How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexible loan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

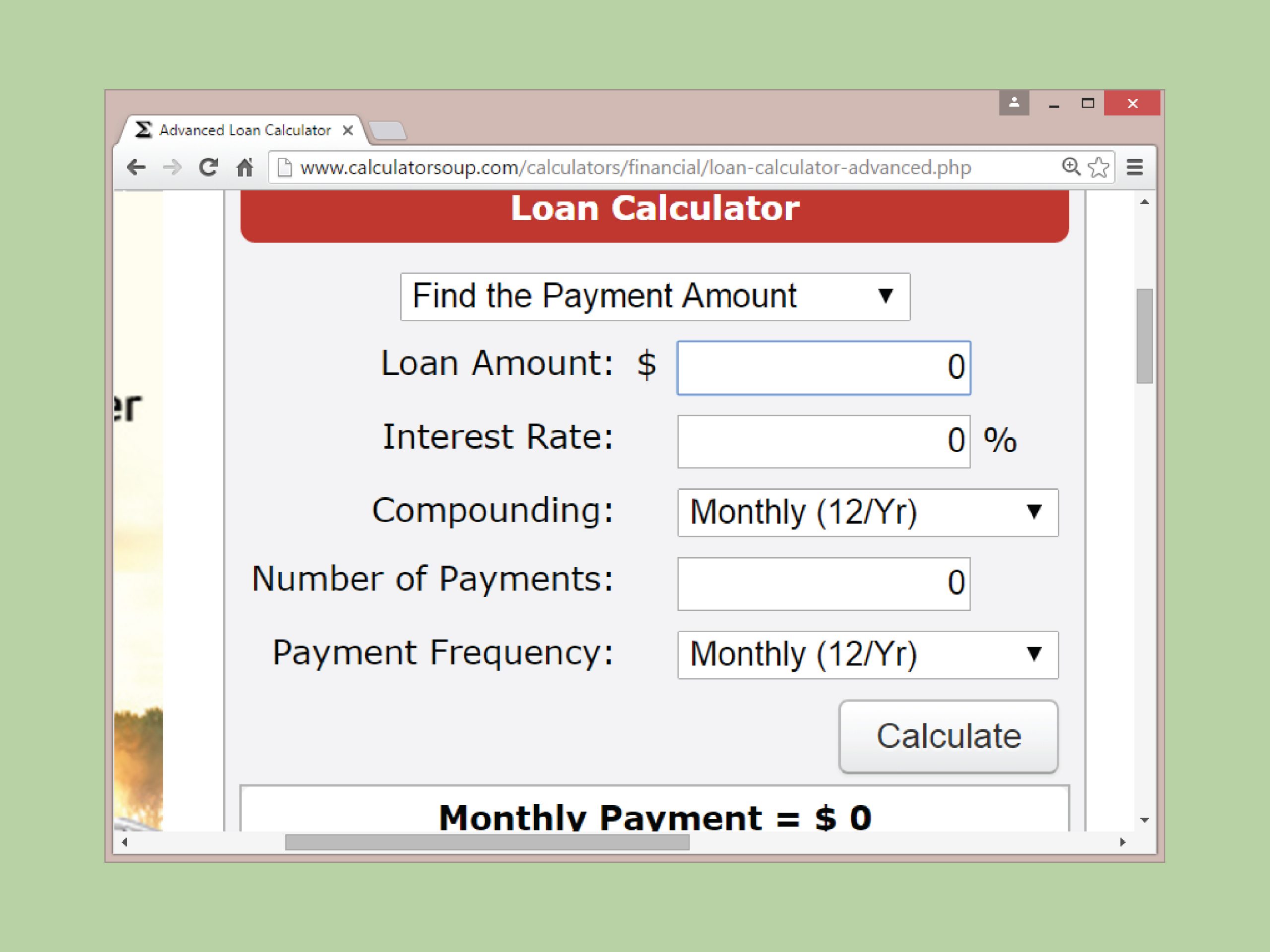

Use our VA home loan calculator to estimate how expensive of a house you can afford.

Take A Longer Mortgage Term

The longer your mortgage term, the lower your monthly payment. If you take a longer term, you spread your payments over a larger number of months and years, which reduces the amount youll owe each month. While taking a longer term will increase the amount you pay in interest over time, it can free up more cash to keep your DTI low.

Importance Of Debt Ratios

When you’re just beginning your house hunt, calculating your mortgage-to-income and back-end ratios can give you an idea of how much you can spend each month on your mortgage and whether a house you see is within reach. For example, you can use an online mortgage calculator to plug in a home’s price and your intended down payment along with estimated property tax, insurance and HOA fee amounts. The result will show you an estimated monthly mortgage payment that you’ll be able to use with your income information to calculate your mortgage-to-income and back-end ratios and assess affordability.

