How Do I Find Personalized Mortgage Rates

Finding personalized mortgage interest rates is as easy as talking to your local mortgage broker or searching online. While most factors that impact mortgage interest rates are out of your control, rates still vary from person to person. Lenders charge higher home mortgage rates to borrowers they deem riskier. So having a high credit score will get you the best interest rates. Lenders also look at how much you are borrowing compared to the homes value this is known as loan-to-value, or LTV. Youll get a better rate when the LTV is below 80%. So if your future home has a value of $200,000, youll get the best rates if the loan is for $160,000 or less.

When shopping around for the best rates, consider a variety of lenders, like local banks, national banks, credit unions, or online lenders. Be sure to compare interest rates, fees, and other terms of the mortgage. Also, mortgage rates are constantly changing, so getting rate quotes from multiple lenders in a short time period makes it easier to get an accurate comparison. If thats too much legwork, you could work with a mortgage broker. Mortgage brokers dont directly issue loans. Instead, they work with lenders to find you the best deal. But their services arent free. They work on commission, which is usually paid by the lender.

Compare Rates From Our Lenders

How it works

Checking rates wont affect credit score

Get pre-approved:

With Credible, it only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter and personalized rates, without affecting your credit score.

Compare lenders and choose rate:

Homebuyers can compare current mortgage rates and loan features from multiple lenders to choose your home loan. Our team of licensed mortgage loan officers is available to answer any questions.

Submit your documents:

Credible’s automated document collection process takes the stress out of applying for a mortgage. Youll find its easy to track your loan all the way through closing.

Finish your loan with us:

With Credible, you can complete the whole mortgage process online. We have a team of dedicated mortgage experts ready to help you if you need it.

Pros & Cons About Paying Property Taxes Through Td

The pros of doing this include:

- You won’t forget about your property tax payments, and

- It’s easier to budget for

The cons of doing this include:

- You wont earn interest on your money while you wait to pay your taxes, and

- Since there’s usually a cushion built into how much you pay monthly, more of your money will be locked up in the property tax account than needed.

Read Also: Chase Recast Calculator

How Do I Get A Mortgage

Getting a mortgage is the most important part of the homebuying process. Its likely the largest loan youll ever take out. So finding the right lender and getting the best deal can save you thousands of dollars over the life of the loan.

Heres what you need to do.

There are lots of different types of lenders. Looking at the loans and programs that banks, credit unions, and brokers offer will help you understand all of your options.

If youre looking for a specific type of loan, like a VA loan or a USDA loan, then make sure that the lender offers these mortgages.

2. Apply for preapproval

Before you start shopping for a home, youll need a preapproval letter. A mortgage preapproval is different from a formal loan application in that it doesnt affect your credit and doesnt guarantee youre approved. But it does give you an idea of your likelihood of approval.

3. Submit an application

Once youre ready to start comparing loan offers, submit an application. Until you apply, the lender wont be able to give you an official estimate of the fees and interest rate you qualify for.

To find the lowest rate and fees, you should submit applications with two or three lenders. Once you have each Loan Estimate in hand, its easier to compare and determine which offer is best for you.

4. Underwriting and closing

What Is An Amortization Schedule

A major advantage of a 30-year fixed mortgage is the security in knowing exactly how much youll be paying each month. The ability to predict your largest expense for up to the next 30 years provides a huge advantage in financial planning. Not only can you accurately predict the amount going towards your mortgage, but youll also know how much youll have left over to contribute towards other investments and savings accounts.

This predictability allows lenders to build a repayment plan known as an amortization schedule. Amortization refers to the process of steadily paying off a debt through regular payments over a period of time. For a fixed rate mortgage, building an amortization schedule is much simpler thanks to the locked-in interest rate and monthly minimum.

Heres an example of what a one-year amortization schedule might look like on a $165,000 loan:

| Payment Date | |

|---|---|

| $7,370.55 | $162,338.18 |

The amortization schedule, provided by the lender when shopping for a loan, projects your monthly payments throughout the term of the mortgage. This chart also gives a precise estimate of how much equity youll have gained in a given month. With this knowledge, you can get a head start on your long-term financial goals and prioritize savings years in advance.

Amortization schedules are a great resource when taking out a fixed rate loan, but become much more complicated when applying for an adjustable rate mortgage.

