Can You Get A 300k Buy

Yes, you can, although the rules around buy-to-let properties are different to residential ones. Mortgage lenders often expect you to meet minimum income requirements and put down a larger deposit of say 25%. And while there are lenders wholl accept a smaller deposit like 15%, you would need both a suitable property and sufficient rental income thats at least 125% of your mortgage payments .

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

Don’t Miss: Is Closing Cost Part Of Mortgage

Monthly Payments On A $300000 Mortgage

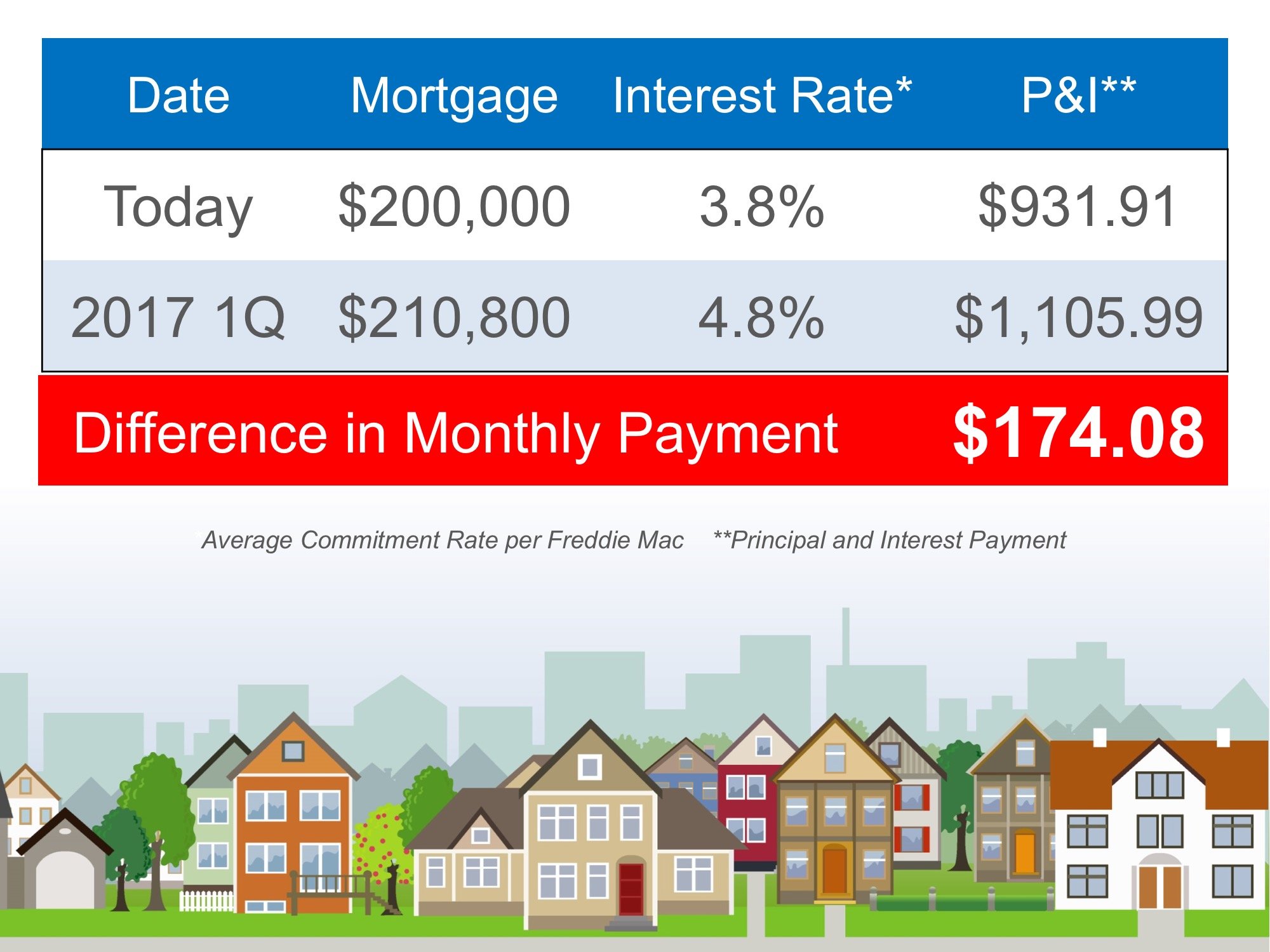

At a 3% fixed interest rate, your monthly mortgage payment on a 25-year mortgage might total approximately $1,422.63 a month, while a 10-year mortgage might cost approximately $2,896.82 a month.

