What Does Prepaid Mean

Prepaid items are exactly what the name implies – payments made in advance of the monies due to obtain your new loan.

These amounts are often necessary to fund what’s known as an “escrow” or “impound” account for property taxes and insurance. Lenders often require homeowners, especially those with less than 20 percent down, to have escro accounts associated with their mortgage loan. This means homeowners pay an additional amount each month to an account administered by the lender.

An escrow account on behalf of the lender lowers the its risk by making sure the home is protected. No liens for missed taxes should occur, and property insurance coverage protects the lender’s collateral.

How Prepaid Interest Is Determined

The timing of the closing of a mortgage affects the amount of prepaid interest that is due, as well as how much time there will be before the first mortgage payment is required. Planning for the prepaid interest to be paid earlier in the month might give the borrower more time to then pay their initial mortgage payment.

Prepaid interest is still an upfront cost to cover. Setting the prepaid interest due date closer to the end of the month would allow the borrower more time to pay that cost. The initial mortgage payment will then be needed in short order. Changing the interest rate or the principal amount of the mortgage can reduce the prepaid interest that is due. However, a borrower may find it challenging to negotiate such changes with the lender.

It is possible for the prepaid interest that is due to change between the time of the loan estimate and the time of the closing disclosure. The charges may be prorated daily from the closing till the first mortgage payment comes due. That calculation will be based on the annual interest rate that will be applied to the mortgage. The specific calculation may vary by lender. There may be options to skip payments on the mortgage, but the prepaid interest will still need to be covered.

Where To Find Your Prepaid Costs On Your Loan

When you first get your mortgage loan document, it might be difficult to locate a description of your prepaid costs. Typically, prepaid costs are broken out on page 2 of your loan estimate, often labeled as other costs after the outlined closing costs. Once you locate this section, you should be able to identify the prepaid costs described in your loan.

Don’t Miss: How To Calculate Self Employed Income For Mortgage

Choosing A Higher Rate To Save Money

RELEVANT FACTS

Matt is uncertain how long he will own property

Existing rate:5.5%Offer 1 closing costs:$15,000Offer 1 break-even:43 monthsOffer 2 Rate:4.15%Offer 2 closing costs:$0Offer 2 break-even:1 month

Matt’s StoryMatt is a divorced 30-something who owns a home that he originally purchased with his ex-wife. He never got around to refinancing and is paying 5.5 percent on an eight-year-old mortgage. The remaining balance of his $350,000 loan is $303,933.

Refinance OpportunityMatt is considering refinancing to a loan with a 3.5 percent rate. His payment will go down by $622 a month! However, the closing costs for the new loan are over $15,000, and his breakeven point is 43 months. Matt’s not really sure how long he’ll keep his house, and that’s a lot of money to pay upfront if he leaves in just two years, he’ll lose thousands.

Should Matt Refinance?Matt should consider a loan with fewer upfront costs, even if the interest rate is higher. For example, if he chooses a no closing cost refinance with a 4.15 percent interest rate, he breaks even in just one month, lowers his payment by $510 and would save nearly $11,000 over the next three years.

Avoid high upfront refinancing costs if you’re unsure of your time owing the property. Sometimes, the loan with the higher interest rate is the better deal.

Three More Months For Insurance

There is an additional three months of insurance collected for the escrow account calculations. The aforementioned 12 months goes directly to your insurance provider after closing. That pays for the first years worth of insurance coverage upfront. The extra 3 months of cushion is held in the escrow account. This excess cushion accounts for the next years premium and future increases.

Example:

You May Like: How To Recruit Mortgage Loan Officers

Loan Points Explained: Par Rebate & Discount Points

Every home loan comes with one of three types of price points: par, rebate and discount.

Par Pricing

Par pricing is neutral and will cost you zero points. It’s the rate you qualify for based on your credit rating, loan-to-value and other factors.

Rebate Pricing

Rebate pricing means you choose a higher interest rate, but in exchange, you receive a rebate. You can use the rebate to cover some or all of your closing costs. Rebate pricing is what lenders mean when they advertise a no closing cost refinance.

