Bank Statement Mortgages For Self

If you cant qualify for a self-employment mortgage the traditional way, you may have another option. Non-QM or portfolio mortgage lenders offer an alternative product called a bank statement loan. Instead of tax returns, you supply 24 months of bank statements for your business or personal bank account.

The lender averages your monthly deposits over a two-year period and comes up with a monthly figure. This number is not usually the full average but some percentage of it.

Again, if your income has dropped year over year, youll have some explaining to do. A good loan officer, like the professionals at Gustan Cho Associates, can help you explain your income and determine which program will work best for you.

Organize Your Financial Affairs

Being organized by completing your tax returns and having up-to-date information on your income will save you time when applying for a mortgage. Lenders currently insist on taking a look at your tax forms, and they prefer collecting this directly from IRS. To expedite the process, you need to fill out IRS Form 4506-T, which gives the lender permission to request your tax records from the IRS.

Documenting Income & Profit Trends In Mortgage Applications

If you’re a W-2 employee and you earn a huge raise, a promotion or a better-paying new position, underwriters use your new, higher income. However, if you’re self-employed and made a lot more income this year than the year before, lenders don’t give you credit for all of it they average it over the last 24 months.

In addition, you must explain an exceptionally large year-over-year increase, or underwriters may conclude the income resulted from a windfall and not from normal business activities. It’s smart, therefore, to prepare explanations for revenue increases that exceed 25 percent. An underwriter may ask you to provide CPA-audited financial statements.

What if revenue declines from one year to the next? You’ll have a hard time finding approval if that’s the case. FHA guidelines state, “Annual earnings that are stable or increasing are acceptable, while businesses that show a significant decline in income over the analysis period are not acceptable, even if the current income and debt ratios meet FHA guidelines.”

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

Using Business Accounts For Your Down Payment And Closing Costs

In some cases, you can use funds from your business accounts from your down payment.

Sometimes, though, the underwriter will ask you for a letter from your CPA saying that taking money from the business wont jeopardize ongoing health of the business. Your CPA may or may not be willing to write this letter.

The underwriter wants to verify your business wont be short on cash and be forced to take out loans or shut its doors due to lack of funds. After all, your business is the source of your income, and if your income stream stops, you may default on your loan.

Any business funds used for closing costs or the down payment on a home should be excess money that the business will not need for the foreseeable future.

What You Need To Do When Youre Self

Below is a simple step-by-step guide to what you need to do to get a mortgage if youre self-employed.

To start you must have an active business for at least 12 months consenutively to qualify for a mortgage from most lenders.

You will have to submit various documents including proof of self-employment.

Recommended Reading: Can You Refinance Mortgage Without A Job

Plan Ahead For Tax Write

If youre self-employed, you probably qualify for various write-offs. These are costs that can be claimed as deductions when you file your taxes. Its typically beneficial for self-employed people to write off business expenses because it reduces the amount of taxes they owe. But write-offs can actually work against borrowers looking to get a mortgage. Why? Write-offs save you money by reducing your overall taxable income. And lenders look at your taxes to see your income history and figure out your net income, which is the amount of money you make after your expenses are subtracted from your total gross income. To lenders, that smaller income amount may qualify you for a smaller mortgage.

Self-employed borrowers can improve their chances of getting approved for a loan by planning ahead. If you want to increase the amount of qualifying income on your application, consider the long-term impact of writing off business expenses. And remember, to count toward qualifying income, most sources of revenue need to be documented consistently for a two-year period.

Using Debt To Income Ratio

Depending on your gross income, and the debts you are servicing, lenders can only allow you to borrow a specific percentage of your income, which is generally referred to as the debt to income ratio. When determining your DTI, two critical numbers matter:

-

Front-end ratio– this is a ratio that indicates what share of your income is committed to mortgage payments. Essentially, the front-end ratio is derived by dividing your expected monthly mortgage payment by your gross monthly income. Ideally, your housing-related payments should not go past 28 percent of your income.

-

Back-end ratio- this is a ratio that indicates what share of your monthly income goes toward settling existing debts, including all your total recurring debt payments, including child support, credit cards, student loans, housing, car loans. Lenders use this ratio together with the front-end ratio to approve mortgages. Your back-end ratio should not exceed 36 percent of your income.

If you want to improve your back-end DTI to qualify for a larger loan, youll need to reduce or eliminate other debt repayments.

Don’t Miss: Is Closing Cost Part Of Mortgage

Tip : Check Your Debt

Your debt-to-income ratio, or DTI, is the percentage of your gross monthly income that goes toward paying your monthly debts. Lenders pay attention to it because youre a less risky borrower when your DTI is low. That means you have more budget for a mortgage payment.

To calculate your DTI, divide your monthly recurring debt by your monthly income before taxes. Fluctuating monthly bills such as utilities, property taxes, groceries and repairs arent considered debts and arent taken into consideration when calculating DTI.

If your DTI is more than 50% and you want to get a mortgage, focus on reducing your debt before applying.

