Mortgage Loan Insurance Premiums When You Switch Lenders

You may have to pay a new mortgage loan insurance premium when you switch lenders, if:

- the amount of your loan increases

- you extend the amortization period

If you already have mortgage loan insurance on your existing mortgage, tell your new lender. This may help you avoid paying mortgage loan insurance premiums twice. Ask your existing lender for a certificate number. They can provide you with a copy of the insurance certificate when you receive your mortgage contract.

You need to sign the registration documents that are part of your mortgage contract. You may have to meet with your lawyer or notary.

Mortgage Rates And The Pandemic

It looked like a puzzle: As the COVID-19 pandemic spread, central banksincluding the Bank of Canadaquickly cut interest rates to cushion the blow. But rates on new mortgages didnt decline much, and some actually went up. Why?

Remember that your lenders funding cost determines most of the mortgage rate. The cost of funding jumped in the early days of the pandemic as investors became nervous. Many simply wanted to hold on to their cash given how uncertain everything was. So, the funding that is normally easy for lenders to get slowed to a trickle. This drove up the funding cost, even as the Bank of Canadas policy interest rate fell.

The Bank of Canada has taken many steps to help financial markets work better during the pandemic, along with the federal government and other public authorities. The goal is to ease strains in funding markets, so lenders can keep supplying credit to households and businesses.

These steps include launching programs to make sure lenders can access the funding they need. As a result of these actions, funding costs fell and some mortgage rates on new loans started to decline.

Keep in mind: existing mortgages didnt become more expensive during the pandemic. They either have an interest rate that is fixed until its next renewal, or a variable interest rate that declined along with the Bank of Canada policy rate.

A Bank Vod Wont Solve All Bank Statement Issues

Verifications of Deposit, or VODs, are forms that lenders can use in lieu of bank statements. You sign an authorization allowing your banking institution to hand-complete the form, which indicates the account owner and its current balance.

VODs have been used to get around bank statement rules for years. But dont count on them to solve the above-mentioned issues.

First, the lender can request an actual bank statement and disregard the VOD, if it suspects potential issues.

Second, depositories are also required to list the accounts average balance. Thats likely to expose recent large deposits.

For instance, if the current balance is $10,000 and the two-month average balance is $2,000, there was probably a very recent and substantial deposit.

In addition, theres a field in which the bank is asked to include any additional information which may be of assistance in determination of creditworthiness.

Thats where your NSFs might be listed.

There are good reasons to double-check your bank statements and your application before sending them to your lender. The bottom line is that you dont just want to be honest you want to avoid appearing dishonest.

Your lender wont turn a blind eye to anything it finds suspicious.

Recommended Reading: Does Chase Allow Mortgage Recast

Calculate How Much House You Can Afford

Before you get your sights set on your dream home, make sure you can afford it.

Estimate how much house you can afford to buy by using the 28/36 rule. This refers to your debt-to-income ratio, or the total amount of your gross monthly income thats allocated to paying debt each month. For example, a 50% DTI means you spend half of your monthly pre-tax income on debt repayment.

Ideally, your front-end DTI, which includes only your mortgage-related expenses, should be below 28%. Your back-end ratio, which includes the mortgage and all other debt obligations, should be no more than 43%, though under 36% is ideal.

If your DTI is too high, youll need to work on reducing or eliminating some existing debt before you apply for a home loan.

And remember, your monthly loan payment is just one piece of the puzzletheres also interest, homeowners insurance, property taxes and, potentially, homeowners association fees. Youll also need to consider how much of a down payment you can contribute, and whether youll be required to pay private mortgage insurance .

There are also plenty of online calculators that can help you run the numbers.

Minimum Credit Score Required For Mortgage Approval In 2021

Categories

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

Recommended Reading: Does Rocket Mortgage Affect Your Credit Score

If Youre Using Money From Your Rrsp

provide a 3-month history of the RRSP account too. If you are withdrawing under the Home Buyers Plan, the funds must have been in the account for 90 days. And make sure you budget enough time to make sure your funds can be transferred out in time. Check out my post about the Home Buyers Plan to get all the details.

