Why Use A Mortgage Payment Calculator

When planning to buy a home, it’s easy to focus on the headline figures, like the final purchase price or your overall mortgage amount. But in many way, the most relevant number for your mortgage will be your regular repayments. After all, your mortgage payments are the amount that you’ll need to take from your pay cheque each month to keep your mortgage under control.

Using a mortgage payment calculator like the one above takes the guess work out of your mortgage payments. Our calculator lets you understand how much you’ll need to pay each month for any size of mortgage, with any rate. This means you can compare homes and mortgage products with confidence, all the while knowing exactly how much you’ll be on the hook for in each scenario.

How Are Average Mortgage Payments Per Month Determined

The average mortgage payment is determined by all the same factors that make up each individual borrowers monthly mortgage payment, just on a larger scale that reflects all the choices people of a given population make. After all, behind any average or median are millions of individuals, each going about their lives and making the decisions that make the most sense for them.

If youre a hopeful home buyer looking at these averages, its important to remember that your own mortgage is going to depend on factors that are unique to your situation, and your monthly payment might end up being anything but average. Thats why its a good idea to understand what factors can influence a mortgage payment, so you understand the why behind the averages.

Average Monthly Mortgage Loan Payment In Canada In 3rd Quarter 2020 And 3rd Quarter 2021 By Metropolitan Area

| Characteristic |

|---|

You need a Statista Account for unlimited access.

-

Full access to 1m statistics

-

Incl. source references

-

Available to download in PNG, PDF, XLS format

You can only download this statistic as a Premium user.

You can only download this statistic as a Premium user.

You can only download this statistic as a Premium user.

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

…and make my research life easier.

You need at least a Single Account to use this feature.

Read Also: Recast Mortgage Chase

How To Calculate Your Monthly Mortgage Payment

While averages can be helpful in showing you what people typically pay, when planning for your expected costs as a homeowner its much better to base your anticipated monthly payment on the factors that are unique to you: your home buying budget, your planned down payment, the interest rate youre likely to get and the area you plan on purchasing in.

To get an idea of how much you might pay for a mortgage each month, try using an online mortgage calculator like this one from Rocket Mortgage®. These calculators let you input those unique factors and give you an estimate thats specific to your circumstances.

Save For A 20% Down Payment

You dont need to pay for private mortgage insurance when you put 20% down on your loan. PMI can add quite a bit of money to your monthly payment, so avoiding it can significantly reduce what you pay each month. You may also be able to avoid paying for mortgage insurance if you have a VA loan and pay the funding fee upfront.

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

More Than The Monthly Payment

If youre trying to figure out how much to spend on a home, remember that theres more to your home purchase than the monthly mortgage payment.

Taxes and insurance are often added to your monthly payment automatically. Your lender collects funds from you, places the money in escrow, and pays required expenses on your behalf.

Homeowners Association dues might also be a significant monthly expense. Those costs cover a variety of services in your community or building, and skipping those payments can lead to liens on your property, and potentially even foreclosure.

Other costs of homeownership can be surprisingly high. You might not pay those expenses monthly, but its helpful for some people to budget for a monthly savings amount for those costs. You need to maintain your property, replace appliances periodically, and more.

Some people suggest a budget of 1% of your property value each year for maintenance. But its easy to go higher than that, especially with older properties. If you need to buy furniture or make upgrades before moving in, you face additional up-front costs.