Discount Points

Discount pricing gets you a lower-than-market interest rate, but it costs extra. The extra costs are called discount points. Paying higher fees to get a lower refinance rate is also called buying down the loan.

What Are Prepaid Fees

After your closing, your lender is required to pay certain bills for you and collect money toward others. When considering closing costs vs prepaid fees, a big difference is prepaid fees are associated with the home rather than the real estate transaction. Prepaid fees include:

- Real estate taxes. When buying a new home, expect to pay taxes up front. The amount is determined by the previous yearâs tax assessment.

- Accrued interest. Interest on your loan accrues from the date you close to the end of the month. The date of the closing, the value of your home and amount of your loan all play a part in determining this fee.

- Association dues. Your new home may be a part of a homeownersâ association . HOAs often require fees for the maintenance and upkeep of the grounds around your home.

- Homeownerâs Insurance. Your yearly homeowner insurance amount is due at closing to protect you from damages right away.

- Mortgage insurance premiums. Your lender sometimes requires you to pay for private mortgage insurance as a condition for getting the loan. This fee guarantees your loan to the lender if youâre unable to pay.

- Hazard insurance premiums. If you need special hazard insurance to protect your home â because the propertyâs on the coast or in a flood plain, for example â you have to pay for it immediately.

Don’t Miss: How 10 Year Treasury Affect Mortgage Rates

Three Months For Taxes Sort Of

We told a little fib above and said the escrow cushion is three months of property taxes. Not true. The amount of property taxes collected from you on the Closing Disclosure will be more than three months. BUT the sellers will reimburse you for their prorated portion of property taxes and your out of pocket net will be three months.

Example:

Escrow Taxes Collected When Taxes Are Due

For closings that occur when the property taxes are due the aforementioned information is still true but the numbers may appear differently on the CD. In Texas, Property Taxes are Due early October and homeowners have until January 31st to pay the bill before considered late. Taxing authorities will only accept one payment for the full amount and the responsibility lies with whoever owns the home at the time the taxes are due. If the taxes arent due at the time of closing, the buyers will be responsible for making the full years worth of property tax payment when the bill is due. Conversely, if the property taxes are due at the time of closing, the seller will pay for the full year of taxes and the buyer will then reimburse the seller for the prorated time theyll own the home.

Example:

Getting A Second Mortgage

A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage.

The loan is secured against your home equity. While you pay off your second mortgage, you also need continue to pay off your first mortgage.

If you cant make your payments and your loan goes into default, you may lose your home. If thats the case, your home will be sold to pay off both your first and second mortgages. Your first mortgage lender would be paid first.

Recommended Reading: How To Get The Best Interest Rate On A Mortgage

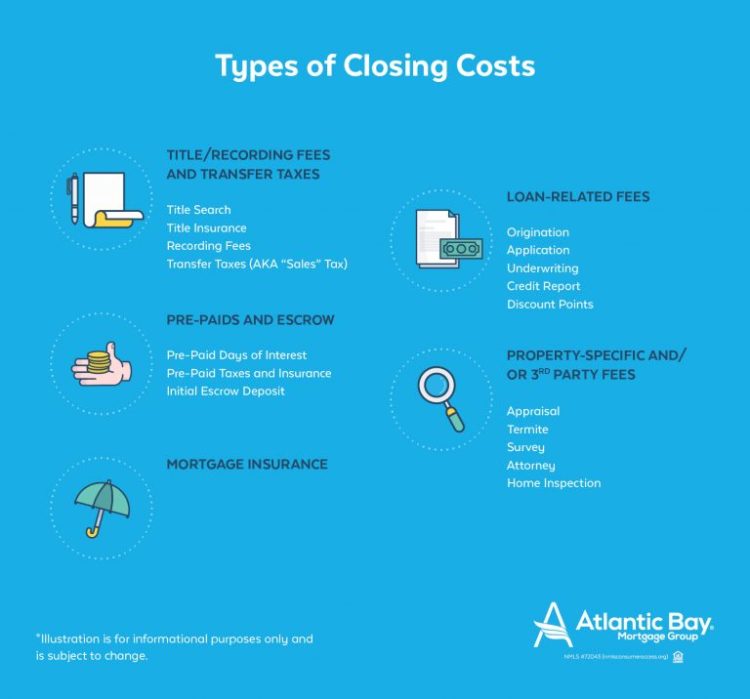

What You Need To Know About Closing Costs

During closing, youll need to review and sign loan and other paperwork to finalize the home purchase process, as well as pay some upfront costs.

