Why Its Smart To Follow The 28/36% Rule

Most financial advisers agree that people should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36 percent on total debt that includes housing as well as things like student loans, car expenses and credit card payments. The 28/36 percent rule is the tried-and-true home affordability rule that establishes a baseline for what you can afford to pay every month.

Example: To calculate how much 28 percent of your income is, simply multiply your monthly income by 28. If your monthly income is $6,000, for example, your equation should look like this: 6,000 x 28 = 168,000. Now, divide that total by 100. 168,000 ÷ 100 = 1,680.

Depending on where you live and how much you earn, your annual income could be more than enough to cover a mortgage or it could fall short. Knowing what you can afford can help you take financially sound next steps. The last thing you want to do is jump into a 30-year home loan thats too expensive for your budget, even if you can find a lender willing to underwrite the mortgage.

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Cost To Break Your Mortgage Contract

The cost to break your mortgage contract depends on whether your mortgage is open or closed. An open mortgage allows you to break the contract without paying a prepayment penalty.

If you break your closed mortgage contract, you normally have to pay a prepayment penalty. This can cost thousands of dollars.

Before breaking your mortgage contract, find out if you must pay:

- a prepayment penalty and, if so, how much it will cost

- administration fees

- appraisal fees

- reinvestment fees

- a mortgage discharge fee to remove a charge on your current mortgage and register a new one

You may also have to repay any cash back you received when you got your mortgage. Cash back is an optional feature where your lender gives you a percentage of your mortgage amount in cash.

