Difference Between Jumbo And Conforming Mortgage In Rochester Ny

Very large jumbo loans are known as super jumbo mortgages. This classification of loan can be between $650,000 to $20+ million. You may also be interested in what is called a conforming jumbo mortgage, which is a loan between $417,001 and $625,000 for a conventional mortgage, or $417,001 and $729,750 for an FHA jumbo loan.

While there are ways to avoid taking out a jumbo mortgage, a jumbo loan is usually the best way to get the lowest interest rate and avoid paying closing costs more than once.

What Is A 30

A jumbo mortgage is a home loan that exceeds the typical lending limits of the Federal Home Loan Mortgage Corporation , Federal National Mortgage Association , the Federal Housing Administration or the Veterans Administration.

Loans sold to Fannie Mae or Freddie Mac are referred to as conventional loans or conforming loans since the mortgage amount “conforms” to these firms’ underwriting standards and lending limits.

Each year, Congress establishes jumbo loan limits.

Most counties in the United States have standard lending limits.There are a few counties that are exempt.Jumbo loans are those that exceed the following lending limitations.

- 1-unit homes: $548,250

- 4-unit homes: $1,054,500

Jumbo Loans At A Glance

- Jumbo Loans exceed limits set by the Federal Housing Finance Agency. This type of financing cannot be purchased, guaranteed or securitized by Fannie Mae or Freddie Mac

- Home buyers are subject to more meticulous credit requirements than when applying for a conventional loan

- A shining credit score and extremely low debt-to-income ratio are required for approval

- The annual percentage rate is in line with conventional mortgages and down payments are typically around 10 to 15% of the total purchase price

The Big Difference of Jumbo Loans

Jumbo Loans are non-conforming. This means that they are types of loans that cannot be purchased by Fannie Mae or Freddie Mac, agencies that were established to help low-to-moderate income buyers purchase homes. To make sure the agencys funds were being used for that purposenot to help wealthy buyersthey established loan limits based on median home prices.

You May Like: Does Chase Allow Mortgage Recast

Minimum And Maximum Loan Amounts

If you are wondering whether youll need a jumbo loan, you need to consider the limits set for conforming loans and U.S. Federal Housing Administration loans. The agency-set maximum limits for these loans provide a baseline for jumbo loans.

Most parts of the country have one maximum loan amount for conforming loans. In some high-cost areas, such as Washington D.C. and certain California counties, the threshold for the maximum conforming loan is raised.

For 2021, the Federal Housing Finance Agency raised the maximum conforming loan limit for a single-family property from $510,400 to $548,250. In high-cost areas, the ceiling for conforming mortgage limits is 150% of that limit, or $822,375 for 2021.

Those limits apply to conforming loans that follow Fannie Mae or Freddie Mac guidelines. A different loan limit kicks in if youre buying a home in 2021 using an FHA loan, which is backed by the Federal Housing Administration. The FHA loan floor for 2021 is $356,362, up from $331,760 in 2020. The maximum limit for approximately 70 high-cost counties has been raised to $822,375, up from $765,000 in 2020.

Keep in mind, the Federal Housing Finance Agency may increase conforming loan limits again for 2022. If you are planning on taking out a mortgage loan in 2022, check back here for updates on loan limits.

What Is The Difference Between Jumbo& super Jumbo Loans

Jumbo loans exceed the conventional conforming mortgage limits.

Super jumbo loans are loans above this threshold, but different lenders in different parts of the country use different dollar denominations to refer to super jumbo. In the midwest & across most of the continental United States where homes are cheap the amount used to refer to “super jumbo” is typically $1,000,000 to $1,500,000. However, in Manhattan, spending $1,000,000 might not buy much more than a closet. In wealthier areas mortgage lenders might refer super jumbo as loans above $2,000,000 with caps ranging up to $10,000,000 to $20,000,000 and beyond.

You May Like: Is Quicken Loans A Mortgage Company

New York Arm Loan Rates

An adjustable-rate mortgage stands in contrast to a fixed-rate mortgage. While your interest rate is locked in with a fixed-rate mortgage, the interest rate on an ARM changes over the course of the loan. Usually, an ARM will have a lower interest rate than a fixed-rate mortgage for an introductory period of one, three, five, seven or 10 years.

Once that initial period has ended, the interest rate can change, which typically means it increases. How often the rate can adjust and the highest possible level that it can reach are specified in the terms of the loan, so it is crucial to assess the terms carefully to make sure that they fit within your budget. Also, note that ARM rates are currently higher than fixed rate loans and jumbo loans.

The average rate for a 5/1 ARM in New York is 4.07% .

New York Jumbo Loan Rates

New York county conforming loan limits are mostly $548,250, but certain counties do get up to the highest limit of $822,375. The variation reflects the higher home prices in certain parts of the state. Jumbo loans are those that exceed an individual countys conforming loan limit. So in counties with high real estate prices where the conforming limit jumps to $822,375, you have additional room to take out a bigger loan without it being considered a jumbo loan. If you do need a jumbo loan in order to make your New York real estate dreams a reality, you should be aware that they are accompanied by higher interest rates as it’s a larger risk for the lender. However, jumbo loan rates are currently lower than fixed rates in New York.