If Your Deposit Is From Savings

If we need to see the deposit in your bank account statements, well let you know in your Decision in Principle.

The number of bank statements well need depends on the location of your savings account:

- Within the UK and European Economic Area well need to see 1 statement.

- Outside of the UK and EEA well need to see 3 months of statements.

- If we do not need to see your deposit, we wont ask to see any bank statements.

Read Also: How Many Years Left On Mortgage

The Bank Of Canada Influences Interest Rates

The Bank of Canada also affects interest rates, mainly through changes in our policy interest rate.

The Bank of Canada doesnt set mortgage rates. But it does have some impact on them.

When the economy is strong, we may raise this rate to keep inflation from rising above our target. Likewise, when the economy is weak, we may lower our policy rate to keep inflation from falling below target. Changes in the policy interest rate lead to similar changes in short-term interest rates. These include the prime rate, which is used by the banks as a basis for pricing variable-rate mortgages. A policy-rate change can also affect long-term interest rates, especially if people expect that change to be long-lasting.

In the past, high and variable inflation eroded the value of money. In response, investors demanded higher interest rates to offset those effects. This increased funding costs for mortgage lenders. But since the Bank of Canada began targeting inflation in the 1990s, interest rates and uncertainty about future inflation have declined. As a result, funding costs are now much lower.

What Does A Mortgage Underwriter Do

A mortgage underwriters job is to assess delinquency risk, meaning the overall risk that you would not repay the mortgage. To do so, the underwriter evaluates factors that help the lender understand your financial situation, including:

- Your credit score

- Your credit report

- The property you intend to buy

The underwriter then documents their assessments and weighs various elements of your loan application as a whole to decide whether the risk level is acceptable.

Heres an example from Fannie Maes underwriting guidelines. Say a given lender typically requires the following to approve a mortgage:

- Maximum loan-to-value ratio of 95 percent

- Maximum debt-to-income ratio of 36 percent

If an applicant falls short in one area, the loan might still be approved based on the strength of other factors, such as:

- LTV ratio

- Type of property and how many units it has

- DTI ratio

- Financial reserves

So, if you had a higher DTI say 40 percent you might get approved for a mortgage as long as you have a better credit score. If your LTV ratio was lower than 95 percent, you might be able to get mortgage approval even with a lower credit score, like 620.

