How Much Should You Put Down On A House

The right down payment for you depends on your goals and financial situation. While there are plenty of pluses with a larger down payment, putting down too much could leave you strapped for cash after you move in.

Conventional mortgages usually require you to pay for private mortgage insurance if you put down less than 20%. Once you start making mortgage payments, you can ask to cancel PMI after you have over 20% equity in your home.

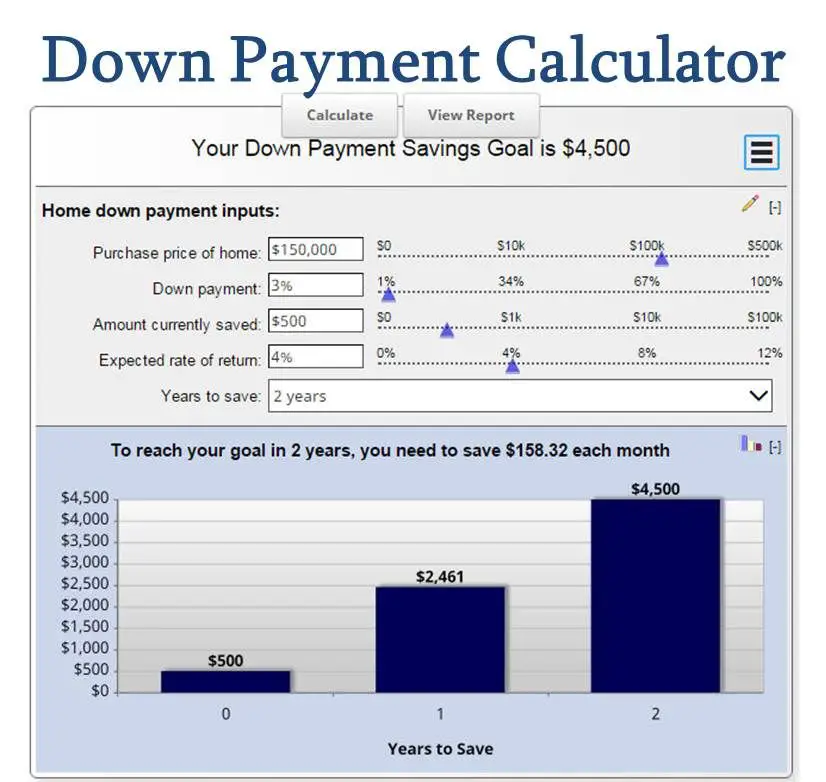

Try out some different scenarios to help you better understand how changing the size of your down payment can affect other costs.

Add In Primary Mortgage Insurance

If your down payment is less than 20% and you have a conventional loan, your lender will require private mortgage insurance , which is an added insurance policy that protects the lender if you can’t pay your mortgage. This payment will be added onto your monthly mortgage bill, requiring you to spend slightly more per month.

Some lenders offer loan products that do not require you to have PMI. However, in return, these lenders will often charge higher interest rates.

The cost of PMI varies based on your and your loan-to-value ratio . It also depends on the insurer. You can expect to pay between $30 and $150 per month for every $100,000 you borrow.

Some types of loans, such as FHA loans, do require you to pay PMI for the life of the loan. However, for many other types of loans, once you’ve built 20% equity in your home, you can ask your lender to cancel your PMI and remove that expense from your monthly payment.

How To Save For A Down Payment

Regardless of what percentage youre aiming to hit 3 percent of the purchase price or 20 percent youll need to put a plan in place to set aside that money. Here are some tips to focus on building up your down payment funds:

Also Check: Should I Split My Mortgage Payment

Is 10000 A Good Down Payment On A House

Conventional mortgages, like the traditional 30-year fixed rate mortgage, usually require at least a 5% down payment. If youre buying a home for $200,000, in this case, youll need $10,000 to secure a home loan. FHA Mortgage. For a government-backed mortgage like an FHA mortgage, the minimum down payment is 3.5%.

What credit score is needed for down payment assistance in Indiana?

Borrower requirements: 640 minimum credit score with a debt-to-income ratio under 45 percent. 680 minimum credit score with a debt-to-income ratio above 45 percent

How much do I need to make to buy a house in Indiana?

According to SmartAsset, if someone in Indianapolis has saved the recommended 20 percent of a homes purchase price for a down payment and earns at least a minimum annual salary of $20,294, then he or she can afford the monthly mortgage payment of $609.

