Decide If Youre In The Right Home

One thing to look at to understand how to pay off your mortgage in half the time is whether youre in the right home.

Selling your current home and downsizing to something smaller or with fewer features is one way to cut your overall payments and free up money to pay extra on your home loan.

While you dont have to sell your home, its an option you may consider if your mortgage is really holding you back.

Refinance Your Mortgage Into A Shorter

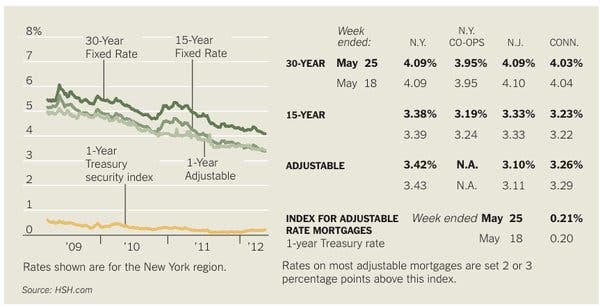

Got a 30-year mortgage? Refinancing it as a 15-year loan will blast you through that mortgage a whole lot faster, and will probably get you a better interest rate as well — shorter loan terms are typically paired with lower interest rates. And thanks to the shorter time frame, you’ll pay a lot less money in interest — so the payments on a 15-year loan are not double the payments of a 30-year loan they’re significantly less. Pull up a mortgage payoff calculator and play around with the numbers to see how much you’d have to pay to do a 15-year refinance. And if the monthly mortgage payment for such a loan would be more money than you can afford, consider a 20-year loan instead.

Discover How To Shorten Your 30 Year Mortgage By 7

By | Submitted On July 02, 2007

How to save thousands of Dollars on your home Mortgage without increasing your payment is a well-kept secret! This is a secret not being used by many homeowners.

Did you know that after paying 15 years on your 30year mortgage youll still owe 90% of the original amount you borrowed and after paying for nearly 24 years youllstill owe over 50%?

Did you know that on a conventional 30 year mortgageyou will make over 120 extra payments? You will pay over3 times the amount you originally borrowed before paying off your mortgage!

Now, if I have gotten your attention, would you like to knowhow to remedy this outrageous situation and, best of all,without spending extra money?Well Ill tell you and you will be amazed at how easy it is. You need to contract with a Mortgage Payment Service. Such aservice uses electronic fund transfers to debit the homeowners bank account every two weeks, not twice per month. There is adifference!

When a homeowner changes to a Bi-weekly budget it allowsthem to accumulate the equivalency of a 13th payment over the course of an entire year by giving them the ability to make 26Bi-weekly payments. Funds are forwarded to the lender onceper month because that is the only way they will accept andpost them.

Periodically the lender will receive the equivalentof 3 Bi-weekly payments to post in a single month, whichallows one Bi-weekly payment to be applied to the principalbalance of the loan.

lesser amount.

page 3

Don’t Miss: Can I Roll My Down Payment Into My Mortgage

Advantages Of Refinancing Into A 15

Rajeh Saadeh, a real estate attorney, professor and investor in Somerville, New Jersey, says the benefits of refinancing to a 15-year loan are plentiful.

Lenders often charge a lower interest rate for a 15-year mortgage than a 30-year mortgage. In addition to lowering your interest rate, you will create a more aggressive paydown schedule, which can save you thousands in interest in the long run, he says. Also, youll build equity more quickly, which youll be able to tap via a future home equity loan, home equity line of credit or cash-out refinance if you need extra money.

Paul Buege, president/COO of Pewaukee, Wisconsin-based Inlanta Mortgage, notes that your monthly payment may not necessarily increase when moving from a 30-year to a 15-year mortgage loan.

You may actually be able to reduce your monthly payment, depending on the size of your current mortgage and how much lower the new rate is compared to your current mortgage rate, says Buege.

Make Mortgage Payments More Frequently

Instead of making one monthly payment toward your mortgage loan, you can make a half-sized payment every two weeks resulting in extra payments during the year. In other words, if your usual mortgage payment is $1000 a month, you would instead pay $500 every other week. These extra payments will have nearly the same impact on your budget as paying one monthly payment, but because there are 52 weeks in a year, a biweekly payment schedule will result in 13 full-sized payments a year instead of the normal 12. You’ll be making an entire extra payment every year without having to scrounge around for the extra money. To look at some real-life numbers, if you have a 30-year $200,000 mortgage at an interest rate of 5%, making biweekly instead of monthly payments would save you $34,328 in interest, save you from extra mortgage payments, and allow you to pay off the mortgage balance almost five years early.

Also Check: How Much Is Personal Mortgage Insurance

Can You Pay Off A Mortgage Early

Because mortgages tend to be large loans that last for a couple of decades or longer, paying off the loan early can save you tens of thousands of dollars in interest. Not to mention, it feels good not having a monthly mortgage payment to worry about.

