Loan Master Dickson Tn

1. LoanMaster in Dickson, TN The Guaranteed Loans! Find complete information about LoanMaster in Dickson 1828 TN-46, Dickson, TN 37055, United States: photos, phone, address, E-mail, working hours! Get directions, reviews and information for Loanmaster in Dickson, TN. Loanmaster. 1828 Highway 46 S, Dickson, TN 37055. 441-3422.

Recommended Reading: How To Check Credit Score With Itin Number

How Your Credit Score Affects Your Interest Rates

Knowing your credit score is the first step in getting the best rates on your mortgage. While mortgage interest rates are currently at an all-time low, they drop even lower when your credit score is above 760.

According to FICO, the current interest rate for a 30-year fixed mortgage is 2.377% APR for a 760+ borrower, and 3.966% for a borrower with a score between 620 and 639 .

This 1.589% savings in APR may seem negligible. But it means saving about $260 per month on your mortgage, or $3,120 per year and roughly $93,600 over the lifetime of the loan.

If you currently have a mortgage and are interested in seeing if you can switch to a better rate, look into the pros and cons of refinancing your home.

How Credit Scores Affect Mortgage Rates

A loan savings calculator, such as the one offered by myFICO, can demonstrate the impact of credit scores on mortgage rates. Enter your state, mortgage amount, and credit score range, and get an idea of what your mortgage terms would be. Such calculators provide only estimates. Your mortgage lender can give you exact terms after reviewing your complete financial details and down payment.

Enter a $200,000 principal on a 30-year fixed-rate loan, and your credit score ranges, mortgage rates, and overall costs, might look something like this :

- 760 to 850: APR of 2.695% with a monthly payment of $811. The total interest paid on the mortgage would be $91,840.

- 700 to 759: APR of 2.917% with a monthly payment of $834. The total interest paid on the mortgage would be $100,341.

- 680 to 699: APR of 3.094% with a monthly payment of $853. The total interest paid on the mortgage would be $107,217.

- 660 to 679: APR of 3.308% with a monthly payment of $877. The total interest paid on the mortgage would be $115,645.

- 640 to 659: APR of 3.738% with a monthly payment of $925. The total interest paid on the mortgage would be $132,953.

- 620 to 639: APR of 4.284% with a monthly payment of $988. The total interest paid on the mortgage would be $155,631.

You can experiment with your own numbers, including down payment amount, loan term, and property taxes, using our mortgage payments calculator.

Also Check: Does Rocket Mortgage Sell Their Loans

Why Your Credit Score Matters When Applying For A Mortgage

by Matt Frankel, CFP® | Updated Sept. 27, 2021 – First published on Oct. 22, 2018

Your credit score is a major factor in the mortgage approval process for two reasons. First, most lenders have a minimum credit score requirement, and if your score falls below this threshold, your application will be rejected.

In addition, your credit score plays a big role in determining the mortgage interest rate you’ll be offered. And, you may be surprised at the difference that a small reduction in your rate can make over the term of a 15- or 30-year mortgage loan.

Can I Get A Mortgage With A Low Credit Score

It is possible to get a mortgage with a low credit score, but youll pay higher interest rates and higher monthly payments. Lenders may be more stringent about other aspects of your finances, such as how much debt you have, if your credit is tarnished.

Keep in mind that credit requirements vary from lender to lender. Shop around with multiple lenders to find one that will work with you.

