Where Can You Get A Mortgage With Guaranteed Rate

Guaranteed Rate NMLS ID: 2611

Probably most borrowers who engage with Guaranteed Rate will do so online.

The lender is licensed across all 50 states so anyone can start their mortgage application right at home.

And why wouldnt you? The website offers exceptional functionality and, if you get stuck, theres a knowledgeable loan officer at the end of a phone line.

Of course, some borrowers prefer a face-to-face relationship when making big financial decisions. To serve customers in person, Guaranteed Rate has over 300 branch locations peppered throughout 46 states, including:

- AK, AL, AR, AZ, CA, CO, CT, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MT, NC, ND, NH, NJ, NM, NV, NY, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, WA, WI, WY

Some states like California have tons of branches, while others like Louisiana have just one.

But still, Guaranteed Rates branch network is better-spread than many other lenders and large banks. Its worth checking where your nearest office is.

Which Mortgage Lender Has The Lowest Closing Costs

Closing costs are around 2-5% of the loan amount on average. Thats over $4,000 on a $200,000 loan a considerable amount of cash.

Just like mortgage rates, you can shop around for the lowest closing costs to minimize your out-of-pocket fees.

Heres how the top mortgage lenders compare for total loan costs, according to 2020 data from HMDA.

| Mortgage Lender | |

| 1.79% | $4,481 |

When youre shopping around, note that some closing costs cannot be negotiated because theyre set by third parties .

But lenders do have wiggle room when it comes to setting their own fees. So if you get multiple offers, you might have some leverage to negotiate your costs down.

Some homebuyers even get the seller to cover some or all of their closing costs. But thats not a guarantee, so you should still plan ahead for these expenses.

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Don’t Miss: How Much Do You Pay Back On A Mortgage

How To Find The Best

Now that you know what all those fees and line items really mean, youre ready to compare prices from different lenders.

At Better Mortgage, weve streamlined the mortgage process and done away with Loan Officer commissions and lender fees, passing the savings to you. So once you have your Loan Estimates from us, feel free to shop around. Were confident that we can get you the best terms.

Mortgage Loan Products At Guaranteed Rate

Guaranteed Rate has a comprehensive range of mortgage products. With FHA, VA, and USDA mortgages, there are plenty of opportunities to get a low- or no-down-payment loan.

In addition, Guaranteed Rate is one of the few lenders weve reviewed that offers interest-only mortgages. This is a unique option that has lower, interest-only payments at the start of the loan term.

Guaranteed Rates full list of mortgage loan options includes:

With such a wide selection, many customers will be able to find the mortgage loan theyre looking for at Guaranteed Rate.

Also Check: Can I Use My Partner’s Income For A Mortgage

Found 70 Of Over 72 Reviews

“Other employees willing to help you”

Cons

“For a sales position, the pay is extremely low”

Team environment, organized, good benefits

Cons

The pay was lower than other companies for that position

Pro employee both in personal and professional development

Cons

Be more proactive with training for new product rollouts

Find A Pro In Your State

We might be right in your backyard

Mortgage rates are volatile and subject to change without notice. All rates shown are for 30-day rate locks with two points for an owner-occupied primary residence unless otherwise noted. The APR for adjustable rate mortgages is calculated using a loan amount of $417,000, two points, a $495 application fee, $400 appraisal fee, $995 underwriting fee, $10 flood certification fee and a $20 credit report fee. Some rates and fees may vary by state.* Products are subject to availability on a state-by-state basis. All interest rates listed are for qualified applicants with 740 or higher FICO and 80 LTV over a 30-year loan term except where otherwise noted and are subject to mortgage approval with full documentation of income. By refinancing your existing loan, your total finance charge may be higher over the life of the loan.

*Terms and Conditions Apply. For complete details click here.

185 Plains Road – 3rd Floor – Milford, CT 06461

Also Check: What Is The Most Accurate Mortgage Calculator

Interest And Partial Principal

In the U.S. a partial amortization or balloon loan is one where the amount of monthly payments due are calculated over a certain term, but the outstanding balance on the principal is due at some point short of that term. In the UK, a partial repayment mortgage is quite common, especially where the original mortgage was investment-backed.

How To Find Your Lowest Mortgage Rate

Mortgage rates are highly personal. Factors like your credit score and debt-to-income ratio will have a big impact on the rate you get.

That means the company with the lowest average rates wont always be the cheapest lender for everyone.

For example: Among the 40 mortgage lenders in our study, Freedom Mortgage had the lowest average mortgage rate in 2020, at just 2.92% for a 30-year loan.

But average rates tell only part of the story. Overall, Freedom Mortgage rates ranged from under 2% to over 6%. So some people got much lower rates than others.

To find your best deal, you have to request rate quotes from more than one company and compare offers.

