Closing Costs You Can Deduct On A Home Purchase

Weâll outline below the closing costs you can deduct on a home purchase, as well as any special considerations that might affect how much you can deduct or in what tax year you can claim the deduction.

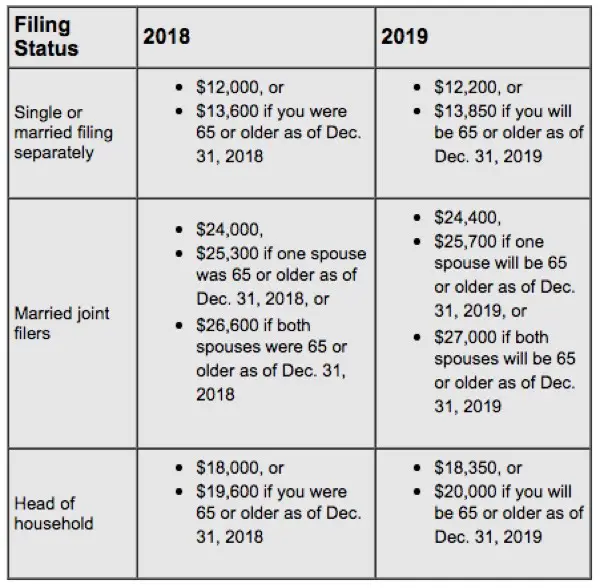

First, you should know the current standard deduction amounts. For 2020 tax returns filed in 2021, the standard deduction is $12,400 for individuals, $18,650 for heads of household and $24,800 for married couples filing jointly and surviving spouses.

Your itemized deductions need to exceed these amounts to benefit from closing cost tax deductions. All your itemized deductions, including charitable donations, go on Schedule A of your annual federal tax return.

Introduction To Mortgage Refinancing

A mortgage refinance involves paying off your old loan and replacing it with a new one from a lender of your choice. People refinance for a variety of reasons, including reducing their interest rate, shortening their repayment term, and tapping into home equity to access cash.

The most important thing to know about refinancing is that it involves closing costs, so it only makes sense to refinance if the new interest rate is substantially lower than the old one. In principle, the more time that has elapsed since your initial mortgage began, the wider the gap in interest rates needs to be for a refinance to be profitable. As a rule of thumb, in the early years of a mortgage a 0.75% lower interest rate should be enough to deliver savings, while in the mid-to-late years of the repayment term, a 1-2% lower interest rate is needed. Of course, always do your own calculations before refinancing.

Rental Property Closing Costs

At a glance: Closing costs for rental properties can be tax-deductible unlike for a personal residence.

Most rental property closing costs are tax-deductible on Schedule E and dont require filing an itemized return.

Some of the eligible costs include:

- Title insurance

However, some expenses cannot be deducted when you refinance your rental property. One example is mortgage points when the loan amount is larger than the original balance.

For instance, if you took out a cash-out refinance on an investment property that appreciated in value, any portion of the points that exceeds the original loan balance cant be deducted as a rental expense.

You May Like: How Much Interest Am I Paying On My Mortgage

Recommended Reading: Can You Refinance Your Mortgage With Bad Credit

Why Is My Mortgage Interest Not Deductible

If the loan is not a secured debt on your home, it is considered a personal loan, and the interest you pay usually isnt deductible. Your home mortgage must be secured by your main home or a second home. You cant deduct interest on a mortgage for a third home, a fourth home, etc.

Second Mortgage Tax Implications

Suppose you opt for a second mortgage ) instead of a cash-out refinance. Are you still able to deduct mortgage interest?

Once again, that depends on what you use the funds for. If you buy or significantly improve a home, you probably can. But, if you borrow for other purposes you almost certainly wont.

The IRSs Publication 936 Home Mortgage Interest Deduction gives full details.