You May Like: Chase Recast Calculator

How Your Credit Score Affects Your Mortgage

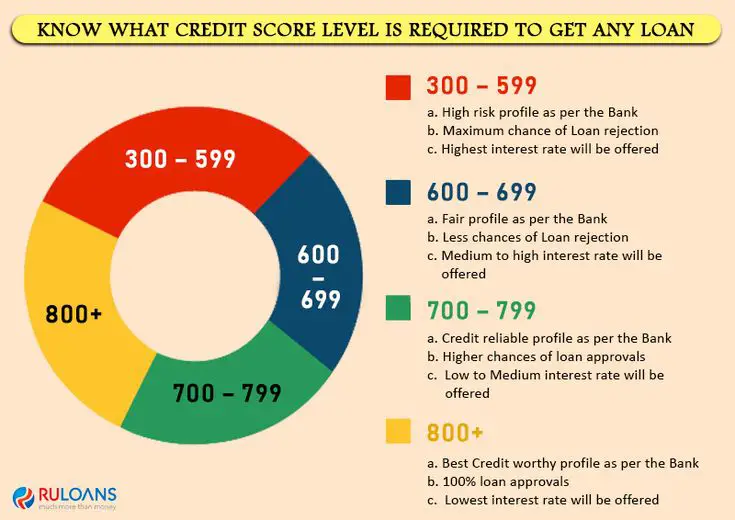

Your credit score can have a positive or negative impact on your mortgage. A high credit score will work in your favour, while a low score or no credit history will work against you. This is because your credit determines how much of a risk you are for defaulting on your mortgage loan.

If your credit score indicates that you dont have a lot of debt and make regular, timely payments, youll have a higher credit score and will be seen as low-risk. If you have lots of debt and pay your bills late, youll have a lower score and will be seen as high-risk.

Understandably, banks dont want to lend lots of money to someone they deem as potentially unlikely to pay it back. If they do, it will be at a much higher interest rate that reflects that risk. Those higher interest rates mean higher mortgage payments and a larger cost over time.

Contact An Expert That Has Experience

If youre still unsure of what to do, dont risk lowering your credit score by applying with an unsuitable lender. Each time you actively apply for credit can bring your credit score down. Furthermore, being declined can have a severe effect on your credit score. Speak to a mortgage advisor before approaching a lender yourself.

Read Also: Chase Mortgage Recast Fee

Are You Ready For All The Fees That Go Side By Side With Purchasing A Home

Do you have enough money saved to cover home inspection? Can you afford the property taxes? Earlier we created a list of fees first time homeowners need to be budgeting for. Take a look at this list of fees that youre likely to encounter while purchasing a home and ensure you can take them all on without jeopardizing your credit score or financial stability.

If you find that these fees makes purchasing a home slightly out of reach, just remember: there is no rush. It is far better to wait before going into something so long-term prepared, rather than jumping into it without being totally ready for what youre getting yourself into.

Its good practice to work hard for about 6 months towards a better credit score for a mortgage prior to applying. This establishes a decent history of good credit management and can boost your score significantly if you keep all your credit products in order. If you want to be able to grow your credit score even faster, consider starting a credit building program from Refresh Financial – theres no money required up front to get started and all your on-time payments are going to be reported to the credit bureaus just like a loan. .

Buying a home is stressful, but you can take a lot of that stress out of the equation if you go into it with good credit. It requires patience, self-discipline, and sacrifice, but it will all be worth it when youre sitting in your cozy new home as a first time home-buyer.

****

Your Credit Score For A Mortgage Should Be 680 Or Above

To qualify for the best mortgage rates available, your credit score should be at least 680 or higher. If your credit score is lower than 680, you have a couple of option. You’ll find some mortgage providers will offer you a mortgage if your score is between 600 and 680, but it’s very likely you’ll pay much higher interest rates. Another option is to improve your credit score prior to purchasing a home. If this sounds like the better option for you, why not consider a secured savings program to build credit? Its a low-risk option that will have a positive effect on your credit right away. Plus, it will leave you with some savings!

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

Minimum Credit Score Required For Mortgage Approval In 2022

Home \ Mortgage \ Minimum Credit Score Required For Mortgage Approval in 2022

Join millions of Canadians who have already trusted Loans Canada

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

What Credit Score Do I Need To Buy A House

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

The credit score needed to buy a house depends on the type of mortgage loan you’re applying for and your lender. While it’s possible to get a mortgage loan with bad credit, you typically need good or exceptional credit to qualify for the best terms.

Read on to learn what credit score you’ll need to buy a house and how to improve your credit leading up to a mortgage application.

