The Cost Of A Bad Credit Mortgage

Heres an example of how your credit score could affect your mortgage interest rates and subsequent monthly mortgage payment. Whiles these rates wont be indicative of todays lowest mortgage rates, the relationship between the different credit score ranges is consistent over time.

| Score |

*For a $500,000 home with a 5% down payment, amortized over 25 years. **Home Trust

What Qualifies As A Good Credit Score

For those who arent as familiar with their credit score, its a three-digit number that encompasses all your credit-related activity into one cumulative average. In Canada, credit scores range anywhere from 300 to 900. The higher your credit score is, the better your chances are of getting approved for various loans and other credit products. Generally speaking, a score of 650 and above is considered good and means that you are a low default risk and a better candidate for lending. A credit score of 750 or higher is deemed excellent.

Loans Canada Lookout

What Mortgage Rate Can I Expect With My Credit Score

In the table below, you can see how much your interest rate might be depending on your credit score, how much your monthly payment might be, and how much youd likely pay in total interest.

This is based on a $200,000, 30-year loan and the interest rates as of Aug. 13, 2020.1

Keep Reading: 750 Credit Score Mortgage Rate: What Kind of Rates Can You Get?

Recommended Reading: Could I Qualify For A Mortgage

The Credit Scores And Other Qualifications Of Actual Mortgage Borrowers

Most mortgage borrowers have significantly higher credit scores than their particular loan program requires. As of September 2020, the average homebuyer who obtained a conventional purchase mortgage had a FICO® Score of 759, according to Ellie Mae — a score largely considered to be great credit.

What’s more, the average buyer put 19% down and had an overall debt-to-income ratio of 35%. This is more money down than a conventional loan requires, and is also a significantly lower DTI.

Even for an FHA loan, the average credit score for a mortgage was a 684 FICO® Score. That’s generally considered to be good credit, and significantly above the minimum requirement. The average FHA borrower only put 4% down and had a relatively high 43% DTI. This makes sense, as FHA loans are typically used by borrowers with little cash to put down.