You May Like: Reverse Mortgage Mobile Home

Insured Insurable And Uninsurable Mortgages

Theinsurability of your mortgagewill affect your mortgage rate. Insured mortgages are those with CMHC mortgage default insurance or private default insurance from Canada Guaranty or Sagen. The borrower will pay for the mortgage insurance premiums.

Since the lender has zero risk, they will offer the lowest mortgage rates for insured mortgages. The mortgage rates that you see advertised online are often only for insured high-ratio mortgages, which are mortgages with a down payment less than 20%. Insured mortgages will need to meetCMHC mortgage requirements.

With insurable mortgages, the borrower wont pay for mortgage insurance. The mortgage wont be individually insured either. Instead, the lender can choose to bulk insure their portfolio of insurable mortgages and pay for this insurance themselves.

What this means to you is that the cost of mortgage insurance isnt directly paid by you if mortgage insurance isnt required. Insurable mortgages will have to meet the same requirements as an insured mortgage, but the only difference is that an insurable mortgage will need to have a down payment of at least 20%. Insurable mortgage rates are also slightly higher than insured mortgage rates.

An insurable mortgage can have a mortgage rate that is around 20 basis points added on top of an insured mortgage rate. Uninsurable mortgage rates will have around 25 basis points to 35 basis points added on top of insured mortgage rates.

Scoring A Low Interest Rate

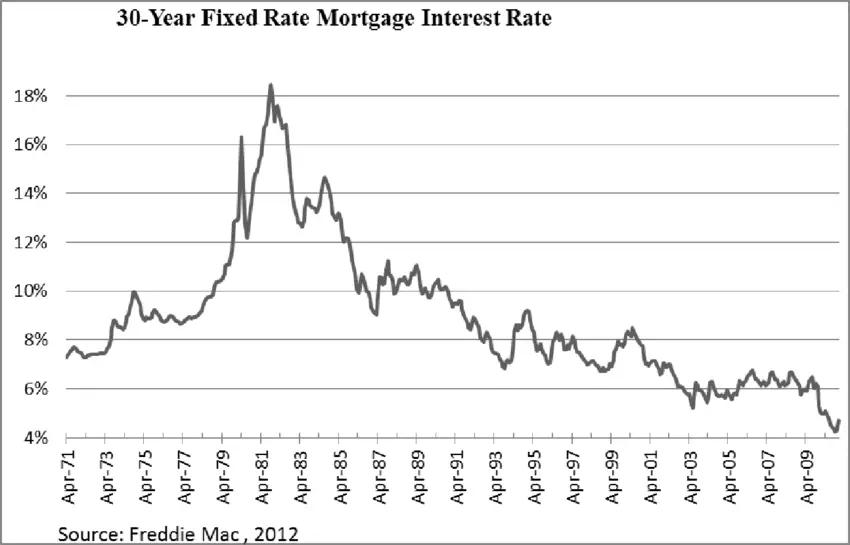

If you are looking to purchase a home, applying for a home mortgage now might be a good idea. Currently, interest rates are historically low, but as the employment situation and economy improve, you can expect those rates to spike soon.

While the aforementioned factors impact the average interest rate, you can control certain elements and help secure a lower interest rate for a home loan.

Read Also: How Much Is Mortgage On 1 Million

What You Should Know

- Variable mortgage rateshave historically performed better than fixed mortgage rates, although interest rates have generally fallen over the past few decades

- 5-year fixed mortgages are the most popular in Canada

- Insured high-ratio mortgageswill have the lowest possible mortgage rate, but youll need to pay formortgage default insurance

- Typically, longer mortgage term lengths will have a higher mortgage rate compared to shorter mortgage terms.

- Closed mortgage rates are lower than open mortgage rates, but open mortgages allow you to make principal prepayments of any amount withoutmortgage penalties

What Are Todays Mortgage Rates

On Thursday, December 23, 2021, according to Bankrates latest survey of the nations largest mortgage lenders, the average 30-year fixed mortgage rate is 3.190% with an APR of 3.350%. The average 15-year fixed mortgage rate is 2.500% with an APR of 2.710%. The average 5/1 adjustable-rate mortgage rate is 2.740% with an APR of 4.070%.

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

How Do I Find Current 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start start the process of getting approved for your home loan. Its that easy

A 30-year fixed-rate mortgage is the most common term of mortgage. It provides the security of a fixed principal and interest payment, and the flexibility to afford a larger mortgage loan because the payments are more affordable theyre spread out over three decades.

