How Do Va Loan Credit Requirements Compare To Others

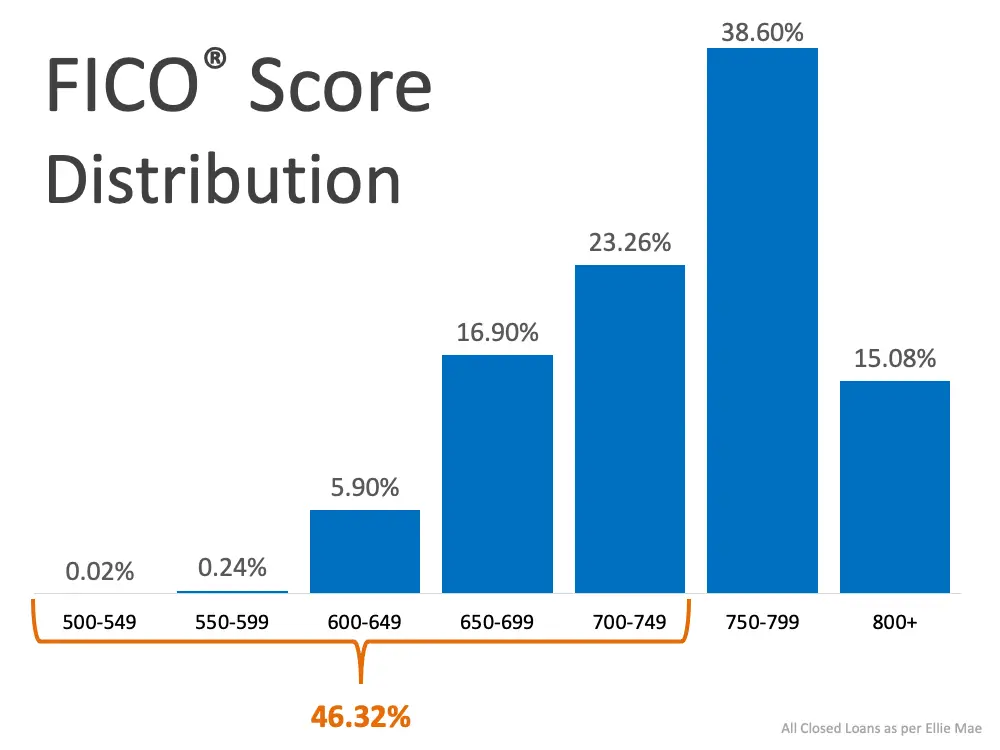

FICO credit scores range from 300-850. FICO no longer releases the median nationwide score, but as of April 2021, the national average FICO score was 716. Keeping that in mind, a 620 minimum is fairly borrower-friendly. It’s not necessarily an easy score to obtain, but it’s an accommodating benchmark when measured against other loan options.

What Other Factors Do Lenders Consider When You Apply For A Mortgage

Your credit score plays a large role in the mortgage approval process, but its not the only factor a lender will look at when deciding whether or not to approve your loan. Other key factors include:

- Debt-to-income ratio. If you have little or no debt and a high income, youre more likely to get away with having a slightly below-average credit score.

Even With A High Enough Credit Score For A Mortgage You Might Have To Prove The Source Of Your Down

You should have a record of where your down payment came from if you can’t prove you’ve had the money for more than three months. Lenders will want to ensure that you’re not borrowing your down payment, as that can impede your ability to pay your mortgage back. If youve saved your own down payment, your account records should be proof enough. If you’ve received your down payment as a gift from friends or family, they will need to write and sign a gift letter.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

How Your Credit Score Is Calculated

|

How Your Credit Score is Calculated |

|

|

Payment History 35% |

Payment history is how well you pay your bills on time. This includes late payments and collection accounts. |

| 30% |

The amount of available credit you’re using is called your . Try to keep your credit utilization ratio below 25%. |

|

Length of Credit 15% |

The longer your accounts stay open, the better your score will be. Don’t close credit cards is possible. |

|

Types of Credit 10% |

A mix of credit accounts such as credit cards, auto loans, mortgages will help improve your credit score. |

| 10% |

When a lenders pulls your credit it creates a hard inquiry. Multiple inquiries hurt your score count against you for 12 months. |

Minimum Credit Score Required For A Conventional Mortgage

A conventional mortgage is one with a downpayment of 20% or more. Conventional mortgages do not require CMHC insurance, so there are fewer restrictions on things like a minimum credit score requirement. Each lender will have guidelines that they follow.

So, it is possible to get approved for a mortgage with a credit score as low as 600, but the number of mortgage lenders willing to approve your mortgage is going to be very small.