Mortgage Rates Are Higher On Low Down Payment Loans

- If you put little to nothing down when purchasing a home

- Expect your mortgage interest rate to be higher

- All else being equal

- To account for the elevated default risk posed to lenders

Regardless of what you wind up paying in mortgage insurance premiums, know that your mortgage rate will likely be higher if you come in with less than 20% down.

Again, were talking about more risk for the lender, and less of your own money invested, so you must pay for that convenience.

Generally speaking, the less you put down, the higher your interest rate will be thanks to costlier mortgage pricing adjustments, all other things being equal.

And a larger loan amount will also equate to a higher monthly mortgage payment.

This can make qualifying more difficult if youre close to the affordability cutoff.

So you should certainly compare different loan amounts and both FHA and conventional loan options to determine which works out best for your unique situation.

Also Check: Can You Borrow More Than You Need For A Mortgage

Down Payments: How Much Do You Need To Qualify For A Mortgage

The amount of your down payment impacts how much interest you’ll pay over the lifetime of your home loan.

Sean Jackson

Sean Jackson is a creative copywriter living in Florida. He’s had work published with Realtor.com, theScore, ESPN, and the San Francisco Chronicle. In his free time, Sean likes to play drums, fail miserably at improv and spend time at the beach.

Alix Langone

Reporter

Alix is a staff writer for CNET Money where she focuses on real estate, housing and the mortgage industry. She previously reported on retirement and investing for Money.com and was a staff writer at Time magazine. She has written for various publications, such as Fortune, InStyle and Travel + Leisure, and she also worked in social media and digital production at NBC Nightly News with Lester Holt and NY1. She graduated from the Craig Newmark Graduate School of Journalism at CUNY and Villanova University. When not checking Twitter, Alix likes to hike, play tennis and watch her neighbors’ dogs. Now based out of Los Angeles, Alix doesn’t miss the New York City subway one bit.

If you’re in the market to buy a house, you’re about to make one of the most significant purchases of your life. And the most expensive aspect of buying your new home will likely be your down payment.

Here’s everything you need to know about down payments, how to save for one and what the right down payment amount is for you.

Final Thoughts: Is It Possible To Buy A House With No Money Down

Buying a house without putting any money down upfront is possible. For those who dont have the funds but want to get into the world of real estate, this is an option. A zero-down payment mortgage exists, which allows borrows to get a loan to purchase a house, without needing a down payment. This is done via government-backed loans, so the government will therefore be liable for the bill, should you default on your loan repayments.

These loans allow lenders to feel more comfortable providing loans to those who cannot otherwise afford them, and dont have a down payment. There are 2 types of zero-down payment loans: VA loans and USDA loans. VA loans are offered to active service duty members, veterans and certain spouses and USDA loans are provided by the United States Department of Agriculture, to encourage development in rural and suburban areas.

So, for those who do not have the cash available for a down payment, weve outlined several options that enable you to buy a home, and for those who have no money at all to put down there are also options available. Real estate is one of the most successful investment opportunities, so its worth looking at all the possibilities available for entering the real estate world.

You May Like: How To Calculate Mortgage Down Payment

Why You Don’t Have To Spend 20%

The 20% rule is a middle-ground number for most potential homeowners. You don’t have to settle with a high percentage of the cost of your home. Instead, you can find a way to pay between 3-10%, or even less.

As stated earlier, your lender will be a deciding factor between you and cheaper down payments. Before you try negotiating a lower fraction of the total cost, try looking at your credit history and current income. This is likely to sway your lender to allow a lower down payment. If you can quickly increase your credit score then the loan should automatically become cheaper.

How Much House Can I Afford

Figuring out how much you can spend on a house is a crucial step in the homebuying process. It can be complex, since you need to consider different factors such as how much youâre earning, how much debt you have, and how much room your budget has for a mortgage payment.

One common rule of thumb is called the 28/36 rule. The idea is that you should spend no more than 28% of your gross monthly income on housing costs, including the mortgage payment, homeowners insurance, and property taxes. When factoring in any additional debt obligations, such as student loans or a car payment, the total amount that goes toward debt repayment should be no more than 36% of your gross monthly income.

You May Like: Can You Get Denied A Mortgage After Being Pre Approved

Is A Typical Down Payment 20 Percent

In the past, the average mortgage down payment used to be much higher at or above 20 percent.

