenders Use

TransUnionEquifax

Here are the specific versions of the FICO formula used by mortgage lenders: Equifax Beacon 5.0. Experian/Fair Isaac Risk Model v2. TransUnion FICO Risk Score 04.

what is the minimum credit score for a mortgage? Many things factor into getting a mortgage, but it all starts with your and your history. While there is no official minimum credit score for a home loan approval, the minimum FICO for conventional loan approval tends to be around 620.

Besides, do any mortgage lenders use FICO score 8?

FICO 8 is a credit-scoring system released in 2009. Since then, only a few lenders have adopted it. The vast majority of lenders still rely on FICO 2, 4 and 5 scores, which are all part of a larger report mortgage lenders can obtain called the residential mortgage credit report .

Which credit score do lenders use for auto loans?

Auto lenders, for instance, often use FICO®Auto Scores, an industry-specific FICO Score version that’s been tailored to their needs. Most card issuers, on the other hand, use FICO® Bankcard Scores or FICO®Score 8. It turns out that the most widely used FICO score is the FICO Score 8, according to Fair Isaac.

Recommended Reading: What Factors Go Into Mortgage Approval

What Does My Credit Score Need To Be To Get Approved For A Mortgage In New Jersey

However, the minimum credit requirements differ. Credit scores generally range from 300 to 850, and borrowers within a certain range may qualify for a home loan. While you don’t need a perfect credit score of 850 to get the best mortgage rate, there are some general credit requirements you need to meet to get a mortgage.

Why The Scores Are Different

Your credit score may be different across the three reporting agencies because each agency may be using different data to calculate your score. Credit agencies do not collect credit data themselves but rely on the information that is supplied by lenders, collection agencies and the courts. These bodies report credit information to different credit bureaus at different times, so you cannot assume that each credit bureau has the same or even the most up-to-date information about your credit history. Other discrepancies, such as debts taken out under a maiden name, can also lead to variations in the three FICO scores.

You May Like: How Do You Calculate Points On A Mortgage

How To Get Approved For A Mortgage After Bankruptcy

Tips for Approving a Mortgage After Bankruptcy 1 Open a secured credit card account. A secured credit card is easy to obtain and a great way to grow your money again. 2 Pay your bills on time. 3 Apply for a loan carefully. 4 Do not close accounts. 5 Keep your credit reports. Beware of credit repair scams.

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

You May Like: Can You Add Someone To Your Mortgage Loan Without Refinancing

How Can I Get A Mortgage Without A Credit Score

You just need to find a hand-drawn lender, such as Churchill Mortgage. While it is more difficult to get a mortgage without a loan, it is not impossible. All you need to do is find a lender to handle the manual underwriting. What is manual subscription? The manual acceptance is a practical test of your ability to pay off debt.

Which Fico Score Do Banks Use For A Mortgage Application

While the FICO 8 model is the most commonly used scoring model for general credit decisions, banks use the following FICO scores when applying for mortgages: As you can see, each of the three major credit bureaus uses a slightly different version of the FICO industry score.

Also Check: How To Find A Cosigner For A Mortgage

How Does Credit Score Determine Loan Type

Conventional loans require that you have a higher credit score, while Federal Housing Administration loans are a bit more forgiving when it comes to your score.

With an excellent credit score, you can expect to pay less for your loan because your interest rate will be lower.

Not only will a poor score affect your ability to get a loan, but if you do qualify for one, you could be paying thousands of dollars extra over the life of your loan due to a higher interest rate.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How To Shop For Mortgage Refinance

How A Lender Can Help You Understand Specific Credit Goals

If youre unsure if your credit score is high enough to qualify for the mortgage you need, you can reach out to a loan officer for guidance on reaching your credit goals to purchase a home.

They can discuss the specific qualifications you should meet to afford the home you want, such as your debt-to-income ratio and down payment amount.