The average 30-year fixed jumbo loan rate in New York is 2.91% .

Don’t Miss: How To Calculate Mortgage Payoff Amount

History And Current Market Outlook For Jumbo Reverse Mortgages

Like all mortgage products, the jumbo lending environment changes based on many factors. Historically, there were many non-FHA reverse mortgages with different rates and terms. After the housing crash in 2008, most jumbos disappeared from the market. Based on low interest rates and changes to the FHA lending limit in recent years several jumbo products launched, offering a variety of rates, terms, and features.

If you are interested in a jumbo reverse mortgage, its important to ask about the specific terms offered by your lender, such as the amount that can be borrowed, the ways in which proceeds can be obtained, and the types of protections in place regarding non-borrowing spouses.

New York Mortgage Resources

The Empire State has some valuable resources for its homebuyers. The State of New York Mortgage Agency offers five mortgage programs with low down payment requirements, competitive interest rates, home rehabilitation funding and no prepayment penalties. These mortgages are available for qualifying first-time homebuyers.

The New York State Association of REALTORS and The Community Foundation have paired up to offer $2,000 grants for first-time homebuyers in New York. Applicants must apply for the grant.

For Big Apple buyers, the NYC Housing Preservation & Development agency provides down payment assistance of up to $40,000 for first-time homebuyers. It also offers a First-time Property Buyers course to help buyers learn about the purchasing process.

Also Check: Does Bank Of America Do Mortgage Loans

Frequently Asked Questions About Jumbo Loans

Q. Are jumbo loan rates higher?A. Yes. Because of the size of the loan and the potential loss with a default, lenders usually require a higher interest rate due to the risk.

Q. Can I get a 10 down mortgage on a jumbo loan?A. With the mortgage crash in the rear view mirror, lenders are offering jumbo mortgages with as little as 10% down payment. Some lenders are even willing to eliminatePMIon these loans.

Q. How can I avoid a jumbo loan amount and interest rate?A. The interest rates on jumbo loans are usually higher than mortgages that are under the jumbo limit. A common tactic to get under the jumbo limit is to take on a second mortgage. For example, if the current conventional loan limit is $548,250 and you need to borrow $600,000. You could borrow $600,000 and pay the jumbo interest rate, or you could structure the first mortgage at $548,250 and a second mortgage for the balance of $51,750.

Q. How much can you borrow on a jumbo loan?A. The amount you can borrow depends on your income and monthly debt. Lenders use a borrowing formula to determine the maximum loan amount, calleddebt to income.

Q. Is a jumbo loan a conventional loan?A. A jumbo loan can be aconventional loan if the loan meets the underwriting requirements of either the Federal National Mortgage Association or the Federal Home Loan Mortgage Corporation.

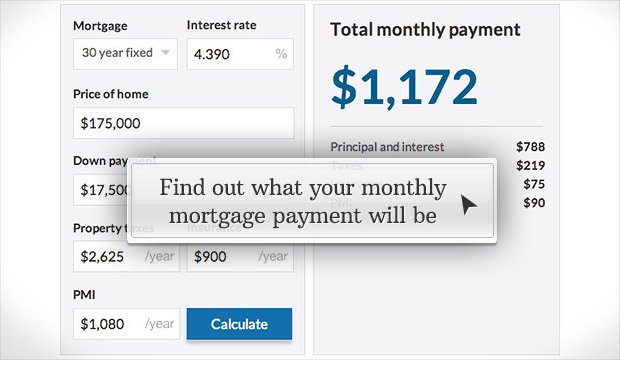

Calculators

How Do I Get A Jumbo Loan With 5% Down

Simply by shopping around. Check in with a few different mortgage lenders and ask about their minimum down payment for a jumbo loan.

Ask about credit score and income requirements, too, to see whether youre likely to qualify.

Youll likely have to look beyond your local bank, says Eric Jeanette, president of Dream Home Financing and FHA Lenders. There are many online lenders who have creative loan programs that local banks simply do not offer.

Another way to find a low down payment jumbo loan is to look to wholesale mortgage brokers.

Wholesale mortgage brokers have relationships with many lenders who can offer flexible terms and guidelines. They can also yield the most cost-effective mortgage solutions for the jumbo loan market, says David Yi, president at Providence Mortgage.

When you find a lender offering low-down-payment jumbo loans, you can fill out a pre-approval application to verify your eligibility.

Then, once you have a signed purchase agreement on the home, your lender will be able to issue a final loan approval confirming the interest rate, loan terms, and closing costs on your new jumbo loan.

One thing to note: most lenders are not very forthcoming with information about their jumbo loans online. So dont expect to find everything you need on a lenders website.

Instead, get in touch directly with a loan officer or mortgage broker who can fill you in on the details.

