Whats The Maximum Amount You Can Borrow For A Mortgage

Loan amount the amount borrowed from a lender or bank. In a mortgage, this amounts to the purchase price minus any down payment. The maximum loan amount one can borrow normally correlates with household income or affordability.

How much would the mortgage payment be on a $200K house? Assuming you have a 20% down payment , your total mortgage on a $200,000 home would be $160,000 . For a 30-year fixed mortgage with a 3.5% interest rate, you would be looking at a $718 monthly payment.

How Much Is A Downpayment On A 200k House

Conventional mortgages, like the traditional 30-year fixed rate mortgage, usually require at least a 5% down payment. If youre buying a home for $200,000, in this case, youll need $10,000 to secure a home loan. FHA Mortgage. For a government-backed mortgage like an FHA mortgage, the minimum down payment is 3.5%.

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make. When youre ready to apply, compile necessary documentation like income verification and proof of assets and start shopping for the best rates.

Recommended Reading: Mortgage Recast Calculator Chase

Loan Type And Interest Rate

The type of mortgage you choose can affect the mortgage rate youre offered and therefore the sum you can borrow. The differences tend not to be huge, but every bit helps when youre paying interest on a large sum over a long time.

Lets take a single month, June 2021, as an example that shows those differences. We got our figures from the ICE Mortgage Technology Origination Insight Report.

Here were the average interest rates across three major loan types:

- All loans: 3.22%

- FHA loans: 3.23%

- VA loans: 2.92%

The differences can be even greater if you choose a shorterterm loan rather than a 30year one, or if you opt for an adjustablerate mortgage .

Mortgage Insurance Vs Life Insurance

Mortgage life insuranceis an optional insurance policy that you can purchase from your mortgage lender that protects your mortgage balance. If you pass away, a death benefit will be paid to your mortgage lender to pay off some or all of the mortgage balance. If you get a critical illness, disability, or lose a job, youll receive a payout that helps cover some or all of your monthly mortgage payments. In all of these cases, your lender is the one that receives the insurance payouts.

With life insurance, youre purchasing a policy with a beneficiary that you get to choose. You can also choose to purchase a policy with a certain payout benefit, rather than having it tied to the balance of your mortgage.

Mortgage life insurance premiums are based on the borrowers age and the balance of their mortgage. Premiums are charged as a certain rate per $1,000 of mortgage balance. Mortgage life insurance in Canada is completely optional. A lender cant force you to purchase mortgage life insurance, no matter your down payment. However, if you make a down payment less than 20%, your lender can require you to purchase mortgage default insurance.

Mortgage life insurance can be easier to obtain, but having a potential insurance benefit that gradually decreases as you make mortgage payments means that the benefit gets smaller while your insurance premiums stay the same.

You May Like: 10 Year Treasury Yield And Mortgage Rates

How Much Does A 200 000 Mortgage Cost

Monthly payments on a £200,000 mortgage At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £954.83 a month, while a 15-year term might cost £1,479.38 a month. Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

What Are The Repayments On A 200000 Mortgage

The answer, of course, is not the same for everybody, which is why bespoke advice is crucial.

For a start, every lender is different, along with every borrowers and circumstances there are many factors that can affect your monthly repayments.

Two main factors will have a bearing on how much the repayments cost: the term of the mortgage and the interest rate that the lender gives you.

This table shows how your monthly repayments can vary, based on the term and the interest rate.

| £200,000 Mortgage Repayments |

|---|

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Can I Cancel My Mortgage Life Insurance

Canadas major banks all allow you to cancel your mortgage life insurance at any time, and to receive a refund if you cancel your plan within the first 30 days. This 30-day free look or 30-day review period is important as it lets you change your mind should you decide that mortgage life insurance isn’t right for you.

To cancel, you can call your lender’s insurance helpline, complete a form at a branch, or send a written request by mail.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

How Do People Afford A 550k House

How Much Income Do I Need for a 550k Mortgage? You need to make $169,193 a year to afford a 550k mortgage. We base the income you need on a 550k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $14,099.

What house can I afford on 60k a year?

The usual rule of thumb is that you can afford a mortgage two to 2.5 times your annual income. Thats a $120,000 to $150,000 mortgage at $60,000.

What Are The Different Loans And Programs For First

While the 28/36 rule applies most conventional mortgage lenders, certain programs designed to help first-time homebuyers, veterans and certain low-income home buyers allow some exceptions:

- Mortgages backed by the Federal Housing Administration, known as FHA loans, are designed to help first-time homebuyers qualify for mortgages and allow back-end DTIs of up to 43%.

- Mortgages known as VA Loans, issued through the U.S. Department of Veterans Affairs, are geared toward veterans, service members and qualifying spouses, and allow back-end DTIs of 41%.

- The maximum back-end DTI allowed on USDA Loansmortgages issued under guidelines set by the U.S. Department of Agriculture to help low-income borrowers buy homes in certain rural areasis 46%.

- State and national programs designed to assist with homeownership may be able to help if you’re having trouble meeting the down-payment requirements for a loan, or if your income falls below the level needed to secure some conventional loans.

The factors that determine the amount of a monthly mortgage loan, including your credit score and history and down payment amount, along with your monthly non-housing debt expenses, play a major role in determining how much income you’ll need to afford a mortgage. Understanding DTI and the 28/36 rule can help you anticipate your needs and plan for the mortgage-application process.

