How Much Can You Afford To Borrow

Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit. In this example, the lender would be willing to offer a loan amount of £171,000. Meanwhile, some lenders may offer first-time buyers a 100% mortgage with a £0 deposit. However, obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. This is usually one percent higher than a mortgage that requires a deposit. Consider this expensive trade-off before choosing a zero-deposit deal.

If you know the interest rate youll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. The example is shown in the table below.

Default Calculation

| £551,596 £524,016 = £27,580 | £240,272 £228,258 = £12,014 |

If you had £200 in other monthly home ownership related fees, then this might take a renter equivalent of £1,000 down to £800.

What The Early Mortgage Payoff Calculator Does

Do you want to pay off your mortgage early? Maybe you have 27 years remaining on your home loan but you would rather pay it off in 18 years instead. The early payoff calculator demonstrates how to reach your goal.

The mortgage payoff calculator shows you:

-

How much more principal you would have to pay every month so you can pay off the loan in a certain number of years.

-

How much interest you would save by paying off the loan early.

There are many reasons you might want to accelerate the mortgage’s payoff, but the motivation usually boils down to either or both of these:

-

You want to own your home free and clear by a milestone in life, such as your retirement or the beginning or end of your kids’ college years.

-

You want to reduce the total interest you pay over the life of the loan.

To steadily pay off the mortgage early, you need to know how much more to pay toward the principal balance every month to accomplish that goal. This calculator lets you do that.

When paying down the principal on a mortgage faster, keep in mind that each servicer has its own procedures for assuring that your extra payments go toward the principal balance instead of toward future payments. Contact your servicer for instructions.

Additional Ways To Find Your Mortgage Balance

Mortgage companies will send out a mortgage statement â electronically or by mail â on an annual basis. These statements reveal the mortgage balance, number of payments that were made, and interest charged.

But what if you want to proactively find your exact mortgage balance â as stated by your mortgage company? Two popular options include:

- â Your mortgage company can give you your mortgage balance over the phone. Simply call and ask.

- Go online â Your mortgage company website will probably show your mortgage balance. You’ll have to create an online account â with a login and password â that will enable you to view your mortgage balance anytime you wish.

Don’t Miss: Can You Add Money To Mortgage For Improvements

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

Why Overpay On Your Mortgage

Making early payments means you could:

-

Pay off your mortgage early which means you’ll be mortgage free quicker

-

Save thousands of pounds in interest charges

For example, a monthly overpayment of £200 on a £200,000 mortgage could save you £21,622 in interest. You would also shave 5 years and 11 months off your mortgage term..

Don’t Miss: What Is Excellent Credit Score For Mortgage

How Do You Compare Loan Offers

In any loan scenario, you have to make underlying assumptions such as:

- If you are likely to remortgage the loan again.

- When you are likely to remortgage.

- Where you think interest rates are headed.

- If you think you will sell the home soon.

- If rates head higher and your rate resets well above the initial offer, will your wages be enough to cover payments?

Look Beyond the Monthly Payment

Its important to consider the overall mortgage costs, not just the monthly payment amount. Borrowers will find interest-only payments affordable. However, compared to a full repayment mortgage, you immediately build equity in your home. This bring you closer to home ownership, stability, and grants you further life flexibility. In contrast, interest-only payments do not build equity. It does not provide financial cushion which helps protect you against shifting market conditions.

If one loan amortises and the other does not, then you have to look at how much equity you build in a home. This is a key factor in determining value. Most people also do not want to pay mortgages for the entire lifetime, or until they hit a tough patch and risk foreclosure.

Example Loan Comparison from a Reader

The key to being able to accurately compare mortgage offers is to only adjust a single variable at a time. This way you can easily see the differences between offers, instead of trying to compare apples to oranges.

The example below is based on a question from one of our users named Dan.

| Year |

|---|

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Don’t Miss: What’s The Average Mortgage Payment

Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

Don’t Miss: Which Is Better 30 Or 15 Year Mortgage

How To Use The Mortgage Repayment Calculator For Overpayments

Simply enter your details into the overpayment mortgage calculator.

We work out how much interest your mortgage deal is likely to charge over the remaining term if you don’t make any overpayments. We then compare this with the interest you could pay if you make the overpayments entered. Using this information, we can then show you how much you would save in interest by making those overpayments.

We also calculate how long it would take to pay off your mortgage if you overpay. Comparing this to your remaining mortgage term lets us show you how much sooner you could pay off your mortgage balance.If you dream of achieving an early mortgage payoff, this calculator could help you get on the right track.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Also Check: What Score Do Mortgage Companies Use

How Lenders Decide How Much You Can Afford To Borrow

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio.

Your debt-to-income ratio is the percentage of pretax income that goes toward monthly debt payments, including the mortgage, car payments, student loans, minimum credit card payments and child support. Lenders look most favorably on debt-to-income ratios of 36% or less or a maximum of $1,800 a month on an income of $5,000 a month before taxes.

How To Use The Existing Loan Calculator

Follow these steps:

You May Like: How Much Income For A 250k Mortgage

Mortgage Calculator With Taxes And Insurance

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

How To Account For Taxes And Recurring Expenses

Accounting for recurring charges like PMI and HOA fees requires a little more work, but even these aren’t very difficult to calculate. You can find the total cost of recurring expenses by adding them together and multiplying them by the number of monthly payments . This will give you the lifetime cost of monthly charges that exclude the cost of your loan.