Don’t Miss: What Is A Teaser Rate Mortgage

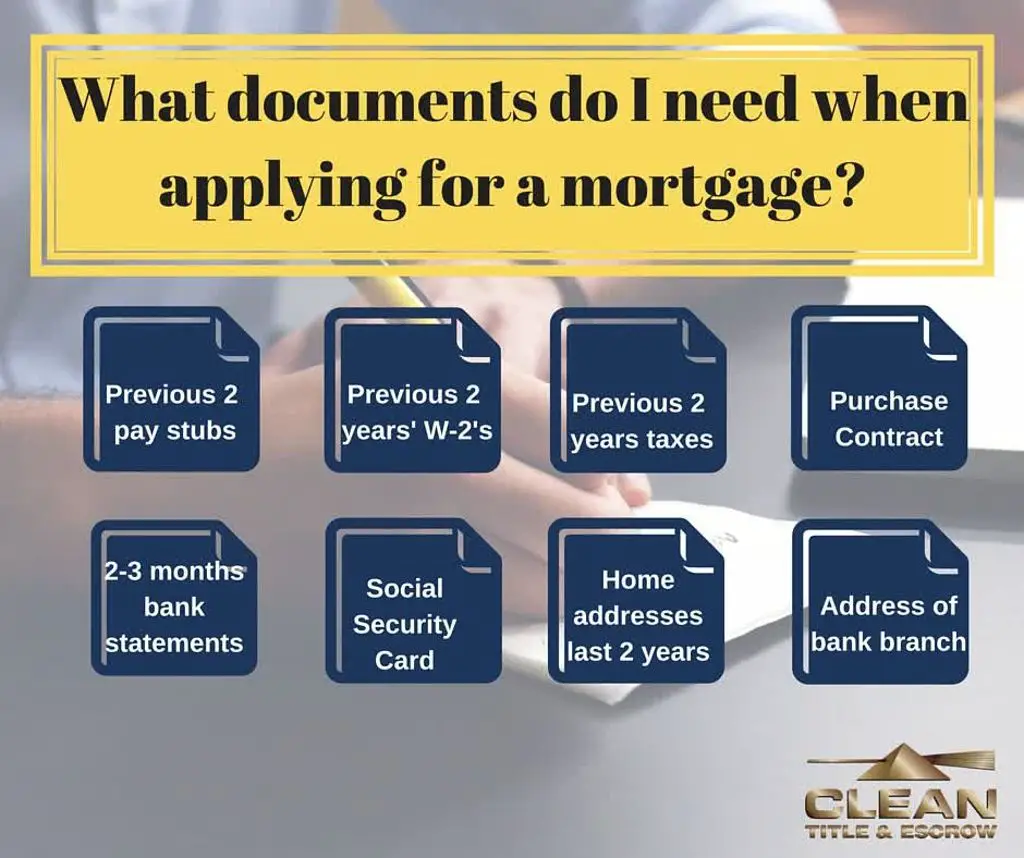

What Documents Do I Need To Present To The Bank To Apply For A Mortgage As A First

Most lenders look for information about your income, employment, living costs and existing loan repayments to help them decide whether you can afford to repay a loan.

If you are a PAYE employee, you will typically need to provide:

- Your last three months payslips

- The last six months bank account statements .

If you are self-employed:

- Your last two years certified/audited accounts

- The last six months business bank account statements .

You may also be required to provide identification documents and confirmation of your address. This is usually a current valid passport or driving licence and recent utility bill.

You may need to provide your last years Employee Detail Summary from Revenue.ie if you are relying on variable income to support your mortgage application

If your application is approved in principle, the following are examples of documents that you will also be asked to provide:

- PAYE applicants: a Certificate of Income .

- Self-employed: your accountants or auditors written confirmation that your personal/business tax affairs are up to date, and your management figures for the current trading year.

Bank Statements And Other Assets

When assessing your risk profile, lenders may want to look at your bank statements and other assets. This can include your investment assets as well as your insurance, such as life insurance.

Lenders typically request these documents to make sure you have several months worth of reserve mortgage payments in your account in case of an emergency. They also check to see that your down payment has been in your account for at least a few months and did not just show up overnight.

You May Like: What Information Do You Need To Prequalify For A Mortgage

Shopping For A Mortgage Online

In todays tech-savvy world, many mortgage lenders and brokers have automated the application process. This can be a huge time-saver for busy families or professionals as they balance choosing the best mortgage, searching for a home, and their day-to-day lives. Some lenders even provide apps so you can apply, monitor, and manage your loan from a mobile device.

Running a Google search for mortgage lenders will give you about 500 million results, along with with a lot of company ads, top lender recommendations from personal finance sites and news stories. At a glance, it can be overwhelming. Its always good to browse different lenders sites to familiarize yourself with their loan products, published rates, terms, and lending process. If you prefer to apply online with minimal face-to-face or phone interaction, look for online-only lenders. If you do business with a bank or credit union, check online to see what products and conditions they offer. Remember, comparison shopping, along with working on your credit and financial health, will help you find the best loan for your needs.

As you search online, youll inevitably encounter lending marketplaces or personal finance sites that recommend specific lenders. Keep in mind that these sites usually have a limited network of lenders. Also, they typically make money on referrals to lenders featured on their site. So dont rest on those recommendations without doing additional shopping on your own.

Why Do People Need Mortgages

The price of a home is often far greater than the amount of money most households save. As a result, mortgages allow individuals and families to purchase a home by putting down only a relatively small down payment, such as 20% of the purchase price, and obtaining a loan for the balance. The loan is then secured by the value of the property in case the borrower defaults.

