Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Mortgage Options For Low Credit Scores

Depending on the private mortgage lender, no minimum credit score for a mortgage may be required. Instead, private lenders look more heavily towards the amount of equity that you have in your home. Private lenders do have higher mortgage rates than traditional lenders and are generally a last-resort option for temporary financing. Building up your credit score in the meantime, such as making on-time payments on a credit card, can help you qualify for lower interest rate mortgages at traditional lenders in the future.Mortgage brokerscan also help you to find a suitable mortgage lender that is right for you.

If you are over 55 years old,reverse mortgages can be an option if you need extra cash today. Reverse mortgages, from Equitable Bank or CHIP, do not have any minimum credit score requirements. Instead, there is a minimum home value requirement. Interest rates are also higher.

Save A Larger Down Payment

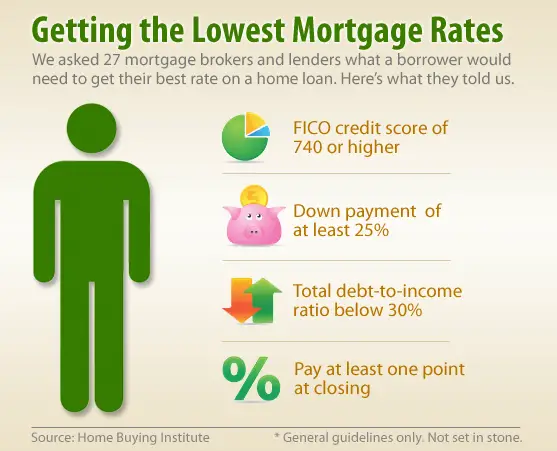

Lenders look at more than just your credit score when considering your mortgage application. They also consider factors like your income, your debt levels, and the size of your down payment. In Canada, the minimum down payment amount is 5% of the homeâs purchase price. If your credit is less than ideal, your lender may require a higher down payment, since it is riskier to lend to you.

Consider saving a 20-25% down payment for a bad credit mortgage. Not only does this larger down payment signal that you are financially stable enough to own a home, but it also lowers your monthly mortgage payment. It also means you wonât have to pay for mortgage default insurance, which is required for anyone getting a mortgage in Canada with a down payment of less than 20%. Mortgage default insurance protects your lender in the event you default on your loan.

The table below illustrates the benefit of saving a larger down payment at a mortgage rate of 2.54%.

| 5% Down Payment |

*For a $500,000 home amortized over 25 years.

