What Is A Good Mortgage Rate

Whats considered a good mortgage rate varies by loan type as well as whats happening in the economy . For instance, a good mortgage rate as of February 2021 is generally a fixed rate of 2.5% or less for a 15-year mortgage and 3% or less for a 30-year mortgage. However, interest rates change daily, so its important to keep an eye on the interest rate environment, especially if youre shopping for a mortgage.

In addition to the loan type and economic conditions, a good mortgage rate can also vary based on your credit score and the size of the down payment youre able to make.

For example, as of February 2021, the average rate on a 30-year fixed-rate mortgage with a down payment of less than 20% for borrowers with a FICO score better than 740 was 2.772%, compared to 3.087% with a FICO score less than 680. The average 30-year fixed-rate for those able to make a down payment of 20% or more was 2.785% for FICO scores better than 740 and 3.169% for FICO scores less than 680. These are all considered good mortgage rates.

When Should You Lock In Your Mortgage Rate

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires.

If you donât lock in right away, a mortgage lender might give you a period of timeâsuch as 30 daysâto request a lock, or you might be able to wait until just before closing on the home.

Once you find a rate that is an ideal fit for your budget, itâs best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While itâs not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

If you donât lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs.

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youâre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youâll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

Don’t Miss: What Is Amortization Schedule Mortgage

How Do I Find Personalized Mortgage Rates

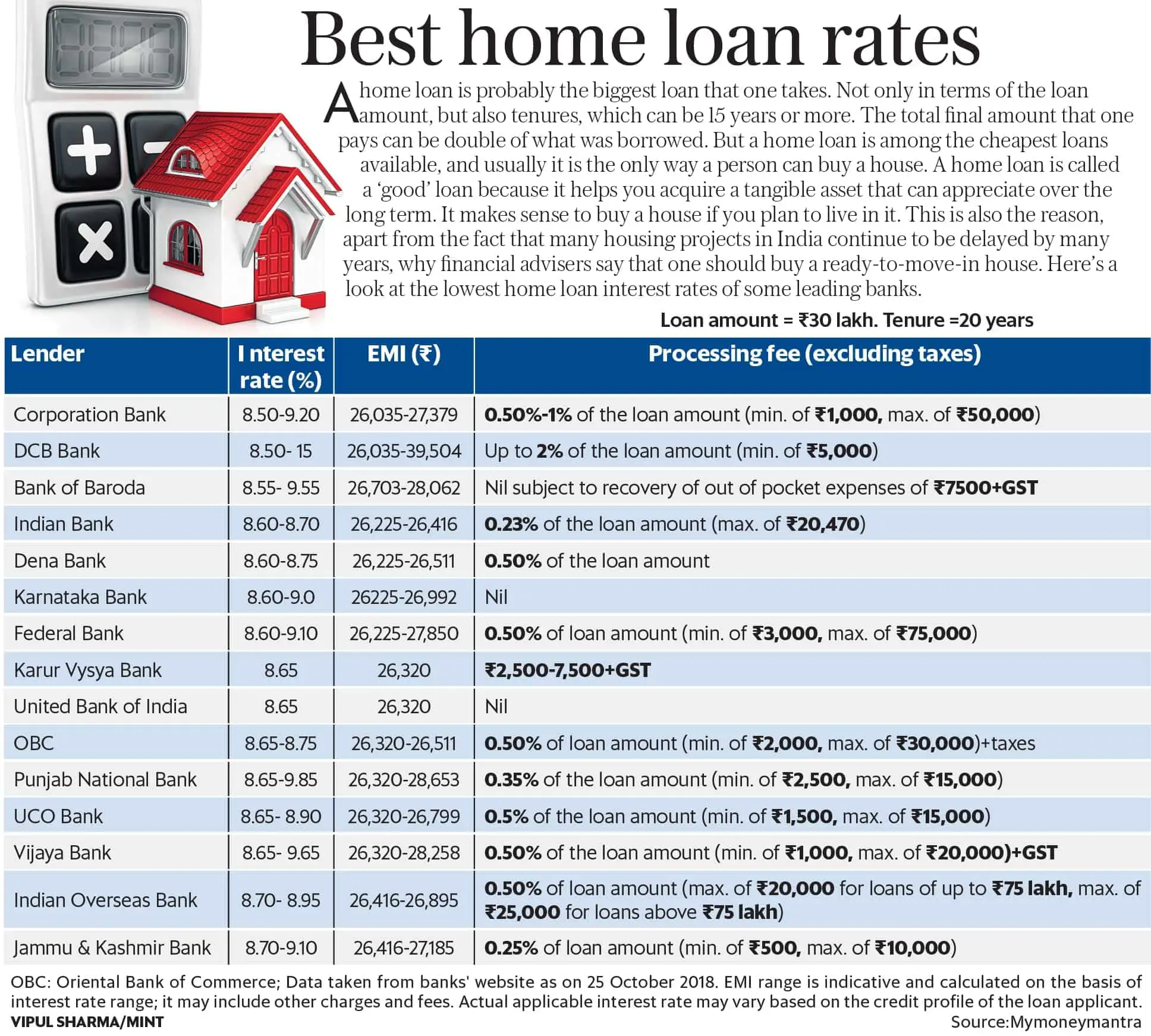

Finding personalized mortgage interest rates is as easy as talking to your local mortgage broker or searching online. While most factors that impact mortgage interest rates are out of your control, rates still vary from person to person. Lenders charge higher home mortgage rates to borrowers they deem riskier. So having a high credit score will get you the best interest rates. Lenders also look at how much you are borrowing compared to the homes value this is known as loan-to-value, or LTV.