How Big Of A Down Payment Do I Need

Depending on what type of loan you borrow, you may not need to pay a down payment. Some government-backed loans for veterans and farmers may not require a down payment, while conventional loans or Federal Housing Administration loans typically require 3% or more.

To see all your options, visit our loan types page to see what kind of mortgage may be best for you.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

What Is A Variable Rate Mortgage

Like fixed rate mortgages, variable rate mortgages also have a set term , but they have one big difference: the interest rate can go up and down during your mortgage term. This can happen as often as every month, as its tied to whatever is happening with the rate set by the Bank of Canada.

How does it work? The variable rate is related to the prime interest rate, which refers to the interest rate that a bank offers to their most trusted customers. This preferential rate is based on the Bank of Canadas overnight rate or key interest rate which is the interest rate at which banks get money from the Bank of Canada.

The bottom line: if you choose a VRM, your payment will go up or down depending on what the Bank of Canada does and how your lender reacts with their prime interest rate. While some people think can predict what the Bank of Canada is going to do, the truth is that no one has a crystal ball and can see what interest rates will do over the long term.

You may see banks advertise their variable interest rates as prime minus 0.2% or something similar. This means that you will get 0.2% off of the floating prime interest rate which could go up or down throughout your mortgage term.

What To Do When You’re Coming To The End Of A Fixed Rate Mortgage Deal

Up to six months before the end of your fixed rate period, start looking at the best fixed mortgage rates available to see if you can save money. When your fixed rate deal ends, you’ll usually go onto your lender’s SVR, or sometimes a tracker rate. These don’t offer the same payment security as a fixed rate, and, depending on the interest rate climate, could mean that your payments make a sudden jump.

On the flipside, it can sometimes be the case that the variable rate you go onto is lower than the fixed rate you’ve been paying. While this may come as a pleasant surprise, remember that your providers default variable rate is likely not the most competitive on the market, so you might be able to save even more by finding a different deal to remortgage to. If you can, you may want to set the wheels in motion for a remortgage several months before your fixed rate period comes to an end, to avoid accidentally defaulting. By making arrangements in plenty of time, you would be able to simply wait until the fixed rate period finishes to remortgage.

Depending on the wider mortgage market, you may be tempted by a variable rate deal. However, those used to the security of a fixed rate mortgage may not be prepared for their repayments changing, so do your research. If you do decide to move your mortgage to a variable rate, consider keeping your monthly mortgage payments the same. This overpayment will reduce the term of your mortgage more quickly.

Don’t Miss: Can You Refinance A Mortgage Without A Job

How Are Mortgage Rates Set

Mortgage rates fluctuate for the same reasons home prices change supply, demand, inflation, and even the U.S. employment rate can all impact mortgage rates. The demand for homes isnt necessarily a sign of where mortgage rates are headed. The best indicator of whether rates will go up or down is the 10-year Treasury bond rate.

When a lender issues a mortgage, it takes that loan and packages it together with a bunch of other mortgages, creating a mortgage-backed security , which is a type of bond. These bonds are then sold to investors so the bank has money for new loans. Mortgage bonds and 10-year Treasury bonds are similar investments and compete for the same buyers, which is why the rates for both move up or down in tandem.

Thats why, in a slumping economy, when more investors want to purchase safer investments, like mortgage-backed securities and treasury bonds, rates tend to go down. The Federal Reserve has been purchasing MBS and treasury bonds, and this increased demand has led to the lowest mortgage rates on record.

When Should I Lock My Mortgage Rate

Right now, mortgage rates are historically low, so its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, ask your lender for a float down. With this option, you get the lower of the two rates. Pay attention to the fine print, though. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

Read Also: Rocket Mortgage Requirements

Va 30 Year Fixed Mortgage Rates

Since VA loans are guaranteed by the government, VA loans provide access to special benefits, including:

Open Vs Closed Mortgage: How To Choose

Again, theres no right choice here: it really depends on your financial situation and personal preferences. Generally, most Canadians prefer the simplicity of a basic closed mortgage with fixed interest payments. Its easy to understand and there are no surprises. But if theres a chance that you may inherit a wack of cash in the near future, you may want to opt for an open mortgage so you pay it off faster and incur less interest. Its totally up to you.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

