Speak With Your Current Lender

Let your current lender know that you’d like to refinance and find out if it offers options that will work for you. The best thing about working with your current lender is that it knows your mortgage file and can quickly determine whether you’d qualify for any of their refinance programs, even with bad credit.

Your current lender may help by changing your loan terms. For example, it may be willing to refinance your loan to a longer term. You’d end up paying more in total interest over the life of the loan if you extend it, but it will lower your payments and, hopefully, give your budget a little breathing room.

Also, if you’re still carrying private mortgage insurance on your loan because you put less than 20% down when you purchased the property, find out how close you are to hitting the 20% equity mark. Once you have 20% equity in the property, your mortgage lender will drop PMI. Here’s how that works:

- Get your home appraised. A home appraisal typically runs between $300 and $450. You have to pay for the appraisal, but it could take as little as two months to recoup the cost once PMI is dropped.

- Figure out how much you still owe. Let’s say the appraisal comes in at $325,000, and you currently owe $250,000. That means you owe less than 80% of what the home is worth and are eligible to drop PMI. .

- Ask your lender to drop PMI. Provide your mortgage company with the appraisal and a written request to drop your PMI payments.

Simple Tips To Secure A 175% Mortgage Rate

Secure access to The Ascent’s free guide that reveals how to get the lowest mortgage rate for your new home purchase or when refinancing. Rates are still at multi-decade lows so take action today to avoid missing out.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

How Soon Can I Refinance After Exiting Forbearance

Your refinance timeline depends on the type of mortgage loan you have.

If you have a conventional loan backed by Fannie Mae or Freddie Mac, you must make three consecutive payments after youve exited forbearance before you become eligible for refinancing.

Different terms may apply if you have a government-backed loan, including FHA, VA, and USDA mortgages.

- FHA loans According to the Federal Housing Administration, you must have made at least 3 consecutive payments after exiting forbearance to be eligible for most FHA refinances. Some borrowers using the FHA Streamline Refinance may qualify with fewer than 3 payments. To refinance with cash back, youll need to have made at least 12 consecutive payments post-forbearance

- USDA loans If your current mortgage is a USDA loan, you must have made 3 consecutive payments after exiting forbearance to be eligible for a refinance. In addition, the loan must have originally closed at least 12 months prior to the date you request a refinance

- VA loans There is no waiting period for a VA IRRRL Refinance, as long as the borrower can prove theyve recovered from the financial situation that caused them to request forbearance in the first place

Prior to the coronavirus pandemic, homeowners had to wait 12 months after using a forbearance program to apply for a refinance.

The revised rules give borrowers who experienced financial hardship access to lower rates, thereby getting further economic relief.

Don’t Miss: Is Citizens Bank Good For Mortgages

What Are Usda Loan Fees In 2021

USDA mortgages come with two fees that are specific to the program: an upfront guarantee fee and an annual fee. The upfront guarantee fee this fiscal year, which began Oct. 1, 2020, is 1 percent of the loan amount. This fee can often be rolled into the mortgage instead of paying it out of pocket. The annual fee for this fiscal year is 0.35 percent of the loan amount. So, a $100,000 mortgage would have a $1,000 one-time payment and a $350 per year ongoing payment for the life of the loan.

Both of these fees are charged to the lender who then, usually, passes the cost on to the borrower. These fees keep USDA loans subsidy-neutral, which means that any losses incurred by the program are paid for by these fees instead of taxpayer dollars. Depending on the needs of the program, the fees can change annually.

Other USDA mortgage costs might include:

- Origination fees

- Discount points

Pros And Cons Of Usda Loans

The benefits of a USDA home loan include less stringent credit score guidelines and no down payment requirement. There is also no formal loan limit, unlike FHA loans. This can be a great program for homebuyers on a budget that are flexible about where they live. The cons mostly have to do with restrictions, like those on where you can buy or how much your family can make.

Also Check: How Much Is Mortgage Tax In Ny

What Requirements Must Be Met For A Usda Refinance

While you should talk to your lender about the specifics, some of the basic requirements include:

- The mortgage must already be a USDA loan

- The mortgage must not be delinquent

- The refinance will need to lower the monthly payment

- No cash may be taken out during the refinance process

- The past 12 payments should have been made on time

The most important thing to remember is that refinancing a USDA loan does have certain special requirements and it may take a little more work. Thats why it is vital that you work with a mortgage company that understands USDA loans AND one that is comfortable handling the refinance process. Here at Liberty Financial in Louisville Kentucky, we have the knowledge and expertise necessary to help you with anything related to your mortgagebe it applying so you can buy your first home or refinancing a loan you had for years. Our refinance experts are just a phone call away.

What Is The Usda Refinance Pilot Program

What is the USDA Refinance Pilot Program? This video tip explains the highlights and how it can help homeowners with an existing USDA loan reduce their rate & save money each month without the need for an appraisal. If you are a realtor, please forward this tip to any past clients who purchased a home with USDA financing. This is a great way to stay in touch and help at the same time.