You May Like: Who Benefits From A Reverse Mortgage

Find A Mortgage Loan Officer In New York

Our local mortgage loan officers understand the specifics of the New York market. Let us help you navigate the home-buying process so you can focus on finding your dream home.

Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rate and program terms are subject to change without notice. Mortgage, Home Equity and Credit products are offered through U.S. Bank National Association. Deposit products are offered through U.S. Bank National Association. Member FDIC. Equal Housing Lender

Annual Percentage Rate represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after consummation for ARM loans.

The rates shown above are the current rates for the purchase of a single-family primary residence based on a 60-day lock period. These rates are not guaranteed and are subject to change. This is not a credit decision or a commitment to lend. Your guaranteed rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors.

FHA Loans – Annual Percentage Rate calculation assumes a $255,290 loan with a 3.5% down payment, monthly mortgage insurance premium of $176.30, and borrower-paid finance charges of 0.862% of the base loan amount, plus origination fees if applicable.

What Types Of Housing Qualify For A Jumbo Loan

There are no government restrictions on how jumbo loan funds can be spent, which means these mortgages can be used to purchase various types of housing. Your lender may have specific requirements, but in most cases a jumbo mortgage can be used to buy a primary residence, dream vacation home, or investment property.

Read Also: Does Shopping For A Mortgage Hurt Your Credit Score

Are Jumbo Loan Rates Higher

Jumbo mortgage rates Taking out a jumbo mortgage doesn’t immediately mean higher interest rates. In fact, jumbo mortgage rates are often competitive and may be lower than conforming mortgage rates. … But, if lenders are able to provide jumbo mortgages, they’ll usually keep their rates competitive.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: What Is The Best Mortgage Loan Company

Is Qualifying For A Jumbo Mortgage Different

Jumbo mortgages have the same overall qualifying methodology as a conforming loan. Lenders will look at credit score, down payment size, total monthly debt obligations relative to income , and money left over after closing.

As for money left over after loan closing often called reserves or post-closing liquidity jumbo loans will be more stringent than conforming. Typically jumbo lenders want to see 12 months of reserves after the close, half liquid , and half calculated from retirement assets. Conforming loan reserve requirements range from 0 to 12 months, depending on factors such as credit score, down payment, and DTI . Jumbo exceptions are available if your debt-to-income ratio is low and your down payment is high.

However, jumbo loan approvals have some flexibility that conforming loans dont have:

Breaking Down Jumbo Loan Qualifications

Larger loans come with increased amounts of risk for both mortgage lenders and borrowers. To ensure you can afford to take on a jumbo mortgage, qualifying guidelines are stricter than those for a traditional conforming loan. While exact underwriting requirements may depend on the lender, here are some general guidelines and questions to consider when it comes to jumbo mortgages:

What are the jumbo loan minimum down payment requirements?

In the past, lenders have usually required a 20% down payment minimum for borrowers to be approved in a jumbo loan application. However, more flexible options may be available depending on the lender you choose..

At Better Mortgage, jumbo loans are available to borrowers with down payments of just 10%. But keep in mind that 10% can be quite a chunk of change given the higher price tag of the homes. For example, a 10% down payment on the minimum jumbo loan amount is nearly $55,000.

At Better Mortgage, getting pre-approved for a Jumbo Loan is just as quick and simple as it is with any other type of loan. Similar to the process for conforming loans, pre-approval for a Jumbo Loan starts with online pre-approval: youll be asked to provide basic information about your household income, debts, and assets, and Better will run a soft credit check which wont impact your score. You can learn more about the specific product details and limits here.

What credit score do you need for a jumbo loan?

What is the jumbo loan DTI requirement?

You May Like: How To Determine Ltv Mortgage

Jumbo Vs Conventional Loans Faqs

What is the difference between jumbo and conforming loans?

A conforming conventional loan adheres to the loan limits and underwriting guidelines established by the Federal Housing Finance Agency and by Fannie Mae and Freddie Mac. The conforming loan limits for 2021 for a single-family home range between $548,250 and $822,375, depending where you live.Jumbo loans exceed the conforming loan limits and can be used to purchase high-value and luxury homes. Lenders typically have higher credit score and down payment requirements for jumbo loans, and the interest rates are higher as well.

Is a conforming loan a jumbo loan?

No, a jumbo loan is not a conforming loan. Conforming loans conform to rules set by Fannie Mae and Freddie Mac and are typically easier to qualify for than jumbo loans. There are conforming loan limits that constrain the amount a lender can approve a borrower for in 2021, the limits for a single-family home are between $548,250 and $822,375.Jumbo mortgages are options for borrowers who want to buy homes above the conforming loan limits. They usually have higher credit score and down payment minimums and higher interest rates.

Is a jumbo loan better than a conforming loan?

If youre buying a home in a high-cost area or want a luxury property, you may need a jumbo loan. However, if youre looking for a relatively modest home, a conforming loan can be easier to qualify for and require less money upfront.