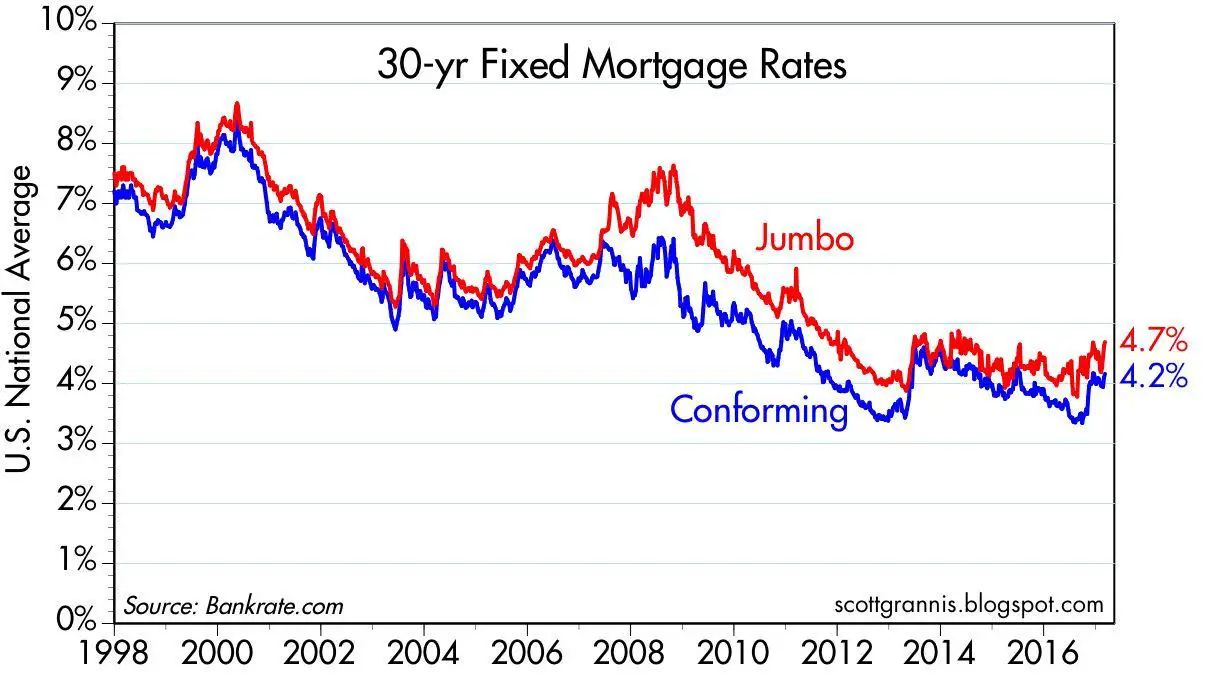

Conventional Loan Requirements And Qualifications

- Loan amount – The loan amount for a conforming mortgage is generally limited to $548,250 for a single-family home, though limits may be higher in regions where home prices are higher. Jumbo loans allow you to exceed the conforming loan limit to borrow for a higher-valued home.

- Down payment – Most conventional loans will require at least 5 percent as a down payment. For loans with lower down payment requirements, explore government-backed mortgages like VA and FHA loans or speak to your mortgage loan officer about other options that may be available. If the down payment is less than 20 percent on a conventional loan, mortgage insurance may be required.

- – Conventional loans are a good choice for borrowers with very good credit, which generally means a FICO score of 740 or higher. There are also established guidelines for income and other personal financial information.

Conventional fixed-rate mortgages are a popular option, but they’re not the only one. Compare mortgage options to learn more on your own, or contact a mortgage loan officer to find out which mortgage option may be the best fit for you.

Can You Get A Jumbo Loan Without Pmi

Do you have to pay for Mortgage Insurance with a California 10% Down Payment Jumbo Loan? No, mortgage insurance is not required although many jumbo lenders require it! 10% Down & 90% Loans for Jumbo Value Financing available up to $3,000,000 loan amount!

How can I avoid PMI without 20% down?

In short, when it comes to PMI, if you have less than 20% of the selling price or value of the home to use as a down payment, you have two basic options: Use a stand-alone first mortgage and pay PMI until the LTV of the mortgage reaches 78%, at where PMI can be omitted. 1 Use a second mortgage.

How can I avoid PMI with 5% down?

The traditional way to avoid PMI payments on a mortgage is to take out a piggyback loan. In that case, if you can only provide a 5 percent down payment on your mortgage, you take a second backing mortgage for 15 percent of the loan balance, and combine it for your 20 percent down payment.

Don’t Miss: How Much Does Getting Pre Approval Hurt Credit