How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

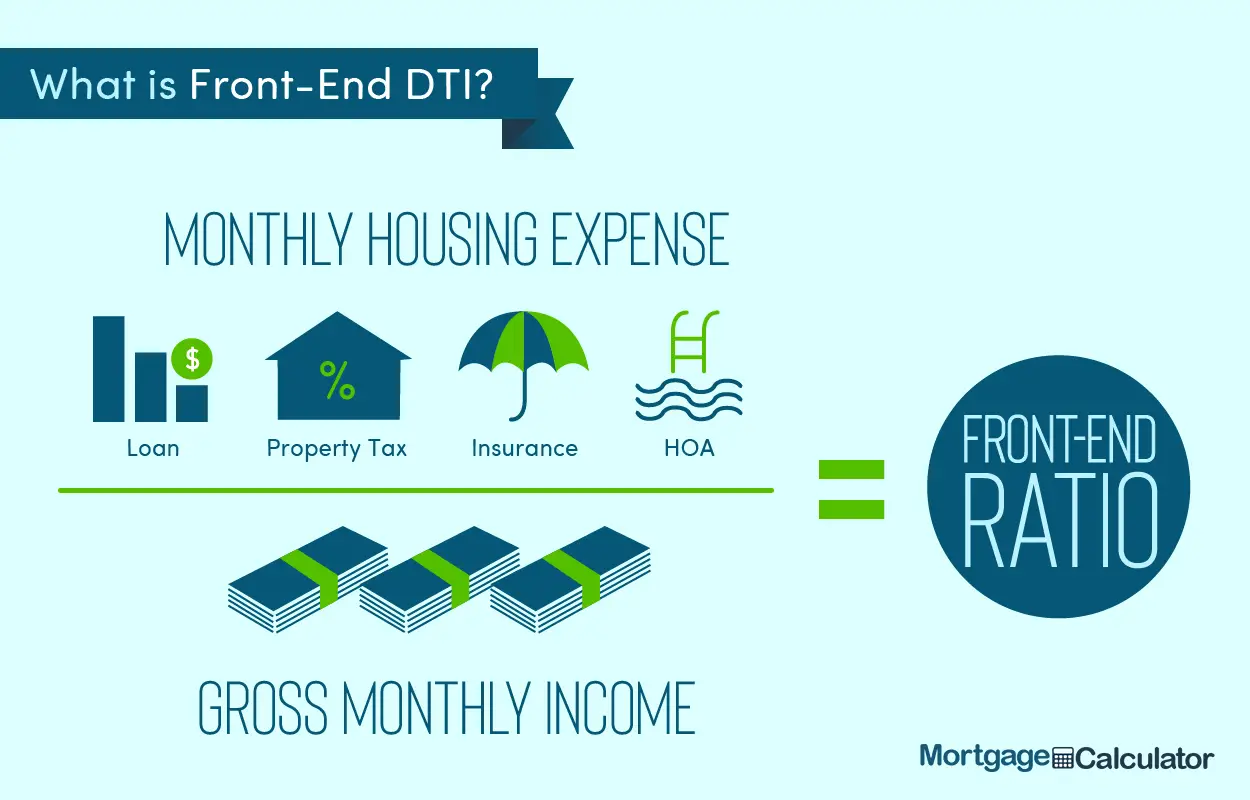

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

Low Down Payment Loan Programs

The old standard used to be that homebuyers needed 20% down to buy a home. Times have changed. Many homebuyers, especially first-time buyers, simply dont have a 20% down payment saved. This is becoming increasingly the case as home prices soar in many U.S. housing markets. For example, the median existing-home price in November 2020 was $310,800, a 14.6% increase from $271,300 in November 2019, according to the latest data from the National Association of Realtors.

In fact, homebuyers who financed their home put down an average of 12% of the purchase price, according to NARs 2020 Profile of Home Buyers and Sellers. First-time buyers using financing typically put down just 7% of the purchase price, the survey found.

For those who cant afford a 20% down payment, several types of mortgages offer a low down payment option.

Recommended Reading: How Much Is An Application Fee For A Mortgage

How To Get Pre

To get pre-approved for a mortgage you will need to provide all of the documents required for a mortgage. Essentially, your initial application for a mortgage usually comes before you have found the home that you are looking for which means that you will normally receive a pre-approval based on your current situation. To get pre-approved you have to provide the lender with proof of employment, proof of income, recent bank statements, federal tax returns, identification paperwork, and your credit score. Once the lender has finished running a thorough check, you will receive a pre-approved letter that you can then submit when you are making offers on a house.

