Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.

Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

Figure Out Where You Spend Your Money

Track your spending for a week or two, and youll be astonished at the ways your money disappears. In addition to simply making you more mindful of your spending, expense tracking will help you identify all the splurges that accumulate too much outflow. Identify some places where you can cut back , and youll be surprised how much your spending adds up.

Check Your Mortgage Eligibility

Estimating your DTI can help you figure out whether youll qualify for a mortgage and how much home you might be able to afford.

But any number you come up with on your own is just an estimate. Your mortgage lender gets the final say on your DTI and home buying budget.

When youre ready to get serious about shopping for a new home, youll need a mortgage pre-approval to verify your eligibility and budget. You can get started right here.

Popular Articles

Also Check: Can You Take Out Two Mortgages

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you won’t likely have money to handle an unforeseen event and will have limited borrowing options.

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Recommended Reading: How Much Would My Mortgage Payment Be

Tips On How To Lower Your Debt To Income Ratio

If you want to reduce your debt to income ratio, here are a few ways to help you achieve that goal:

What Are Common Debt Ratios

The total debt service ratio is the percentage of gross annual income required to cover all other debts and loans in addition to the cost of servicing the property and the mortgage .

The gross debt service ratio is the percentage of the total of annual mortgage Ratio payment relative to annual household income.

Also Check: What Is The Lowest Fixed Rate Mortgage

Make A Plan To Reduce Your Debt

Once youve identified those savings, make a plan to reduce your debt. There are a variety of popular approaches to this, and two of the most popular trends involve snowballs and avalanches. The snowball method suggests paying off your smallest debt first and working your way up to your largest. The avalanche method posits that it is better to tackle your highest-interest debt first. Either way, the result is the same. Your debt gets paid off more quickly, and you save money and lower your DTI.

Buyer Bewareof How Much You Can Afford

Because debt-to-income ratios are calculated using gross income, which is the pre-tax amount, its a good idea to be conservative when you feel comfortable taking on. You may qualify for a $300,000 mortgage, but that amount may mean living paycheck-to-paycheck rather than being able to save some of your income each month. Also remember, if youre in a higher income bracket, the percentage of your net income that goes to taxes may be higher.

While your debt-to-income ratio is calculated using your gross income, consider basing your own calculations on your net income for a more realistic view of your finances and what amount youd be comfortable spending on a home.

You May Like: How Much Mortgage 200k Salary

What Does This Mean

The higher your debt to income ratio is, the worse off you look to creditors. Having a high debt to income ratio could mean that you are living beyond your means. If your credit utilization ratio is high, you are quite possibly using credit to make the majority of your purchases, and without the credit, you would not be able to make ends meet.

A high debt to income ratio is a red flag for any lending company. If they see you have too many debts, the company is most likely not going to give you more credit. And if they do, theyre going to charge you a higher than normal interest rate.

To avoid overpaying with high interest rates, Ill show you how to improve your Debt To Income score.

How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexible loan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use our VA home loan calculator to estimate how expensive of a house you can afford.

Read Also: Do Medical Collections Affect Getting A Mortgage

Whats Included In A Debt

There are many monthly expenses that wont make it into your DTI ratio calculations even though part of your income is allocated toward them. Thats because your DTI ratio typically only includes the accounts that show up on your not everything you pay monthly is part of the equation.

DTI-applicable expenses include:

Not every bill you pay will appear on your credit, though. Basic living expenses like utilities, cable, cell phone bills and monthly fees for any subscription services wont show up.

This doesnt mean there wont be any consequences for your credit if you dont pay these bills. Unpaid bills of this type can end up being reported as collections, which can have a big negative impact on your credit score. However, theres no effect from these types of accounts on your DTI.

Tips For Improving Your Debt

If your current DTI doesnt qualify you for a mortgage, there are steps you can take to improve your ratio:

Improving your DTI can also qualify you for better terms and interest rates, so even if your DTI is under the max threshold, you might consider working on your ratio before applying for your loan. If its your first home youre buying, you can also save with these programs for first-time homebuyers.

Recommended Reading: How To Pay Off Your Mortgage Quickly

Find Ways To Make Your Debt Less Expensive

If youre carrying high-interest credit card debt, try to find less costly debt alternatives. You can start by asking your current debtors for a lower interest rate. If you already own a home, you might consider a home equity loan to consolidate debt. You might consider applying for a personal loan with a fixed repayment schedule. In some cases , it might make sense to get a low interest rate credit card and transfer your balances before you cut up the original cards!

Another similar strategy is to reduce your credit card charges or ditch your card altogether. Fewer expenses on your credit account will cut payments that you have to make in the future. Go old-school and try to use cash for expenses like food and clothes. Limiting your spending to cash purchases can also help you save money on daily purchases to put toward paying off debt. This strategy is interest-free and can help you increase your mindfulness around your spending habits.

Typical Monthly Costs Included In The Debt

- mortgage loans and home equity loans on other properties you own

- housing costs on subject property including homeowners insurance, mortgage insurance, property tax, HOA dues

All the above count against your income, so if you can eliminate or reduce these debts, your income go will further in terms of what youre able to afford.

When it comes to plastic, the minimum credit card payment listed on your credit report will be considered. All the more reason to apply for a mortgage when all your credit cards are paid off, with no new charges, if practical.

