Average Mortgage Interest Rates

When it comes to mortgages, as with any loan, the interest rate is one of the most important factors. Unlike most other loans though, mortgages are very big often theyll be the biggest loan youll ever take out in your life.

There are also different types of mortgage, which makes getting the average mortgage interest rate a little tricky.

Statista as a useful graph showing the most up to date mortgage rates depending on if you are going for a fixed or variable mortgage.

Loan to value is the relationship between the current value of the property that the mortgage is paying for, and the actual amount the mortgage is. The mortgage value divided by the property value = LTV. Dont be scared of the maths, pull out your phone or use the Which? LTV calculator

You also need to think about mortgage fees, which can be anything from £500 to £2,000 or more. Some mortgage providers will let you add the fees to the mortgage itself. This means you dont need to shell out the money when you first get the mortgage.

The con of doing this though is that the interest then applies to the fee, so you end up paying more overall, as well as more per month. Our advice: pay the fees upfront.

Ways To Reduce Your Monthly Mortgage Repayments

We mentioned interest-only mortgages earlier, and this type of product is certainly much more affordable when comparing the monthly payments.

However, the issue is that interest-only mortgages do not include any element of the original amount borrowed. When you arrive at the end of the term, you still owe the lender the full amount and need to demonstrate how you plan to pay this at the point of application.

Exit strategies can include selling the home or refinancing.

An interest-only mortgage is usually more expensive when you add the interest payments made over the term and the final balance payable.

A larger deposit will immediately decrease your interest rates because the lenders risk is mitigated, and they are considering a lower LTV on the property.

Options to boost your deposit value include:

- Gifted deposits or contributions from family members.

- Applying to the Help to Buy equity loan scheme.

- Delaying your purchase to enable you to save more.

Extending the loan term is another option, which means that the monthly repayments will drop the longer the mortgage remains active.

Some mortgage lenders offer flexibility with repayments, so you can overpay or underpay, although there may be restrictions on how often you can do so per year.

If you have this option and can overpay, you will chip away at the total interest payable and bring down your monthly cost.

How Much A $200000 Mortgage Will Cost You

For a $200,000, 30-year mortgage with a 4% interest rate, youd pay around $954 per month. But the exact costs of your mortgage will depend on its length and the rate you get.

Edited byChris JenningsUpdated January 4, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Your mortgage size depends on the homes price and the down payment youre making. If you buy a home priced at $255,000, for example, and put down a 20% down payment , youll need a mortgage worth $200,000.

Youll then pay off that balance monthly for the rest of your loan term which can be 30 years for many homebuyers.

Before you start shopping around, though, youll want to get pre-approved. Getting pre-approved will let you know if you can afford a $200,000 mortgage and demonstrate to sellers that youre a serious buyer. Credibles pre-approval process is simple it only takes a few minutes to see if you qualify for a streamlined pre-approval letter, and it wont affect your credit score.

Learn more about what goes into those payments and how much a $200,000 mortgage loan will cost you:

Also Check: Reverse Mortgage For Condominiums

Ways To Lower Your Mortgage

- Improve your credit score enough to qualify for a better interest rate

- Pay off debts or increase your income to lower your debt-to-income ratio

- Save 20% for a down payment, which will help you avoid paying private mortgage insurance

- Shop for a mortgage by getting quotes from multiple lenders.

- Buy in an area without an HOA

- Buy a home in a cheaper neighborhood

More Than The Monthly Payment

If youre trying to figure out how much to spend on a home, remember that theres more to your home purchase than the monthly mortgage payment.

Taxes and insurance are often added to your monthly payment automatically. Your lender collects funds from you, places the money in escrow, and pays required expenses on your behalf.

Homeowners Association dues might also be a significant monthly expense. Those costs cover a variety of services in your community or building, and skipping those payments can lead to liens on your property, and potentially even foreclosure.

Other costs of homeownership can be surprisingly high. You might not pay those expenses monthly, but its helpful for some people to budget for a monthly savings amount for those costs. You need to maintain your property, replace appliances periodically, and more.

Some people suggest a budget of 1% of your property value each year for maintenance. But its easy to go higher than that, especially with older properties. If you need to buy furniture or make upgrades before moving in, you face additional up-front costs.

