What Is A Mortgage Rate ‘float Down’

A mortgage rate lock with a float down feature allows you to exercise an option to snag a currently available lower interest rate. You can usually trigger it only once.

A float down option is most often associated with new construction loans and longer-term rate locks, though it never hurts to ask your lender if a float down is available for your loan. The terms, parameters and pricing of a float down option will vary widely among lenders.

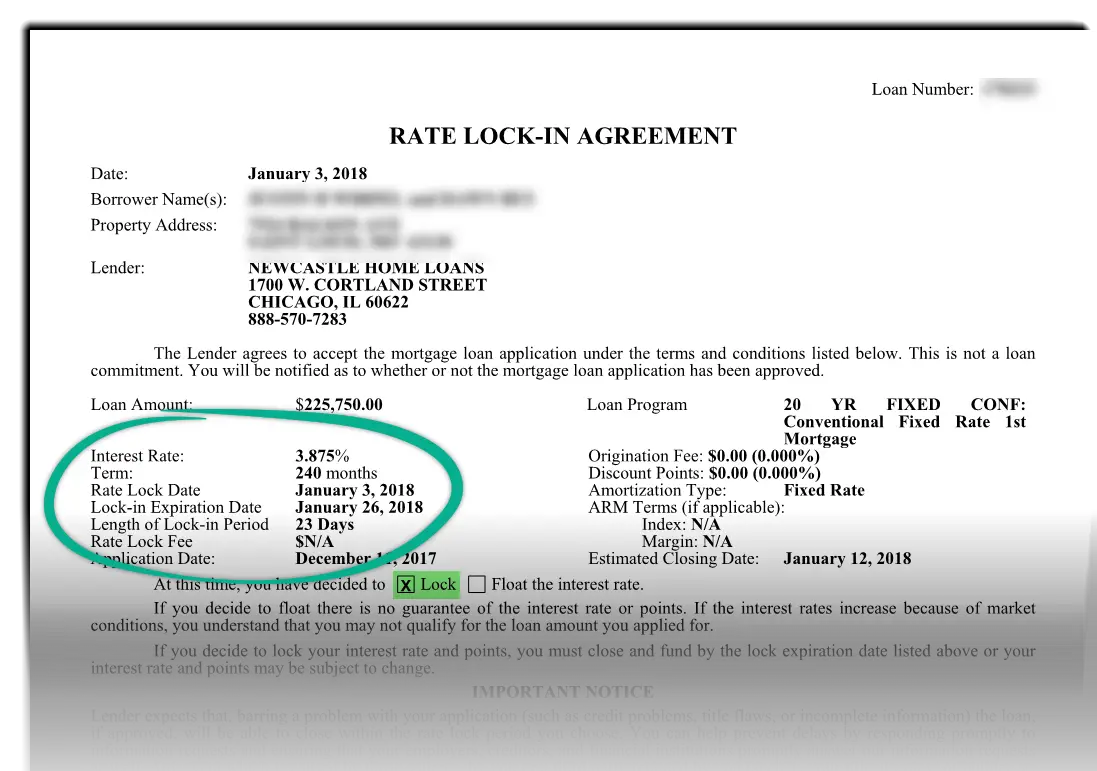

Know How Long Your Rate Lock Lasts

Rate locks are usually good for 30 60 days. Depending on your lender, you may have to pay to extend the period beyond that.

You should be mindful of how long you think it will take you to close when you lock your rate. Your lender will be able to provide a reliable estimate for this. If you only have a lock period of 30 days and you anticipate the closing process will take longer, you should talk to your lender about extension options.

Should I Hold For A Lower Mortgage Rate Lock

Everyone becomes a trader when rates drop. Here are two common consumer refrains during this rate drop:

Ill just hold for better, this corona thing is going to get worse.

The rate market will improve because markets wont like .

Word to the wise: rate markets are run by the most sophisticated investors in the world. And even they dont know how markets play out when it gets volatile like this.

The 10-year Treasury Note provides a decent signal for where mortgage rates might go.

The 10-year Note just dropped just below 1% for the first time, and Wall Street estimates say itll drop another 0.25%, then maybe settle around 0.85%.

This wouldnt cause rates to drop much further than todays levels. And waiting to see carries way more upside rate risk right now.

If you pass on a 30-year fixed in the low 3% or high 2% range, youre very likely to regret it.

If you really want to be a trader because you think rates will drop, heres your play:

Ask your lender to do a no-cost refi.

Your rate will be about .125% to .25% higher than a normal-cost loan , but trading a higher rate for no closing costs means youre free to refi again if rates drop more later.

Again, talk through this with your lender and theyll do the math you need to make the right decision.

Don’t Miss: Is Closing Cost Part Of Mortgage

How To Lock In A Mortgage Rate

Knowing when to lock in your mortgage can be tricky, but the actual process for locking is pretty simple. Heres how:

Find Out: How to Buy a House: Step-by-Step Guide

Can I Get A Lower Interest Rate

You may be able to lower your interest rate by making changes that lower your risk factors described above. Here are some of the things you may want to consider:

- Putting more money down and lowering the LTV ratio.