When you send in your monthly check to your mortgage lender, the payment is split between principal and interest. Early on in the loan, a large portion of that payment is applied to interest. As time goes on, more of the payment goes toward paying down the principal. This is known as amortization, and it allows the lender to make back a larger portion of their money within the first several years of repayment.

The key to paying off your mortgage early is by applying extra payments to the principal.

Pour Every Bit Of Extra Cash Into Your Mortgage

Dedicate every windfall a bonus, raise, or holiday or graduation gift you receive toward paying down debt, recommends Marilyn Lewis in Money Talks News.

Obviously, the highest-interest debt takes priority. But if you have an adequate emergency savings fund and your mortgage is your only debt, dont even ask yourself what youll do with extra money when it falls into your hands: Add it to your mortgage payment, designating it as additional principal.

Also Check: How Much Is An Application Fee For A Mortgage

Bringing It All Together

In short, keep yourself in good standing by paying your home loan on time every month. Solidify your record within your current bank if you have already signed financial documents and put your best financial foot forward if you have yet to choose a bank for your mortgage. Keep abreast of the market as a whole and make sure that your banker knows that you know he is not the only game in town. You must make them work in order to keep your business and you must make sure that your business is worth keeping. Keep these tips in mind and you are sure to find a great deal when it comes to renegotiating your mortage or getting a great home loan contract so that you can pay off your home loan as quickly as possible.

How Can Making Extra Payments Help

When you make an extra payment or a payment that’s larger than the required payment, you can designate that the extra funds be applied to principal. Because interest is calculated against the principal balance, paying down the principal in less time on a fixed-rate loan reduces the interest youll pay. Even small additional principal payments can help.

Here are a few example scenarios with some estimated results for additional payments. Lets say you have a 30-year fixed-rate loan for $200,000, with an interest rate of 4%. If you make your regular payments, your monthly mortgage principal and interest payment will be $955 for the life of the loan, for a total of $343,739 . If you pay $100 extra each month towards principal, you can cut your loan term by more than 4.5 years and reduce the interest paid by more than $26,500. If you pay $200 extra a month towards principal, you can cut your loan term by more than 8 years and reduce the interest paid by more than $44,000.

Another way to pay down your loan in less time is to make half-monthly payments every 2 weeks, instead of 1 full monthly payment. When you split your payments like this, youre making the equivalent of 1 extra monthly payment a year . This extra payment may be applied directly to your principal balance. Be sure to first check with your lender if this is an option for your loan.

Also Check: What Percentage Of Mortgage Is Interest

How To Decide If Refinancing To A 15

Should you refinance to a 15-year mortgage? Again, that depends on your situation. If youre trying to save money right now, youll want to compare costs and do the math to make sure youre actually going to accomplish that especially if you dont plan on staying in the home for a long time. If youre looking to save money in the future and plan on living in your home for many years to come, refinancing to a 15-year may be a good option for you.

Here are a few ways decide.

Whats The Difference In Payments For A 15

The minimum monthly payment on a mortgage is the amount required to be paid in full each month. As the minimum payment for a 30-year mortgage will be lower than that of a 15-year mortgage, this allows more flexibility within your monthly budget. That can come in handy if your income changes, you lose a job or you have financial emergencies to cover.

Before converting to a 15-year mortgage, carefully consider the impact on your finances. Evaluate your ability to pay monthly expenses and how the higher payment will affect your capacity to pay down debts and invest, versus staying pat with the remaining term on your existing 30-year mortgage.

If your goal is merely to pay down your mortgage faster, you can accomplish this by simply making periodic extra payments on your existing mortgage loan. If you make enough extra payments over your loan term, you can easily shave time off your loan even 15 years if you prepay aggressively.

The catch with this strategy is that youll probably pay a higher interest rate on your current 30-year mortgage compared with a new 15-year loan. Youll also have the hassle of managing, specifying and sending in extra payments that will need to be applied to your loan principal.

Lets examine how a lower interest rate and shorter loan term affect the principal amount of a mortgage. In the following scenario, a homeowner with a 30-year, $200,000 mortgage can pay it off in 15 years by adding $524 to each monthly payment.

You May Like: Are Mortgage Rates Predicted To Go Up Or Down

Make More Frequent Payments

It could be one extra mortgage payment a year, two extra mortgage payments a year, or an extra payment every few months. Whatever the frequency, your future self will thank you. Maintain these additional payments over an extended period of time and you’ll likely eliminate several years from your term.

A quick note here: there is no best day of the month to pay your mortgage. Both the principal and interest amounts decrease over time, whether you make payments on the 1st, 15th, or a date in between.