Also Check: Can You Get A Reverse Mortgage On A Condo

How Much Income Do You Need To Qualify For A $300 000 Mortgage

With a mortgage of $300k and an 3.5% down payment, you could have a pretty nice home. Applicants must earn $74,581 per year to qualify for the loan with a 5% interest rate for 30 years and a down-payment of $10k. We offer a Mortgage Required Income Calculator so you can explore those parameters further.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Mortgage payment calculator

Save & exit

Loan termThe amount of time you have to pay back the loan. Usually 15 or 30 years for common loan types.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Must Reads

You May Like: 10 Year Treasury Yield Mortgage Rates

Summing Up The Average Mortgage Payment In The Uk

Mortgage payments vary hugely, depending on your circumstances, how much you need to borrow, and the region where you live but it is worth reiterating the sheer number of lenders and products available.

Options such as mortgage guarantee schemes can support applicants who might otherwise not have been approved, and a specialist private broker can substantially increase your approval prospects.

Understanding costs, both the monthly repayment and overall commitment, is vital to ensure every homebuyer knows what they can expect to spend on mortgage interest.

Think Plutus always recommends lenders and products that meet your needs, whether your priority is to find the lowest possible monthly repayment, the most cost-effective mortgage long-term, or a product that offers the lowest interest rates possible.

Please get in touch if you would like any information about the mortgage rates and the average mortgage payments we have shown here or tailored guidance to help secure the mortgage borrowing you require.

How To Lower Monthly Mortgage Payments

Choosing an interest-only mortgage would be much cheaper each month than taking a repayment mortgage out, as you are only paying off the interest on the loan and not any of the loan.

This is another way that people can afford homes but it means that after the mortgage term finishes, the loan is still outstanding, therefore you wouldnt own your home. Interest-only mortgages have become more difficult to get approved, with other solutions such as Help to Buy mortgages becoming more popular.

Putting down a larger deposit will considerably lower the monthly payments, or extending the term length can always bring the payment down.

It is also possible with some mortgages to make overpayments so that you can pay the mortgage off quicker, reducing the amount of overall interest that is paid.

Recommended Reading: 70000 Mortgage Over 30 Years

Monthly Payments For A $200000 Mortgage

Monthly mortgage payments always contain two things: principal and interest. In some cases, they might include other costs as well.

- Principal: Principal is money that goes directly toward whittling down your balance.

- Interest: This is what you pay to actually borrow the money. The amount youll pay is reflected in your interest rate.

- Escrow costs: If you opt to use an escrow account , youll also have your property taxes, mortgage insurance, and homeowners insurance rolled into your monthly mortgage payment, too.

On a $200,000, 30-year mortgage with a 4% fixed interest rate, your monthly payment would come out to $954.83 not including taxes or insurance.

But these can vary greatly depending on your insurance policy, loan type, down payment size, and more.

Credible is here to help with your pre-approval. Answer a few quick questions below to get started.

Heres a more detailed look at what the total monthly payment would look like for that same $200,000 mortgage:

| Interest rate |

|---|

Check out: 20- vs 30-Year Mortgage: Is an Unusual Option Right for You?

Understanding Median Vs Average Mortgage Payment

When looking at typical mortgage payments, its important to understand the difference between the median and the average. Although both numbers can paint a picture of what you can expect and sometimes are used interchangeably by novices these terms are different and can therefore lead to very different results.

An average is the mean of a set of numbers. Its calculated by taking the total of those numbers divided by the amount of numbers in the set. The median, on the other hand, is the central number in the range meaning half the numbers are lower than the median and half are higher.