Note that your monthly mortgage payments may differ slightly depending on the type of interest rate , your mortgage term, payment frequency, taxes and possible other fees.

-

See your monthly payments by interest rate.

Interest $1,667.50

Can You Get An Interest

Yes, you can. An interest-only mortgage means that youll only have to pay off the interest each month until the end of your term, where youll have to pay back the capital, aka the entire loan. While this could be a great way of keeping the costs down, youll need to have a solid repayment strategy in place before theyll agree to lend.

In order to get an interest-only mortgage, you may need to put down a larger deposit of 25% or even 30% to offset any risks.

Also Check: How 10 Year Treasury Affect Mortgage Rates

Land Transfer Tax Rebate In Ontario

The Ontario government gives a maximum $4,000 rebate to first-time house buyers to offset the cost of the land transfer tax. Based on Ontario land transfer tax rates, this rebate refunds the full value of Ontarios land transfer tax for homes up to $368,000 in value.

Visit our Ontario land transfer tax rebate page for more information on conditions and home buyer eligibility.

What If You Can’t Afford A House

There’s nothing more frustrating than wanting to buy a home and either getting denied for a mortgage or deciding you can’t really afford it. This can be an especially big problem for people who live in areas where housing is very expensive.

If you can’t afford a home, don’t get discouraged. Saving for a larger down payment can help you qualify for a better interest rate and make mortgage payments lower so you’re better able to afford monthly costs.

You can also consider options such as looking for a cheaper home you could fix up over time, or buying a home that has room for tenants or roommates who can help you subsidize costs.

Also Check: Are Mortgage Discount Points Worth It

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Don’t Miss: Does Bank Of America Do Mortgage Loans

What Are My Monthly Costs For Owning A Home

There are five key components in play when you calculate mortgage payments

- Principal: The amount of money you borrowed for a loan. If you borrow $200,000 for a loan, your principal is $200,000.

- Interest: The cost of borrowing money from a lender. Interest rates are expressed as a yearly percentage. Your loan payment is primarily interest in the early years of your mortgage.

- Property taxes: The yearly tax assessed by the city or municipality on a home that is paid by the owner. Property taxes are considered part of the cost of owning a home and should be factored in when calculating monthly mortgage payments. However, lenders dont control this cost and so it shouldnt be a major factor when choosing a lender.

- Mortgage insurance: An additional cost of taking out a mortgage, if your down payment is less than 20% of the home purchase price. This protects the lender in case a borrower defaults on a mortgage. Once the equity in your property increases to 20%, you can stop paying mortgage insurance, unless you have an FHA loan.

- Homeowners association fee: This cost is common for condo owners and some single-family neighborhoods. Its money that must be paid by owners to an organization that assists with upkeep, property improvements and shared amenities.

Which Mortgage Calculators Can You Use

There are online mortgage calculators you can use on our website. And while calculating your costs ahead of applying for a £300,000 mortgage can help you to avoid nasty surprises , bear in mind that these calculators wont provide you with an accurate cost, only a rough idea of what you may be eligible for.

For a more accurate calculation on how much a £300,000 mortgage could cost you, speak to a specialist.

Don’t Miss: How To Purchase A House That Has A Reverse Mortgage

Mortgage Rates In Ontario

Mortgage brokers and certain lenders can charge different mortgage interest rates depending on the province. Ratehub.ca has a comprehensive page of the best mortgage rates in Ontario. The most current Ontario mortgage rates are already included in the calculator above, so you can trust the numbers we provide to be accurate.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

You May Like: What Banks Look For When Applying For A Mortgage

What Other Factors Could Affect Your Chances

Most mortgage lenders will consider your whole application before they decide to lend. While each lender will favour different factors over others, many will look at your age, your monthly expenses, the type of property you want to buy and your income sources. For more information on these factors, see our quick summaries below.