Also Check: Can You Refinance Mortgage With Poor Credit

Total Mortgage Services Reviews

- – New Haven, CT, United States Area

- – Bridgeport, CT, United States Area

- – Willimantic, CT, United States Area

- – Massachusetts

- – Worcester, MA, United States Area

- – New York State

- – Albany, NY, United States Area

- – Rhode Island

- – Providence, RI, United States Area

- – Wisconsin

- – Milwaukee, WI, United States Area

How Do Guaranteed Rate Mortgages Compare

When we looked over Guaranteed Rate’s mortgage offers through its online tool, we found that both the user experience and the numbers were much better than what we’ve found with the average direct lender. We made a comparison of the company’s 30-year mortgage with those at major banks, based on a purchase price of $198,000 and down payment of 10%.

30-Year Fixed Rate Mortgage Estimates at Major Banks

| Guaranteed Rate | |

|---|---|

| $66 | $61 |

While mortgage rates are constantly changing, obtaining these estimates at the same time allowed us to get an idea of Guaranteed Rate’s competitive advantage. While the rate on offer isn’t significantly better than those at national brands like Chase, Guaranteed Rate will actually give you lender credit in situations where others would charge you for discount points. These points and credits count towards your closing costs, making Guaranteed Rate the more cost-efficient option if you’re determined to reduce your upfront mortgage fees.

If you’re going into a purchase mortgage with less than 20% in down payment, you should note that Guaranteed Rate also provided the cheapest estimate on the cost of mortgage insurance. Mortgage insurance actually protects the lender from the risk of default, but it’s mandatory for borrowers themselves to cover this cost in most cases. Although borrower-paid mortgage insurance can be canceled eventually, having lower premiums from the beginning of your home loan can save you hundreds in the long run.

Also Check: Who Should You Get A Mortgage From

The Latest Conversations About Finance

Everything is here to make your job the easiest. Great support team!

Cons

There are no downsides working at Total Mortgage.

Pros

The job was easy enough to do with a lot of work to do so the day went by quickly

Cons

The pay is very unfair and low

Not much to be honest.

Cons

Awful operations and communication. Poor organizational flow

A self-motivated environment and excellent team effort

Cons

There are too many emails.

Cons

Too many to list off the top of my head

Continue reading1 person found this review helpfulHelpful

Pros

There’s a real work hard play hard mindset here if you like that sort of thing. There’s a lot of good people that work here that make it a good place to work.

Cons

There are also some really immature people who work there. It can be very cliquish in a high school way and one upper manager is just a pathetic bully.

Easy job, occasional parties, cliques

Cons

Tips To Get The Lowest Mortgage Rate

If you want the lowest mortgage rate available, you have to shop around. Thats the number one rule.

But there are other strategies you can use to get lower offers from the lenders you talk to.

Recommended Reading: How Is Home Mortgage Interest Calculated

Guaranteed Rate Review: Good Deals If You Qualify

While it’s somewhat more difficult to get approved for a mortgage with Guaranteed Rate, people who make the cut enjoy the benefits of the lender’s lower rates and closing costs. The credit score minimum on Guaranteed Rate’s conventional loans is 620, but the lender claims to be a bit more selective when it comes to its requirements for income and available funds. However, borrowers can apply to the lender’s FHA and VA loans with a minimum credit score of 580. For those who qualify, Guaranteed Rate carries extremely advantageous rate offers for purchase mortgages in a range of terms and loan types.

In addition, Guaranteed Rate offers an array of smaller discounts that can help you cut back on your closing costs. In our phone call with the company’s loan officers, we found that you can obtain significant credits towards your loan fees if you work with one of Guaranteed Rate’s affiliated real estate agents. This makes the lender a good place to start if you’re still in the early stages of finding a home to buy. And none of Guaranteed Rate’s mortgage products come with prepayment penalties, which means you won’t have to worry about extra fees if you refinance to a new mortgage early on. This is a rare feature compared to other home lenders.

Working With Guaranteed Rate Mortgage

Guaranteed Rates 300 branches are distributed well. But some states still have none or only one or two. So not everyone will have one within a reasonable drive.

Of course, that wont be a problem for those who are comfortable with technology. Guaranteed Rates online services come with all the bells and whistles you could want.

After all, these are the people who claim to have come up with the worlds first digital mortgage, which can deliver a loan approval within minutes.

Theres also an intuitive loan finder tool to help you find your perfect mortgage, a mobile app, and a facility to upload your documents in a secure environment.

Read Also: Why Would A Mortgage Be Declined

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Best Mortgage Rates From Top Lenders

We looked at the 40 biggest mortgage lenders in 2020 to see how their interest rates stacked up.

The 25 companies with the best mortgage rates on average are as follows:

| Mortgage Lender | |

| Citizens Bank | 3.27% |

Note that average rates shown in this table are from 2020, when rates were near record lows almost all year. Todays mortgage rates could be higher than whats shown.

You can still use last years interest rates as a tool to compare lenders side by side. But before you lock in a loan, youll want to get custom interest rates from a few different lenders to make sure youre getting the best deal available today.