Allocate Extra Funds Towards Your Mortgage

Many taxpayers get a tax refund every year. If you use most, or all, of that money as an extra payment on your mortgage, you can make serious progress in getting your house paid off. Other potential windfalls include a bonus from work, a successful garage sale, or a gift from a relative. And if you get a raise, consider putting all the extra income into your mortgage. For example, let’s say your monthly take-home pay was $4,000 and your 3% raise means that you’re now getting $4,120 per month. Put the extra $120 into your mortgage every month and you won’t even miss the money, since you’re not used to having it, and you’ll end up paying off down your mortgage faster than you think.

Don’t Miss: What To Look Out For With Mortgage Lenders

Should You Pay Off Your Mortgage Early Or Refinance

Do you want to pay off yourmortgage faster because youre worried about how much youre spending oninterest?

If youre simply concerned about your mortgage interest rate, consider refinancing to a lower rate and maybe a shorter term instead of making extra payments on your existing mortgage.

But if you already have a competitive interest rate and anideal loan term, you probably dont need to refinance. You may be tempted topay less interest by paying off your mortgage faster.

As you make your decision, consider whether you could earnmore investing in securities than youd save by paying down your mortgagebalance more quickly. Investing that money in a tax-preferred IRA could offermore financial peace of mind than owning your home outright sooner.

Any kind of investing can be risky. Check with a personalfinancial advisor before making any big moves if youre not sure about therisks youre taking.

Ready To Refinance Your Mortgage

If you want to refinance to a mortgage you can pay off fast, talk to our friends at Churchill Mortgage. The home loan specialists at Churchill Mortgage show you the true costand savingsof each loan option. They coach you to make the best decision based on your budget and goals.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Also Check: Will Mortgage Pre Approval Hurt Credit Score

Pay A Little More Toward Your Principal Each Month

Another trick is to divide your current mortgage payment by 12, and then add this much to each monthly payment. So if your mortgage payment is $1,400 a month, make an extra principal payment of $116 each month. At the end of the year, you would have made the equivalent of one extra mortgage payment.

How To Reduce Mortgage Principal With Bi

One of the subjects I didn’t cover in my ebook about fixed rate mortgages is paying the mortgage off early by accelerating the payments and reducing the pricipal owed. The following discussion is about the math behind this process, it doesn’t include any penalties or fees your bank might charge for early payments. If you have been making payments on your mortgage for some time and want to figure out how much principal you owe, you need to check or calculate an amortization table for the loan.

The basic formula for calculating mortgage interest is:

Monthly Payment = Principal /

which is explained in depth with detailed examples in the ebook. The “i” in the formula is the interest per compounding period, or the annual interest divided by the number of payments per year. It works out to this because mortgages are structured so that the payments are made per compounding period, normally a month, which makes it easy to produce a meaningful amortization table. The “n” in the formula is the number of compounding periods in the life of the loan. For a normal 30 year mortgage, n=360.

M = P

multiply both sides by

Mx – M = Pix

divide by the monthly payment

x-1 = Pix/M

substitute back in for x

Don’t Miss: How To Determine Ltv Mortgage

Why Mortgage Rates Change

Mortgage rates can fluctuate on a daily basis as theyve done for much of 2021. Many factors influence the movement of mortgage interest rates, including

-

Actions the Federal Reserve takes on short-term interest rates

-

Current home sales and housing starts

-

Inflation

-

Unemployment

-

Corporate earnings

Because mortgage rates are so volatile, it can be a good idea to get pre-approved and lock in a low mortgage rate as soon as possible when youre shopping for a house.

Credible lets you see prequalified rates for conventional mortgages from multiple lenders all within a few minutes. Visit Credible today to get started.

Make Additional Principal Payments

My second nerdy money rule to crush our new mortgage in 5 years was to make additional monthly payments toward the principal each month. We would do this by reducing our expenses and increasing our income.

Reduce Expenses

Here are some of the ways we cut back:

- Less eating out for dinners

- Packing my lunch for work

- Dialing back our grocery spending

- Cutting the cord on cable

- Going with high deductible insurance plans

- Saying no to family and friends more

Although these sacrifices felt difficult, we had a healthy income between $160,000-$180,000 during the mortgage payoff process. So it wasn’t that much sacrifice really, it was more just us getting used to the new normal.

And we were prepared as well. A couple of years prior, we had eliminated our $48,032 of debt by living on a lot less than we make. Having no debt definitely helped!

By reducing our expenses, we were able to make additional principal payments each month. This had a major impact on the dramatic reduction of our mortgage. Yes, we had a 15-year mortgage, but we wanted to turn it into a 5-year mortgage.

Increase Income

Bonuses

I didn’t always receive bonuses at work. It depended on how my company was doing that year or how I performed. During the payoff process, I was fortunate enough to receive two bonuses for a solid performance. That unexpected money was also sent to attack the mortgage.

Estimated total mortgage payoff impact: $6,000

Sell stuff online

Estimated total mortgage payoff impact: $3,000

Live on less

Don’t Miss: How Do You Calculate Points On A Mortgage