How Much A Month Is A 300 000 Mortgage

Monthlymortgagemonthly mortgagemortgagemonthmonth

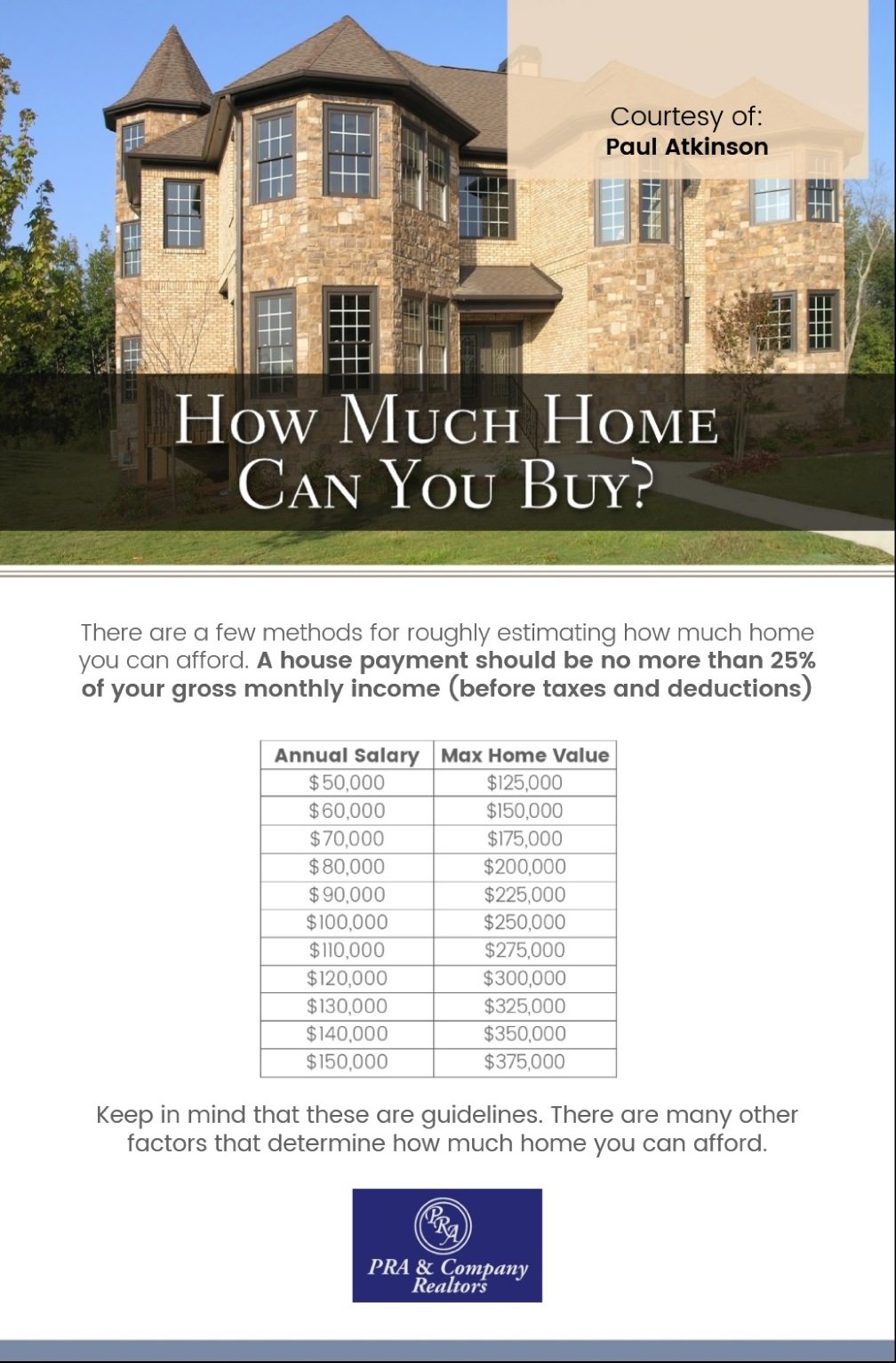

Based on their mortgage calculator it seems reasonable to look at houses up to about $300,000. Their calculator estimates the monthly payments to be about $1500 a month for this price. We will be making about $50,000 a year plus about $20,000ish for a down payment.