Calculating A 25% Dti

- Monthly recurring debts: $2,000

- Monthly housing payment: $2,500

Most mortgage programs require homeowners to have a Debt-to-Income of 40% or less, but loan approvals are possible with DTIs of 45 percent or higher. In general, mortgage applicants with elevated DTI must show strength on some other aspect of their application.

This can include making a large down payment showing an exceptionally-high credit score or having large amounts of reserves in the bank accounts and investments.

Also, note that once a loan is approved and funded, lenders not longer track Debt-to-Income ratio. Its a metric used strictly for loan approval purposes. However, as a homeowner, you should be mindful of your income versus your debts. When debts increase relative to income, long-term saving can be affected.

Mortgage Default Insurance Rates For A Self

If you can prove your income through your personal tax Notices of Assessment, mortgage default insurance works exactly the same for a self-employed mortgage as it does for a traditional mortgage: you have to pay a premium if you are only putting down between 5 and 19.99%, and you dont have to pay it once you can put down 20% or more. The premium is then added to your mortgage and paid off over the life of your loan.

Mortgage Lenders Only Count Taxable Income

If you hope to buy a house or refinance while self-employed, thispoint is key: lenders only count taxable income toward your mortgage.

Underwriters use a somewhat complicated formula to come up withqualifying income for self-employed borrowers. They start with your taxableincome, and add back certain deductions like depreciation, since that is not anactual expense that comes out of your bank account.

Business owners and other self-employed workers often take as manydeductions as they can. While this can save you a lot of money come tax time,it can also hurt you when it comes to your mortgage application.

For instance, say you earn $6,000 a month. But after deductions,your taxable income is only $4,000 per month. Heres how your home buying budgetchanges:

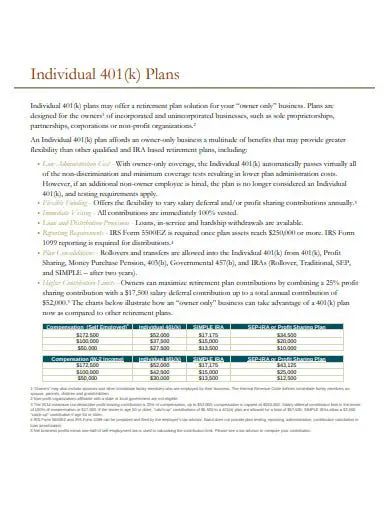

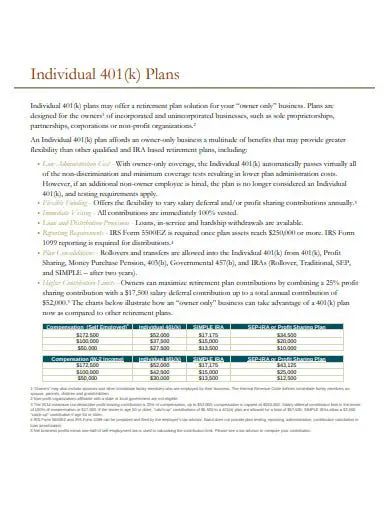

| Monthly Income |

| $250,000 |

*Example assumes a maximum debt-to-income ratio of 36%

In this example, losing $2,000 off your monthly income reduces yourhome buying budget by more than $150,000.

Some self-employed borrowers get around this issue by using a type of mortgage called a bank statement loan, which lets you qualify based on total funds coming into your bank rather than tax returns.

However, bank statement loans are considered non-qualified mortgages. This means they lack some of the consumer protections of major loanprograms and have higher interest rates.

The majority of self-employed borrowers stick to mainstream loan programs with lower interest rates, even though their loan amount may be smaller.

How To Get A Mortgage When Youre Self

3-minute read

When youre self-employed and you want to buy a home, you fill out the same application as everyone else. Lenders also consider the same things: your , how much debt you have, your assets and your income.

So whats different? When you work for someone else, lenders go to your employer to verify the amount and history of that income, and how likely it is youll keep earning it.

Required Documentation For Self

If you are self-employed, you will have to hand over more documentation than a salaried borrower would. Here are a few extra items youll need to provide:

- 2 years personal tax returns with all schedules

- 1099s

- W2s from your self-employed business

- Schedule C, D, E, F

If you are part of a business that has many owners, make sure all controlling parties agree that you can have access to business tax returns and can turn them over to a lender.

The Va Interest Rate Reduction Refinance Loan

The VA Interest Rate Reduction Refinance Loan is another refinance program which waives traditional home loan Debt-to-Income requirements. Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W-2s and pay stubs.

The VA Streamline Refinance is available to military borrowers who can show that theres a benefit to the refinance either in the form of a lower monthly payment or a change from an ARM to a fixed-rate loan.

How Does A Self

When youre self-employed, it can be sometimes tricky to figure out your overall income and your profit. Unlike full-time employed people, you dont have a fixed wage or hourly pay. Its important for self-employed people to know how much they actually earn, especially when it comes to figuring out what your mortgage payments are likely to be.