If you’re already in the mortgage application process, your ratios are one of the critical factors your lender will look at to determine how much of a mortgage you can get. While having your ratios at 28/36 or lower can improve your chances of getting the mortgage, some loan programs do allow for higher ratios, sometimes depending on compensating factors like a big down payment or a high credit score.

For example, Federal Housing Administration loans may have a mortgage-to-income ratio as high as 31 percent and a back-end ratio of between 43 and 50 percent, and conventional loan underwriters may allow for these higher back-end ratios as well. Magnify Money notes that underwriters of Veterans Affairs loans can make judgments on the back-end ratio.

Recommended Reading: What Salary Is Required For A Mortgage

How Do I Calculate A Monthly House Payment For A 30

Related Articles

Calculating a 30-year fixed-rate mortgage is a straightforward task. In order to find out what your monthly payments might be, you can use a mortgage formula or a calculator. This will give you a good estimation of whether you can afford the mortgage. Home loans are amortized over 30 years with monthly payments that are the same each month. As you begin to pay your mortgage, you will actually pay more in interest. Over time, as the loan decreases, more of your money goes toward the principal.

Make a note of the interest rate, the loan amount and the terms of payment. Fixed-rate mortgage payments stay the same for the life of the loan. Example: $500,000 mortgage loan at 5 percent interest for 30 years making 12 payments a year — one per month.

Multiply 30 — the number of years of the loan — by the number of payments you make each year. For example, 30 X 12 = 360. You are making 360 payments over the course of the loan.

Divide your mortgage interest rate by your total payments. For example, 5 percent interest with 12 payments is 0.05 / 12 = 0.004.