- Clearing any errors on your credit report.

- Adding a co-signer with additional income and/or a higher credit score to support the loan.

- Changing the number of years of your loan term.

You also may be able to lower your rate by paying discount points.

Read Also: How To Purchase A House That Has A Reverse Mortgage

How Much Does A Mortgage Rate Lock Cost

Some lenders charge a separate fee for a rate lock. This fee varies and can be expressed as a dollar amount, such as $1,000, or as a percentage of the loan amount, such as 0.25% of the total loan value.

Other lenders might not charge a fee for a rate lock, but this usually just means its included in the rate youre offered.

Should You Choose A Longer Rate Lock Period

All things being equal, consumers should choose a longer rate lock period to ensure they can get the agreed upon rate even if there are delays in processing the loan. But theres a catch: Sometimes if you pick a rate lock with a longer duration the interest rate wont be as good as with a shorter duration rate lock period, or the lender may charge a fee for this longer duration. Normally if a loan fails to close within its lock period, the borrower will be charged the worst case scenario price for a re-lock . Ask your lender to spell out the differences in cost and rates for different duration periods.

You May Like: Can You Refinance Mortgage Without A Job

Whats A Mortgage Rate Lock

A mortgage rate lock is an agreement between a borrower and a lender that allows the borrower to keep a certain interest rate on a mortgage for a specified time period. The rate you lock is protected from increasing during this period.

Interest rates fluctuate daily. So when you lock, youll be able to estimate your monthly payment with close accuracy and protect yourself from changes in the market.

Locking an interest rate is a risk to a lender because if rates go up, they must still honor the one you locked.

Why Locking Your Mortgage Rate Wont Box You In

If youre applying for a mortgage or refinancing a current loan, one of the steps youll take is locking your interest rate. While interest rates can go up or down during the course of the underwriting process, locking your rate guarantees a specific interest rate for your loan. Though that terminology may seem final, the truth is you may still have some flexibility even after youve locked in your rate. Keep reading to learn more about how rate locks work.

Also Check: How Do You Calculate Self Employed Income For A Mortgage

Initial Rate Lock Fee

Some lenders choose to tack on a separate fee for locking. Others account for the initial lock fee by integrating it into your interest rate. Be sure you know whether and how you will be charged for an initial lock.

Heres an example breakdown of what you may expect in terms of fees for mortgage locks:

|

Lock |

|---|

|

$270 |

What Happens If You Lock In A Mortgage And Then Rates Go Down

If you lock a mortgage and then rates rise, youre in luck: You get to keep the lower interest rate you locked in. But what if you lock a mortgage and then rates fall?

Unfortunately, you cant just unlock your rate. Your best option is to ask your lender about a rate float down, although this will cost you an additional fee.

Switching lenders last minute is also an option for refinancers. But it means starting over from square one, so make the decision carefully and be sure your new rate is low enough to be worth it.

Don’t Miss: Are Mortgage Discount Points Worth It

How Often Do Interest Rates Change

Mortgage rates can change daily, sometimes multiple times a day. Theyre difficult to predict, though theyre often influenced by economic changes, world events, and the Federal Reserve . While the Federal Reserve does not set the specific interest rates in the mortgage market, its actions in establishing the Fed Funds rate significantly influence them.

The bottom line: bad news and uncertainty are generally good for mortgage interest rates. Investors tend to flock to bonds in bad times, and more demand pushes interest rates lower.

How Long Should The Lock Last

Before choosing a lock-in period, determine the average time for loan processing in your market. Ask your lender to estimate the time necessary to process your loan and verify the information with other realty and mortgage professionals. Locks average 30 days but can range from 15 to 60 days or more. Longer is usually better. If the loan doesn’t close on time, lenders can extend your lock for free, charge more for the extension, or charge an additional percentage of the loan amount.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

What Locking Your Mortgage Rate Means

You can lock in an interest rate when you and your lender feel market conditions are favorable enough to provide the best available rate for your mortgage.

Note that the final interest rate you end up locking may be different from the rate that was used when you received your preapproval letter. However, after you lock, your lender will honor that rate, even if market fluctuations cause rates to increase.

Keep in mind that rate locks dont go on indefinitely. They typically last between 30-60 days, which is long enough to get most loans through underwriting and to the closing table. When you do decide to lock in your rate, confirm that the lock period extends beyond your closing date. If your rate lock expires before this time, it can be extendedjust check with your lender to find out if doing so will result in any additional fees.

Mortgage Rate Lock Faq

What happens if my mortgage rate lock expires before closing?

If your rate lock expires before closing, youll have to re-lock a rate in order to close the loan. If rates havent moved, your new rate will likely be the same rate you originally qualified for. If rates increased during the lock period, your rate will likely go up. But if rates have fallen, you will not get a lower rate. Youll likely still get the original rate you locked in.

Can you lock in a mortgage rate with more than one lender?

Yes, you can lock in a mortgage rate with more than one lender. Some borrowers decide to lock a rate with Lender 1 and let their rate float with Lender 2. That way, if rates fall, they have a backup. They can lock in a lower rate with Lender 2 and cancel their application with Lender 1 with fewer consequences.

