Usda Rural Loans Guidelines

USDA Rural Development home loans or USDA loans are typically used by medium income households to purchase homes in eligible areas. The funds can also be used to build, repair, renovate or relocate a home, or purchase and prepare sites, including providing water and sewage facilities, although it might be tough to find a lender willing to take on some of the available options.

USDA home loans are available in all 50 states as well as the Virgin Islands, Western Pacific & Puerto Rico. The general guidelines for the loan program are the same throughout all eligible areas. Check with an USDA approved lender to see if they will lend in all areas.

There are two different types of USDA loans. There is a direct program that is handled by your local USDA service center. These loans are for low income households. The second type of USDA loan is the 502 Guaranteed program. These loans are catered to more of a average household income. These loans are done by lenders and banks and are insured through the USDA Rural Development program.

What are the terms?

Am I Eligible For A Usda Loan

Eligibility requirements for USDA loans depend on your area and your lender. There are income limits borrowers must not exceed in order to qualify they vary by geographic region and family size. A complete list of income limits by area and family size is available at the USDA.gov website.

Additionally, homes must be located within USDA-allowed zones, which are typically in rural areas or less densely populated suburban areas. To find out if you qualify, check the zone map at the USDA.gov website.

Finally, homes must be owner-occupied as USDA loans cannot be used for investment properties or vacation homes.

Getting A Usda Loan With No Credit Score

You need to have 2-3 accounts open for at least 12 months to have a credit score. Some people might not have a credit score because they dont have a credit history. It is okay not to have a credit score and USDA loan lenders will not use this as a basis to reject your loan application.

If you have insufficient account history or no credit score, USDA lenders will accept non-traditional credit reports. They are regular credit reports but credit agencies will generate them manually through proof of payment documentation for insurance, rent, school tuition, childcare, utilities and other recurring bills.

The lender might approve the loan without using the non-traditional credit report. However, you must have third-party verifications, especially proof of payment of rent on time from a landlord. If you dont have a credit score, you should be able to buy a home using the loan program effectively.

Also Check: How Much Per 1000 On Mortgage

What Are The Income Requirements For A Usda Loan

The USDA loan program is geared toward low- and moderate-income homebuyers. For this reason, applicants cant earn more than certain income limits, which vary by metro area and family size. In more expensive areas, the income ceiling is higher.

The annual income limit for a one- to four-person household in most eligible counties is $90,300, and $119,200 for five- to eight-member households. The USDA sets limits at or below 115 percent of the median household income in each region, and updates them annually.

Its important to check the maximum income limits for your household size and where you live to get the most accurate data.

What Is A Usda Loan

In 1991, the U.S. Department of Agriculture introduced the Single Family Housing Guaranteed Loan Program to boost homeownership in rural America. As a result, low- and moderate-income home-buyers who may otherwise not qualify for a traditional mortgage can apply for a government-backed loan to purchase, construct and renovate homes in eligible rural areas. During the 2019 fiscal year, lenders issued nearly 100,000 loans under this program.