The reverse is true for annual charges like taxes or insurance, which are usually charged in a lump sum, paid once per year. If you want to know how much these expenses cost per month, you can divide them by 12 and add the result to your mortgage payment. Most mortgage lenders use this method to determine your monthly mortgage escrow costs. Lenders collect these additional payments in an escrow account, typically on a monthly basis, in order to make sure you don’t fall short of your annual tax and insurance obligations.

You May Like: How To Know How Much Mortgage I Can Afford

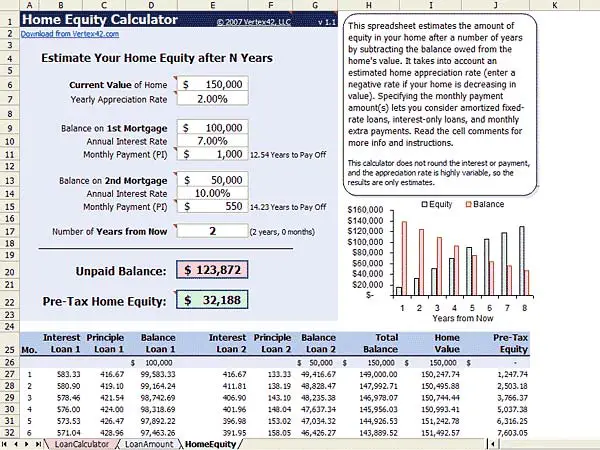

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

How To Use The Early Mortgage Payoff Calculator

To fill in the calculator’s boxes accurately, consult a recent monthly statement or the first page of the Closing Disclosure that you received when you closed on your mortgage.

-

Under Loan term , enter the number of years for which your home is financed.

-

Under What was your mortgage amount?, fill in the loan amount. In the Closing Disclosure, you can find this on the first line of the Loan Terms section.

-

Under Interest rate, enter the percentage.

-

Under How many years are left on your mortgage?, you’ll need to enter a whole number, so round up or down.

-

Likewise, under In how many years do you want to pay off your mortgage?, you’ll have to enter a whole number, rounding up or down.

-

Under How much do you still owe ?, look for this figure in a recent monthly statement, or contact the mortgage servicer. Or you can use NerdWallet’s mortgage amortization calculator and drag the slider to find out how much you still owe.

You May Like: What Is Needed For Mortgage Application

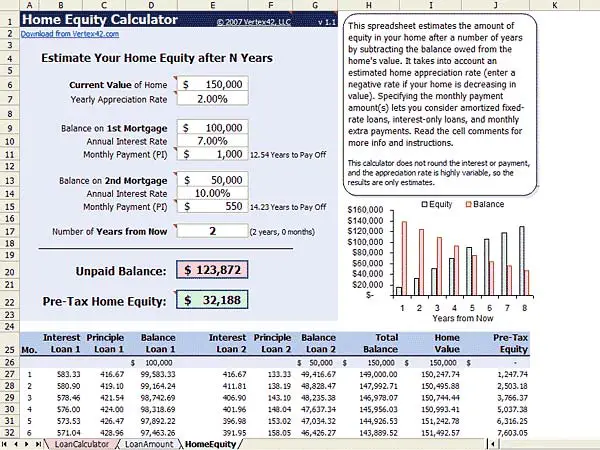

What Does Having Equity In Your Home Mean

Equity is the value of how much of your house you own. For example, if your mortgage balance is £150,000 and your house is worth £200,000, you have £50,000 equity in the property.

If you sold your house for £200,000, you would use £150,000 of this to pay off your mortgage, and you could keep the remaining £50,000 or use it towards buying a new property.

Your equity is made up of the deposit you paid towards the house purchase and any of your mortgage you have paid off. It should keep going up until your mortgage is paid off you then have 100% equity in your home.

Calculate The Balance Remaining On Any Mortgage

This mortgage balance calculator will figure the remaining balance of your…show instructions

To use this calculator just enter the original mortgage principal, annual interest rate, term years, and the monthly payment. Then choose one of the three options for calculating the number of mortgage payments made to determine the remaining balance.

Note: this mortgage balance calculator is only for fixed rate mortgages where the terms are constant. Don’t use for any mortgage where the terms will vary over time .

Don’t Miss: Can You Get A Mortgage With Less Than 20 Down

Want To Make Irregular Payments Do You Need More Advanced Calculation Options

- Biweekly Payment Method: Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.

- Extra Payments In The Middle of The Loan Term: If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. For example, if you are 3.5 years into a 30-year home loan, you would set the loan term to 26.5 years and you would set the loan balance to whatever amount is shown on your statement. If you do not have a statement to see the current balance you can calculate the current balance so long as you know when the loan began, how much the loan was for & your rate of interest.

- Irregular Extra Payments: If you want to make irregular extra contributions or contributions which have a different periodicity than your regular payments try our advanced additional mortgage payments calculator which allows you to make multiple concurrent extra payments with varying frequencies along with other lump sum extra payments.

For your convenience current Los Angeles mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

Read Also: Are Mortgage Rates Going To Rise

How Do I Pay Off My Mortgage Early

One way to pay off your mortgage early is by adding an extra amount to your monthly payments. But how much more should you pay? NerdWallet’s early mortgage payoff calculator figures it out for you.

Fill in the blanks with information about your home loan, then enter how many more years you want to pay it. The calculator not only tells you how much more to pay monthly to pay down your principal faster it also shows how much you’ll save in interest.