Call me for details on how to qualify for the USDA Refinance Pilot Program. I can be reached at 935-8330 or by email at . You can also apply online or subscribe for free on the right to receive more USDA details and tips.

Don’t Miss: How To Get Assistance With Mortgage Payments

Expert Insights On Usda Loans

MoneyGeek spoke with industry leaders and academics to provide expert insight on USDA loans. All views expressed are the opinions and insights of the individual contributors.

Does Usda Have A Streamlined Refinance

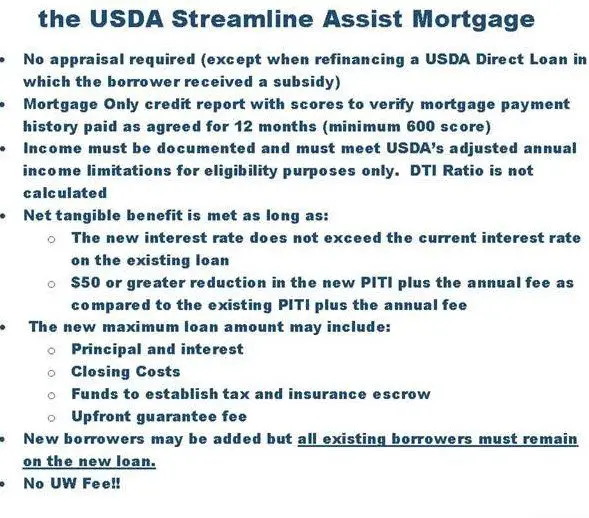

Yes! The USDA streamlined assist refinance is similar to other government agencies’ refinance programs, like the Federal Housing Administration’s FHA streamline refinance and the VA Interest Rate Reduction Refinance Loan, or VA IRRRL, offered by the Department of Veterans Affairs. These all allow homeowners who already have a government home loan to complete a fixed-rate, rate-and-term refinance with less hassle than a typical refinance.

With a USDA streamlined assist refinance, your existing loan can be a USDA direct loan or a guaranteed loan. The USDA’s regular streamline refinance is not available to direct loan borrowers, though its standard rate-and-term refinance is. The USDA does not offer cash-out refinances.

Also Check: Is 3.99 A Good Mortgage Rate

Bottom Line: Are Usda Loans Worth It

If youre a prospective homebuyer earning less than a moderate income in a rural area, then a USDA loan could be a great option for you. If you meet USDA loan requirements, youll pay very little or $0 down on a house and get access to low fixed-interest rates over a 15- or 30-year term.

Remember, applying for a USDA loan is a lot like applying for any other mortgage loan. You must prove your creditworthiness, plus meet the USDAs other qualifying requirements: your income must be significantly less than the median income in your area, and the property you finance with a USDA loan must meet certain criteria. The only way to confirm you meet the income and property requirements for a loan guarantee or direct loan from the USDA to consult the USDA Income and Property Eligibility site. If you are eligible for a USDA loan program, the site will direct you toward the correct application process.

Michele Lerner, author of HOMEBUYING: Tough Times, First Time, Any Time, has been writing about personal finance and real estate for more than two decades. Michele writes for regional, national and international publications in print and online for a variety of audiences including consumers, real estate investors, business owners and real estate professionals.

Questions And Answers About The Usda Streamline Loan Program

I bought my property with a USDA loan but now rent it out to relatives, can I still refinance? No. All borrowers on the original loan must occupy the property when applying for the USDA streamline refinance.

My home was in a USDA eligible area when I purchased, but now its not. Am I eligible for the USDA streamline? Yes. As long as your homes location met eligibility requirements at the time of purchase, you can use the program.

I want to make some improvements to the home, can I borrow more money for a new addition? No. Additional funds may not be received from the refinance for any reason.

My lender wants to run a credit report but I dont want them to. I thought the USDA pilot program didnt require a credit report. You can opt not to have your credit report pulled but if the lender requires it, your application may not be approved. In some cases, lenders can impose additional restrictions above USDAs requirements. Lenders can order a credit report to verify you have made your previous 12 mortgage payments on time. Ask your lender if copies of your canceled checks or cashiers checks to your mortgage company will work in lieu of a credit report.

My annual fee is 0.40% because I bought my home before the increase. Will my new annual fee be lowered to 0.35%? Yes. Since the refinance is considered a new USDA loan, all current guidelines are applicable.

Don’t Miss: What Is The Average Time To Pay Off A Mortgage

Eliminate Mortgage Insurance Premiums

Conventional mortgages let you stop paying for mortgage insurance when your mortgage balance falls below 80% of your homes market value. For some, that happens quickly because they live in areas where home prices are rising fast.

But government-backed loans from the FHA and USDA dont let you do that. Youre on the hook for mortgage insurance premiums throughout the life of your loan. Well, nearly always: If you initially make a 10% down payment on your FHA loan, you can stop paying MIPs after 11 years.

But most borrowers with this type of mortgage have to keep paying until they sell the home or finish paying off their loan. Unless they refinance to a different sort of mortgage.