Don’t Miss: Does Pre Approval For Mortgage Affect Credit

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

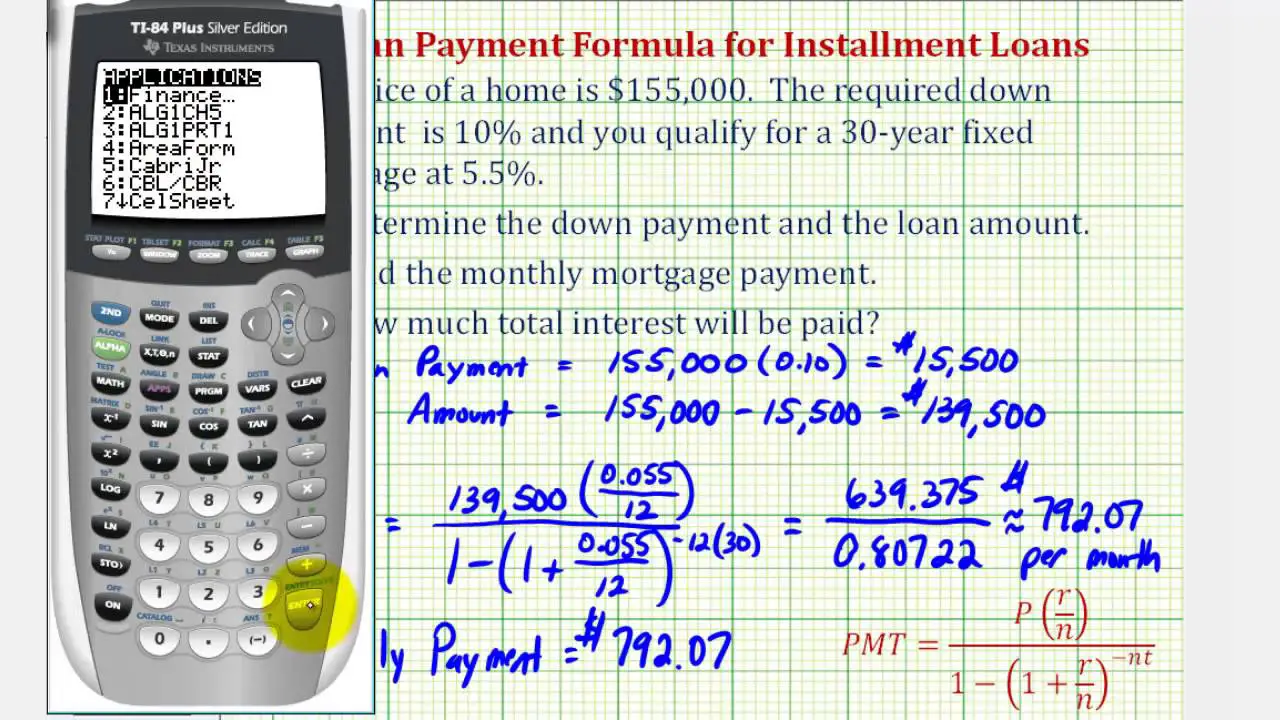

How Is A Mortgage Calculated

First of all, lets begin this discussion by explaining how a mortgage is calculated. The monthly payment that youre responsible for paying is your loan amount times the interest rate each month. In total, monthly payments consist of principal, interest, real estate taxes, and mortgage insurance .

The higher the interest rate attached to your mortgage, the more youll be paying towards the interest portion of your mortgage payments. The opposite is also true. Each month that a mortgage payment is made, the portion dedicated your principal increases, and the portion dedicated to interest decreases. Each month, the interest rate is calculated based on the current outstanding loan amount.

Read Also: How Long Is The Mortgage Process

What To Consider Before Prepaying Your Mortgage

Prepaying your mortgage is a great goal to work toward, but before you do, make sure youve met these financial milestones first:

- Get the match. If youre not getting the full company match from a workplace retirement plan, youre passing up an instant return. The typical company match equals 50 percent to 100 percent of your contribution, up to a limit . Thats where extra money should go first until youre on track for retirement. Retirement plan contributions get a tax break and the more time your money has to grow, the better.

- Pay off your higher-rate debt. It doesnt make sense to pay off a 4 percent mortgage if you have credit cards accruing at 16 percent or more.

- Plan for emergencies. A savings account with at least three to six months worth of expenses can help you weather most setbacks.

- Protect yourself. You should be adequately insured, which for most people means having property, health and disability policies. If you have financial dependents, youll probably want life insurance, as well.

Once those bases are covered, prepaying a mortgage comes down to discipline and comfort level. Do you want to be completely debt-free, or would you prefer your money working harder for you in other ways? Ideally, you want to pay off your mortgage before retirement so you dont have those monthly payments to worry about if your income becomes more limited.

How Lenders Decide How Much You Can Afford To Borrow

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio.

Your debt-to-income ratio is the percentage of pretax income that goes toward monthly debt payments, including the mortgage, car payments, student loans, minimum credit card payments and child support. Lenders look most favorably on debt-to-income ratios of 36% or less or a maximum of $1,800 a month on an income of $5,000 a month before taxes.

Also Check: How To Get A 15 Year Fixed Mortgage

How Much Will My Mortgage Cost

The cost of your mortgage will depend on several different factors, including how much you are borrowing, your mortgage term, and the rate of interest youre paying. For example, the longer the mortgage term you choose, the cheaper your monthly payments will be, but the more youll end up paying back overall. If you choose a shorter term, your monthly payments will be higher, but youll reduce the total amount of interest you pay back.

Mortgages often come with arrangement fees, which can also have an impact on how much your monthly mortgage payments cost if youve chosen to add these to the amount you are borrowing.

If youre not sure which mortgage deal is likely to be most cost-effective for you based on your individual circumstances, seek professional advice from one of our advisers who can run you through all the available options.

Make One Extra Mortgage Payment Each Year

Making an extra mortgage payment each year could reduce the term of your loan significantly.

The most budget-friendly way to do this is to pay 1/12 extra each month. For example, by paying $975 each month on a $900 mortgage payment, youll have paid the equivalent of an extra payment by the end of the year.

Also Check: Can A Locked Mortgage Rate Be Changed

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Total Interest Paid On A $100000 Mortgage

The amount of interest you pay on a mortgage loan depends on the interest rate your lender gives you.