Read Also: Can My Llc Pay My Mortgage

Tax Deductions And Refinancing

The IRS allows you to deduct the interest paid on up to $1 million in mortgage debt, on either your primary or secondary home, or the two combined. So if you have a $750,000 mortgage on your primary home and $250,000 mortgage on a vacation home, you can deduct all your mortgage interest.

That doesn’t change after refinancing, so you can refinance one or both mortgages and still deduct all your mortgage interest, as long as the combined mortgage principle does not exceed $1 million for a couple, or $500,000 for a single filer.

Mortgage Interest Deduction Maximum

Its helpful to know that theres a ceiling on the mortgage interest deduction you can take. As of the start of the 2018 tax season, the interest you can write off has to be based on a loan amount of up to $750,000, Greene-Lewis says. You can refinance for a larger mortgage, certainly, but youll only be able to take a deduction on the interest of the loan amount up to $750,000.

Also Check: How Much Is Mortgage Insurance In Michigan

Are Staging Costs Tax Deductible

In summary, the IRSâs position is that Staging costs are a legitimate selling expense for both primary and secondary homes and are therefore tax deductible. However, it is important to note that if a house is staged and then taken off the market before it sells, the staging expenses are not tax deductible.

Dont: Raise Red Flags By Erroneously Claiming Points And Fees From Your Refinance

People often make the mistake of thinking that the points and fees paid on a refinance are tax deductible just as they may have been when they originally obtained the mortgage on their home, says Jones. That, however, is not the case.

Jones explains that, per IRS guidelines, points paid when refinancing are not taken in full during the year in which the refinance was obtained. Instead, the points must be deducted equally over the life of the loan, she says. To figure the annual deduction amount, divide the total points paid by the number of payments to be made over the life of the loan. Usually, this information is available from the lender.

For example, a homeowner who paid $2,000 in points on a 30-year mortgage could deduct $5.56 per payment, or a total of $66.72 for 12 payments. Taxpayers may deduct points only for those payments actually made in the tax year, according to Jones.

Note: If your 2021 refinance was a second refinance, the undeducted portion of any points that were to spread among the old loans remaining term are accelerated into the current year, and so the remainder of those undeducted costs become be fully deductible this year. Of course, any new points paid for the new mortgage will again be spread out over the new loans term, as before.

Keith Gumbinger revised and updated this article.

Recommended Reading: How To Calculate What Mortgage You Can Get

Don’t Miss: Do You Pay Interest On A Reverse Mortgage

Restrictions On Refinancing Deductions

The IRSs objective is to collect taxes owed to the federal government, so these deductions obviously come with some limitations. In order to qualify for most of the tax deductions listed above, you must itemize your deductions rather than take the standard deduction.

To save the most money on your annual tax return, youll want to choose the deduction method thats most valuable to you. The 2019 standard deduction is:

- $12,200 for single filers

- $24,400 for married couples filing jointly

You Can Deduct Your Gambling Losses

The good news is that you can deduct your losses up to the amount of your winnings. So if you won $1,000 but lost $500, you would only need to pay taxes on the $500. You can’t deduct, however, more than the amount of gambling income you reported on your return. So if you won $1,000 but lost $2,000, you can only deduct up to $1,000. You can claim your gambling losses as “Other Itemized Deductions.”

You can deduct gambling losses as long as you itemize your deductions and keep track of all your winnings and losses. This can be done by keeping a gambling journal or using software that tracks your bets. That way, come tax time, you’ll have everything you need to properly report your income and deductions.

Don’t Miss: Can You Refinance A Mortgage With Less Than 20 Equity

Does Refinancing Affect Taxes

Unfortunately, theres no cut-and-dry answer here. Refinancing may or may not affect your taxes, depending on what type of refinance you used and how you file.

As a general rule, your mortgage only impacts your taxes if you itemize your deductions.

And, if you used a straightforward rate-and-term refinance, there likely arent any tax implications. A cash-out refinance could have some, but you will not have to pay income tax on the equity you cashed out. Heres what you should know.

The Mortgage Reports is not a tax site. This information is for general guidance only. Consult with a tax professional about your specific situation.