Rbc Royal Bank Mortgage Affordability

Before you get a mortgage from RBC, it is important to know how RBC calculates your mortgage affordability. RBC takes into account the following factors:

- Your household income

- Your down payment

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

If your down payment is less than 20%, RBC’s mortgage affordability calculator also considers your mortgage insurance premiums. Unlike some other mortgage affordability calculators, RBC’s mortgage affordability calculator does not take into account your location for property taxes and utility costs.

RBC calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 32% and a maximum total debt service ratio of 40%. These ratios are more strict than CMHC regulations, but you may still be able to get a mortgage with RBC even if you exceed these limits.

Another factor in determining your mortgage affordability is your down payment. According to RBC, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Don’t Miss: Who Can Get A Fha Mortgage

What Is My Mortgage

If you have more debt, you might struggle to keep your DTI low while also paying off a mortgage. In this case, it can be useful to work backward before you decide on a percentage of income for your mortgage payment.

Multiply your monthly gross income by .43 to determine how much money you can spend each month to keep your DTI ratio at 43%. Youll then subtract all of your recurring, fixed monthly debt obligations and minimum payments on credit cards and other lines of credit. The dollar amount you have left after subtracting all of your debts lets you know how much you can afford to spend each month on your mortgage.

Lets take a look at an example. Imagine that your household brings in $5,000 in gross monthly income. Your recurring debts are as follows:

- Rent: $500

- Minimum student loan payment: $250

- Minimum credit card payment: $200

- Minimum auto loan payment: $200

- Homeowners association fees: $100

In this example, your total monthly debt obligation is $1,250.With quick math, we find that 43% of your gross income is $2,150, and your recurring debts take up 25% of your gross income. This means that if you want to keep your DTI ratio at 43%, you should spend no more than 18% of your gross income on your monthly payment. Use a mortgage calculator and your estimated monthly payment to calculate how much money you can borrow and stay on budget.

How To Increase Your Mortgage Affordability

If you want to increase how much you can borrow, thus increasing how much you can afford to spend on a home, there are few steps you can take.

1. Save a larger down payment: The larger your down payment, the less interest youll be charged over the life of your loan. A larger down payment also saves you money on the cost of CMHC insurance.

2. Get a better mortgage rate: Shop around for the best mortgage rate you can find, and consider using a mortgage broker to negotiate on your behalf. A lower mortgage rate will result in lower monthly payments, increasing how much you can afford. It will also save you thousands of dollars over the life of your mortgage.

3. Increase your amortization period: The longer you take to pay off your loan, the lower your monthly payments will be, making your mortgage more affordable. However, this will result in you paying more interest over time.

These are just a few ways you can increase the amount you can afford to spend on a home, by increasing your mortgage affordability. However, the best advice will be personal to you. Find a licensed mortgage broker near you to have a free, no-obligation conversation thats tailored to your needs.

Also Check: How Much Money Should You Spend On Mortgage

Current Minimum Mortgage Requirements For A Usda Loan

Down payment. Borrowers that meet the USDA income limits can purchase a home with no down payment. Money needed for closing costs can come from your own funds or from a gift.

USDA guarantee fees. The USDA requires two types of guarantee fees instead of mortgage insurance. The fees are charged to offset the costs of the rural loan program to taxpayers. The first is a guarantee fee of 1% of the loan amount and is typically financed. The second is an annual guarantee fee equal to 0.35% of the loan amount, which is divided by 12 and added to the monthly payment.

. Although the USDA doesnt set a minimum score, USDA-approved lenders typically require a minimum credit score of 640.

Employment. USDA borrowers must have 12 months of stable income. If youre self-employed, a two-year history is required.

Income limits. The USDA counts the income of all adult household members to ensure the household income doesnt exceed the program limits in your area. Total household income for a USDA loan must be at or below 115% of the median household in the area youre buying. Use the income eligibility search tool to check on the limits in your state.

DTI ratio. The front-end DTI ratio maximum is 29%, while the back-end DTI ratio maximum is 41%. USDA borrowers with a credit score of 680 or higher may qualify with higher front- and back-end DTI ratios of 32% and 44%, respectively, with proof of steady income and extra cash reserves.

Occupancy. USDA financing is for primary residences only.

Current Minimum Mortgage Requirements For An Fha Loan

Down payment. FHA loans require a 3.5% down payment with a 580 or higher credit score, and funds can come from employers, close friends, family members or charitable organizations. The down payment requirement jumps to 10% with a credit score of 500 to 579.

Mortgage insurance. FHA borrowers are required to pay two types of FHA mortgage insurance. The first is an upfront mortgage insurance premium of 1.75% of the loan amount, typically financed into the mortgage. The second is the annual mortgage insurance premium that ranges from 0.45% to 1.05% of the loan amount, and is divided by 12 and added to your monthly payment.