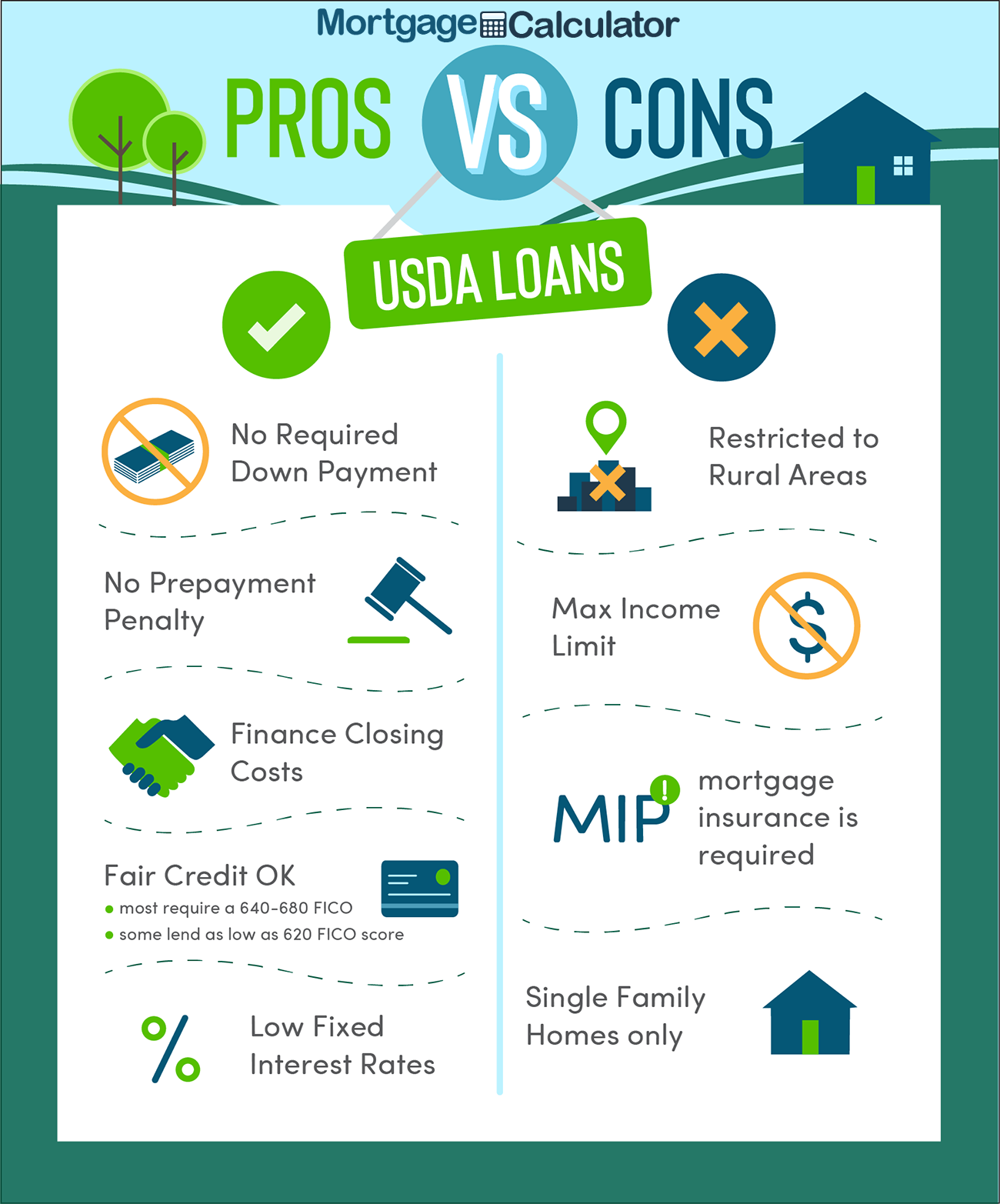

USDA mortgage loans do not require a down payment, and they usually come with low interest rates. Payback periods for USDA loans may stretch to 33 years and possibly even 38 years for very low-income applicants. Under the USDA mortgage terms, the USDA guarantees 90% of the USDA loan if the borrower defaults.

Fixed interest rates on USDA loans are based on current market rates, which, as of February 2021, are 2.62%, with an average percentage rate of 2.803%.

Also Check: What Percentage Of Your Income Should Be For Mortgage

Debt Ratios 2020 To Maintain Changes Rolled Out In 2014

The program adopted new debt ratio requirements on December 1, 2014. There are no planned updates to this policy in 2020.

Prior to December 2014, there were no maximum ratios as long as the USDA computerized underwriting system, called GUS, approved the loan. Going forward, the borrower must have ratios below 29 and 41. That means the borrowers house payment, taxes, insurance, and HOA dues cannot exceed 29 percent of his or her gross income. In addition, all the borrowers debt payments added to the total house payment must be below 41 percent of gross monthly income.

For example, a borrower with $4,000 per month in gross income could have a house payment as high as $1,160 and debt payments of $480.

USDA lenders can override these ratio requirements with a manual underwrite when a person reviews the file instead of the algorithm. Borrowers with great credit, spare money in the bank after closing, or other compensating factors may be approved with ratios higher than 29/41.

How Much Income Is Needed For A 250k Mortgage

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

Don’t Miss: Can You Get A 30 Year Mortgage On Land

Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

Usda Construction New Home Purchase Rate Reduction Refinance & Renovation Home Loans In All 50 States

We are proud to present hard working bankers that roll up their sleeves to deliver amazing solutions. With USDA rural loan programs might be available to those whom have been previously turned down by other banks, or whom need a focused banker ready to listen and fight for their loan. Put us to work for you, we’re ready!

*Construction Loans not available in Alaska or Hawaii.