A self-employed mortgage calculator uses the information you put in to calculate what your mortgage repayments might be based on your income. When you use a self-employed mortgage calculator, youll usually be asked to put how much you get paid, your pension contribution and the business expenses to work out your affordability, and what your repayments are likely to be.

We Created A Helpful Infographic To Aid You In Understanding How To Use Add

-

Red light means stop. These items are generally not acceptable to claim as an add-back.

-

Yellow light means proceed with caution. These items will be considered by your underwriter on a case-by-case basis. Consult your underwriter if need be theyre the experts and theyre happy to help.

-

Green light means go! These items are acceptable and approved by lenders.

When in doubt, let us help you figure it out. Providing your underwriter with the clients statement of business activities, T1 summary and accountant-prepared company financials with your submission will take the guesswork out of what income can be used for qualifying and will also allow for a smooth process and reliable approval.

We hope this information helps clarify these options for your next deal. If there are other mortgage terms youd like to see explored, please leave us a comment. And make it a tough one, we love a good challenge.

Need a Broker?

Qualifying The Self Employed Borrower

$125.00

After completing this training your MLOs and processors wont go into a panic because the borrower states their self employed.

Detailed, realistic, and current tax returns are used throughout this training. You may have software to do these calculations but software cant explain therules to the borrowers.

What If Your Reported Income Seems Too Low

Many taxpayers maximize their deductible expenses to lower their tax bills. That’s great at tax time, but it minimizes your reportable income when you apply for a loan lenders count the income you report on your taxes. If your monthly income turns out to be lower than you expected, consider these steps:

- Include other sources of income. Although the Credit CARD Act of 2009 limits the types of income you can include on a credit application, if you have any of the following, you may be able to include them in your stated income:

- Employment earnings

Is It Possible To Reduce Your Self

If you want to reduce your self-employment tax, then you will need to claim all available self-employment deductions that you can on Schedule C. This will reduce your net business income which will reduce the amount you owe in self-employment tax. You can get more information about proper forms necessary for self-employment deductions by speaking to a professional or getting information from the IRS website.

What If I Dont Have Two Years Of Accounts

Very few lenders will accept self-employed borrowers with less than one year of trading history. You might have a very strong start to your company followed by a slump in sales. If you nearing the end of your second year of trading, its possible that a lender will consider your application if you also have a strong credit history, an existing relationship with the bank, or a healthy deposit. Every self-employed person is different, so the best first step you can take is to speak to a mortgage advisor who will be able to determine which lenders are most likely to accept your application.

Income Requirements For Sole Traders

As the name suggests, sole traders are one-man bands. If you set up your self-employed business as a sole trader, then calculating your income will be much easier as all company profit is yours to keep.

When considering your income, mortgage lenders will usually want to see at least 2 years worth of accounts. They will usually ask to see your SA302 form from HMRC. This is your end of year tax document which outlines your income and expenses and your tax liability.

Most mortgage lenders will either calculate your average income for the past two years if the most recent figure is higher. They might also just consider the most recent years total income. Some lenders will ask to see SA302 forms for the past 3 years and work out the average of all 3.

How Long Must You Be Self

The general rule is that mortgage lenders look for you to be self-employed for at least 24 months. They will look to document this history through a variety of sources, including two years income tax returns, a verbal or written verification of employment from your CPA, or a copy of a business license.

The reason for the two-year requirement is that lenders understand that income from self-employment is usually less predictable than what it is for salaried borrowers. As such, they will want evidence that you have been in business for at least two years. They will then average your income over that two year period.

> > MORE: Compare Loan Options and Mortgage Rates

However, they may also accept a shorter time frame. They may consider income if you have been self-employed for between 12 and 24 months, but never less than 12 months.

If they do accept 12 24 months, you will have to provide your most recent income tax return, clearly demonstrating that you have received self-employment income for the entire 12 months covered by the return.

If they do accept less than 24 months, they will also verify your previous earnings history, to cover two years of employment. The lender will want to know that you have at least been employed in a similar line of work, even though its from a job, and that you have the skills, qualifications and earnings history to support the self-employment income used to qualify.

What Documents Do You Need To Provide

To start, youll need a history of uninterrupted self-employment income, usually for at least two years. Heres some examples of documents a lender might ask for.

Employment Verification

Employment verification is proof that youre self-employed. It could include emails or letters from the following:

- Current clients

- A licensed certified personal accountant

- A professional organization that can attest to your membership

- Any state or business license that you hold

- Evidence of insurance for your business

- A Doing Business As

Income Documentation

Have proof of steady, reliable income and youre one step closer to getting approved for a mortgage. Note that even if you make consistent money now, your past income will also influence your ability to get a loan. Your lender will ask for the following:

- Personal tax returns

- Profit and loss forms, which could include a Schedule C, Form 1120S or K-1, depending on your business structure

What happens if youve been self-employed for less than two years?

Great question. Ultimately, your business must be active for a minimum of 12 consecutive months and your most recent two years of employment must be verified. In this situation, your lender will likely do an in-depth look at your training and education to determine whether your business can continue a track record of stability.