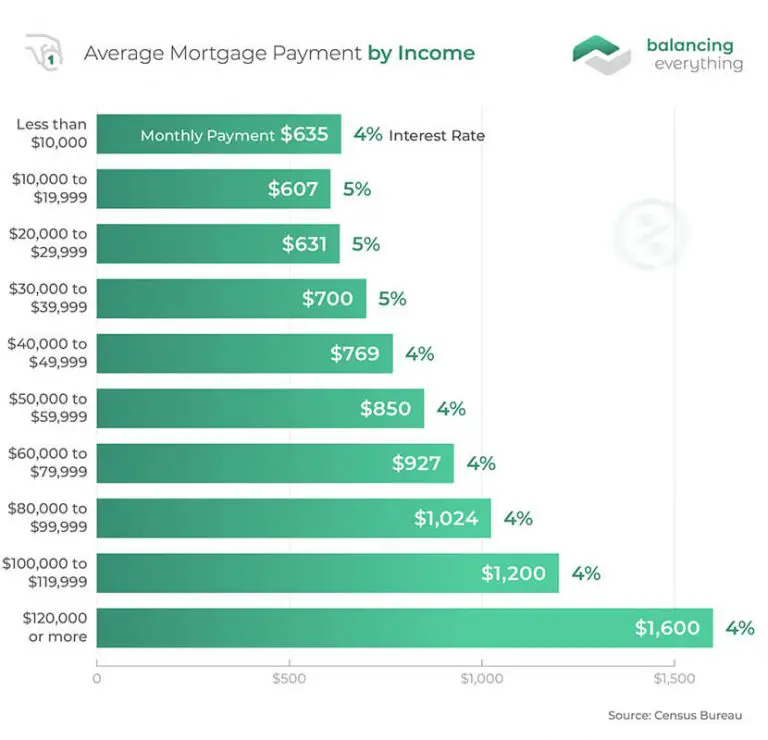

Mortgage Payments By Income

Just like the average mortgage payment in Utah is different from payments elsewhere, this segment varies by income, as well. According to the data provided by the US Census Bureau, Americans making the most money have the highest average house payments per month. People from this income group, interestingly, dont have the highest median interest rate.

The highest mortgage interest rates are reserved for Americans making between $10,000 and $39,999. Those from the $10,000-19,999 income group are among the consumers paying the highest interest rate. Yet, they boast the lowest typical mortgage payment per month.

As you can see in the table above, households making $120,000 or more pay the highest median mortgage of about $1,600. Those making $10,000-19,999 meanwhile pay the lowest median mortgage payment per month of $607.

The difference between the highest and lowest median payments is an impressive $993. The first group gets better median rates of 4%, while the latters median mortgage rate is 5%.

You May Like: Can You Do A Reverse Mortgage On A Condo

Average Mortgage Interest Rates As Of May 2021

| Rate Type | |

|---|---|

| 2 year fixed rate, 95% LTV | 3.85% |

| 2 year fixed rate, 75% LTV | 1.46% |

| 3 year fixed rate, 75% LTV | 1.72% |

| 5 year fixed rate, 75% LTV | 1.74% |

| 10 year fixed rate, 75% LTV | 2.58% |

| BSA.org.uk |

Please note that mortgage rates vary greatly from one lender to another, as well as there being different deals available with the same lender for different circumstances e.g. Loan to Value amount, applicants credit history, etc.

Therefore, the mortgage interest rates are very attractive for mortgage applicants right now, although there are other factors that are not as attractive, such as the requirement to provide a deposit in order to get a mortgage loan and higher house values.

The current market shows that Halifax are offering an initial rate as low as 1.23% . At the other end of the rates scale are the bad credit mortgages, with Kensington providing an initial rate of 5.59% . So there really is a huge gulf in the interest rates that are available, depending on the applicants circumstances and the details of the loan.

How Much Is The Average Loan Amount For First Home Buyers

According to Finder.com.au, the average loan amount for first home buyers was $451,002 as of May 2021, an average increase of roughly 16% since 2019. This number is a good indication of what first home buyers around the country can afford, but everyones loan size should be a personal choice based on their financial situation. Ultimately, when it comes to your mortgage, you dont want to bite off more than you can chew, which could leave you with financial difficulties and stress for years to come.

Do as much research as possible to figure out what size mortgage you would be comfortable servicing. Use online tools, like eChoices loan repayment calculator, make a strict but reasonable budget and employ the help of a financial advisor.

Words by Nell Matzen

You May Like: Chase Recast Calculator

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, todays mortgage rates are near historic lows. Freddie Macs average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 3.6% right now.

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loans amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Read Also: Rocket Mortgage Qualifications

How Much Is The Average Monthly Mortgage Cost

Most residential mortgages are repayment products, and that means you pay a proportion of the capital back each month, plus the interest.

An interest-only loan is primarily used in rental property mortgages, so we will focus on repayment mortgages.

As of April 2021, Lloyds Banking Group reports that:

- The average UK monthly mortgage repayment is £753.

- Renting a property costs £821 on average.

- Monthly mortgage costs have increased 31% in the last ten years.

- The average first-time buyer deposit is £58,986 increasing by £11,677 since March 2020.

While buying a home will cost an average of £753 a month, these statistics show that it remains more affordable in terms of regular expenditure than renting.

For example, the average mortgage cost has climbed 31% in a decade, but the comparable figure for rented housing is 36%.

Statista compares the monthly averages between regions, although these most recent metrics refer to 2020:

| Region |

|---|

| £457 |

Understanding The Differences In Payments

As mentioned the above is just for information purposes and is not a quote however the above will give you a good idea of various mortgage payments at those loan amount levels.

When reviewing the various payments youll notice the difference in payments from one rate to the next is not significant. Keep in mind that these mortgage rates do not factor in closing costs which is a big part of structuring the loan to match your needs and long-term goals.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

What Determines A Mortgage Interest Rate

Interest rates are determined by a multitude of factors but are affected mainly by the RBA official cash rate which as of July 2021, is sitting at a historically low 0.1%. The cash rate is the rate charged by the RBA to lend money to banks then, the banks pass this interest rate on to their customers . As demonstrated by lowering interest rates in response to the COVID-19 pandemic, the RBAs cash rate is adjusted to complement and strengthen the current economy.

