What Is A Discount Point

A discount point is a fee you can choose to pay at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

What You Should Know

- Variable mortgage rateshave historically performed better than fixed mortgage rates, although interest rates have generally fallen over the past few decades

- 5-year fixed mortgages are the most popular in Canada

- Insured high-ratio mortgageswill have the lowest possible mortgage rate, but youll need to pay formortgage default insurance

- Typically, longer mortgage term lengths will have a higher mortgage rate compared to shorter mortgage terms.

- Closed mortgage rates are lower than open mortgage rates, but open mortgages allow you to make principal prepayments of any amount withoutmortgage penalties

Don’t Miss: How Much Per 1000 On Mortgage

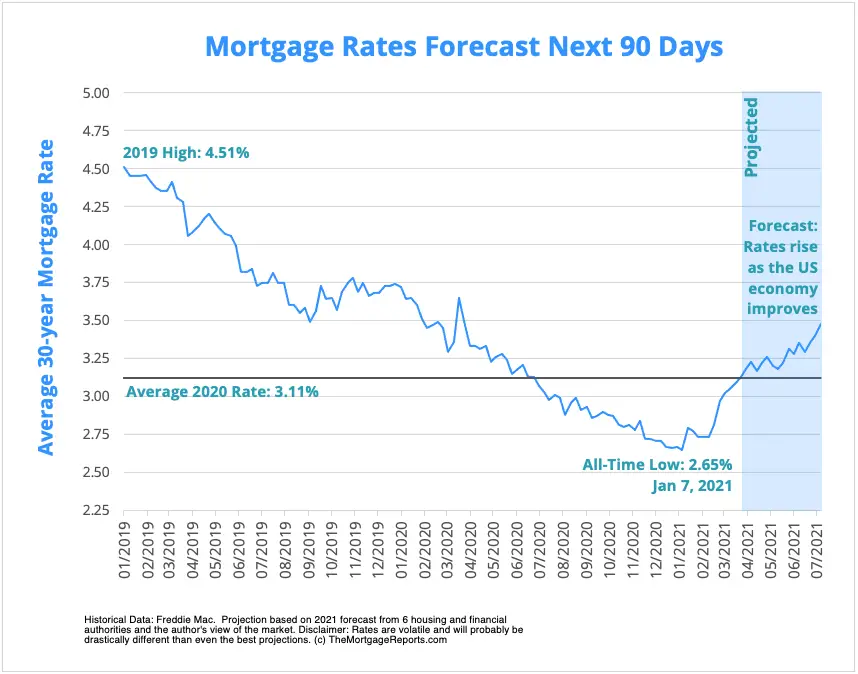

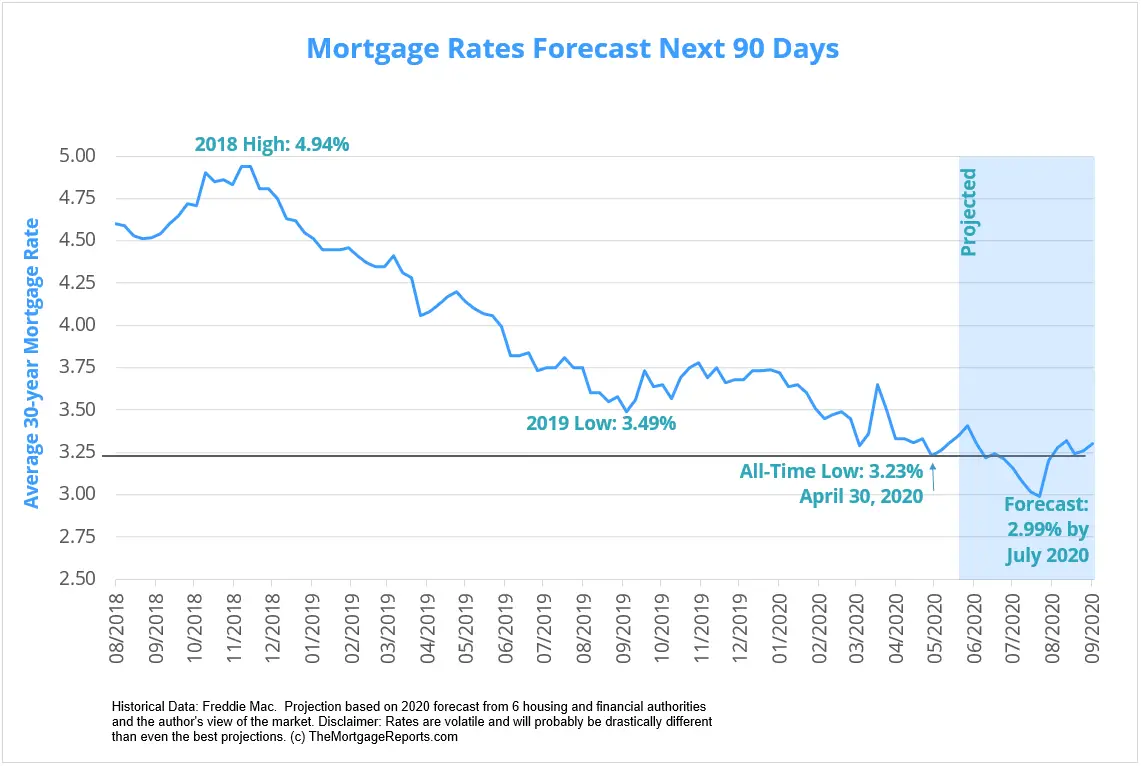

Mortgage Interest Rates Forecast Next 90 Days

We expect mortgage rates to continue to hover near or just below 3% for the next few weeks. Over the next 90 days, a modest overall increase seems likely.

Based on expert mortgage rate predictions and forecasts from housing authorities, 30-year mortgage rates could go as high as 3.17% within the next 90 days.

Mortgage Rates Surpass Three Percent

The 30-year fixed-rate mortgage rose to its highest point since April. As inflationary pressure builds due to the ongoing pandemic and tightening monetary policy, we expect rates to continue a modest upswing. Historically speaking, rates are still low, but many potential homebuyers are staying on the sidelines due to high home price growth. Rising mortgage rates combined with growing home prices make affordability more challenging for potential homebuyers.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Read Also: What Does A Mortgage Payment Consist Of

Why Is Inflation Rising

Inflation the cost of general goods and services is being driven up by worldwide supply shortages following a return to trading after the Covid lockdowns.

The shortage of microchips, which has caused supply issues for items ranging from games consoles to on-board tech for new cars, has been a prime example. A shortage of new cars has, in turn, impacted the used car market which, according to figures from AutoTrader, were 21% more expensive in September compared to the previous month.

A shortage of staff in some sectors is also triggering subsequent rises in costs the most recent and notable example being HGV drivers, which led to the recent dearth of fuel in forecourts across the nation. According to the ONS, the cost of fuel in September 2021 was the highest recorded since September 2013.

Meanwhile, soaring wholesale gas prices have translated into a sharp rise in household energy costs just in time for the colder weather, and the regulators price cap rose by 12% in October. Cheaper fixed rate energy tariffs have disappeared from stock entirely, meaning there are no savings to be gained from shopping around for a better deal.