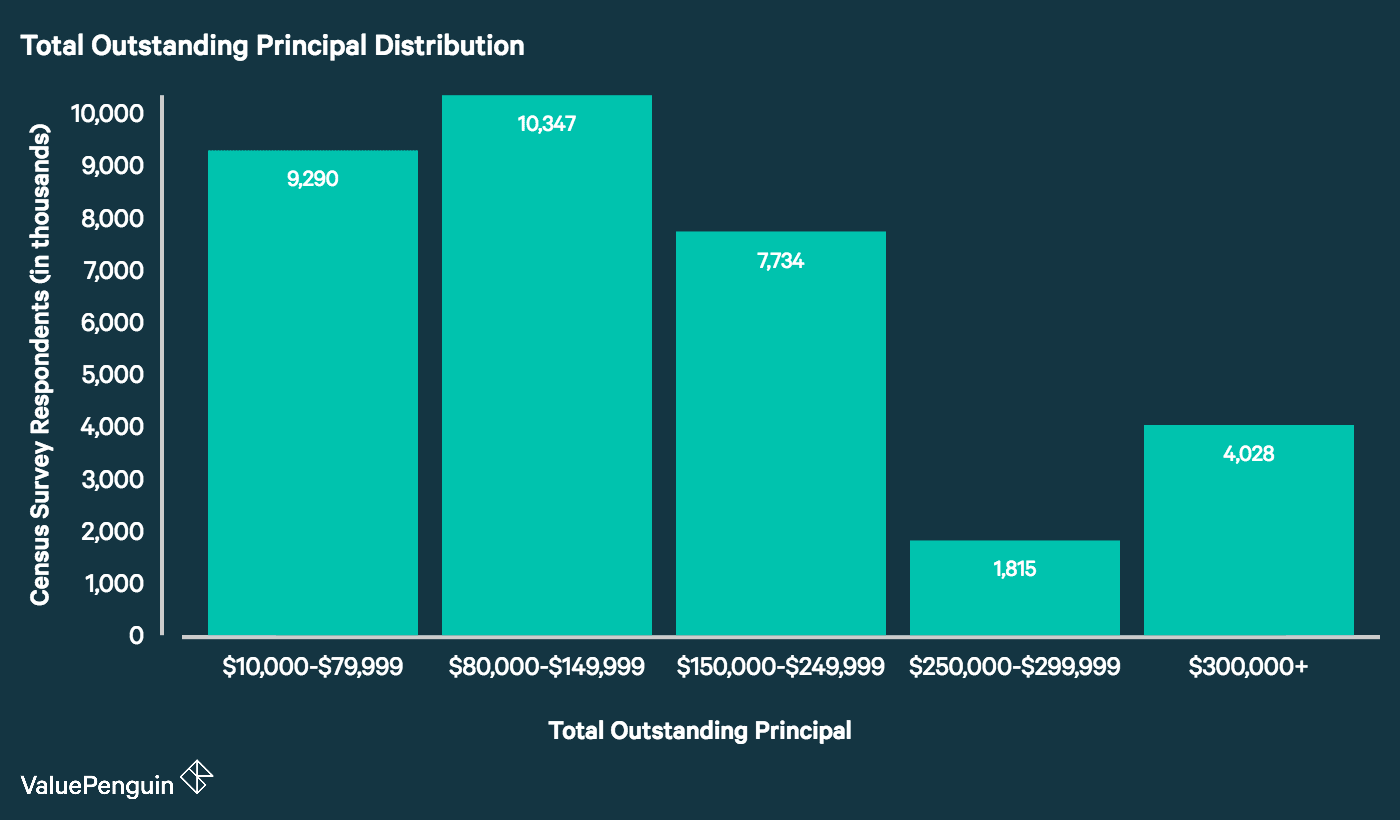

When looking at mortgages, medians tend to be more accurate, as averages can be easily impacted by extremely high or low rates. The U.S. Census Bureau reports median payments, which represent a broader range of homeowners across the country.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

Most And Least Affordable Counties

The CAR report also showed the average payment for individual counties, within our region and also statewide.

Based on that breakdown, Solano County had the lowest average mortgage payment of any county within the Bay Area. With the parameters outlined above, a typical monthly house payment in Solano County was around $2,630 per month.

At the upper end of the pricing spectrum, we have San Mateo County. According to CAR, San Mateo County had the highest average monthly mortgage payment in the Bay Area during 2021, coming in at $9,760 per month. That was actually the highest monthly payment of any county in California.

To quote the August 2021 CAR report:

San Mateo County was the least affordable, with just 17 percent of households able to purchase the $2,117,500 median-priced home. Forty percent of Solano County households could afford the $570,000 median-priced home, making it the most affordable Bay Area county.