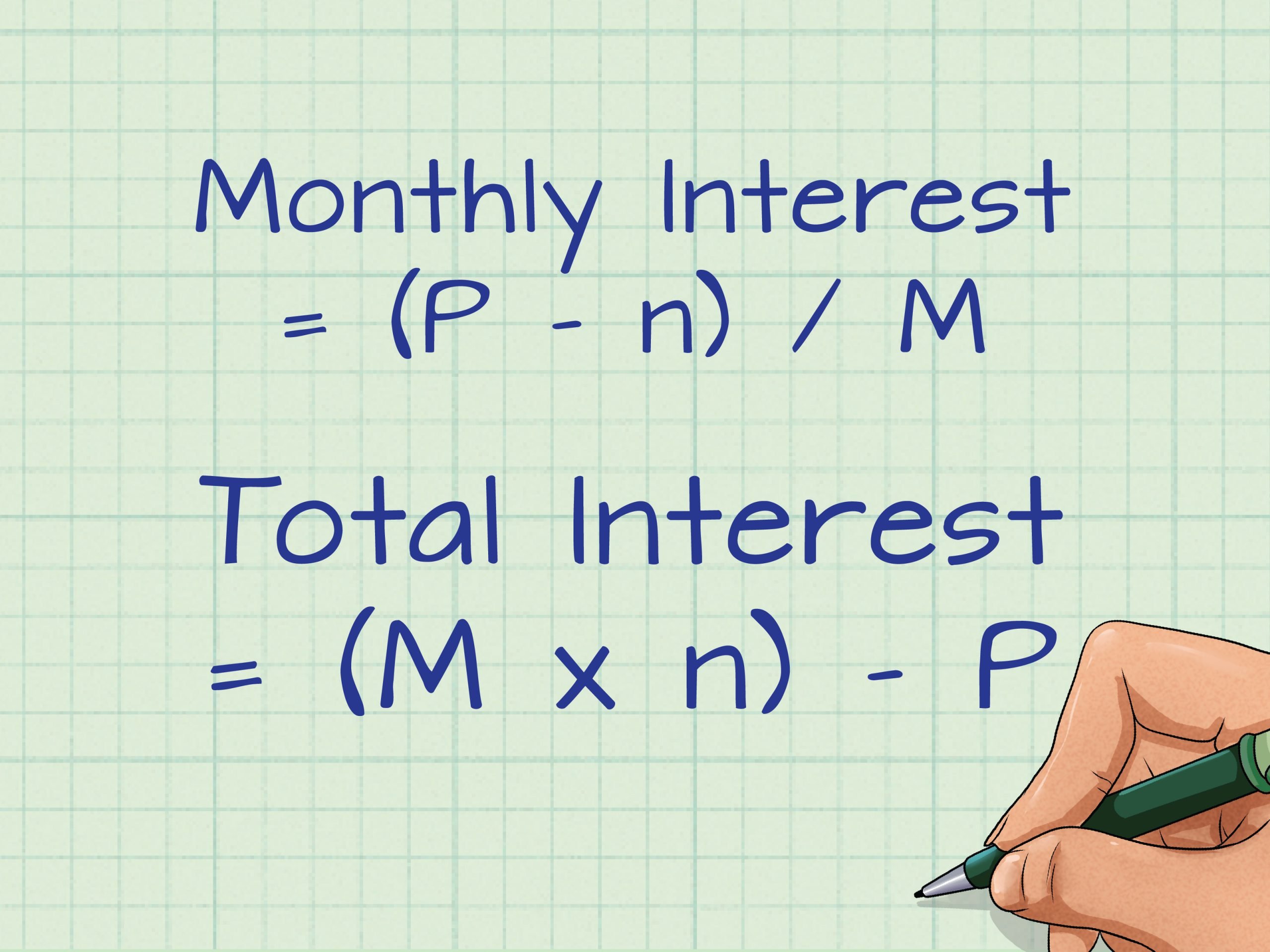

Use this mortgage formula and plug in the appropriate numbers:

Monthly Payments = L/, where L stands for “loan,” C stands for “per payment interest,” and N is the “payment number.”

Monthly Payments = 500,000 /

Monthly Payments = $2684.10

- Check your work with a mortgage calculator.

Warnings

- You should also add insurance and taxes on to your monthly payment.

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

Read Also: How Much Do You Pay Back On A Mortgage

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Do All Interest Rates Move In Line With The Cash Rate

Fixed home loan rates and term deposit rates are not tied to the cash rate in the same way that variable rate products are. While they may seem to move in line with the cash rate, theyâre more so a reflection of how the economy is faring.

Itâs more accurate to say that rates like these are influenced by government bonds. By buying up government bonds with the aim of driving down medium term fixed rates, the RBA effectively pushes fixed mortgage and term deposit rates lower.

Don’t Miss: Does My Husband Have To Be On The Mortgage

The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

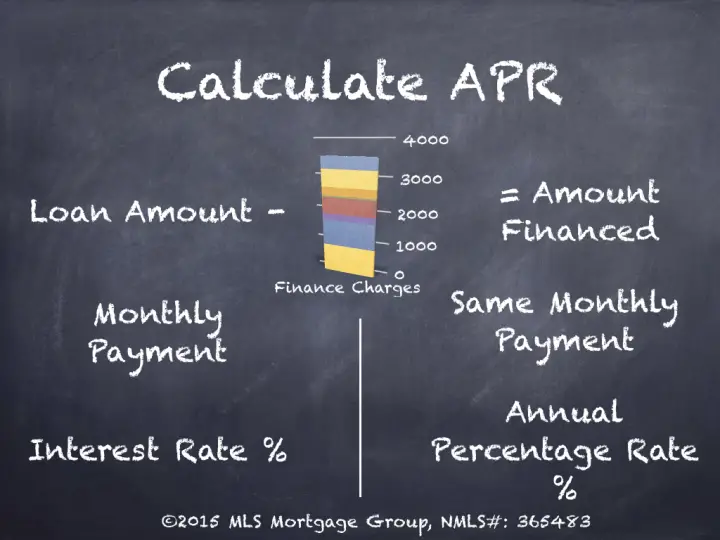

Why Use An Apr Mortgage Calculator

Your lender will figure your APR for you, and will advertise it in loan offers. However, you may wish to see yourself how the APR will vary if you make certain changes in the loan, such as buying more or fewer points. Or you may want to compare loan offers from lenders with different fee schedules and want to see how different fee schedules affect the APR and total cost of the loan.

FAQ: It is also helpful if you: Are working with a tight budget and need to know exactly how much you can afford.

FAQ: You want to compare the true total monthly payment required from two or more providers. For the best way to do this, .

Read Also: What Is The Mortgage Rate In Florida

Why Choose A 10

The biggest advantage to a 10-year mortgage: You’ll avoid paying the interest that comes with a longer loan like a 15- or 30-year mortgage. Over the course of three decades, you pay much more interest than you would over a single 10-year period. Your interest rate on a 10-year mortgage will generally be lower than the rates on comparable longer-term mortgages as well.

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- : Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

You May Like: Do Mortgage Lenders Work On Saturdays

Use Our Interest Rate Calculators

If all of that looks like way too much math to stomach, or if you donât have time to become a spreadsheet expert, you can use our handy financial calculators to do the work for you.