You May Like: Mortgage Recast Calculator Chase

The Cost Of A Bad Credit Mortgage

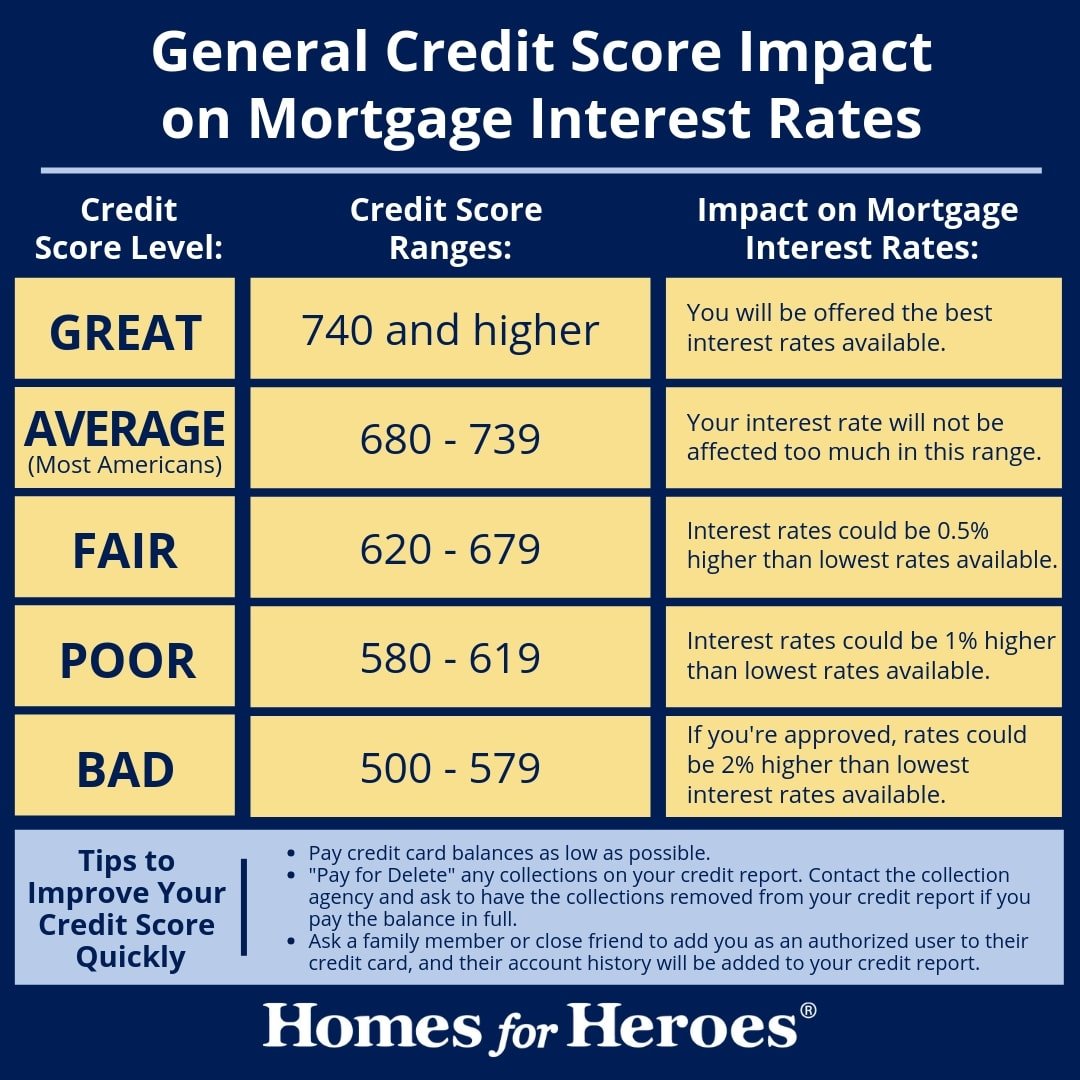

Hereâs an example of how your credit score could affect your mortgage interest rates and subsequent monthly mortgage payment. Whiles these rates wonât be indicative of todayâs lowest mortgage rates, the relationship between the different credit score ranges is consistent over time.

| Score |

*For a $500,000 home with a 5% down payment, amortized over 25 years. **Home Trust

Take Advantage Of Credit

The UltraFICO and Experian Boost programs track the movement of cash in your bank account, and in many cases, your score can go up based on this data.

For example, 60 percent of those who have completed the Experian Boost process experienced credit score increases. The average increase was 12 points. The change was even bigger for those who fall into the poor or bad credit categories: 87 percent of those who started with a score lower than 579 saw an average increase of 22 points.

While youre working to boost your score, keep an eye on it, too. Many banks also offer credit monitoring for their customers, which can be a good idea to utilize in tandem. Youll be able to get a sense of when and why your score goes up or down.

Read Also: Can You Refinance A Mortgage Without A Job

Improving Your Credit Score Vs Getting A Mortgage Now

You could spend several months or more improving your credit. But what will happen to interest rates during that time?

- If they go up, you may not save any money despite your improved credit.

- If they go down, you could save money from both your improved credit and the markets lower rates.

No one knows where interest rates are headed. The countrys most educated guess comes from the Federal Reserve, so thats a good source to consult.

In the press release section of the Federal Reserve website, look for the most recent economic projections from the Federal Open Market Committee . Do they think the federal funds rate is headed up or down?

If they think its headed up, mortgage rates could be headed up. Right now, they expect the federal funds rate to stay around zero through 2021 and possibly 2022. But thats a prediction, not a guarantee.

The Cons Of New American Funding:

- Not available to residents of Hawaii or New York

Minimum credit score and down payment listed are for FHA mortgages only.

The bottom line:Rocket Mortgage is a good option if you want a smooth online experience and prioritize customer support. However, its the only lender on this list that doesnt accept alternative credit data.

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

Whats A Typical Bad Credit Mortgage Term Length

Bad credit mortgages are only meant to be used as a temporary stopgap measure while you get your finances in order. You wouldnt want to stay with a bad credit mortgage lender for long either. Thats why youll usually see bad credit mortgages with term lengths from 6 months to 2 years. Youll need to have an exit plan when applying for a bad credit mortgage so that you can transition back to aB lenderor A lender.