- Your closing costs, which will depend on your lender, type of mortgage, and home location, may cost thousands of dollars theyre typically 2 to 5% of your home purchase price.Estimate your costs.

- Closing costs can be paid by you, the home seller, or the lender.

- You may be able to use monetary gifts from family for all or a portion of your closing costs.

Examples Of Typical Mortgage Closing Costs

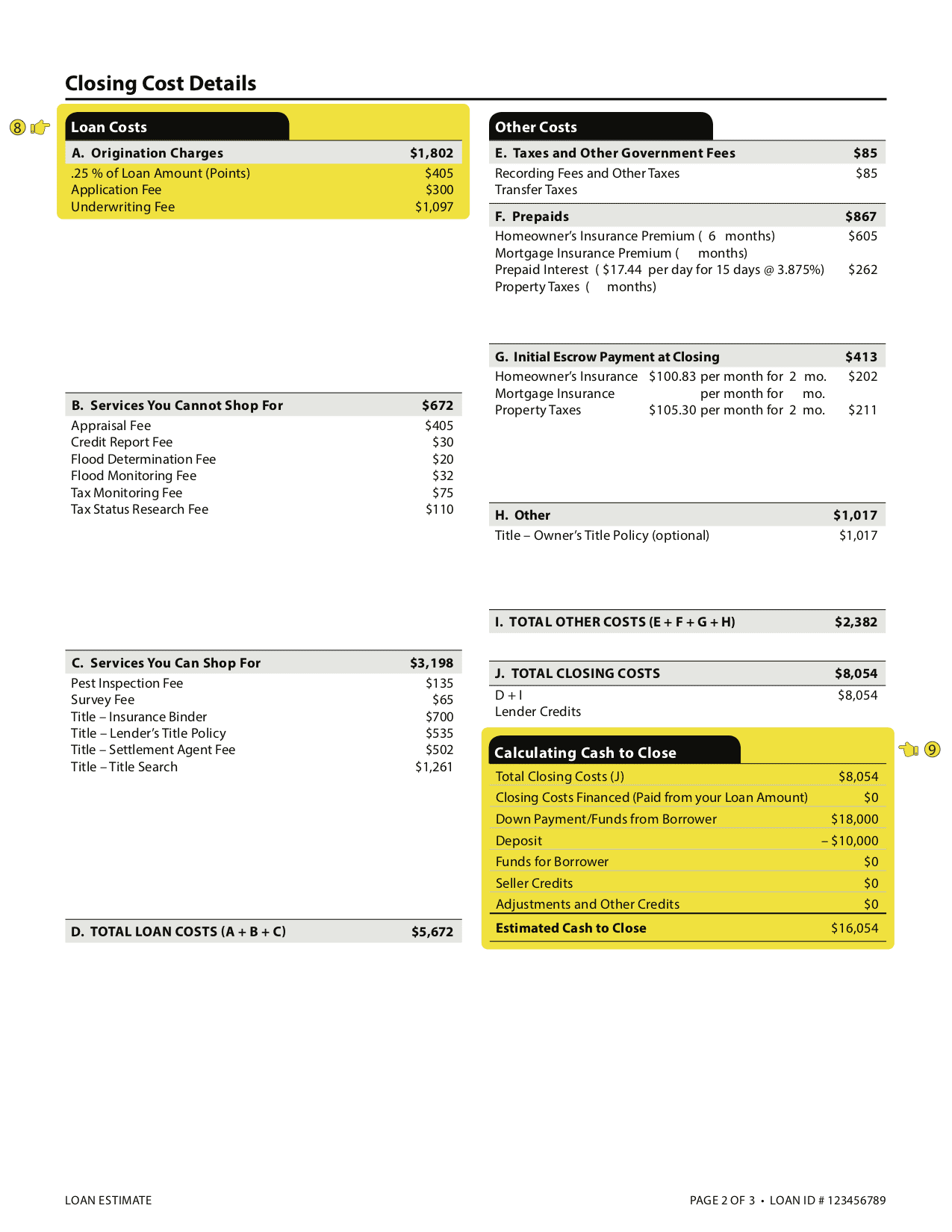

Within 3 days of submitting a complete mortgage application, youll get a Loan Estimate that will give you a better idea of how much you need to pay in closing costs. Then, 3 days before you close, youll get a Closing Disclosure with final costs, which may include:

- Origination charges for application and underwriting fees

- Services where we select the service provider like appraisal, credit report, and flood determination service

- Services where you request the service provider including the pest inspection, survey, and title search

- Taxes and other government fees like recording fees and other taxes

- Prepaids are the first payments for your homeowners insurance, mortgage insurance, and prepaid interest

- Initial escrow payment covers payment of future homeowners insurance and property taxes

- Other costs including anything else not covered, such as an optional Owner’s Title Policy

Wire Transfer Fraud: Before you wire funds, be sure to verify all instructions and contact information to avoid real estate scams. Learn more

Recommended Reading: Which Bank Is Best To Get A Mortgage

S To Compare Mortgage Quotes

Follow these fine steps when you comparison shop for a loan. But let’s start with the premise does comparison shopping matter? Yes. According to Stanford University researchers, you need at least four mortgage quotes to have a chance at getting the best deal. According to the Federal Reserve of Chicago, home loan comparison shoppers save thousands in lifetime costs in comparison to non-shoppers. Here’s how to shop systematically for the best deal on a refinance.

1. Compare FairlyTry to get your quotes quickly this is important because mortgage rates can and do change several times a day. A Monday quote from Lender A can’t be compared reliably to a Tuesday quote from Lender B. If the lender issues a Good Faith Estimate, it should indicate how long the quote is valid.