Recommended Reading: 10 Year Treasury Yield Mortgage Rates

What Credit Score Do You Need To Be Approved For A Mortgage In Canada

When it comes to getting a mortgage, the higher your credit score, the better. A good credit score will ensure that you:

In Canada, . Anything above 650 is considered to be good, which means that your risk for defaulting on your mortgage is low and youre a safe candidate for a loan.

While it will vary from lender to lender, in general, the minimum credit score to be approved for a mortgage is 650. Some lenders may go a little lower, but again, higher is better. A credit score above 700 is considered optimal when applying for a mortgage.

Several factors can impact your credit score, including:

- Payment history. Do you pay your on time?

- . You should use less than 35% of your available credit.

- The longer you have had your credit accounts, the better.

- New credit requests. How recently and often have you applied for new loans or credit cards?

- Types of credit. Having a mix is best, such as a .

If youre unsure of your credit score, you can get it from one of the two credit-reporting agencies in Canada: Equifax Canada or TransUnion. You can request a free copy of your credit score each year .

» MORE:How to check your credit score

Check Your Credit Score And Reports

Knowing where you stand is the first step to preparing your credit for a mortgage loan. You can check your credit score with Experian for free, and if it’s already in the 700s or higher, you may not need to make many changes before you apply for a preapproval.

But if your credit score is low enough that you risk getting approved with unfavorable terms or denied altogether, you’ll be better off waiting until you can make some improvements.

Whether or not your credit is ready for a mortgage, get a copy of your credit reports to check for potential problems or concerns. You can get a free copy of your credit report every 30 days from Experian or from each of the three national credit reporting agencies every 12 months at AnnualCreditReport.com.

Once you have your reports, read through them and watch for items you don’t recognize or are outright inaccurate or fraudulent. If you find any inaccuracies, you can dispute them with the credit reporting agencies. This process can take time, but it can also improve your score quickly if it results in a negative item being removed.