Determine What Mortgage Is Right For You

When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget. Most borrowers opt for 30-year mortgages, but thats not the only choice. Typically, 15-year mortgages have lower rates but larger monthly payments than the more popular 30-year mortgage. Adjustable-rate mortgages usually have lower rates to begin with, but the downside is that youre not locked into that rate, so it can change over the life of your loan.

You May Like: Who Is Rocket Mortgage Owned By

Best Mortgage Rates In Canada

-

Answer a few quick questions and see the lowest rates you can qualify for.

-

Apply online

Apply for your mortgage instantly and easily using our secure online application.

-

Connect with our mortgage advisors

Questions or comments? Book a call and one of our mortgage advisors will walk you through all the details

Should I Use A Mortgage Broker In Winnipeg

A mortgage broker can connect you with mortgage products from a range of lenders, both big and small. As well as being connected with multiple lenders, brokers often have access to rates and deals that arenât available to the public. Generally, getting a mortgage through a broker will help you secure a lower mortgage rate than going directly to your current bank. Mortgage brokers are free for you to use, so thereâs no risk in approaching one for a chat.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

| Laurentian Bank |

Also Check: Are Home Mortgage Rates Going Down

When Should I Lock My Mortgage Rate

Right now mortgage rates are historically low, so its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, you can ask your lender if it offers the option to change your rate if it drops, this is also called a float down. With this option, youll need to pay attention to the fine print. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

Why Do I Need A Mortgage Number

The lending system was not made to benefit the borrower. It includes a complicated qualification process filled with intricate jargon and complex processes. The mortgage number calculator helps you save the time necessary to scale your goals with a clear understanding of opportunities available in the mortgage space. This is just what you need to gain the confidence to take the next steps with a clear understanding of how you fit in todays lending system.

If you get a high mortgage number, youll have the confidence to take the first step in buying your home since you know youre ready. If you get a low mortgage number, itll stop you from getting into something youre not financially prepared for. Youll know that it might be a better tactic to wait and save money for a while until your mortgage number goes green and you know youre ready! The objective with the mortgage number calculator is to bring transparency and understanding of mortgage prequalification, so a potential buyer is confident to move forward with whatever the next step may be, whether it be buy now or save more and buy later.