2. Narrow the FieldReview your mortgage quotes and pick two lenders with the most competitive pricing. Contact them both and discuss your home refinance. Go with the loan professional who is most responsive and who provides the best answers to your questions. Make sure you’re comfortable with this person you may discuss sensitive topics , and you’re trusting him or her with an expensive transaction.

Let’s look at a simple example of how to calculate the breakeven point on two loans with different interest rates and closing costs.

| Loan Amount |

|---|

|

-$3,000 |

|

Breakeven = $3,000 / $28,60 = 105 months or 8.75 years |

Difference Between Prepaids Closing Costs

There is a difference between prepaids, closing costs and fees. Prepaid items are not closing costs. They are monies that would have been paid anyway — new home loan or not.

Prepaid items, listed above, are figures on your Closing Disclosure unrelated to the process of getting a mortgage. The exception to this is upfront mortgage insurance premiums for Federal Housing Administration mortgage loans.

Closing costs on the other hand, describe all of the fees or charges for actions or items connected to originating and closing a mortgage loan. Closing costs can include things such as:

- Payments to title companies

- Governmental title recording fees

- Lender fees

Some homebuyers wonder, “Is the inspection part of closing costs.” The answer is “typically not.” Generally the homebuyer orders and pays for an inspection to gain a detailed understanding of the home’s condition. Sometimes, the homebuyer is able to use the inspection report to gain price concessions from the seller or to negotiate certain repairs to the home. In cases where a homebuyer doesn’t pay for the inspection fee promptly at the time of service, inspection fees could be handled at closing as part of the closing costs.

Don’t Miss: How To Purchase A House That Has A Reverse Mortgage

How Borrowing On Home Equity Works

You may be able to borrow money secured against your home equity. Typically, interest rates on loans secured against home equity can be much lower than other types of loans.

Not all financial institutions offer home equity financing options. Ask your financial institution which financing options they offer.

You must go through an approval process before you can borrow against your home equity. If youre approved, your lender may deposit the full amount you borrow in your bank account at once.