. You can have a credit score as low as 500 up to 579 with a 10% down payment. Homebuyers making a minimum 3.5% down payment will need a score of at least 580.

Employment. FHA loan income requirements look at the borrowers stability of income and employment for the past two years. Job-hoppers need to explain changes or gaps in employment.

Income. There are no income limits for FHA loans. However, borrowing power is limited to the FHA maximum loan limit cap of $356,362 in 2021, compared to $548,250 for conventional loans in most parts of the country.

Cash reserves. FHA loan qualifications dont usually require cash reserves unless youre buying a two- to four-unit home, or trying to qualify with a lower credit score.

Occupancy. A one- to four-unit home financed with an FHA loan must be your primary residence for at least the first year after buying it.

Don’t Miss: Does Rocket Mortgage Affect Your Credit Score

Shop Around For A Great Pre

Just as youll see several homes before settling on the one, you should shop around for the best mortgage rate. Dont just go to your local bank branch and expect to receive a great deal. Do your research and compare mortgage rates, or use a mortgage broker who will negotiate on your behalf.

Even half a percentage point can make a huge difference in your regular payments and the amount of interest youll pay over time. To see what we mean, plug in your numbers into our mortgage payment calculator, then change the interest rate in small steps. Youll very quickly see what we mean!

What happens after your mortgage pre-approval? Generally, youll have a 90 to 120 day period where your offered rate will be held for you. This is when you should start house hunting!

I Don’t Know What To Enter For Property Taxes Or Homeowners’ Insurance

You can leave these and most other boxes blank if you don’t know what those costs might be, and the Mortgage Qualifying Calculator will generate an answer without them. The same for the inputs under Down Payment and Closing Costs, and Total Monthly Debt Payments. But your results will be more accurate and useful if you can provide these figures.

You May Like: How Much Income For A 250k Mortgage

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

Homeowners May Want To Refinance While Rates Are Low

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility.

Are you paying too much for your mortgage?

Also Check: How Much Income For Mortgage Calculator

Do Mortgage Calculators Require A Credit Check

No, our mortgage calculator simply uses the information you enter to calculate how much you might be eligible to borrow, along with the value of a home you could afford. You wont even be required to enter your name.

Only when you apply for a mortgage will you undergo a full credit check, which will be marked on your file and potentially impact your credit score.

Td Bank Mortgage Affordability

Before you get a mortgage from TD Bank, it is important to know how TD calculates your mortgage affordability. TD takes into account the following factors:

- The location of your future home

- Whether your future home is a detached home or condo

- Your household income

- Your down payment

- Your monthly bills and expenses including groceries, transportation, shopping, and insurance.

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

Your location and property type are used to provide estimates for your potential property taxes, utilities, and condo fees.

TD calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 39% and a maximum total debt service ratio of 44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to TD, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Also Check: What Is Tip In Mortgage

Coronavirus Pandemic Mortgage Requirement Changes In 2021

Lenders have added additional mortgage requirements that may be very different from what youre used to if you havent taken out a mortgage in the past year.

Outside-only home appraisals. Conventional, FHA, VA and USDA-approved lenders may allow exterior-only appraisals, meaning the appraiser will value the home without inspecting the inside.

Extra asset documents. Because of the volatility in the financial markets, lenders may ask for updated documentation of any retirement, stock and mutual funds needed to qualify for a mortgage to confirm the value just before closing.

Virtual closings. Many lenders require notary signings, power of attorney signings or electronic signings, especially in states heavily affected by COVID-related restrictions.

Final tip:

Benefits Of Larger Down Payment

While not always available for a homebuyer, making a larger down payment can be a smart strategy to lower both the monthly cost of carrying the home, as well as the overall cost of interest paid over the lifetime of the loan. This also means that you will have larger amount of home equity in your house to draw on if you need to access it through a home equity loan or HELOC. This can be helpful if you need to remodel or just need the cash for a large expense or emergency.

In addition to the lower financial costs of owning your home, a larger down payment can also qualify you for a lower interest rate on your mortgage, especially if you can get the loan amount down below the jumbo loan threshold. You also won’t need to pay for PMI mortgage insurance and you may have an advantage over other potential buyers in the case of multiple bids by making a more attractive offer.

While there are benefits to a larger down payment, one must balance the pros and the cons. With a larger amount down, that money is no longer available to make other purchases or investments, so there is an opportunity cost. That money will also be tied up in your home, making it less liquid than as cash.

Also Check: Do Mortgage Companies Verify Tax Returns With The Irs