With average mortgage down payments being significantly lower than those seen historically, the opportunity of homeownership has opened to many who may not have been able to afford it previously. However, its important to note that private mortgage insurance is usually required on homes where less than 20 percent is deposited, so you should be aware of what PMI can do to your monthly payment if you decide to put down less than 20 percent. While putting down less than 20 percent of the purchase price makes it easier to buy a home, that decrease in upfront expense can translate into a higher monthly amount due.

Most importantly, lenders tend to view PMI-required loans as a riskier venture. But theyre not a deal breaker by any means. Youll pay a bit more, but if youre qualified, youll get the loan. And conversely, there are loan programs out there where the cost of a down payment on a house is no money down at all. These zero down mortgages arent a typical home down payment, but they are possible under certain circumstances, depending on the loan type.

Mortgage Options For Low Down Payments

Here are some common types of loans that offer low-down-payment options.

Conventional loans

Down payment as low as:

First time homebuyers might qualify for a down payment as low as 3% of the purchase price with some fixed-rate conventional loans, such as Dream. Plan. Home.SM mortgage.

VA loans

Down payment as low as:

If you qualify for a VA loan, which is backed by the Department of Veterans Affairs, you wont be required to make a down payment at all.

USDA loans

Down payment as low as:

If you qualify for a loan backed by the U.S. Department of Agriculture, you down payment could be 0%.

FHA loans

Down payment as low as:

3.5%*

With Federal Housing Administration loans, first-time homebuyers might qualify for a down payment as low as 3.5% of the purchase price.

*Exact down payment amounts are based on additional factors, including credit score, and are subject to change.

What to know about low down payments

Remember, if you do choose to make a lower down payment, your monthly payment is likely to be larger. With a low down payment, mortgage insurance will be required, which increases the cost of the loan and will increase your monthly payment. Well explain the options available, so you can choose what works for you.

Reach out to a home mortgage consultant today to discuss loan amount, loan type, property type, income, first-time homebuyer, and homebuyer education requirements to ensure eligibility.

Solutions for first-time homebuyers

Also Check: How Do You Shop Around For The Best Mortgage

% Down Eliminates Private Mortgage Insurance

When you put 20% down, that means you own 20% of your home. This allows you to avoid paying PMI, which is a monthly charge thats rolled into your mortgage payment to protect the lender from what they see as a riskier loan.

Example: If you buy the same $300,000 home noted above, with 5% down, your PMI payments each month would be $181 until your equity reaches 20% of the home, or you refinance into a loan without PMI.

A Smaller Mortgage Down Payment Can Leave A Helpful Cushion

- You dont necessarily need a large down payment to buy

- Especially if it will leave you with little in your bank account

- Sometimes its better to have money set aside for an emergency

- While you build your asset reserves over time

While a larger mortgage down payment can save you money, a smaller one can ensure you have money left over in the case of an emergency, or simply to furnish your home and keep the lights on!

Most folks who buy homes make at least minor renovations before or right after they move in. They also spend money on moving trucks and/or movers.

Then there are the costly monthly utilities to think about, along with unforeseen maintenance issues that tend to come up.

If you spend all your available funds on your down payment, you might be living paycheck to paycheck for some time before you get ahead again.

In other words, make sure you have some money set aside after everything is said and done.

The lender will probably require that you have some cash reserves in order to close your mortgage, but even if they dont, its wise to make it a requirement for yourself.

Tip: Consider a combo loan, which breaks your mortgage up into two loans. Keeping the first mortgage at 80% LTV will allow you to avoid mortgage insurance and ideally result in a lower blended interest rate.

Or get a gift from a family member if you bring in 5-10% down, perhaps they can come up with another 10-15%.