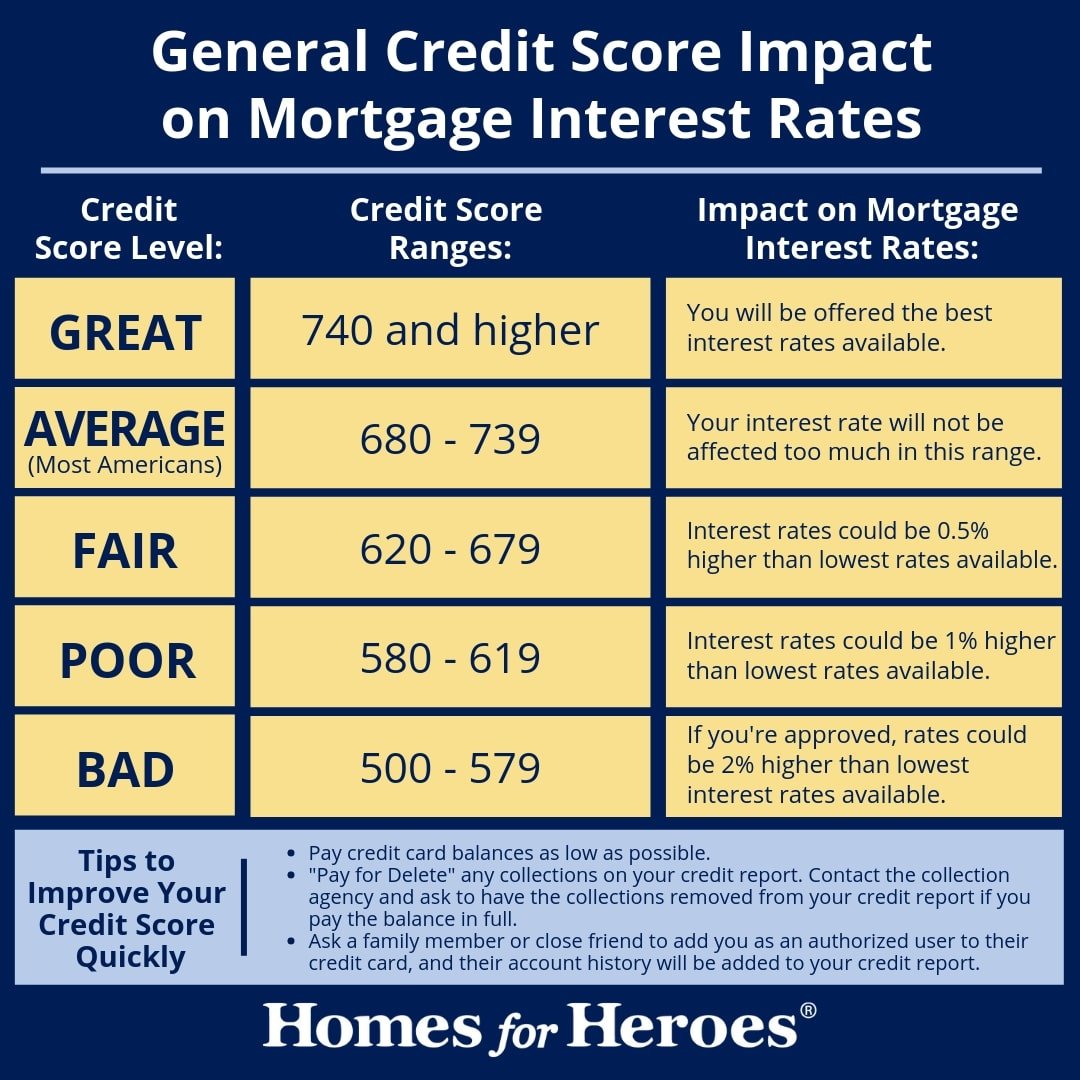

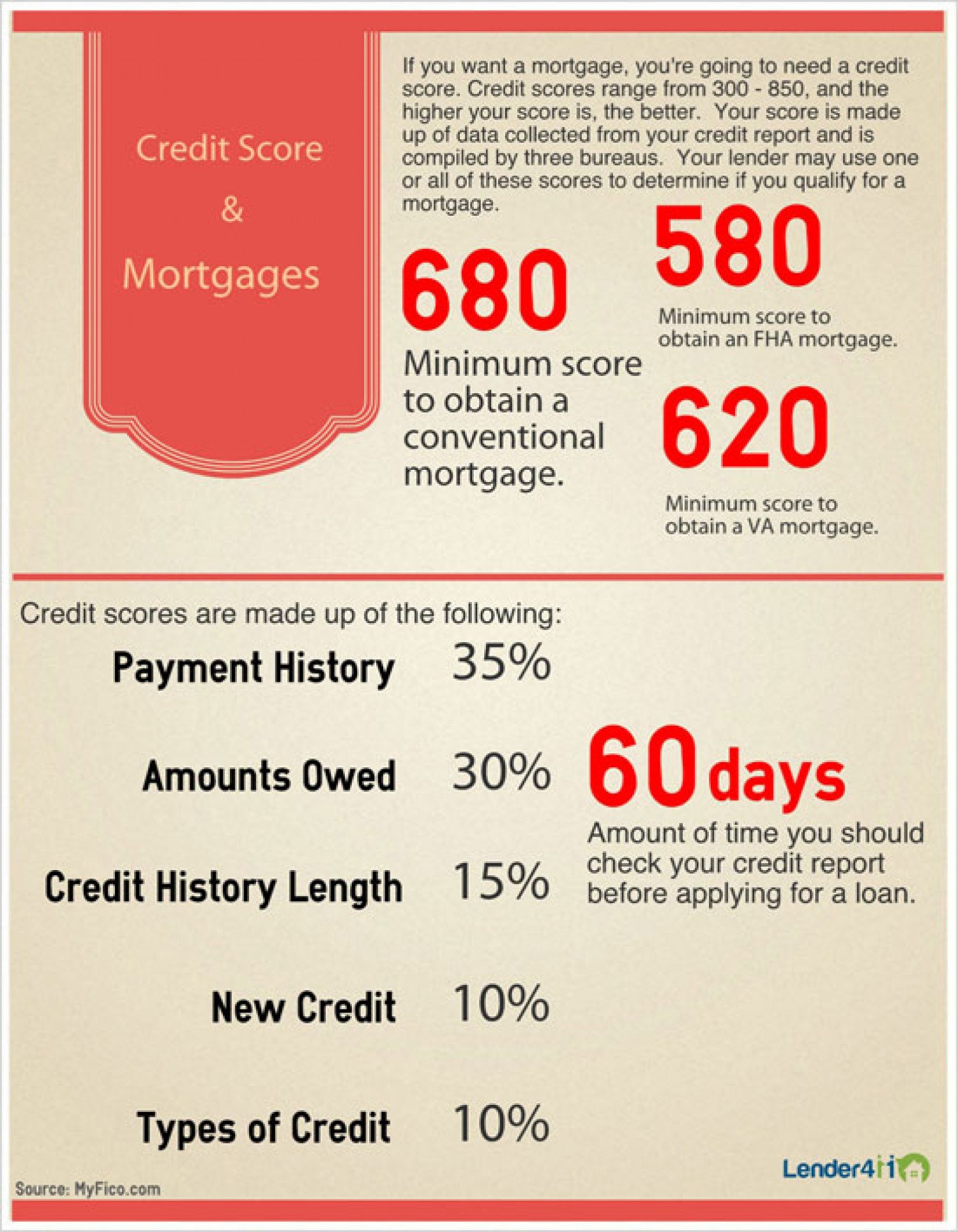

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history, and help lenders assess your financial health. Home buyers with lower credit scores are typically assigned a higher interest rate.

Read Also: Can Low Credit Score Get Mortgage

What Credit Score Is Needed To Buy A House With An Fha Loan

In the event you dont have much money saved for a down payment and have a lower credit score, an Federal Housing Administration loan may be right for you. To obtain an FHA loan, a borrower will need a credit score no lower than 580, along with a minimum of 3.5 percent down. Borrowers can obtain a loan with a lower credit score. However, if your credit score is between 500-579, a 10 percent down payment would be required.

How Your Credit Score Affects Your Mortgage Rate

Although its up to specific lenders to determine what score borrowers must have to be offered the lowest interest rates, sometimes even the difference of a few points on your credit score can affect your monthly payments substantially. For example, the difference between a 3.5 percent interest rate and a 4 percent rate on a $200,000 mortgage is $56 per month. Thats a difference of $20,427 over a 30-year mortgage term.

A low credit score can make it less likely that you would qualify for the most affordable rates and could even lead to rejection of your mortgage application, says Bruce McClary, spokesman for the National Foundation for Credit Counseling. Its still possible to be approved with a low credit score, but you may have to add a co-signer or reduce the overall amount you plan to borrow.

You can use Bankrates loan comparison calculator to help you see interest rates for credit scores.

Using myFICO.coms loan savings calculator, heres how much youd pay at the current rates for each credit score range. These examples are based on national averages for a 30-year fixed loan of $300,000.