Our repayments calculators will tell you the repayment youâll make on a monthly, fortnightly or weekly basis, and give you the total amount of interest youâll wind up paying on your car, personal or home loan. And our credit card debt payment calculator will show you how long it will take you to pay off a credit card debt, plus how much youâll pay in interest and fees.

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

You May Like: How To Determine Ltv Mortgage

What Is An Annual Percentage Rate

The Annual Percentage Rate represents the effective interest rate when considering a mortgage. It incorporates both your quoted mortgage rateand any fees associated with the mortgage. Fees can include broker fees,closing costs, rebates, or discount points. If you have any closing costs and no interest rebates, the APR will always be greater than the quoted mortgage rate.

You should always try to find the lowest APR when comparing mortgage loans because it includes all costs. If two lenders are offering the same mortgage rate, but one of them has higherclosing costs, it will be reflected in a higher APR. The best way to learn what goes into an APR is tocalculate it yourself. You should not use the APR without understanding it because the APR may be misleading under the following circumstances:

What Your Lender Needs To Tell You

If your lender is a federally regulated financial institution, such as a bank, they have to provide certain information.

The following details must appear in an information box at the beginning of your mortgage agreement:

- prepayment privileges

- prepayment penalties

- other key details

Your lender must tell you how they calculate your prepayment penalty. Your lender must also tell you what factors they use to determine the penalty. These details must be clear, simple and not misleading.

Read your mortgage contract carefully. Make sure you understand the details about penalties before you sign your contract. Ask questions about anything you dont understand.

Don’t Miss: What Does A Mortgage Consist Of

Why Do Banks Charge Different Interest Rates

While the cash rate is one of the main things banks will consider when setting commercial interest rates, itâs not the only one. Banks will also be keeping an eye on overhead costs, as well as maintaining a healthy margin between the loan and deposit rates theyâre offering.

Generally speaking, online banks tend to offer cheaper home loan rates and more generous savings account rates than their larger counterparts, as they have fewer overhead costs to worry about. The flipside to this is that larger banks tend to offer more when it comes to physical branches and face-to-face services.

Third Federal Savings And Loan Best Bank Lender

Third Federal Savings and Loan Association is a bank and lender in 25 states and Washington, D.C., with branch locations in Ohio and Florida. The bank offers mortgage products including fixed- and adjustable-rate loans, 10-year loans, jumbo loans and bridge loans.

Strengths: Borrowers can find 10-year and other mortgage rates updated on Third Federals website daily, including for the banks 10-year low-cost loan, which costs just $295. The bank also offers a $1,000 rate guarantee and free 60-day rate lock . Third Federal also services all of its loans, so your mortgage will be originated and managed by the same entity.

Weaknesses: Third Federal is not licensed in every state, and if youre looking for a government loan , youll have to look elsewhere.

Also Check: What Banks Look For When Applying For A Mortgage

Combined Loan To Value Ratio

Combined loan to value ratio is the proportion of loans in relation to its value. The term “combined loan to value” adds additional specificity to the basic loan to value which simply indicates the ratio between one primary loan and the property value. When “combined” is added, it indicates that additional loans on the property have been considered in the calculation of the percentage ratio.

The aggregate principal balance of all mortgages on a property divided by its appraised value or purchase price, whichever is less. Distinguishing CLTV from LTV serves to identify loan scenarios that involve more than one mortgage. For example, a property valued at $100,000 with a single mortgage of $50,000 has an LTV of 50%. A similar property with a value of $100,000 with a first mortgage of $50,000 and a second mortgage of $25,000 has an aggregate mortgage balance of $75,000. The CLTV is 75%.

Combined loan to value is an amount in addition to the Loan to Value, which simply represents the first position mortgage or loan as a percentage of the property’s value.

Hsbc Bank Best Bank Lender

HSBC Bank is a bank and lender with approximately 200 locations across the U.S. and an extensive global footprint. The bank offers a multitude of mortgage products, including 15-year fixed-rate loans.

Strengths: HSBC Bank displays interest rates and APRs on its website, which can make it easy to do comparisons. The bank also participates in several low-down payment loan and assistance programs.

Weaknesses: You can only apply by phone or by visiting a branch , and mortgage products arent available in Alaska or West Virginia.

Also Check: How Much Mortgage On 200k

How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratio that lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

Payoff In 14 Years And 4 Months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

If Pay Extra $500.00 per month

| Remaining Term | 14 years and 4 months |

| Total Payments |

| 24 years and 4 months |

| Total Payments |

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options.

Don’t Miss: How Many Times Annual Salary For Mortgage