In this article

Are Refinancing Points Tax Deductible

Home ownership has its privileges, or at least its opportunities. Tax deductions as well as the ability to refinance a loan to tap equity or reduce ones monthly payments are two examples. Did you know that refinancing points could have tax deductions?

Similar to a purchase mortgage, a refinance mortgage may require a borrower to pay points as part of the closing costs of the loan. The option to pay refinancing points or not to pay refinancing points could be left to the borrower to decide, and there are tax advantages and disadvantages to each.

Well take a look at the pros and cons paying refi points, but before we do, lets make sure we understand what they are.

Also Check: How Much Would A Mortgage Be For 250 000

Mortgage Refinance Tax Deductions On Rental Properties

As noted earlier, you may be able to tax deduct your closing costs on rental investment properties. You also may deduct the points that you paid up front. I may save you money to get the facts on investment property and second-home refinances. Some of the closing costs that you can deduct on your investment property include:

The only thing you have to remember is that these fees have to be prorated over the loans life. To determine expenses that you may deduct for this tax year, you need to divide your total closing costs by the number of monthly payments you are going to make on your loan. You then multiply that amount by the payments you made for that tax year.

Home Equity Loan Vs Home Equity Line Of Credit

Home equity loans and home equity lines of credit are similar, but have a few key differences. Both loans use home equity as collateral for the loan. However, home equity loans provide you with a lump sum of cash, repaid over a set term with a set interest rate. You repay the money over the lifetime of the loan. Terms generally range from 5 to 15 years.

With HELOCs, you get access to a revolving line of credit with a variable interest rate, though some lenders do offer fixed-rate options. Like a credit card, you can take what you need up to your credit limit, pay it back, and borrow more. HELOCs have a draw period, which typically lasts 5 to 10 years. The draw period is followed by a repayment period of about 10 to 20 years, during which you must repay your balance and can no longer draw money.

You May Like: How To Find The Cheapest Mortgage Rates

Is It Worth It To Claim Student Loan Interest

Yes, when it comes to student loans and tax returns, you may be able to deduct up to $2,500 from your taxable income if youre eligible.

To be able to claim the deduction, your modified adjusted gross income must be less than $70,000 . Youll also experience a phased-out deduction if your MAGI is between $70,000 and $85,000 .

The amount of deduction you can claim starts to phase out at MAGIs of $70,000 for individuals and $140,000 for those who file jointly. It disappears entirely at MAGIs above $85,000 and $170,000 for joint filers.

How Much Should I Pay In Closing Costs For A Home Refinance

With all of these different fees, you may wonder, how much are closing costs on a refinance? Your costs for refinancing depend on your outstanding principal on your current mortgage. You can expect to pay 2% to 5% of your outstanding principal for your closing costs.

So if you have a current outstanding principal of $100,000, you can expect to pay from $2,000 to $5,000 in closing costs to refinance your home.

Also Check: Is A 10 Year Mortgage Worth It

The Bottom Line On Refinance Tax Deductions

Refinancing a mortgage can leave you with a lower monthly payment or can save you tens of thousands of dollars in interest payments during the life of your loan. Refinancing can also bring tax deductions, specifically on the amount of interest you pay each year on your new mortgage loan. If you are ready to refinance your home start your application online with us today.

Refinancing: What Is Tax Deductible

A tax deductible is an expense you can subtract from your taxable income. This deductible expense lowers your taxable income and reduces the amount of taxes owed.

When completing your tax form, you can choose standard or itemized deductions. Filing an itemized tax return allows you to claim mortgage refinance tax deductions which can reduce your federal income taxes.

Read Also: What Is The Mortgage Rate For Bank Of America

How Do Helocs Work

HELOCs generally work like other lines of credit. You can borrow money as you need it for any reason, and make monthly payments as spelled out in your loan agreement. You may only pay interest for the first several years, but can save money during that time by also making principal payments.