| Source: myFico. APR rates as of Nov. 5, 2021. Assumes a $300,000 loan principal amount. |

| How your credit score affects your mortgage rate |

|---|

| FICO score |

| If your score changes to 640-659, you could save an extra $34,017. |

You May Like: Are Home Mortgage Rates Going Down

What Is A Conventional Mortgage

A conventional mortgage is one thats not guaranteed or insured by the federal government.

Most conventional mortgages are conforming, which simply means that they meet the requirements to be sold to Fannie Mae or Freddie Mac. Fannie Mae and Freddie Mac are government-sponsored enterprises that purchase mortgages from lenders and sell them to investors. This frees up lenders funds so they can get more qualified buyers into homes.

Conventional mortgages can also be non-conforming, which means that they dont meet Fannie Maes or Freddie Macs guidelines. One type of non-conforming conventional mortgage is a jumbo loan, which is a mortgage that exceeds conforming loan limits.

Because there are several different sets of guidelines that fall under the umbrella of conventional loans, theres no single set of requirements for borrowers. However, in general, conventional loans have stricter credit requirements than government-backed loans like FHA loans. In most cases, youll need a credit score of at least 620 and a debt-to-income ratio of 50% or less.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

How To Find Your Credit Score

You can request a free copy of your credit report online through each of the major credit bureausEquifax, Experian, and TransUniononce a year, but it doesnt include your credit score. For a fee, you can get credit scores and access credit reports through the Fair Isaac Corp. to see where you fall.