Youll get a better rate when the LTV is below 80%. So if your future home has a value of $200,000, youll get the best rates if the loan is for $160,000 or less.

When shopping around for the best rates, consider a variety of lenders, like local banks, national banks, credit unions, or online lenders. Be sure to compare interest rates, fees, and other terms of the mortgage. Also, mortgage rates are constantly changing, so getting rate quotes from multiple lenders in a short time period makes it easier to get an accurate comparison. If thats too much legwork, you could work with a mortgage broker. Mortgage brokers dont directly issue loans. Instead, they work with lenders to find you the best deal. But their services arent free. They work on commission, which is usually paid by the lender.

Are Interest Rates And Apr The Same

Interest rates and APR are not the same. An annual percentage rate reflects additional charges associated with your mortgage, which includes the interest. The interest rate reflects the cost homeowners pay to borrow money. These fees include charges such as origination fees and discount points, which is why the APR is typically higher than the interest rate.

You May Like: What Are The Requirements To Get A Reverse Mortgage

Is A Variable Rate Better

If yourecomparing a variable rate and a fixed rate mortgageat the same point in time, a variable rate will almost always be lower than a fixed rate. Just as how a longer term mortgage will have a higher rate when compared to a shorter term mortgage, borrowers will pay a premium for locking-in a fixed rate.

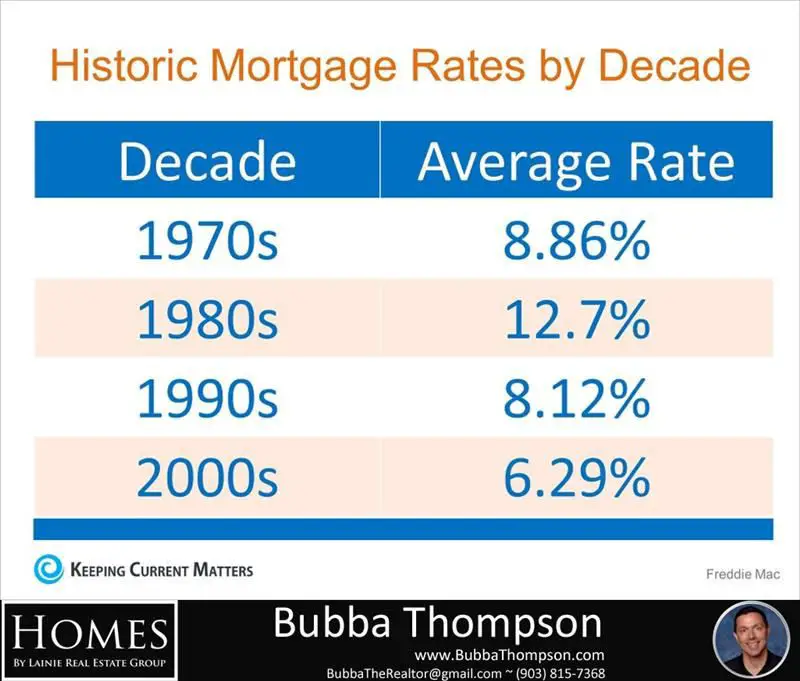

Historically, variable rates have performed better than fixed rates, as found in a 2001 study by theIndividual Finance and Insurance Decisions Centre. Thats because interest rates have generally fallen over the past few decades, meaning that borrowers with a variable mortgage rate would have benefited from falling interest rates.

In 2020, a low interest rate environment increased the popularity of variable rate mortgages as borrowers were enticed to low mortgage rates. However, interest rates have been rising and are expected to increase further into 2023.