Don’t Miss: How To Determine What You Qualify For A Mortgage

Is Guaranteed Rate The Best Mortgage Lender For You

To sum things up, theres little not to like about Guaranteed Rate.

If it offers the loan type you need, its worth getting a mortgage rate quote to see what Guaranteed Rate could offer you.

Just be sure to get quotes from a few other companies, too. And compare them line by line.

Remember, things like discount points can make a loan look more or less attractive at face value than it really is.

Ready to get started?

Bad Credit Doesnt Matter

If you see this, don’t call, don’t e-mail, and don’t say yes to anything if the company approaches you. These loans are probably predatory in nature and will almost certainly come with terrible terms. These types of loans normally target lower-income individuals who are more likely to have damaged credit.

Also Check: Can You Add Money To Mortgage For Improvements

Who Has The Best Mortgage Rates

We analyzed data from the 40 biggest lenders in 2020, looking for the lowest interest rates and fees.1,2 These lenders topped the list for best 30-year mortgage rates:

Freedom Mortgage, Better Mortgage, Citibank, Guild Mortgage Company, American Financial Network.

Remember that rates vary a lot from person to person, so theres a good chance your best rate will come from a company not listed above.

Luckily, rates are at historic lows right now. Its a good time to shop for your best offer.

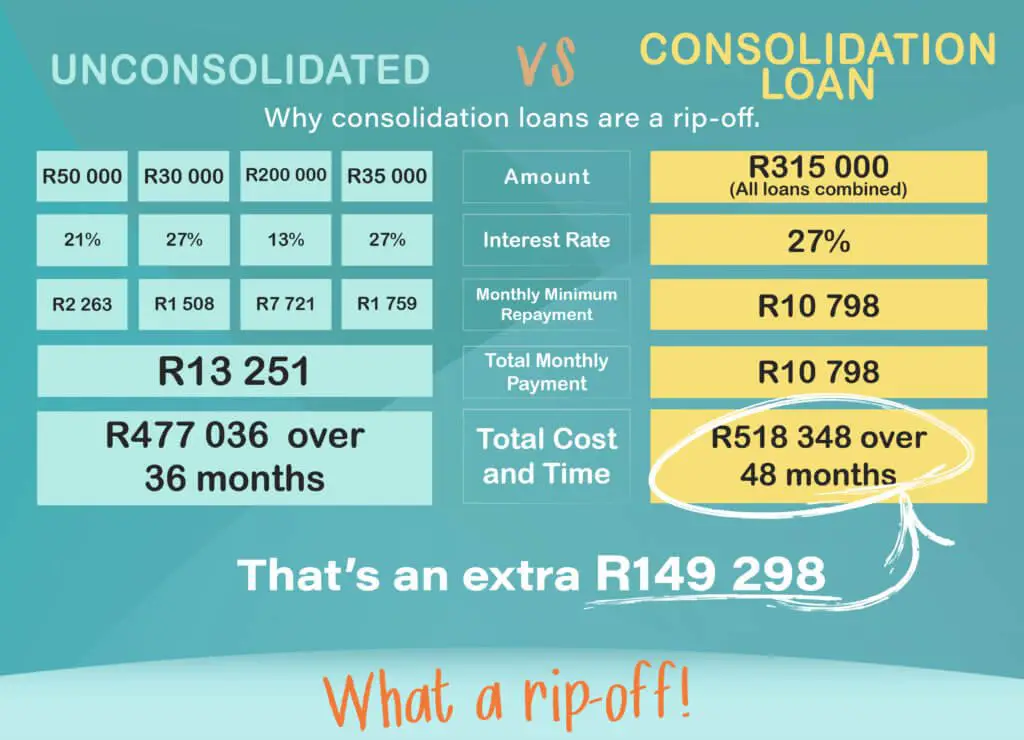

What Is A Reasonable Amount Of Debt

Debtthe word often has a negative connotation as there are many stories of how individuals and companies with too much debt have headed down a road to financial ruin. However, debt can often be a good thing, if managed properly.

Debt can help companies grow and help people purchase valuable assets that are otherwise too costly, such as a house, which in the long term would improve their financial condition. The amount of debt also depends on the interest rate that you’re paying on your debt. An acceptable, low-interest rate, such as those found on mortgages, make debt manageable. On the other hand, high-interest rates, such as those found on credit cards, can often lead to debt levels spiraling out of control.

This is not to say that an individual should constantly be taking on debt. Like most things, a moderate amount that is carefully monitored and within one’s financial means is the right level of debt. Generally, what is considered a reasonable amount of debt depends on numerous factors, such as what stage of life you are at, your spending and saving habits, the stability of your job, your career prospects, your financial obligations, and so on. But to keep it simple, let’s assume that you have stable employment, have no extravagant habits, and are considering the purchase of a property.

You May Like: How To Get A Million Dollar Mortgage