Lower interest rates will mean fewer interest costs, while higher ones mean the opposite. This is why its important to compare several loan options using a tool like Credible.

How long your loan lasts will also play a role in your interest costs. Longer loan terms charge the most interest, while shorter ones reduce those costs.

Use the below calculator to see how much youll pay in interest, as well as what your home will cost you every month.

Enter your loan information to calculate how much you could pay

Read Also: What Do I Need To Become A Mortgage Broker

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- : Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

You May Like: Can You Refinance Mortgage Without A Job

Early Renewal Option: Blend

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. If you choose this option, you dont have to pay a prepayment penalty. Lenders call this option the blend-and-extend, because your old interest rate and the new terms interest rate are blended. You may need to pay administrative fees.

Your lender must tell you how it calculates your interest rate. To find the renewal option that best suits your needs, consider all the costs involved. This includes any prepayment penalty and other fees that may apply.

How Much Extra Should You Pay To Payoff Your Mortgage Early

You dream of paying off your mortgage early.

You long for the day when you are debt free.

But how do you do it?

How much must you pay each month to be out of debt by a certain date?

What if you wanted to pay off your mortgage in 15 years instead of 30? How much would you save?

The good news is this mortgage payoff calculator makes figuring out your required extra payment easy.

You choose how quickly you’d like to pay off your mortgage, and the calculator will tell you the required extra monthly payment to get it done. It will also tell you how much interest you’ll save!

However, before you start making your extra payments, there are a few factors you’ll want to consider first . . . .

Don’t Miss: How To Apply For A House Mortgage

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

How Much House Can I Afford On My Salary

Want a quick way to determine how much house you can afford on a $40,000 household income? $60,000? $100,000 or more? Use ourmortgage income calculatorto examine different scenarios.

By inputting a home price, the down payment you expect to make and an assumedmortgage rate, you can see how much monthly or annual income you would need and even how much a lender might qualify you for.

The calculator also answers the question from another angle, for example: What salary do I need to buy a $300,000 house?

Its just another way to get comfortable with the home buying power you may already have, or want to gain.

Also Check: Does Bank Of America Do Mortgage Loans

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

How Do You Compare Loan Offers

In any loan scenario, you have to make underlying assumptions such as:

- If you are likely to remortgage the loan again.

- When you are likely to remortgage.

- Where you think interest rates are headed.

- If you think you will sell the home soon.

- If rates head higher and your rate resets well above the initial offer, will your wages be enough to cover payments?

Look Beyond the Monthly Payment

Its important to consider the overall mortgage costs, not just the monthly payment amount. Borrowers will find interest-only payments affordable. However, compared to a full repayment mortgage, you immediately build equity in your home. This bring you closer to home ownership, stability, and grants you further life flexibility. In contrast, interest-only payments do not build equity. It does not provide financial cushion which helps protect you against shifting market conditions.

If one loan amortises and the other does not, then you have to look at how much equity you build in a home. This is a key factor in determining value. Most people also do not want to pay mortgages for the entire lifetime, or until they hit a tough patch and risk foreclosure.

Example Loan Comparison from a Reader

The key to being able to accurately compare mortgage offers is to only adjust a single variable at a time. This way you can easily see the differences between offers, instead of trying to compare apples to oranges.

The example below is based on a question from one of our users named Dan.

| Year |

|---|

Recommended Reading: How 10 Year Treasury Affect Mortgage Rates

Where To Get A $200000 Mortgage

To buy a home, youd traditionally research mortgage lenders, choose several, and then fill out the applications for each. Those lenders would then give you a loan estimate detailing expected costs of the loan, including closing costs, interest rate, and APR. Youd use these to compare your options and choose who to go with.

Shopping around for a mortgage can save you thousands of dollars over the life of your loan. Credible simplifies this process. You can easily compare mortgage options from our partner lenders in the table below its free and only takes a few minutes.