Also Check: What Is Loan To Value Mortgage

How Do Usda Loans Compare To Conventional Loans

A USDA loan and a conventional loan are both a kind of mortgage you get to finance a home. Conventional just means a type of mortgage that isnt backed by the government, like FHA, USDA and VA loans.

You pay them all back the same way, in monthly payments with interest. But USDA loans, like other government-backed loans, are different in a few ways.

Usda Home Loan Eligibility

In order to be considered eligible for a USDA home loan, borrowers must meet specific guidelines.

Eligible Geographic Areas: To get a USDA home loan, the property you buy must be in a USDA designated rural area, but its not all farmland. Almost 97% of the U.S. is eligible, which includes small towns and suburbs. The USDA Mortgage eligible area requirement map will show you all the areas where you can use this loan.

Income limits: The USDA loan was originally designed for low to moderate income earners. The programs guidelines define income level as being up to 115% of the areas median income. In many parts of the country, this can be quite generous. For lower income buyers, a households entire income is considered during the application process, which helps increase eligibility. This can include income from a child or other family member living in the house but who isnt listed on the loan application.

USDA home loans differ based on the kind of loan youre interested in, but they all have the same eligibility requirements.

Don’t Miss: How To Determine Ltv Mortgage

Usda Loan Terms & Eligibility

The home must be purchased in an area designated eligible by the USDA. USDA Loans location eligibility can be found by going to the USDA eligibility pagehere. Applicants for loans may have an income of up to 115% of the median income for the area they are interested in. State and county income limits can be found on our state pages hereUSDA home loan state and income information.

Individuals or families must be able to afford the housing payment, which includes taxes and homeowners insurance, along with reasonable credit and not own a home by the closing date.

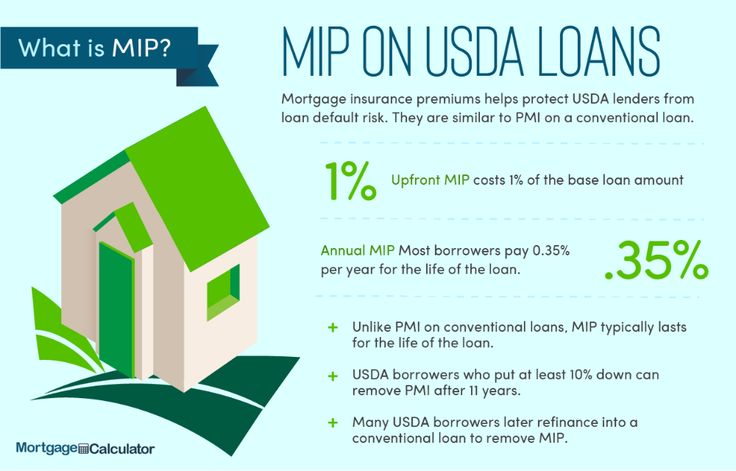

The mortgage will be for a term of 30 years with interest rates that are comparable with any other 30 year government mortgage. Because of the terms of a USDA home loan, payment are lower than most other loans on the market today. There is no maximum loan amount. There is a yearly fee that is .35% of the loan amount per year broken down into 12 monthly payments.

Closing Costs On Usda Loans

How about closing costs on the home purchase?

On any home purchase transaction, there are closing costs that a home buyer is responsible for. However, a home buyer does not have to cough up any closing costs on a home purchase.

As long as buyers can get a sellers concession towards the home buyers closing costs. In the event, if the home seller does not want to give a sellers concession towards the buyers closing costs, lenders can give a lenders credit.

Lenders credit towards the home buyers closing costs covers when there is a shortage in closing costs with a sellers concession.

If the home buyer can structure the home purchase right, buyers can purchase a home with no down payment and no closing cost with USDA Loans.

USDA loan programs do have a mandatory funding fee.

But the funding fee can be rolled into the balance of the mortgage loan.

Don’t Miss: How Long Is The Mortgage Process

These Classes Are Designed To Help You Navigate The Homebuying Process And Can

How much can i qualify for as a first time home buyer. The Home Possible loan program is Freddie Macs version of the HomeReady program. Household income is generally defined as the combined income of all members in the household even if their names are not on the loan. Created as a response to the 2008 financial crisis the Housing and Economic Recovery Act HERA allowed new homebuyersto get a tax credit of up t0 7500 during the first year of the initiative.