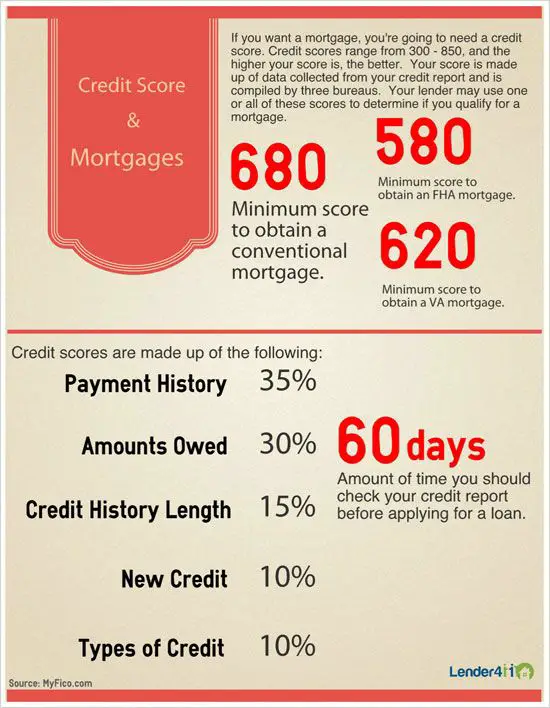

Conventional Mortgage Credit Score Requirements

Conventional mortgages have the strictest credit score requirements, but theyre still more lenient than you might think.

Freddie Mac and Fannie Mae, the two huge companies that help make conventional mortgages widely available, have strict credit score requirements for borrowers making the minimum down payment of 3%: Freddie Macs minimum credit score is 660 and Fannie Maes is 620. Freddie will allow a credit score as low as 620, too, but only with a down payment of at least 25%.

Most lenders follow these rules because after they close your loan, they sell it to one of these companies. The table below shows how few borrowers get conventional loans with credit scores below 700.

Recommended Reading: Chase Mortgage Recast Fee

Can I Get A Mortgage With No Canadian Credit History

Many Canadian lenders allow new immigrants with little or no Canadian credit history to be eligible for a mortgage through special programs. For example, RBC, TD, CIBC, and BMO all offer Newcomer programs that dont require any Canadian credit history. However, they are only available to newcomers that have been in Canada for five years or less. Some lenders can also give you the option of using your credit history from another country if you dont have a Canadian credit history.

If you’ve been in Canada for longer than five years, some lenders may consider alternative credit data, which would be creditors that do not report information to Equifax or TransUnion. Showing proof that you have made consistent payments on-time can demonstrate that you are financially responsible. This can include your rental payments to a landlord, your monthly utility bill, or your cell phone plan. Lenders will usually want to see at least 12 months of payment history.

Will A Mortgage Benefit Our Consumer Credit Score

Removing a loan may have having a positive influence on your credit history if someone makes your payments timely. Making a latter pay or missing a payment completely will in all probability lead to a damaging impact on your credit history.

Trying to find many financing at the same time or possessing a higher many funding may even probably have actually a negative influence on your credit history as it can certainly appear that you are dependent on account.

You May Like: Rocket Mortgage Qualifications

What Can Be Done About A Low Credit Score

Whether your low credit rating is because of a poor credit history or no credit history to speak of, you will need to approach improving your credit score in much the same way.

You need to focus on improving your credit record by showing you are a reliable borrower, and weve broken down the tactics we recommend into three broad stages:

Each stage contains further details of what you need to do. Well explain these over the next few sections, keeping it as straightforward as possible.

What If You Don’t Have A High Enough Credit Score To Buy A House

Having bad credit or no credit may mean youre unlikely to get a mortgage unless someone you know is willing to help out. Having a co-signer who has a better credit score could help you secure the loan.

Another option would be to have “a friend or more likely a family member purchase the home,” add you to the title and then try to refinance into your name when your credit scores improve sufficiently, according to Ted Rood, a mortgage banker in St. Louis.

If such assistance isnt available to you, your best bet will be waiting and working on your credit.

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home

What If I Cant Fix My Credit Score

Its important to keep in mind that your credit score isnt the only thing that mortgage lenders look at. If you are not able to improve your credit score and dont want to consider a private mortgage lender, you can consider other options. Making a large down payment can make it easier to be approved for a bad credit mortgage. If you can find a co-signer, their credit score will be considered as well. This is helpful if they have a strong credit score or more income.