Some banks and lenders allow installment credit cards such as those issued by American Express to be excluded from the debt-to-income ratio as they often account for thousands of dollars a month, and likely get paid off in full monthly.

Don’t Miss: Can A Locked Mortgage Rate Be Changed

How To Lower Your Debt

To improve yourDTI ratio, the best thing you can do is either pay down existing debt or increase your income.

While paying down debt, avoid taking on any additional debt or applying for new credit cards. If planning to make a large purchase, consider waiting until after you’ve bought a home. Try putting as much as you can intosaving for a down payment. A larger down payment means you’ll need to borrow less on a mortgage. Use aDTI calculator to monitor your progress each month, and consider speaking with a lender toget pre-qualifiedfor a mortgage.

Two Main Kinds Of Dti

The two main kinds of DTI are expressed as a pair using the notation x/y .

You May Like: What Will Be My Mortgage

What Is Monthly Debt

Monthly debts are recurring monthly payments, such as credit card payments, loan payments , alimony or child support. Our DTI formula uses your minimum monthly debt amount meaning the lowest amount you are required to pay each month on recurring payments. Whencalculating your monthly debts, you can exclude:

- Monthly utilities like water, garbage, electricity or gas bills

- Car insurance expenses

- Health insurance costs

- Groceries, food or entertainment expenses

To calculate your total minimum monthly debts, add up each minimum payment. If you pay more than the minimum amount on your credit cards, this does not count against your DTI, since only the minimum amount you’re required to pay is included in the total. For example, if you owe $5,000 on a high-interest credit card and your minimum monthly payment on that card is $100, then $100 is the minimum monthly debt amount used for your DTI.

What Should Your Dti Be To Buy A Home

The lower your DTI, the betterthis means less of your income is tied to recurring debt payments, and youll likely be more able to continue making payments on time even if you experience a minor financial setback. Borrowers with higher debt obligations relative to their incomes are less able to absorb those setbacks, and are at greater risk of defaulting on their loan. This is why high DTI is the #1 reason mortgage applications get rejected.

So, whats the magic number when it comes to DTI? Well, it varies slightly based on the type of mortgage, the lender, and other aspects of your financial profile.

Typically, though, most lenders prefer to see a DTI of under 36%. In other words, the total of your monthly debts, including your estimated monthly mortgage payment, will be less than 36% of your monthly gross income. However, it may be possible to get a mortgage with a DTI of up to 50% depending on the lender. If you have a DTI of 50% or higher, then it could be challenging or even impossible to get approved for a mortgage until you lower your debt to income ratio.

Conventional loan DTI requirements

While many lenders require a DTI of no more than 43%, some lenders, including Better Mortgage, can provide mortgages to borrowers with DTIs up to 50%. This means even if your DTI is 49.999%, you could be eligible for a home mortgage loan.

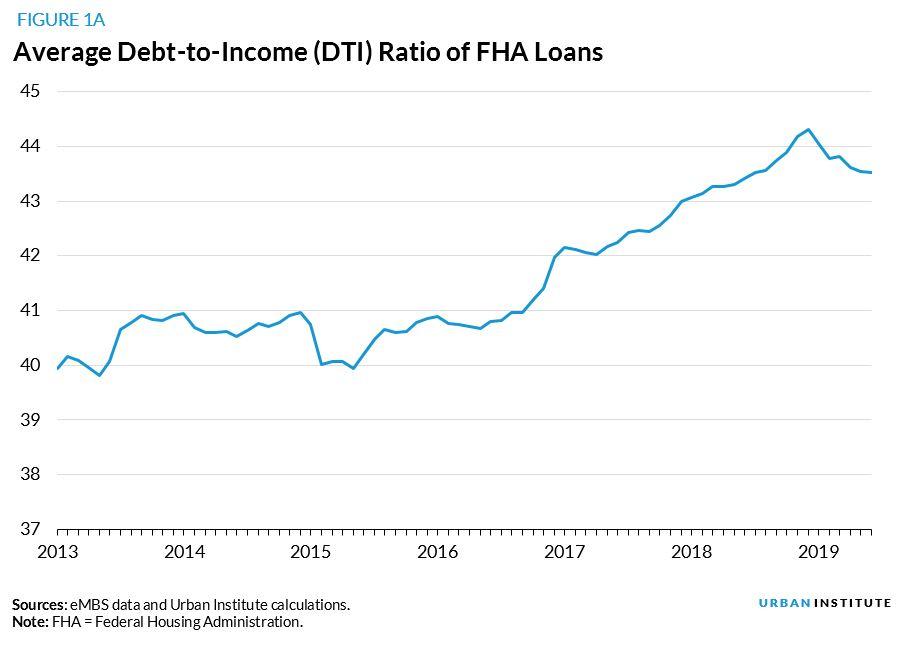

FHA loan DTI requirements

Read Also: What Does Prequalification For A Mortgage Mean

Having A Good Dti Isnt Too Hard

Your debt-to-income ratio is one of the most important factors in qualifying for a mortgage.

DTI determines whether youre eligible for the type of mortgage you want. It also determines how much house you can afford. So naturally you want your DTI to look good to a lender.

Luckily, thats not too hard. Todays mortgage programs are flexible, and a wide range of debt-to-income ratios fall in or near the good category. So theres a good chance you can get approved as long as your debts are manageable.