Once you know your own credit scores, youll have a good idea of whether youll be approved for a mortgage. However, while a minimum credit score of 660 probably means youll get approved for a loan, you wont get the best rates or terms. For instance, you may have to pay a higher interest rate than someone with better credit .

As such, if your score hovers around the minimum range, you may want to make an effort to boost your score before you start house hunting.

Read Also: How To Apply For A Home Mortgage

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

A Review Of Credit Karma Members Shows The Average Vantagescore 30 Credit Score Across The Us For Those Who Opened Any Type Of Mortgage Tradeline In The Past Two Years Is 717

Looking at VantageScore 3.0 credit scores from TransUnion for tens of millions of Credit Karma members who had a mortgage tradeline open on their credit report in the past two years, we also studied the average VantageScore 3.0 credit score among homebuyers state by state.

Our findings: Average credit scores ranged from 683 to 739 . The range of scores was even wider when broken down by city.

You May Like: Is A Reverse Mortgage Good Or Bad

Access To Other Adaptation Grants

Disabled veterans may also qualify for a Temporary Residence Adaptation grant to add modifications to your property that make it easier to navigate if you live with a family member. Like SAH grants, you wont need to pay back your TRA grant, which makes them a powerful tool for veterans with mobility-related disabilities.

Property Tax Exemption

Property taxes fund things like libraries, fire departments, and local road and development projects. Disabled veterans property tax exemptions can lower the amount you must pay in property taxes.

These tax exemptions arent a federal program, and they vary by state, so check with your local VA office to learn the exemptions youre eligible for. Some states offer an exemption to all veterans, while other states limit this benefit to veterans who are currently receiving disability payments. Disabled veterans are 100% exempt from property taxes in some states.

Down Payment And Closing Costs

It should come as no surprise that to buy a home, you need to have enough funds available to cover the down payment and closing costs However, you can’t just get these funds from any old source. Your lender will need to confirm that the down payment isn’t from borrowed funds and that you’ve had the money in your possession for at least 30 days.

Exceptions can be made, but don’t plan to use the income tax refund you expect to arrive in a couple of weeks to qualify for a mortgage you’re applying for tomorrow. Here is a list of acceptable sources of down payment.

Acceptable down payment sources

- RRSPs

- Other investments

- Equity from the sale of another property

- Gift from a parent or close relative

- Inheritance, employer bonus

You May Like: Why Do You Need Mortgage Insurance

What Credit Score Do You Need To Buy A House In 2021

Credit scores can be a confusing topic for even the most financially savvy consumers. Most people understand that a good credit score boosts your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

But do you know the minimum credit score you need to qualify for a mortgage and buy a house? And did you know that this minimum will vary depending on what type of mortgage you are seeking?

The Importance Of FICO®: One of the most common scores used by mortgage lenders to determine credit worthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

However, the following guidelines can help determine if youre on the right track.

Tips To Improve Your Credit Report Before Home Buying

Badcredit doesnt necessarily mean you wont qualify for a mortgage. But borrowerswith good or excellent credit have the most loan options. They also benefitfrom lower rates and fees.

If youreable to polish up your credit report before shopping for a mortgage, youremore likely to qualify for the best loan terms and lowest interest rates.

Here area few tips to improve your credit report and score before applying.

Removinginaccurate information can increase your credit score quickly. Developingbetter credit habits will take longer to produce results.

If youdiscovered problems in your credit history after applying for a mortgage loan,it may be too late to increase your credit score. If you continue the homebuying process, expect a higher monthly payment especially on a conventionalloan.

But you may be able to refinance your mortgage in a few months or years after your credit score improves.

Refinancing could help you replace your existing mortgage with a new one that has a lower rate and better terms, once your finances are looking better.

You May Like: What Is The Current Rate For A 30 Year Mortgage

Fha Mortgages Have Lower Credit Score Standards

An FHA mortgage is insured by the federal government. In order to be eligible for an FHA mortgage, borrowers must have at least two established credit lines, a debt-to-income ratio of 31% or less excluding the expected mortgage payment, and no delinquent federal debts.