Recommended Reading: What Are 30 Year Mortgage Rates

How Much Should I Put Down On A House

The ideal down payment amount is 20% of the purchase price of the home. Paying 20% upfront can:

- reduce your monthly mortgage payments

- eliminate costly private mortgage insurance

- reduce interest rates

- improve the competitive nature of your offer

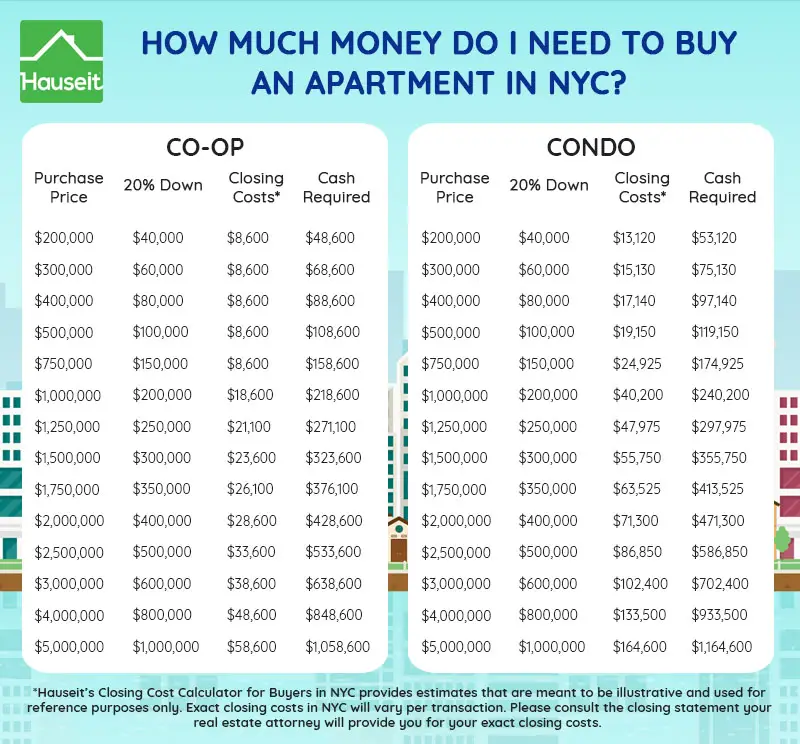

When trying to decide how much you should put down on a home, play around with a mortgage calculator to determine an amount that works best for your finances. As you explore, remember that in addition to your down payment, youll have some other upfront costs youll need to pay at closing, collectively called your escrow funds. It can include your closing costs, prorated taxes, title fees and more.

Find The Right Home For You

You no longer have to wait for the same options again and again. You can find a lender that cares and wants to get you into the home of your dreams. All you need is a good sense of trust and know the direction you plan on traveling.

With rising home prices, finding a down payment can be hard. That’s why you need a lender that’s willing to lend a hand. What could be better than starting that process today?

It’s your turn to take some action for your future. The Seattle area is beautiful and worth working for. All you need is a mortgage broker you can trust. Don’t wait for the house you want to be taken, choose a broker you can trust to lower your down payment!

Don’t Miss: How Long Does Refinancing A Mortgage Take

Next Steps: Can You Afford To Buy A House

Your lenders goal is to assess you as a borrower and ensure you can make your payments on time.

If youre thinking about a home purchase in the near future, these are some good questions to ask yourself to prepare for the home-buying process.

- How much down payment can you afford? A higher down payment is often a good sign for the lender about your finances.

- What is your debt-to-income ratio? Youll likely need to keep this number below 43%.

- What monthly mortgage payment can you comfortably afford in your budget?

- Are you prepared for closing costs, such as an appraisal or prepaid property taxes?

How Your Down Payment Impacts Your Offers

When youre on the hunt for the right home, time is of the essence. Homes at entry-level price ranges typically sell quickly, and you want to put your best foot forward when making an offer because youll probably have competition. When markets are competitive and sellers receive multiple offers, they want to see buyers best offers, including a sizable down payment. From a sellers viewpoint, buyers who have more money to put down are more attractive because they have more skin in the game.

A higher down payment can indicate to a seller that you have enough cash on hand and solid finances to get a final loan approval without a hitch. Also, a higher down payment could beat out other offers that ask for sellers to pay closing costs or offer below the asking price. Someone with a sizable down payment is unlikely to request such assistance, and sellers are more likely to work with a buyer who has the money and motivation to see the purchase through with minimal haggling.

You May Like: How Are Mortgage Interest Rates Determined

How Much Down Payment Do You Need To Buy A House

To buy a house, you will need cash for a down payment but how much?

If you read investment magazines and financial blogs, youve probably seen many references to the standard 20 percent down payment to buy a house. The good news is that not all loan programs require that much of a cash contribution from the buyer.

In fact, according to Zillow, only 45 percent of home buyers put this much money down, and many did so because they chose to.

The amount of your down payment will depend on what type of home loan program you select for your purchase.