While the focus can be on the direction of the change, you should also pay attention to how large the interest rate changes can be. The pace that rate hikes are occurring, due to highinflation in Canadaand countering Bank of Canada rate hikes, might slow down or stop entirely. This can affect your variable vs. fixed rate decision.

Since variable rates are often already priced at a discount to fixed rates, variable rates would be a better choice if interest rates dont move at all. Variable rates might still be a better choice if interest rates only increase slightly and later on in your mortgage term.

Factors That Influence Mortgage Rates

Many factors influence the interest rate a lender may offer you. Some such as your credit score are in your control. But others you have no ability to affect, such as:

- The economy During financial downturns, the Fed may lower interest rates to try to stimulate the economy. And when the economy is doing well, interest rates can rise.

- Inflation Interest rates tend to move with inflation. When the overall cost of goods and services increases, interest rates are also likely to rise.

- The Federal Reserve The Fed may choose to lower interest rates to stimulate a struggling economy, or raise rates in an attempt to put the brakes on inflation.

- Macro employment trends When many people are out of work, as they were during the months of pandemic lockdown, mortgage rates may fall. As employment increases, interest rates typically also increase.

If youre trying to find the right mortgage rate, consider using Credible. You can use Credible’s free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at and your question might be answered by Credible in our Money Expert column.

Read Also: Are There Any Mortgage Lenders For Bad Credit

What Are The Mortgage Rate Trends In 2022

The current macroeconomic environment makes it very likely that the average 30-year, fixed-rate mortgage will end the year above 7%, Channel says. Consumers looking for signs that inflation is cooling off, should start by keeping track of grocery and fuel bills, Channel adds. If those monthly expenses stop going up, it could mean inflationary pressure is finally leveling off.

Current Mortgage Rate Trends

The mortgage or refinance rate you get depends a lot on your personal finances. But the overall market provides context for your personal rate.

Average mortgage rates bottomed out in 2020 and 2021. This climate allowed the most qualified borrowers to access historically low rates. But rates have risen in 2022 and could potentially go even higher by the end of the year.

To see where 30-year mortgage rates may be going, lets check where theyve been.

Recommended Reading: How To Become A Reverse Mortgage Specialist

Fed Sees Through November Hike Mortgage Rates At 7 Percent

The benchmark fixed rate on 30-year mortgages now sits at 7 percent, its highest level in 20 years, according to Bankrates national survey of large lenders. This, as the Federal Reserve made good on its promise to raise rates yet again at its .

The interest rate mantra for 2023 is shaping up as higher for longer, says Greg McBride, CFA, Bankrate chief financial analyst. Unfortunately, were likely to feel the pain of a slower economy before we see the gain of lower inflation.

Federal policy doesnt directly impact rates on fixed mortgages, but the central bank has some sway with 10-year Treasury yields, which do drive fixed mortgage movement. The Feds actions affect adjustable-rate mortgages and home equity products, however. Each time the central bank raises its key rate, variable home loan rates move in tandem.

Some analysts believe fixed mortgage rates might hover in the 7 percent range, while others arent ruling out the possibility of the 30-year rate approaching 8 percent. Learn what the experts predict in Bankrates forecast.

Whatever type of mortgage youre looking for, in this environment, its more important than ever to compare rates before selecting a lender.

Conducting an online search can save thousands of dollars by finding lenders offering a lower rate and more competitive fees, says McBride.

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan and is built into your monthly payment. Mortgage fees are usually paid upfront and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

Also Check: Which Fico Score Is Used For Mortgages

Other Factors Besides Your Credit Score

Remember, FICO is looking only at the difference your credit score makes in the chart above. But lenders will check more than your credit history when you apply for a new mortgage loan. They will also need to know your:

- Debt-to-income ratio : This ratio measures how much of your income goes toward existing monthly debts

- Income stability: Homebuyers need to show W-2 forms or pay stubs to prove a steady income. If youre self-employed, you can provide tax forms or even bank statements

- Down payment: Most loans require a minimum down payment amount . Putting more than the minimum down could help lower your interest rate

- Home equity for refinancing: Mortgage refinance lenders will check your home equity which, measures how much your home value exceeds your mortgage debt. Having more equity can lower your rate

In short, the better your personal finances look, the lower your mortgage interest rate will be. Taking steps like raising your credit score or savings for a bigger down payment before you buy can help you get the best rates available.

What Is A Discount Point

Discount points are optional fees paid at closing that lower your interest rate. Essentially, discount points let you make a tradeoff between your closing cost fees and your monthly payment. By paying discount points, you pay more in fees upfront but receive a lower interest rate, which lowers your monthly payment so you pay less over time. Any discount points purchased will be listed on the Loan Estimate.