One may also ask, how much deposit do I need for a 300 000 House UK? The amount of deposit you’ll need in order to get a mortgage is worked out as a percentage of the value of the property. Typically, you’ll need to save between 5-20 per cent. For example, if your home is £300,000 you’ll need a minimum of £15,000.

Similarly one may ask, how much is a 400k mortgage per month?

Mortgage Loan of $400,000 for 30 years at 3.25%

| Month |

|---|

| 668.25 |

Can I afford a 300k mortgage?

The oldest rule of thumb says you can typically afford a home priced two to three times your gross income. So, if you earn $100,000, you can typically afford a home between $200,000 and $300,000. But that’s not the best method because it doesn’t take into account your monthly expenses and debts.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

Canadian Mortgage Regulations Taxes And Fees

Canada-wide mortgage regulations are set by the Ministry of Finance to help protect home buyers and lenders alike. These regulations include guidelines on minimum down payments, maximum amortization periods, as well as mortgage default insurance.

Here are the key regulations you need to be aware of, and that are included in the Ontario mortgage calculator above:

- The minimum down payment in Canada is between 5% and 10%, depending on the purchase price of the home.

- The maximum amortization is 25 years for down payments under 20% and 35 years for higher down payments.

- Mortgage default insurance – also called CMHC insurance – must be purchased for down payments between 5% and 20%. Visit our CMHC insurance page to learn more.

How Can I Choose The Best Mortgage

If you’re like most people, a mortgage represents the largest long-term debt obligation you’ll ever have. Choosing the right mortgage can set you up for success and help minimize the overall costs of buying the home. Here are four tips to help you shop for the best mortgage:

1. Determine how much you can afford. A home is a large purchase, and you may wonder how much you can realistically afford. Try various scenarios on a mortgage calculator to find out what your optimal loan might look like. No matter how much loan you qualify for, keep in mind that you don’t have to borrow the entire amount.

2. Compare mortgage loan term lengths. A 30-year fixed-rate mortgage is the most popular loan type, but it’s not your only option. Use a mortgage calculator to see how various loan terms impact your monthly payment, the amount of interest you’ll pay, and the total cost of the home. Remember, a longer loan term means lower monthly payments, but you’ll end up paying more interest over the life of the loan. This chart compares how monthly payments and total interest differ for a fixed-rate $250,000 loan at 4%, depending on the loan term:

| Loan Term | |

|---|---|

| $53,735.41 | $303,735.60 |

Read Also: Can You Refinance Mortgage Without A Job

What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

Your Down Payment Determines The Amount Of Cmhc Insurance You Pay

Your CMHC insurance premium, calculated as a percent of your mortgage amount, gets smaller as you increase your down payment. To learn more about CMHC insurance and how it is calculated, please visit our CMHC insurance page.

| Down Payment |

|---|

| 5% – 9.99% |

| Total Payments over 25 Years | $402,726 | $377,991 |

|---|

Under Scenario B, the additional $15,000 put towards the mortgage down payment lowers CMHC insurance by $2,423 and saves the homebuyer around $25,000 in interest over the life of the mortgage. However, it is also important to consider the opportunity cost, or alternative uses for the additional outlay under Scenario B. You must look at your expected returns associated with RRSP contributions, stock investments, and/or debt repayments, for example, to make an informed decision.