Personal factors will also influence your interest rate, including whether you choose a fixed or variable rate, your loan term, loan amount and your .

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Recommended Reading: Does Rocket Mortgage Sell Their Loans

Mortgage Rates Soared This Week With The Average Rate For A 30

Mortgage rates soared this week with the average rate for a 30-year fixed-rate mortgage climbing to 3.69%. Thats a 0.14 percentage point jump compared to last week and the highest the 30-year rate has been in nearly two years.

Rates for other loan categories in Freddie Macs weekly report are also higher. The 15-year fixed-rate mortgage is averaging 2.93% while the average rate for a 5/1 adjustable-rate mortgage is up to 2.80%. All rates are for on borrowers with the strongest credit scores.

Mortgage Rates In Ontario

Mortgage brokers and certain lenders can charge different mortgage interest rates depending on the province. Ratehub.ca has a comprehensive page of the best mortgage rates in Ontario. The most current Ontario mortgage rates are already included in the calculator above, so you can trust the numbers we provide to be accurate.

You May Like: Chase Recast Mortgage

Calculating The Average Mortgage Payment In California

Every month thousands and thousands of Californians look for a new home to buy or theyre looking to refinance their current mortgage. Some mortgage loans amounts are over $1,000,000.00 and some mortgage loan amounts are below $100,000.00 but not matter what size the loan amount is everyone wants a great low mortgage rate.

Lower the rate, the lower the mortgage payment, and every person can agree that lower is better when it comes to a mortgage payment.

There are thousands and thousands of mortgages in the state of California and because of that its incredibly difficult to nail down the exact average. Also, thousands of mortgages get paid off every month and new ones with lower or higher mortgage loan amounts rates get opened.

So to calculate the average mortgage payment in California you would have to have all that information and do so some serious math to find the exact average.

What Mortgage Amount Could I Qualify For

A lender will weigh up multiple factors when deciding your approval amount. For example, they will consider your income, partners income, dependents, living expenses, and more. Applying for pre-approval can be a good way to determine how much you are eligible for whilst making you a more attractive buyer.

You May Like: Can You Refinance A Mortgage Without A Job

Contact Us To Learn More

We know this example does not match everyones scenario. However, this simple calculation can give homebuyers a general idea of the average monthly mortgage payment in Texas. To learn more about particular home loans and get more specific scenarios, contact our expert team! Our Client Advisors are available 7 days a week for any questions by phone at 855-4491 or by email at .

Jay Voorhees

Mortgage Lenders Are Highly Likely To Pass On The Increase In Interest Rates To Borrowers Meaning If You Are On A Variable Rate Your Payments Will Go Up

Mortgage rates are set to increase for many borrowers, after the Bank of England announced that interest rates will rise from 0.25 per cent to 0.5 per cent.

This is the first time the Bank has increased interest rates in back-to-back months since June 2004, as the cost of living crisis deepens.

Heres everything you need to know about how it will affect your mortgage.

Recommended Reading: Chase Mortgage Recast Fee

Factors That Affect Your Monthly Mortgage Payment

Home prices play a big role in determining the average mortgage cost for different cities. However, theyre not the only important factor. In addition to the amount of your loan, there are other factors that affect your monthly mortgage payment. This includes:

- The interest rate on your loan

- The term length of the loan, i.e., the time required to fully pay it off

- Homeowners insurance

Monthly Mortgage Payments By Region

The census data we reviewed allowed us to compare mortgage payments across different regions of the country. We found that median payments in 2015 were roughly 35 to 40 percent higher for Northeast and Western states than in the Midwest or the South.

| Region | |

|---|---|

| $75,520 | $180,000 |

While mortgage interest rates were similar for all regions, this did not correlate with similarities in payment amounts. In the wealthiest regions of the country, the Northeast and West, consumers had larger outstanding balances on their mortgages and made higher monthly payments. In the South, where median annual income was the lowest, mortgages had the highest interest rates, leading to payments slightly higher than in the Midwest.

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home

What Does It Mean For A Fixed Rate Mortgage

i money editor Sarah Davidson advises: On a fixed rate mortgage you are protected from changes in the base rate for the period you fix for.

A two-year fix taken today will leave you paying exactly the same amount each month until February 2024.

At this point you can choose to remortgage to another deal or lapse on to your lenders SVR, which will almost certainly mean your mortgage payments jump significantly.

If youre in a position to remortgage, speak to an independent broker who should be able to help you find a cheaper rate.

More from Property and Mortgages

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If youre not sure about a lenders credentials, ask for its NMLS number and search for online reviews.

Read Also: Mortgage Recast Calculator Chase