Don’t Miss: What Is A 5 1 Arm Mortgage

How Do I Get The Best Mortgage Interest Rate

The right deal for you will depend on your circumstances and what you want from a mortgage. In most cases you’ll need to meet certain conditions to qualify for the most competitive rates on offer.

Follow these steps to increase your chances of getting a great deal:

- Have a good credit record. Lenders are very thorough in checking your credit history when assessing your application – they want to know that you are good at repaying debt, so the better your credit score, the better your chances of being approved. Find out more in our guide to how to improve your credit score.

- Build a bigger deposit. The best rates are reserved for people borrowing at a lower loan to value ratio – i.e. borrowing a relatively small percentage of the property price. You can achieve this by saving a bigger deposit, or, if you already own a property, increasing your equity by paying down your mortgage each month.

- Shop around. There are dozens of different mortgage lenders, from the big, high-street names you are familiar with to challenger brands that are exclusively online. Each will have a range of different products on offer, and it pays to take time working out the most suitable deal for you.

- Use an independent, whole-of-market mortgage broker. Not only are mortgage brokers familiar with the different products on offer and able to advise on the lenders most likely to accept you, but they have access to mortgage deals which you can’t get by applying directly.

Are Winnipeg Mortgage Rates Higher Than Other Cities

Winnipeg mortgage rates can sometimes differ from other Canadian cities, but not just because of the city itself. Mortgage rates are determined by lots of factors, including competition among lenders to offer the lowest rates. Some cities have more competition than others, which generally leads to slightly lower rates. However, the differences are generally small.

Read Also: Is Rocket Mortgage And Quicken Loans The Same

Shall I Get A Variable Rate Mortgage

Variable rates are typically a little lower than fixed rates because the borrower takes on the risk of rates changing over time.

Variable rates are expected to remain low for the foreseeable future. 3 of the 7 economic forecasters that we watch expect variable rates will rise in 2022. A few months ago, only Royal Bank thought that was possible.

What Is A Good Mortgage Rate

Average mortgages rates have been at historically low levels for months, even dipping below 3% for 30-year fixed-rate loans for the first time ever. If you can get a mortgage with an interest rate below 3%, you could be getting the deal of a lifetime.

But even if youre getting a low interest rate, you need to pay attention to the fees. Hidden inside a good mortgage rate can be excessive fees or discount points that can offset the savings youre getting with a low rate.

You May Like: What To Expect When Applying For A Mortgage Loan

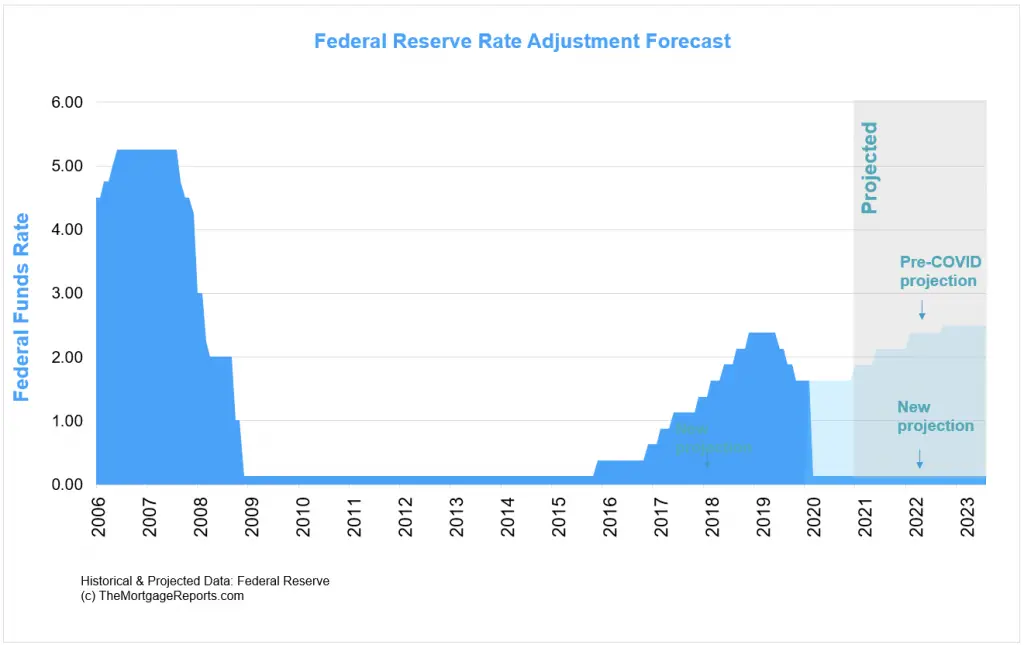

How Are Mortgage Rates Set

Mortgage rates fluctuate for the same reasons the price of homes change supply, demand, inflation, and even the U.S. employment rate can all impact mortgage rates. But the demand for homes isnt necessarily a sign of where mortgage rates are headed. The best indicator of whether rates will go up or down is the 10-year Treasury bond rate.