If passed into law eligible first-time home buyers would receive up to 25000 cash which they could use for down payments on a house real estate closing costs mortgage interest rate reductions and other home purchase expenses. Fannie Mae and Freddie Mac created loan programs for low-income first-time homebuyers. The term first-time homebuyer can be misleading.

As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. Home Possible loans were created by Freddie Mac to help first-time homebuyers. 1 day agoThat means you can likely find a low-down-payment loan or one with lower credit requirements even if you dont qualify as a first-time home buyer.

While that might sound shocking its no wonder when you consider that Americans have record-breaking credit card debt and oppressive student loan balances. Well help you estimate how much you can afford to spend on a home monthly payment. – Down payment of 0 -.

First-Time Home Buyer Resource Center.

Shop Around For A Great Offer

It’s always a good idea to seek out multiple mortgage offers rather than settle on the first one you get. Contact a few different USDA mortgage lenders to see what rates you qualify for.

With a USDA loan, you could become a homeowner with little or no down payment, so it pays to see if one of these mortgages is right for you. And if you don’t qualify immediately, you may want to work on making yourself a better loan candidate by dealing with delinquent debt or waiting until you’ve been at your job for at least two years. Though there are other mortgage types that let you buy a home with a minimal down payment, so it’s worth doing what you can to take advantage of a USDA mortgage if you’re buying in a rural part of the country.

Recommended Reading: Can You Refinance Mortgage Without A Job

What Are The Drawbacks Of A Usda Loan

One of the biggest drawbacks of a USDA loan is finding an eligible property that meets the criteria. For example, if a home has a second unit on the same property, such as an accessory dwelling unit or a grannie flat , the home might be ineligible for a USDA loan.

Likewise, the value of in-ground pools can affect your financing as the USDA might deduct the value of the pool from the price of the house, so you wont get 100% financing.

The USDA also charges an upfront guarantee fee of 1% and an annual fee of 0.35% of the total loan amount. This applies to both purchases and refinances.

Income And Credit Qualification Requirements For Usda Loans

How Do I Qualify for USDA Loan:

Besides the property needing to be in a USDA location, the borrower needs to be qualified for USDA mortgage requirements.

The maximum debt to income ratios required is 28% front-end ratio and 41% back-end debt to income ratios. There is also a maximum income cap. Borrowers cannot be making $500,000 per year and qualify for a USDA loan.

The borrowers household income cannot exceed 115% of the countys median income. Maximum income requirements vary from county to county. Household income requires all income by the heads of household to be used.

Also Check: Who Has The Best Mortgage Loan Rates

Upcoming Eligible Usda Map Changes

USDA had slated changes to its eligibility maps for October 1, 2015. However, according to a source inside USDA, map changes had been postponed.

According to the source, eligibility maps are now reviewed every three to five years. The last review happened in 2014.

USDA runs on a fiscal year of October 1 through September 30. This is why most big changes to the program happen in October. For this reason, watch for a geographical boundary change on October 1, 2020.

Changes are more likely in 2020 and 2021. The reason: The 2020 census. USDA bases its maps on these US-wide population counts that happen every 10 years. Since the USDA has not made major changes to maps since the year 2000, its becoming more and more likely that big updates will happen soon.

What Are The Eligibility Requirements For A Usda Home Loan

The location of the home must have a population of 35,000 or less and the home must be a primary residence. Loans are available to those with low and moderate incomes. Income limits vary depending on where you live and the loan program. In general, a credit score of at least 640 is ideal, but you may still qualify if your score is lower. Also, you cannot be delinquent on any federal debt and must be a U.S. citizen or legal nonresident alien.

Also Check: How Much Is Mortgage Tax In Ny

Usda Loan Property Requirements

The USDA loans goal is to provide safe and sanitary residences for low to moderate-income households. Through the USDA loan, eligible homebuyers can purchase, build or refinance a home.

To meet this goal, the USDA sets basic property requirements that protect homebuyers as well as lenders. A few of these property requirements include:

- The home must be used as the homebuyer’s primary residence

- The site must have direct access to a street, road or driveway

- The property must have adequate utilities and water and wastewater disposal

A final consideration is that the USDA loan cannot be used to purchase an income-producing property. However, if the property includes barns, silos, commercial greenhouses or livestock facilities that are no longer used for commercial operation, the property may still be eligible.

Other eligible property types include:

- New construction

- Condos or townhouses

- Short sales and foreclosed homes

The USDA loan program has helped thousands of borrowers achieve the dream of homeownership and continues to be one of the best loan options on the market today.