Can you change lenders after locking a rate?

Yes, you can change lenders after locking a rate. But youll have to start the application process over with your new lender. That means getting pre-approved, submitting all your documents, and waiting for underwriting twice. All in all, closing a mortgage or refinance usually takes more than a month. So if youre anywhere near the closing date on your original application, consider your options very carefully before deciding to change lenders.

Can you negotiate mortgage rates?Can I back out of a mortgage rate lock? Is it smart to lock in a mortgage rate?Can my loan amount change after the rate lock?

You May Like: How 10 Year Treasury Affect Mortgage Rates

Revised Loan Estimates For Rate Extensions

Now that we have discussed how a written rate lock agreement relates to a revised loan estimate, the next thing to consider is what happens when that already locked-in rate expires or is extended. In other words, our question now becomes this: Is a revised Loan Estimate required when a rate expires and is subsequently relocked or extended?

Upon first reading the TRID rule for a revised Loan Estimates relating to rate locks, it might appear that a revised Loan Estimate is required any time a rate is locked. The reason for this is that the actual rule is not very clear on this:

The points or lender credits change because the interest rate was not locked when the disclosures required under paragraph of this section were provided. No later than three business days after the date the interest rate is locked, the creditor shall provide a revised version of the disclosures required under paragraph of this section to the consumer with the revised interest rate, the points disclosed pursuant to § 1026.37, lender credits, and any other interest rate dependent charges and terms.

Unfortunately, neither the rule nor the commentary specifically address what happens when a rate that was locked is extended or expires and is subsequently again locked. That said, the CFPB has provided guidance on this topic in the TRID Small Entity Compliance Guide.

People Are Locking In Variables At Lower Fixed Rates

In a normal universe, people who lock in a floating-rate mortgage lock into a fixed rate. And that fixed rate is almost always higher than their current variable rate.

But this is not a normal universe.

In the world we now live in, variable borrowers are actually locking into five-year fixed rates that are lower than their current rate. For as long as weve been keeping detailed rate records , weve never seen this happen before.

One couple we spoke with this week has a prime 0.55% variable from a major bank. That bank is offering them 2.92% for a new fixed rate today. Thats a 48-basis-point rate drop or almost $4,200 savings on their nearly $400,000 mortgage. And all they have to do is e-sign to get it. No effort, no penalties, no fees.

Such rate-locks may not be a large-scale trend but they are happening virtually every day, especially with 2016 vintage variables. If more people thought the Bank of Canadas next rate change would be a hike, the number of variable-to-fixed conversions would be proportionally much higher.

What If I Cancel My Loan And Then Decide I Want To Move Forward

If you cancel/withdraw your loan application and then decide you want to move forward:

Within 14 calendar days from the date we process your cancellation/withdrawal request: Your application may be eligible for reactivation at no cost to you. In this case, you will receive your original rate, loan terms, and rate lock expiration date. Contact your home mortgage consultant or private mortgage banker for information regarding reactivation criteria.

After 14 calendar days: You will need to start a new application and obtain a new rate lock at current market rates.

The Risks Of Not Comparing Mortgage Rates

It may seem like a lot of effort to shop around for a new lender, and the payoff may not seem worth it at first. However, not shopping around could leave you financially vulnerable. This vulnerability is due to something called interest rate risk. Interest rate risk occurs when your mortgage is expected to renew at a higher rate, putting more financial strain on your budget. According to the Bank of Canada, about 53% of households were subject to interest rate risk in 2018.

Interest rate risk occurs in three scenarios for homeowners in Canada:

- If you have a variable rate mortgage, rising interest rates affect you immediately

- If you have a fixed-rate mortgage coming up for renewal

- If you have a home equity line of credit with a variable interest rate

In these cases, renewing your mortgage at a higher rate could add hundreds of dollars to your monthly mortgage payment, as we saw in the example above. Whether you are choosing renewal vs refinance, the bottom line is the same: these hundreds of dollars could be the difference between paying down debt and just making ends meet. For this reason, its important to take the time to shop around for the best mortgage rate your financial prosperity depends on it.

Give Yourself Time To Switch Lenders

If you decide to switch lenders, you may be wondering when should I start looking to remortgage? The answer is as early as possible. Youll need to submit a mortgage application as though you are applying for a new mortgage, which means youll need to provide documentation including:

- Copy of your mortgage renewal letter

- Proof of income

- Proof you own your home

- Proof of property insurance

It usually takes a mortgage broker over a week to process your application, so make sure to leave plenty of leeway between when you start the process and when your mortgage is due to renew, otherwise you may end up sticking with your current lender for your next mortgage term.

Extending Mortgage Locks For New Construction

When you want to lock a rate for a new construction set to be built months from now, a 15-day lock wont give you peace of mind on your expected monthly payments. Thats why some lenders offer 180-day lock programs for new constructions.

Making the decision to go with a longer lock period is about weighing two things against each other:

|

The risk of rates increasing in the future |

The extra cost youll pay for a longer lock |

Talk to your lender about what whether or not you should purchase an extended lock for a new construction. Your mortgage adviser will consult with you to provide the best advice and options to protect you throughout the process.