Solano and San Mateo are therefore the most and least affordable counties for home buyers in the Bay Area. Solano County has some of the most affordable home prices of any county in the region, while San Mateo is the most expensive / least affordable housing market for home buyers.

Average Mortgage Payments In The Us

Monthly mortgage payments are largely determined by the size of a loan. In general, high-income consumers who take out bigger mortgages will pay more in lifetime interest than lower-income consumers. Still, smaller loans generally have the higher interest rates, as do loans drawn by borrowers with poor credit scores. As expected, higher interest rates also lead to larger monthly payments as a whole.

You May Like: Rocket Mortgage Requirements

Average Monthly Mortgage Payment In Colorado By City

According to the U.S. Census Bureaus latest American Housing Survey, the average monthly mortgage payment in the U.S. is $1,487.00. In Colorado, that number is slightly higher, coming in at an average monthly mortgage payment of $1,681.00.

However, in some cities of Colorado, homeowners pay more for their mortgage due to higher home prices. In other areas, the average monthly payment is less.

If youre considering buying a home in Colorado, you may be wondering what to expect for your monthly payment. Below, weve provided some information about average mortgage payments in different cities of Colorado including Denver, Grand Junction, Colorado Springs, and Pueblo.

Breakdown Of The Average Mortgage Payment

In 2015, the average American homeowner spent about $1,800 on paying down the principal on their loans and nearly $8,000 on mortgage interest and related charges, a combined monthly average of about $820. The bulk of each payment is split between paying interest and paying principal. As time goes by, the portion of money going towards interest decreases while the amount put towards reducing principal increasesa process called amortization.