Recommended Reading: Rocket Mortgage Vs Bank

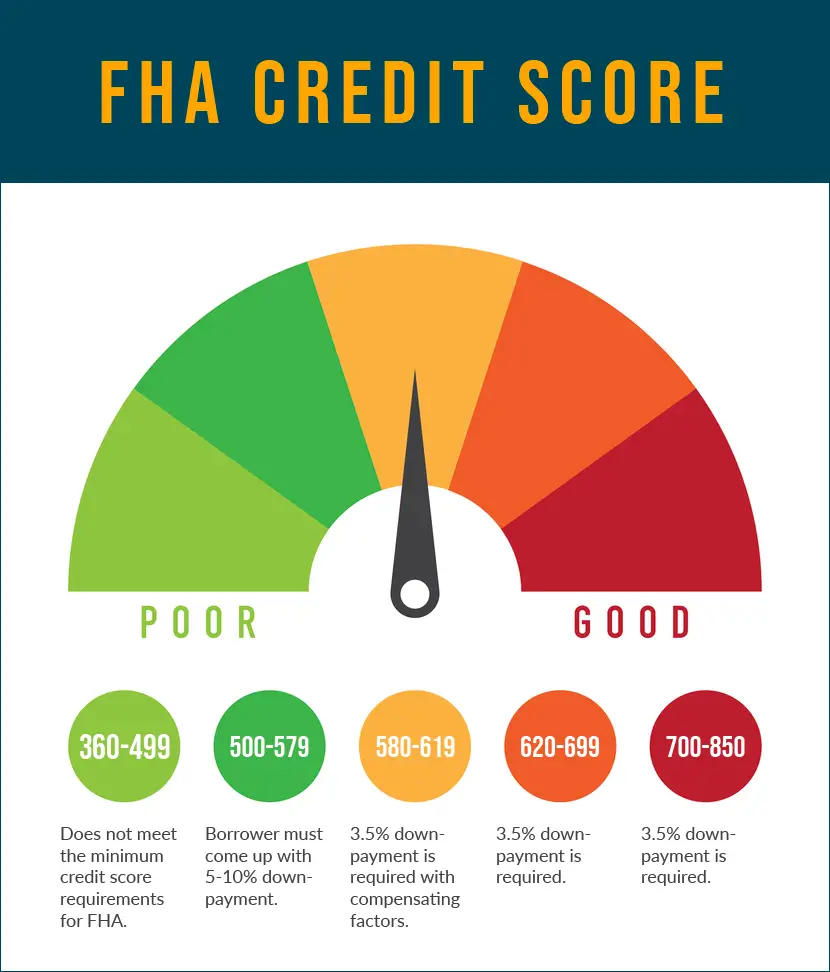

What Credit Score Is Needed For A Va Loan

Qualifying service members, veterans and surviving spouses can buy homes with little or no down payment and no private mortgage insurance requirements, thanks to housing benefits from the U.S. Department of Veterans Affairs, commonly known as VA loans. Issuers of VA loans have some discretion in setting minimum credit score requirements, but they may accept applications from borrowers with FICO® Scores as low as 620.

What Credit Score Do You Need To Buy A House In 2022

A lot of first-time home buyers worry that their credit scores are too low to buy a home. First, know that whether your credit score is good or bad is subjective and wont affect your home-buying. Second, mortgage lenders are bound by specific rules which determine what credit scores you need to buy a house, and those rules vary by your loan type.

Conventional loans are the most common loan type. On the credit score scale, which ranges from 350-850, conventional loans require a credit score of at least 620. Other loan types allow for lower credit score minimums, and some mortgage programs have no credit score requirement whatsoever.

Read on for details by loan type, or jump to learn more about your credit score:

Read Also: Rocket Mortgage Loan Types

Besides Credit Scores What Else Do Mortgage Lenders Look At

Your credit score is a main factor that lenders look at when qualifying you for a mortgage, but itâs not the only one. Other factors mortgage lenders consider when approving you for a mortgage include:

-

Your income

-

Your employment

-

Your payment history

Your current sources of debt include:

-

Student loan payments

-

Open lines of credit

Youâll also need to pass the mortgage stress test. The mortgage stress test proves to the lender that you can afford higher mortgage payments if and when higher mortgage rates arrive.

A mortgage lender will take all of these factors into account when deciding whether to approve your mortgage application. You donât have to be perfect, although if youâre strong in all or most of these areas, it can help make the mortgage approval process go much smoother.

Itâs a good idea to get pre-approved with a mortgage broker before looking at properties. If youâre not qualifying for the purchase price that you want, the mortgage broker can make suggestions to help you qualify, such paying down debt or bringing on additional income via a co-signer.

How Much Deposit Do I Need To Get A Mortgage With A Poor Credit Score

It may be the case that to access your chosen lenders rates and meet their terms, you have to deposit a higher percentage of the properties market value. That being said, the amount of deposit you need to get a mortgage will vary depending on a whole host of factors including your age and the type of property you want to buy.

There isnt a typical deposit size, but some lenders ask applicants to deposit as much as 30% for a mortgage if they have a poor credit score or low affordability.

For a home valued at £200,000 that would equate to a £60,000 deposit. Large deposits arent a viable option for a lot of borrowers and thankfully there are a handful of lenders that appreciate this and may be more willing to lend under more flexible terms.

You May Like: Can You Get A Reverse Mortgage On A Mobile Home

How To Improve Your Credit Score Before Applying To Refinance Your Home

The most important thing to do is to understand how your credit score works. Once you have that down, you can take the necessary steps to improve your score. And because your recent credit history is weighted more heavily, you should ensure you have several clean months of credit history before applying for a refinancing loan.

Also Check: Approval Odds For Care Credit

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

Also Check: Rocket Mortgage Qualifications

How Much Does It Cost To Refinance Your House

In 2020, the average cost for a refinance of a mortgage on a single-family home was $3,398, ClosingCorp reports. Generally, you can expect to pay 2% to 6% of the loan principal amount in closing costs. For a $200,000 mortgage refinance, for example, your closing costs could run from $4,000 to $10,000.