And thats why so many of those with FHA and USDA loans refinance to conventional loans as soon as their mortgage balances reach 80% of their homes values. With MIP costing 0.85% annually of the mortgage value on FHA loans and 0.35% for USDA loans, they get to save a small fortune.

When Can You Refinance A Jumbo Loan

You can refinance a jumbo mortgage at any time. However, you must first find a lender thats willing to do it, as many avoid financing them. You will also be held to higher standards to qualify, just like you were for your first jumbo mortgage.

Typically, a lender will be looking for a high credit score , a low DTI , an 80/20 LTV and enough cash reserves to cover the monthly mortgage payments.

Jumbo loans can also be eligible for cash-out refis, but options vary by lender. Jumbo loans, as the name implies, are for loan amounts that exceed standard requirements and therefore require extra assurances for the lender, since they are riskier loans overall. Today, a jumbo loan is one that is over $548,250 in most of the U.S. and cannot be insured by Freddie Mac or Fannie Mae.

Read Also: How Much Mortgage Protection Insurance Cost

How Soon Can You Refinance A Usda Loan

If you have a USDA loan thats backed by the federal government, youll have to wait 12 months before you can refinance.

But, more rarely, the USDA offers direct loans. That means its lending you its own money rather than just guaranteeing a private lenders loan. If you have one of those, there are no formal rules governing seasoning periods for refinances.

What Is The Usda Streamlined Assist Refinance Loan

The USDA Streamlined Assist Refinance Loan gives current USDA loan borrowers an opportunity to get lower monthly payments, regardless of negative equity. With a simpler application process, this refinance option features no debt-to-income limitations, no inspection or appraisal, and no loan-to-value requirements.

Read Also: What Is Loss Mitigation Mortgage

How To Refinance A Usda Loan

Shop around for the lowest rates and fees from multiple lenders before taking on the five steps to refinancing:

Other Options After Forbearance Ends

Refinancing isnt your only option. Here are a few ways you can approach the end of forbearance:

The right decision for you will depend on your current loan and how your finances are looking as you exit COVID mortgage forbearance.

Your loan servicer should walk you through all your options before forbearance ends, so you can be sure youre making the best choice about how to resume your mortgage.

Also Check: How Do I Become An Underwriter For Mortgage

Can A Home Appraisal Save Money On Your Refi

Appraisals add hundreds of dollars to your refinance closing costs. The process could also add a week or more to your closing time. And a too-low appraisal can stall your loan application.

So waiving the appraisal is definitely attractive at face value.

But there are times when a fresh appraisal report might actually save you money over the life of your loan.

For example, you may be able to get a lower mortgage rate if your appraisal comes in higher than expected.

A higher appraisal lowers your loan-to-value ratio, and lower LTVs mean the lender is putting less on the line and may be willing to charge a lower interest rate.

LTV is only one factor influencing home mortgage rates, though. Your credit score and debt-to-income ratio matter a lot, too. So theres no guarantee an appraisal will save you money even if it comes in high.

But if youve made a lot of home improvements or built an addition to your home recently, a home appraisal may enhance your refinance savings.

Should I Refinance Without An Appraisal

If refinancing your mortgage will improve your financial situation, it may be worth the expense of an appraisal.

Keep in mind that a home appraisal costs just $310-$420 on average, according to Home Advisor.

If you save $100 per month by refinancing, you will have recovered the appraisal cost in 3-4 months.

And there are other good reasons to refinance, too.

For instance, if your property value has risen to the point that youd be able to drop your mortgage insurance by refinancing, you should probably do it. You may recoup the cost of an appraisal in just a few mortgage-insurance-free months.

Youll also probably need an appraisal to tap your homes equity, whether via a cash-out refinance, home equity loan, or home equity line of credit .

Because home equity financing is some of the cheapest money available, the cost of an appraisal may not be much of a factor.

Recommended Reading: How Much Mortgage Can I Afford On 200k Salary

Refinancing With Usda Rural Development

The USDA has announced a great opportunity for homeowners with a rural development mortgage. This zero-down mortgage option is great for first time home buyers because of the 100% financing. With homeowners who went this route a few years ago, interest rates were decent – in the 8% range – but those rates have fallen near 4% now. The only problem is that in that same time period, home values have dropped so refinancing is difficult with no equity. Enter the rural development refinance program.

On Thursday May 31, the Deputy Undersecretary for Rural Development Doug O’Brien traveled from Washington, D.C. to Portage, Michigan to announce this program. Because AmeriFirst Home Mortgage is the leading lender for USDA rural development in Michigan, the announcement was made at the AmeriFirst headquarters. Michigan’s Rural Development Director James Turner and several other USDA staff members joined in on the announcement, as well as staff from Senator Debbie Stabenow’s office.

The point behind this program is to help those homeowners with an RD loan – who have kept up with their payments despite falling values – to refinance their mortgage into a lower interest rate. This will lower their house payment, putting cash directly into their budgets. Because this refi option doesn’t require an appraisal, the value of the home is not the focus. Instead, the homeowners credit score, income and employment are the deciding factors.