If you are over 55 years old, you are eligible forreverse mortgages. Reverse mortgages have no income or credit score requirements, and there are also nomortgage paymentsrequired either. This is particularly useful for seniors as a source of income during retirement.

Renting instead of buyinga home might also be a temporary solution in the meantime. If there is a particular property that you would like to purchase, but cannot afford to do so currently,rent-to-own homeprograms allow you to rent the home for a period of a few years, with a portion of your rent payments going towards your eventual down payment on the house. This allows you to save up money until you canafford a mortgage.

Poor Credit Score Mortgages

Now you are aware of how little or no credit history can result in a low credit score, lets take a look at how this impacts your mortgage application. When they see you have no real history of borrowing, lenders will react in one of a number of ways:

- A simple No they just flat-out refuse your application.

- Asking you to come up with a larger deposit as well as showing your commitment and resources, it means they will be lending you less, making you less of a risk.

- Charging higher fees with less options on the table, you may need to consider an offer where the lender is happy to assist for a higher fee.

- Charging a higher rate of interest again, this is the cost of the lenders help in these circumstances, and reflects the perceived risk of lending money to you.

This approach can be very disappointing, especially when you are just starting out on the road to home ownership and have never needed to borrow money before.

It might look like lenders are asking you to prove yourself or pay for their confidence, but if you cant afford a larger deposit, you might just have to accept this philosophically and move forward with positive actions to improve your credit score.

Unless you are waiting for a black mark to drop off your credit report , there are a few tactics you can use to help create a better credit history.

Recommended Reading: Recast Mortgage Chase

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

Why Use A Mortgage Broker

Most of our customers have had some form of credit difficulties, from low credit score, missed payments or declined a mortgage elsewhere.

- Valuable knowledge, through years of experience helping customers

- Bad credit / poor credit experts

- Find the right mortgage first time

- Some mortgages are only available through a broker

- Help with the application process

- Advice on all options available, such as help to buy, guarantor or shared ownership

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

Private Mortgage Lenders For Bad Credit

There are plenty ofprivate mortgage lendersthat offer bad credit mortgages in Canada. A few examples include Alpine Credits, Prudent Financial, Clover Mortgage, Canadalend, and Guardian Financing. Forprivate mortgage lenders in Ontario, a few examples include Castleton Mortgages, MortgageCaptain, and MortgageKings. You might be required to go through a bad credit mortgage broker in order to access some private lenders, as some may only work through brokers.

Some private lenders have no minimum credit score requirements, and some even allow you to make interest-only payments on your mortgage. This can help you keep up with your payments if you are having cash-flow issues. Making regular mortgage payments to a private lender can also help improve your credit score, making it easier to eventuallyrefinance your mortgageat a lower mortgage rate with another lender.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

How Can You Protect Your Credit Score During The Covid

Taking steps to protect your credit score is more crucial than ever during the coronavirus crisis. Thats especially true if youre planning on buying a home.

So its important to stay on top of your finances during this challenging time. That includes paying your bills on time, and contacting lenders and service providers if you do run into trouble. Here are a few things you can do:

- Create a budget to know where you stand. The Barclays Budget Planner can help.

- If you foresee problems paying your loan or credit cards, contact them right away to explore your options.

- If you think youll be late paying your phone, utilities or other service providers, contact them to let them know and to discuss a possible arrangement. You can also find helpful advice at Barclays money management.

- To help you manage during this period, you can also find valuable ideas and resources at Barclaycard coronavirus help and support about protecting yourself from fraud and managing your finances.

- Youll also find other information about managing your Barclaycard account during the crisis at the Frequently Asked Questions page.

How Much Deposit Do I Need To Get A Mortgage With A Poor Credit Score

It may be the case that to access your chosen lenders rates and meet their terms, you have to deposit a higher percentage of the properties market value. That being said, the amount of deposit you need to get a mortgage will vary depending on a whole host of factors including your age and the type of property you want to buy.

There isnt a typical deposit size, but some lenders ask applicants to deposit as much as 30% for a mortgage if they have a poor credit score or low affordability.

For a home valued at £200,000 that would equate to a £60,000 deposit. Large deposits arent a viable option for a lot of borrowers and thankfully there are a handful of lenders that appreciate this and may be more willing to lend under more flexible terms.

Don’t Miss: Reverse Mortgage For Condominiums