You May Like: Can A Locked Mortgage Rate Be Changed

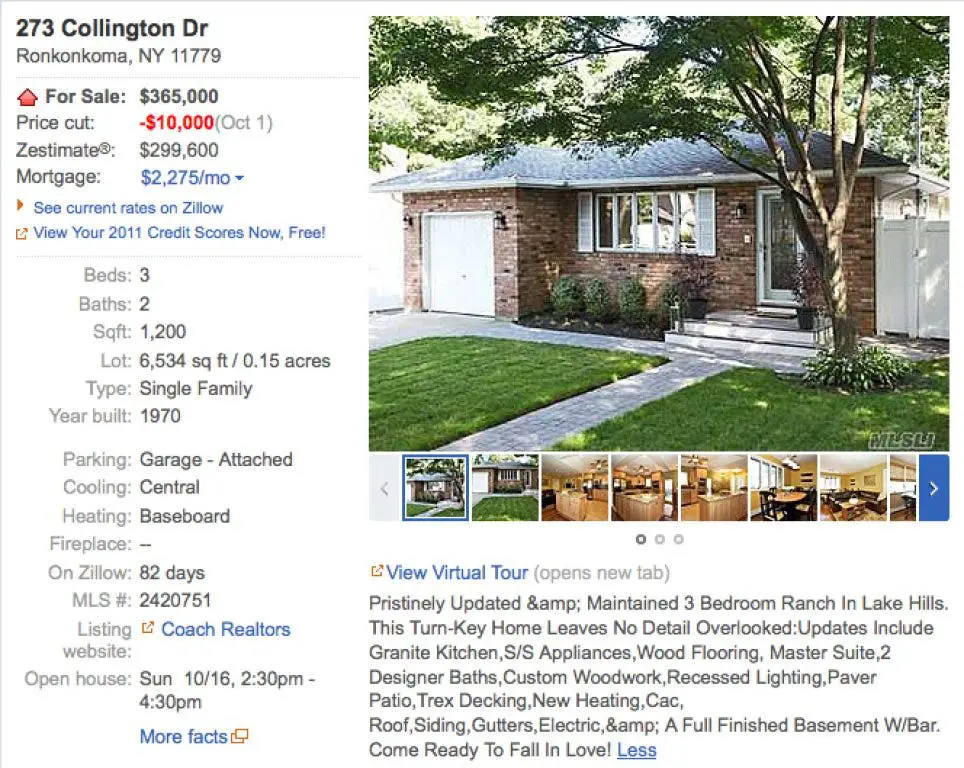

Where To Get A $300000 Mortgage

To get a $300,000 home loan, youll want to get quotes from at least a few different lenders. Though this can be done by reaching out to each mortgage company directly, you can also use an online marketplace like Credible.

Once you receive your quotes, youll want to compare them line by line. You should look at the interest rate, total costs on closing day, any origination fees, mortgage points youre being charged, and more.

After you determine the best offer, you can move forward with that lenders application and submit any required documentation.

Credible makes the process of finding the right mortgage rate easier and more efficient. You can get tailored prequalified rates from our partner lenders simultaneously all with just one form and it only takes a few minutes.

Learn More: How to Know If You Should Buy a House

Other Ontario Closing Costs

There are a number of other Ontario closing costs to consider when purchasing a home.

Legal fees: There are many legal aspects to consider when purchasing a home. With that in mind, its important to hire an experienced real estate lawyer to review all of your paperwork and help you finalize your transaction.

Home Inspections: Its wise to use an home inspector before purchasing a home, to make sure the home youre about to buy is in good condition.

Recommended Reading: How Much Interest Do I Pay On A Mortgage

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

You May Like: Can There Be A Cosigner On A Mortgage

Whats The Monthly Payment On A $300000 House

We can turn to The Mortgage Reportsmortgage calculator to model the monthly payments on a $300,000 home.

Note: The below examples include only loan principal and mortgage interest. Were ignoring things like property taxes, homeowners insurance, and homeowners association dues because they vary so widely from place to place.

You can use the calculators to model your own options using todays mortgage rates.

Weve used the same mortgage rate for each example. But different types of mortgages have different rates. And mortgage rates may well have changed by the time you read this.

We also specified the minimum down payment for a $300K house in each case. But you can input whatever you have saved.

What Is The Minimum Down Payment Required In Canada

The minimum down payment in Canada depends on the purchase price of the home:

- If the purchase price is less than $500,000, the minimum down payment is 5%.

- If the purchase price is between $500,000 and $999,999, the minimum down payment is 5% of the first $500,000, and 10% of any amount over $500,000.

- If the purchase price is $1,000,000 or more, the minimum down payment is 20%.

Mortgage default insurance, commonly referred to as CMHC insurance, protects the lender in the event the borrower defaults on the mortgage. It is required on all mortgages with down payments of less than 20%, which are known as high-ratio mortgages. A conventional mortgage, on the other hand, is one where the down payment is 20% or higher.

According to a recent TD Canada Trust Home Buyers Report1, 30% of homebuyers plan to or have at least a 20% down payment, the point at which mortgage default insurance is no longer required.

Recommended Reading: How Do You Calculate Self Employed Income For A Mortgage