To apply for a HELOC, youll need to provide the lender with your personal and financial information. They will also verify the value of your home to ensure you have enough equity to qualify.

As you pay down the amount you borrow, it becomes available again. Unlike a traditional credit line, however, a HELOC directly draws from the equity in your home, increasing the amount you owe on the property.

Most HELOCs have a draw period that lasts 10 years. During this decade, you pay only monthly interest unless you decide to put more toward principal. After 10 years, the HELOC enters its repayment phase. You must make monthly principal and interest payments and you cant take more money out of your home equity .

Refinance Tax Deductions You May Qualify For

You may qualify for several deductions in the year you refinance the mortgage on your rental property and beyond. Talk to an accountant about your eligibility for the following deductions if you are unsure:

- Mortgage interest deduction

- Discount points deduction

The closing costs that are tax deductible on your rental property may include your attorney fees, state-required inspection fees, other legal fees, appraisal fees, and even your refinance application fee where applicable. Insurance and repair costs for the rental property are also typically tax deductible.

Recommended Reading: How Can I Get The Pmi Removed From My Mortgage

What Is A Tax Deduction

For starters, its helpful to review what a tax deduction is: A tax deduction lowers your taxable income by reducing the amount of your income before you or a tax professional calculates the tax you owe.

For example, a $100 exemption or deduction reduces your taxable income by $100. So it would reduce the taxes you owe by a maximum of $100 multiplied by your tax rate, which can range from 0% to 37%. So your deduction could reduce your taxes between $0 to $37.

And before considering how refinancing affects your taxes, its helpful to review what happens when you refinance a student loan: Your lender swaps out your existing loans and gives you a new loan with new terms. A student loan refinance may be beneficial if you get a lower interest rate and/or a lower repayment amount, which can save you money in the long run.

If youre considering refinancing federal student loans, however, its important to understand that you would lose access to certain federal benefits and protections, such as Public Service Loan Forgiveness or federal deferment and forbearance.

Recommended: 26 Tax Deductions for College Students and Other Young Adults

Are Mortgage Points Tax Deductible

When you close on your house, typically you can also deduct any points you paid when you got the mortgage. Mortgage points are payments you make to get the loan or get it with a reduced interest rate. One point is one percent of the total home loan amount. Two points are two percent. You get the picture.

If you pay these points up front, or pay them all during the first year of ownership, you can typically deduct them. That can add up fast. If, however, you roll them into the mortgage and pay them over time, they may not add up to much in terms of a yearly deduction. Information about your points paid will be on your 1098 form from your mortgage company.

Recommended Reading: Can You Get A Conventional Mortgage On A Manufactured Home

Introduction To Heloc Loans

A home equity line of credit, also known as a HELOC, is an open-end revolving line of credit in which the borrower uses their home equity as collateral. HELOC lenders create a lien against the borrowers home until the full amount is paid off, similar to a first mortgage.

HELOC loans are often used to finance major expenses such as home improvement, medical expenses, or college tuition fees. Borrowers may draw funds at any time, provided they dont exceed the approved credit limit. Borrowers only pay principal and interest on the funds drawn. Like a home equity loan, a HELOC may involve closing fees at the start of the loan.

State Taxes On Gambling Winnings Vary

While federal taxes on gambling winnings are relatively straightforward, state taxes are a different story. That’s because each state has its own laws regarding gambling and taxes. So, if you live in a state where gambling winnings are taxed, you’ll need to pay attention to the rules there.

For example, in Nevada gambling winnings are taxed at 6.75%, the lowest in the country. However, in Rhode Island, New Hampshire, and New York, gambling winnings are subject to 51% in taxes.

Gambling on sports is becoming more and more popular in the United States thanks to the Supreme Court’s 2018 decision to strike down a federal law that previously prohibited sports gambling. That means that more and more people are going to be faced with the task of paying taxes on their gambling winnings come tax season. If you’re planning on getting into sports gambling, it’s important to know how to handle your taxes properly.

Also Check: How To Prequalify For A Mortgage Loan