As long as those requirements are met, an FHA borrower with a rather low credit score for a home loan can still qualify. FHA loans with a rock-bottom 3.5% down payment are available with FICO® Scores as low as 580. And if a borrower can come up with at least 10% down, the FICO® Score requirement drops to 500.

It’s important to mention that lenders can set stricter standards if they want, just as with conventional loans. For example, a mortgage lender that offers the low-down-payment FHA loan could potentially set its own minimum FICO® Score requirement at 600, not 580.

The caveat to FHA loans is that the mortgage insurance is expensive. FHA loans have ongoing annual mortgage insurance premiums of between 0.45% to 1.05% of the loan balance. That’s competitive with the private mortgage insurance paid by conventional borrowers with less than 20% down. However, FHA loans also have an upfront mortgage insurance premium of 1.75% of the loan amount. With a $250,000 loan, this translates to $4,375 — not a small amount of money.

What Is My Credit Score

Your credit score is a numerical rating that tells a lender how responsible you are when you borrow money. High credit scores tell lenders that you pay your bills on time and you dont borrow more money than you can pay back.

On the other hand, low credit scores might also tell lenders that you sometimes miss payments, you overextend your line of credit regularly, your account is very young, or your spending habits are unpredictable.

Equifax®, Experian and TransUnion®, the three major reporting bureaus, gather data on your spending habits and calculate a score for you based on your unique spending and bill-paying habits. Some factors that go into your credit score include your payment history, credit utilization, how much total credit you have, how old your account is and how often you apply for new credit lines.

Your payment history refers to how often you make the minimum payments on your credit card, auto loan and/or student loans. Credit utilization ratio refers to what percentage of your credit you use every month compared to how much total credit you have.

Visit AnnualCreditReport.com and request your free credit report. You can also order your credit report by calling 1-877-322-8228 or by completing the Annual Credit Report Request Form and mailing it to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: What Mortgage Amount Do I Qualify For

What Credit Score Is Needed To Buy A House With A Va Loan

There is no industry-set minimum credit score when using a VA loan. Utilizing a government-backed VA loan can be a great option for you if youre a veteran or qualified service member or spouse.

At Wyndham Capital, active-duty and veteran military members are very important to us. Thats why we are proud to offer VA loans with fast approvals, flexible guidelines, and a zero-down-payment-option.

So, what credit score do you need to buy a house? As you can tell, it depends. However, there are options available for a wide range of scores. Now that you know the answer to your question, what is a good credit score to buy a house? along with credit score requirements of a few common mortgage loans, lets look at lending options.

What If Your Credit Score Isnt Good Enough

If youre nowhere near 660, you may want to take some steps to raise your credit score for a home loan application by reducing the amount of debt you owe or paying your bills on time. Its not a fast process, so dont expect to see results for at least a few months.

Send me news, tips, and promos from realtor.com® and Move.

If you dont have time to boost your credit score into a more acceptable range before buying a home, all is not lost. You may still be able to get a mortgage through a government-backed program like those offered by the Federal Housing Administration. The FHA accepts credit scores for home loans as low as 580and may even go as low as 500 if you can throw down a larger down payment.

If you are an active or former military member, you may also qualify for a loan program backed by Veterans Affairs. Such programs can be particularly forgiving on the credit score front, so its worth checking out if you qualify.

Last but not least, if your , it may make sense to work with a mortgage broker or credit union. Often, small institutions like these are more willing to look at your whole financial picture and work with you if your past mistakes are really in the past.

Credit unions dont flat-out deny somebody immediately, Williams-Barrett says. To me, it is the whole picture, not just the score by itself.

Also Check: What Is The Benefit Of Refinancing A Mortgage

Conventional Mortgages: Everything You Need To Know

6-minute read

*As of July 6, 2020, Rocket Mortgage® is no longer accepting USDA loan applications.

Conventional mortgages are a great choice for many homeowners because they offer lower costs than some other popular loan types. If you have a high enough credit score and a large enough down payment, a conventional mortgage might be right for you.