When a lender issues a mortgage it takes that loan and packages it together with a bunch of other mortgages, creating a mortgage-backed security , which is a type of bond. These bonds are then sold to investors so the bank has money for new loans. Mortgage bonds and 10-year Treasury bonds are similar investments and compete for the same buyers, which is why the rates for both move up or down in tandem.

If the demand for these safer bond investments is low, the mortgage interest rate increases to attract buyers. When there is strong demand for these investments, they can be sold more easily and the mortgage interest rates decrease. Thats why, in a slumping economy, when more investors want to purchase safer investments, like mortgage-backed securities and treasury bonds, rates tend to go down. The Federal Reserve has been purchasing MBS and treasury bonds, and this increased demand has led to the lowest mortgage rates on record.

Congress Continues To Flirt With The Debt Ceiling

Another wild card is the debt ceiling. Though Congress expects to pass a bill that would extend its capacity to pay its bills through early December, there is widespread concern in the market about the potential for the US Treasury to default on its financial obligations later this year. We don’t know exactly what will happen if the US defaults — it would be an unprecedented event — but it would almost certainly drive interest rates higher. “If they don’t lift the debt ceiling, that’s going to crash the stock market and everything else,” White said. “That definitely can affect the mortgage rates and our housing market.”

Brendan McKay, president of broker advocacy at the Association of Independent Mortgage Experts, agrees. “If things are bad for the economy, the stock market goes down,” he explains. “This causes people to move their money from the market to bonds, bond prices go up and interest rates go down. But if it’s also a government problem — that probably would cause bonds to go down as well as stocks, causing interest rates to go up.”

Recommended Reading: Does Mortgage Modification Affect Credit Score

Where Mortgage Interest Rates Are Headed

All of this is fueling speculation about mortgage interest rates. And though a climb would likely be slow and not always linear, experts expect an overall increase over the coming months. Waiting around too long in order to grab the lowest rate may cost you in the long run.

“If somebody waits to refinance and rates go up, the natural human inclination is to chase the lower rates — it’s the gambler’s fallacy and everyone’s prone to it,” McKay said.

If you haven’t refinanced your mortgage because you don’t know how to do it, there are plenty of resources out there to help you through it.

“If refinancing makes financial sense for somebody, yes, they should do it today, they should do it tomorrow, they should do it immediately,” McKay said. “Not because I think rates are going to go up or down, but because it makes financial sense.”

Canada’s Most Popular Mortgage: The 5

In Canada, out of the $1.2 trillion CAD in outstanding residential mortgages in May 2021, the 5-year fixed rate mortgage takes the crown with over $660 billion, or more than 50%, of all mortgages in Canada. There are more 5-year fixed rate mortgages than all variable rate mortgages combined. The 5-year fixed rate mortgage is so popular that the CMHC uses the Bank of Canada’s 5-Year Benchmark Posted Rate for itsmortgage stress test.

You May Like: Can I Get A Mortgage With A 575 Credit Score

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The 5-year fixed rate mortgage is the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wont have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

Choosing A Mortgage Term

There are other considerations to your mortgage term length besides just the mortgage rate. Breaking your mortgage, which happens when you sell your home and move or renegotiate your mortgage before the end of the term, will come with significantmortgage prepayment penalties. You will be able to avoid mortgage penalties if you wait until your term expires. A short mortgage term would be more suitable if youre thinking of selling your home soon or refinancing your mortgage.

Theres also a chance that mortgage rates might not move in the direction that youre predicting it will, or it might not move as much as you thought it would. For example, a 10-year fixed mortgage rate might be at 5% while a 5-year fixed mortgage rate might be at 3%.

If interest rates stay the same for the next ten years, youll be paying a mortgage rate of 5% while you could have had a mortgage rate of 3% for two 5-year terms.

If interest rates increase by 2%, where the first 5-year mortgage term has a rate of 3% and the second 5-year mortgage term has a rate of 5%, youll still be worse-off with a 10-year mortgage as youre paying the 5% rate for the first five years rather than 3%.

Mortgage rates will need to increase significantly for a 10-year mortgage term to break-even over shorter-term options.

You May Like: How To Become A Reverse Mortgage Specialist