You can borrow up to 80% of the appraised value of your home.

From that amount, you must deduct the following:

- the balance on your mortgage

- your total HELOC amount, if you have one

- any other loans secured against your home

Your lender may agree to refinance your home with the following options:

- a second mortgage

- a loan or line of credit secured with your home

What’s An Escrow Account

If you put less than 20 percent down on your home, or refinance with less than 20 percent equity, the lender will set up an escrow account. How it works is, you make your mortgage payment each month plus an additional sum to cover property taxes, mortgage insurance and homeowners insurance. The additional money goes into the escrow account and the mortgage company draws from this account to make sure your tax and insurance bills get paid on time. Your lender can ask for a little extra money each month to put into the escrow account as a cushion, up to 1/6 of the yearly total.

Also Check: How Much Do I Have Left On My Mortgage Calculator

Interest Rates And Fees If You Refinance Your Home

The interest rate on the refinanced part of your mortgage may be different from the interest rate on your original mortgage. You may also have to pay a new mortgage loan insurance premium.

You may have to pay administrative fees which include:

- appraisal fees

Your lender may have to change the terms of your original mortgage agreement.

What Is Required For Prepaid Mortgage Insurance

Prepaid Mortgage Insurance Transactions

Fannie Maes refinance guidelines permit borrowers to finance the payment of closing costs, prepaid items, and points in the loan amount. When the borrower includes any portion of the borrower-paid mortgage insurance premium or monthly escrows into the loan amount , it is considered a prepaid mortgage insurance transaction and not a financed mortgage insurance transaction. For a loan to be eligible for delivery to Fannie Mae with prepaid mortgage insurance, the loan must meet all the standard requirements of this Selling Guide , and the following requirements applicable to this type of loan:

- The mortgage insurance coverage amount is determined based on the LTV ratio that is calculated after the inclusion of all the closing costs, prepaid items, and points.

- The loan is not to be delivered as a financed mortgage insurance transaction lenders should not deliver SFC 281 or the other financed mortgage insurance data elements.

- The Financed MI Premium Endorsement to the mortgage insurance policy should not be obtained.

Read Also: Can You Get A Mortgage While In Chapter 13

Are Prepaids Related To Escrow

Usually. Most lenders want you to use an escrow account to manage any insurance payments and tax payments. Basically, if you choose to use an escrow account, a portion of your monthly mortgage payment will go into that account. Then, your lender will pay your insurance and tax payments using the money in the escrow account.

Lenders prefer using escrow accounts to prevent you from going without insurance or ignoring tax payments, which can ultimately increase the risk of loss for them, whether from a natural disaster or foreclosure. In fact, many lenders charge a fee if you waive an escrow account. Personally, I find having an escrow account a convenient option, but if you choose to waive it, know the fee is nominalonly about 0.25 percent of the loan amount. On a $250,000 loan, for example, that would be a fee of $625.

If you do opt for an escrow account, heres where prepaids come in: Rather than paying property taxes and insurance outright, you’ll pay an initial escrow payment and your lender will deposit the insurance and tax portions into your escrow account. When the bills are due, your lender will handle tax and insurance payments for you using the money in your escrow account. Your mortgage insurance will still be a separate prepaid cost even if you use escrow.

Calculating Prepaid Interest For A Mortgage

Prepaid interest is generally calculated using the first day of accrued interest on your mortgage balance. If you want to double-check the calculation behind your prepaid interest charges, you’ll need to use your mortgage rate, initial loan balance and the number of days between your closing date and the end of the month. As an example, consider a $200,000 home loan with an annual interest rate of 4%. If you close this mortgage 10 days before the end of the month, you generally would calculate your prepaid interest like this:

- Take your annual interest rate and divide it by 365 to calculate your daily rate = 4% / 365 = 0.011%

- Multiply your daily rate by your home loan amount for your daily interest amount = 0.011% x $200,000 = $21.92

- Multiply the daily interest by the number of days between closing and payment to get the prepaid interest charge = $21.92 x 10 days = $219.20

Recommended Reading: How To Transfer A Mortgage To Someone Else