Recommended Reading: Is 3.99 A Good Mortgage Rate

Mortgage Down Payment Sources

There are a number of ways you can source funds for a mortgage down payment. Traditional sources include saving a fixed amount from every paycheque, selling stocks, bonds or personal property, or reaching out to immediate family, for example. Another great option is the RRSP Home Buyers’ Plan which lets first-time homebuyers withdraw up to $35,000 from Registered Retirement Savings Plans for a home purchase, tax-free. Many first-time homebuyers take advantage of this opportunity and set up RRSP accounts well in advance, with the intention to reap the rewards when it is time to purchase real estate.

Non-traditional sources for a down payment include borrowed funds, and gifts from non-immediate family members. It is important to note, however, that when you employ non-traditional sources for your down payment, you will incur a CMHC insurance surcharge of 0.15% for down payments of 5% or less.2

What Banks Look At When Approving A Home Loan

Are you ready to buy a house, or in the planning stages of a home purchase? Either way, it helps to know what banks look for when they evaluate your loan application. Banks need to make sure youre likely to repay a home loan according to the terms of your mortgage agreement. In making this assessment, they consider a variety of factors related to your past and present financial situation.

What specific financial information will the banks look at? Here are a few items virtually all lenders consider before approving a home loan:

1. Credit Score

Also known as your FICO score, this number between 300 and 850 helps banks get a handle on your past credit history. The higher the number, the better. A low credit score tells banks youre a risky borrower, and it could be harder to receive a loan.

How is your credit score calculated? By using a variety of metrics such as:

Payment history. Do you pay off your credit cards every month or carry a balance? Payment history influences your credit score more than any other factor. A history of timely payments will help your score stay high.

Credit utilization. This is the amount of credit you use versus the credit you have available. Lets say your credit card has a $9,000 limit. A balance of $1,800 indicates 20% utilization while a balance of $8,100 indicates 90% utilization. The former is better for your credit score as 90% utilization suggests youre too overextended to pay bills on time.

2. Income

3. Current Loans

Did you know?

Also Check: How Much Is The Mortgage On A $300 000 House

If You Are Getting Money From Outside The Country

get the money into Canada at least 30 days before funding, and provide a 90 day confirmation via bank statements from the previous account. Some lenders will ask that the money have been in a Canadian bank account for 90 days or more, so make sure you investigate this early if this applies to you!

How Far Back Do Mortgage Lenders Look At Bank Statements

Generally, mortgage lenders require the last 60 days of bank statements.

To learn more about the documentation required to apply for a home loan, Contact a loan officer today.

The above information is for educational purposes only. All information, loan programs and interest rates are subject to change without notice. All loans subject to underwriter approval. Terms and conditions apply.Always consult an accountant or tax advisor for full eligibility requirements on tax deduction.

Read Also: How To Reduce My Monthly Mortgage Payment

What Does Fixed Vs Variable Mean On A Mortgage

Many mortgages carry a fixed interest rate. This means the rate will not change for the entire term of the mortgage even if interest rates rise or fall in the future. A variable or adjustable-rate mortgage has an interest rate that fluctuates over the loan’s life based on what interest rates are doing.

Basic Concepts And Legal Regulation

According to Anglo-American property law, a mortgage occurs when an owner pledges his or her interest as security or collateral for a loan. Therefore, a mortgage is an encumbrance on the right to the property just as an easement would be, but because most mortgages occur as a condition for new loan money, the word mortgage has become the generic term for a loan secured by such real property.As with other types of loans, mortgages have an interest rate and are scheduled to amortize over a set period of time, typically 30 years. All types of real property can be, and usually are, secured with a mortgage and bear an interest rate that is supposed to reflect the lender’s risk.

Mortgage lending is the primary mechanism used in many countries to finance private ownership of residential and commercial property . Although the terminology and precise forms will differ from country to country, the basic components tend to be similar:

Many other specific characteristics are common to many markets, but the above are the essential features. Governments usually regulate many aspects of mortgage lending, either directly or indirectly , and often through state intervention . Other aspects that define a specific mortgage market may be regional, historical, or driven by specific characteristics of the legal or financial system.

Also Check: How To Determine What You Qualify For A Mortgage