If you need to improve your DTI, there are two things you can do:

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

Add Other Costs Like Pmi Hoa Fees And Property Tax Or Let Us Estimate These To Get A More Accurate Estimate Of Your Monthly Payment

What if i pay a bigger down payment? Assuming you have a 20% down payment , your total mortgage on a $250,000 home would be $200,000. Easily calculate your monthly mortgage payment based on home price, loan term, interest rate and see how each affects your monthly payment. Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. To determine how much income you need for a $200,000 mortgage, keep in mind that the amount of the monthly payment on that mortgage will depend on your credit score and other factors.

A year later, you will have made 13 payments. Use this calculator to see the total principal and interest you’ll owe each month. Assuming you have a 20% down payment , your total mortgage on a $250,000 home would be $200,000. The parts of a mortgage payment you can approximate the monthly payments on a $200,000 home loan by using a mortgage calculator with an average interest rate. You make deposits into a sinking fund earning an effective annual interest rate of 12% in such a way that the total outlay is x for the first 10 years and x + 10, 000 for.

Use this to calculate a loan for anything, such as a vehicle, business loan, home, rv, motor home, mobile home, manufactured home, real estate, land, vacation property, education, or any type of debt.

Can I Buy A House Making 30k A Year

If you were to use the 28% rule, you could afford a monthly mortgage payment of $700 a month on a yearly income of $30,000. Another guideline to follow is your home should cost no more than 2.5 to 3 times your yearly salary, which means if you make $30,000 a year, your maximum budget should be $90,000.

Also Check: How Much Is Mortgage On 1 Million

How Do You Calculate Square Yards

What mortgage can I afford on 1400 a month? $1,400 per month qualifies to borrow a mortgage of $204,913 add your $20,000 down payment to this, and you can purchase a home of $224,913.

Additionally How much house can I get for $5000 a month? Sticking with our example of an income of $5,000 a month, you could afford these options on a 15-year fixed-rate mortgage at a 4% interest rate: $187,767 home with a 10% down payment $211,238 home with a 20% down payment $241,415 home with a 30% down payment

How much do I need to make to buy a $300 K House? What income is needed for a 300k mortgage? + A $300k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $74,581 to qualify for the loan.

What Should My Down Payment Be On A$ 200 000 Home

$221,563 Can I Afford a $200,000 Home? Financial advisors recommend that your mortgage payment should be no more than 28% of your monthly household income. Considering that fact, here are the minimumrequired monthly incomes you need to afford this house based on your down payment. Down Payment 15 Year Mortgage Household Income

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

How To Pay Less Interest On An Existing Loan

If you already have a mortgage, there’s an easy way for you to lower its interest rate and save yourself money in the course of paying it off — refinancing. When you refinance, you swap your existing home loan for a new one.

Refinancing generally makes sense when you can shave at least 1% off of your loan’s interest rate. And the higher your credit score, the more likely you’ll be to qualify for a competitive refinance rate.

Many homeowners are shocked to see just how much mortgage interest costs them over time. If you want to pay as little of it as possible, make a decent-sized down payment on your home , take out a loan with as short a term as possible, and make an effort to boost your credit score. Doing so could really save you a bundle.

Mortgage Payment Frequency Example

Let’s compare mortgage payment frequencies by looking at a $500,000 mortgage in Ontario with a 25-year amortization, and assume that it has a fixed mortgage rate of 1.5% for a 5-year term.

The monthly mortgage payment would be $2,000. Now, lets see how much it would be with semi-monthly, bi-weekly, and weekly mortgage payments.

Also Check: How Does Rocket Mortgage Work

Skip A Mortgage Payment

Many mortgage lenders offer flexible mortgage payment options, such as the ability to skip a payment or to defer your mortgage payments. Most of Canadas major banks allow you to skip a mortgage payment, with the exception of CIBC and National Bank.

Generally, you won’t be able to skip mortgage payments for mortgages that are insured. Having a CMHC-insured mortgage means that your amortization cannot go over 25 years. For insured mortgages, you’ll need to have made a mortgage prepayment that would be equivalent to the amount that you want to skip for you to be able to skip a mortgage payment in the future.

Lenders also have conditions in order to be able to skip a mortgage payment. Your mortgage must not be in arrears, and your current mortgage balance must not be more than your original mortgage balance at the start of your term.

Rated Excellent By Our Customers

Professional staff

Professional staff, especially Steve, he has dedicated all his time and energy to come up with the best solution for us and very fast. Very satisfied about the service.

Silvia, 27 days ago

OMA pulled out all the stops

Great staff and good communication. Helped us understand the process and gone over and above to help in a difficult situation. Other companies couldn’t even be bothered but Thank you so much OMA.

Anneke Woolley, 12 days ago

Our advisor was amazing from the start!

Aaron went above and beyond. He worked late and kept in contact with me and worked tirelessly to find me the best mortgage he could

James, 10 days ago

You May Like: Chase Mortgage Recast

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Mortgage payment calculator

Save & exit

Loan termThe amount of time you have to pay back the loan. Usually 15 or 30 years for common loan types.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

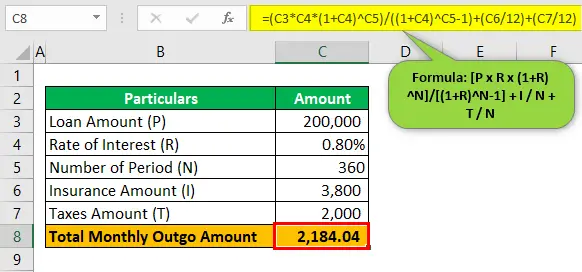

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Must Reads

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Also Check: Who Is Rocket Mortgage Owned By