Read Also: Reverse Mortgage Manufactured Home

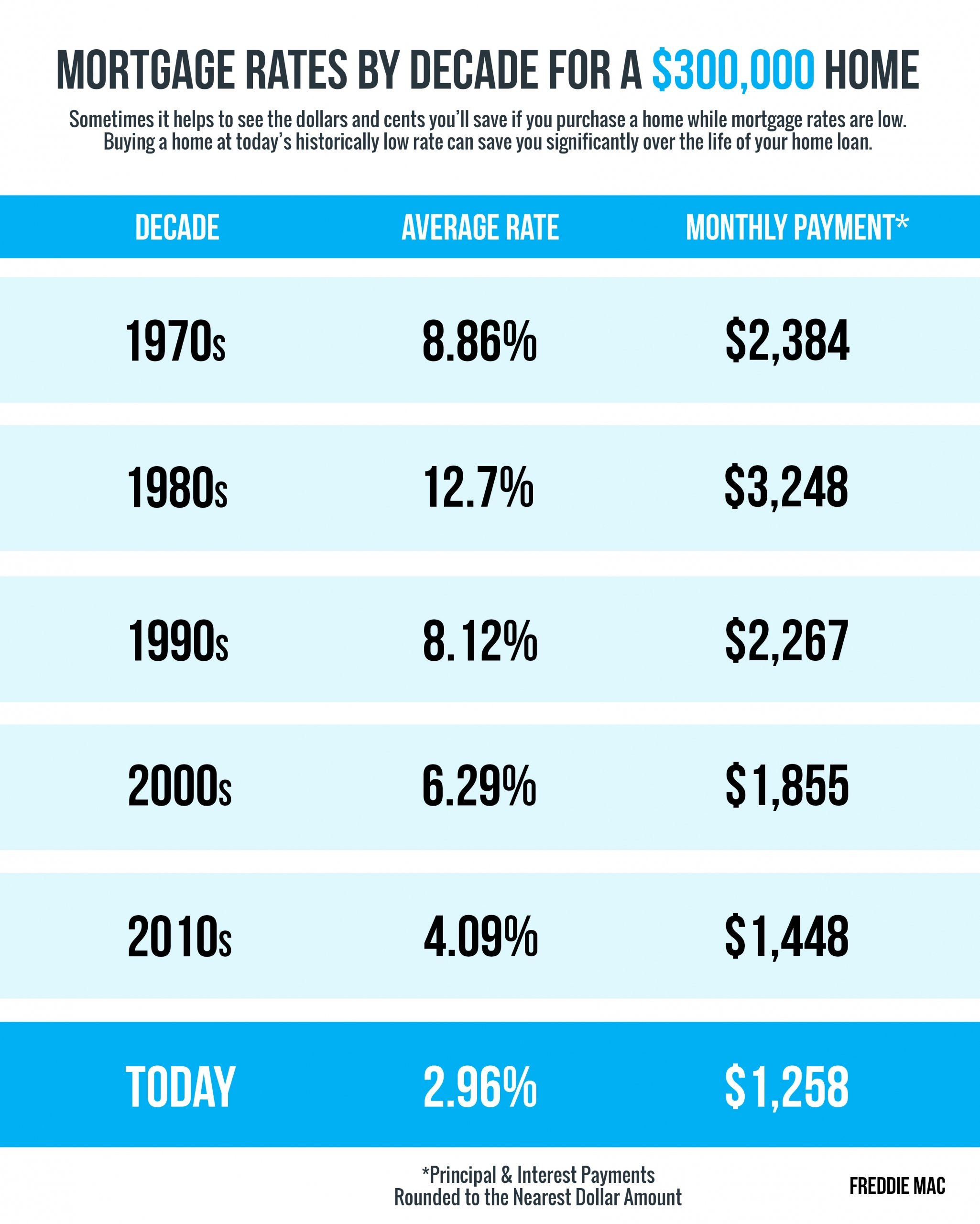

Comparing The Average Mortgage Cost Including Interest

Adding up the cost of a mortgage over the full term can be daunting, but it is essential to go into any long-term financial decision equipped with as much knowledge as possible.

Based on the UK average property price of £285,113 and applying the average mortgage interest rates, we can get a rough idea of the overall repayments depending on the length of the term and deposit available.

| Mortgage Interest Rate | |

|---|---|

| £389,939 | £1,300 |

*These calculations do not include additional fees such as Stamp Duty, legal charges, application fees or brokerage costs. They also based on the interest rate staying the same throughout the whole mortgage term.

It is easy to see how changing the mortgage term, finding a better interest rate, or increasing your deposit can dramatically impact the total repayment value and your monthly outgoings.

For example, if you took out the same £270,857 mortgage, at 2.97% interest with a 5% deposit over 25 years, increasing the term by 5 years, to 30 years overall, will increase the overall repayment by £25,460 but lower your monthly payment by £142 .

This difference is why it is highly advisable to seek independent support from a broker and ensure you make sound decisions about your mortgage borrowing.

Saving just a fraction of a percent on your interest could make a sizable difference to your debt and how quickly you can pay your mortgage off completely.

Improving your credit score before applying can make a considerable difference, for example:

How Much House Can I Afford 50k Salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. Thats because salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Read Also: Rocket Mortgage Vs Bank

Whats The Average Mortgage Payment

We dont want to waste your time, so lets get down to business. The median monthly mortgage payment is just over $1,600, according to the U.S. Census Bureau.1 That can vary of course, based on the size of the house and where you live, but thats the ballpark number.

If youre the kind of person who doesnt need to know how we came up with the number $1,600, feel free to skip to the next section. But if you want more detailsincluding how to calculate your own average paymentread on!

Average Mortgage Payment Summary

The cost of mortgage repayments varies greatly depending on a wide range of factors as discussed within this article, however, the mortgage market has become more diverse than ever over recent years and therefore there is a wider range of mortgage products available to suit various personal requirements.

Should you wish to discuss the mortgage options available to you, get in touch with our friendly team to book a consultation.

Call us today on 01925 906 210 or feel free to contact us. One of our advisors will be happy to talk through all of your options with you.

Further reading:

Don’t Miss: Chase Mortgage Recast Fee

How To Calculate Your Monthly Mortgage Payment

While averages can be helpful in showing you what people typically pay, when planning for your expected costs as a homeowner its much better to base your anticipated monthly payment on the factors that are unique to you: your home buying budget, your planned down payment, the interest rate youre likely to get and the area you plan on purchasing in.

To get an idea of how much you might pay for a mortgage each month, try using an online mortgage calculator like this one from Rocket Mortgage®. These calculators let you input those unique factors and give you an estimate thats specific to your circumstances.