You May Like: How To Create A Mortgage Payment Calculator In Excel

Fixed Or Variable Mortgage Which Is Best

Choosing between a fixed and variable deal can be a tough decision. Variable and tracker mortgages may be cheaper than fixes right now but will leave you at the mercy of interest rate rises. If youre considering a variable rate deal while you see what happens with fixed rate mortgages, look for one with no early repayment charge. By contrast, with fixed deals, youll know what your monthly repayments will be for the duration of the fixed rate period.

What Do Todays Mortgage Rates Mean For Your Home Buying Plans

The big increase in mortgage rates this year has taken a lot of potential homebuyers out of the market. That could present opportunities for you if you can afford the higher cost of borrowing money.

Homebuyers are facing less competition and prices are down compared to their all-time highs earlier this year, but theyre still high. If you can find a deal you can afford, it can still be a good opportunity. After all, nobody knows what mortgage rates and prices will be like next year, and buying a home is a lifestyle decision, not just a financial one.

Especially in a volatile market, make sure youre okay with the payment. Whatever loan youre in, make sure you can afford it on your own, says Sheila Smith, an Idaho-based realtor at RE/MAX Capital City. Pick a home youre happy in thats affordable to you.

Also Check: How Many Mortgage Lenders Should I Apply To

Open Vs Closed Mortgages

If youâre wondering whether to get an open or closed mortgage, the answer is, while an open mortgage may make sense in certain circumstances, the overwhelming majority of Canadians opt for a closed mortgage. While open mortgages have extra flexibility that you might need, closed mortgages are by far the more popular choice not only due to their lower rates, but also because most home buyers do not intend to pay off their mortgages in the short term. Moreover, fixed-rate open mortgages do not exist and variable-rate mortgages are very rare. The most common type of open mortgage is the Home Equity Line of Credit . Below are some quick facts about the differences between open and closed mortgages, and you can also find more detailed information on our blog about open vs. closed mortgages.

Today’s Refinance Rates Decline

The average 30-year fixed-refinance rate is 6.79 percent, down 11 basis points since the same time last week. The 15-year fixed refi average rate is now 6.09 percent, down 14 basis points over the last week. The average rate for a 10-year fixed-refinance loan is 6.18 percent, down 19 basis points from a week ago.

Also Check: What An Average Monthly Mortgage Payment

What Is The Best Mortgage Rate In Canada Right Now

As of November 24, 2022, the best high-ratio, 5-year variable mortgage rate in Canada is 4.75%. This rate is available across Canada, including Ontario, Quebec, British Columbia and Alberta.

As of November 24, 2022, the best high-ratio, 5-year fixed mortgage rate in Canada is 4.84%, which is available across much of Canada, including Ontario, British Columbia and Alberta. In Quebec, the best high-ratio, 5-year fixed mortgage rate is 4.89%.

As of November 24, 2022, the average 5-year fixed mortgage rate available from the Big 5 Banks is 5.46%. Rates from the Big 5 Banks currently range from 5.37% to 5.64%.

To find the best mortgage rates in Canada in 2022, use our rate table to compare the lowest mortgage rates currently offered by Canadaâs Big Banks and top mortgage lenders.

How Are Mortgage Rates Determined

Mortgage rates, in general, are determined by a wide range of economic factors, including the yield U.S. Treasury bonds, the economy, mortgage demand and the Federal Reserve monetary policy.

Borrowers have no control over the wider economy, but they can control their own financial picture to get the best rate available. Typically, borrowers with higher FICO scores, lower debt-to-income ratios and a larger down payment can lock in lower rates.

Related:How To Improve Your Credit Score

Don’t Miss: Should I Get An Interest Only Mortgage

Today’s Refi Rates Slide

The average 30-year fixed-refinance rate is 6.77 percent, down 8 basis points over the last week. The average rate for a 15-year fixed refi is 6.08 percent, down 10 basis points since the same time last week. The average rate for a 10-year fixed-refinance loan is 6.16 percent, down 11 basis points since the same time last week.

Mortgage rates remain on the rise: the average 30-year fixed-mortgage rate is 6.77, the average rate for the benchmark 15-year fixed mortgage is 6.16 percent, and the average 5/1 ARM rate is 5.50 percent.

5 min readNov 25, 2022

What Is The Forecast For Mortgage Rates In Canada In 2022

Between January 2022 to November 2022 alone, fixed mortgage rates in Canada have gone up over 100%. In the same time period, variable mortgages rates in Canada have increased by an average of 400%.

The current consensus among economists is that mortgage rates will continue to rise in Canada in 2022 and possibly 2023 as well.

Recommended Reading: How Of A Mortgage Can I Afford