Also Check: Rocket Mortgage Launchpad

Minimum Credit Score Required For Mortgage Approval In 2022

Home \ Mortgage \ Minimum Credit Score Required For Mortgage Approval in 2022

Join millions of Canadians who have already trusted Loans Canada

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

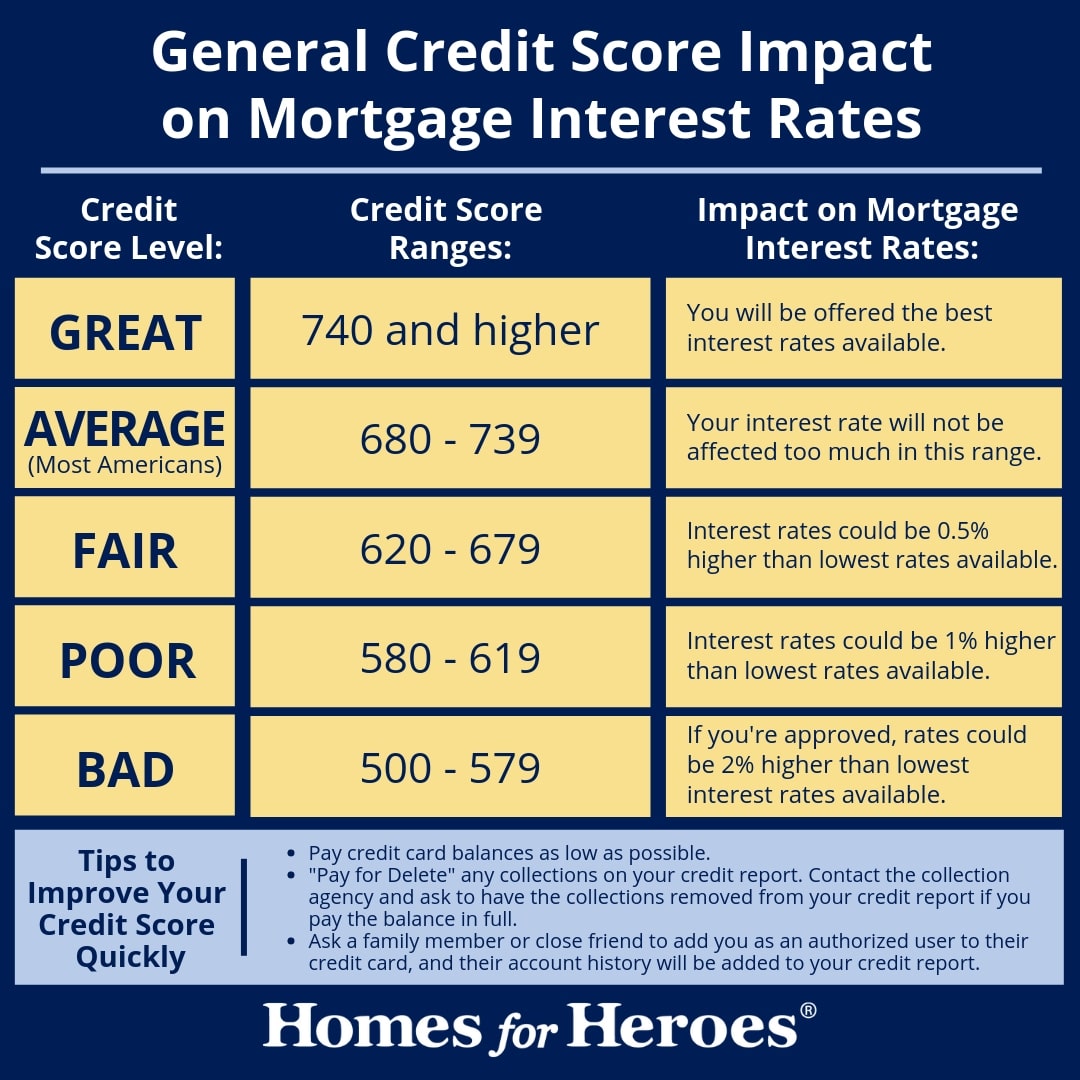

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

Also Check: Does Getting Pre Approved Hurt Your Credit

Is Your Credit Score High Enough To Buy A House

If your credit score is above 580,youre in the realm of mortgage eligibility. With a score above 620 you shouldhave no problem getting credit-approved to buy a house.

But remember that credit is only onepiece of the puzzle. A lender also needs to approve your income, employment, savings,and debts, as well as the location and price of the home you plan to buy.

To find out whether you can buy ahouse and how much youre approved to borrow get pre-approved by a mortgagelender. This can typically be done online for free, and it will give you averified answer about your home buying prospects.

Popular Articles

Improving Your Credit Score

Theres a lot that goes into determining your credit score, including your repayment history, the total balances on your accounts, how long youve had those accounts, and the number of times youve applied for credit in the last year. Improving in any of these areas can help increase your score.

You can:

- Pay down your existing debts and credit card balances

- Resolve any credit issues or collections

- Avoid opening new accounts or loans

- Pay your bills on time, every time

You should also pull your credit report and check for any inaccuracies you might see. If you find any, file a dispute with the reporting credit bureau, and include the appropriate documentation. Correcting these inaccuracies could give your score a boost.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

How To Improve Your Credit Score

So, its clear that a good credit score is one of the more important factors when trying to gain mortgage approval. Since its also a factor in calculating the interest rate youll be given, a favourable score can also save you thousands of dollars over the course of your amortization. Therefore, its best to get your credit score in the best shape you can manage before you apply with any lender. If your score is lower than 600-650, or you would simply like to improve it as much as possible, there are a few simple tricks you can use.

- Paying bills on time and in full

- Do not carry a large amount of unpaid debt

- Use no more than 30% of your available credit card limit

- Dont apply for too much new credit in a short amount of time

- Review a copy of your credit report for mistakes or signs of identity theft

- Consider a secured credit card if youre building from the ground up

Interest Paid By Fico Score

| FICO Score |

Based on the in August 2021

If your credit score is on the lower end, even a small difference in your mortgage score can make a big difference in the cost of your home loan. You could wind up paying more than 20% more each month, which can make it harder to afford a mortgage.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they don’t just take into account what the mortgage payments will be, they also look at the other debts you’ve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

That’s the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders don’t want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. That’s the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowner’s insurance and, if applicable, mortgage insurance and condominium or homeowner’s association fees.

The Credit Score Needed To Buy A House

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

What Kind Of Credit Report And Score Do Lenders Use

There are several versions of your credit score, depending on who issues the score and the lending industry .

To offset their risk and ensure that theyre getting the most accurate picture of a mortgage borrower, most lenders will use whats called a tri-merge credit report showing credit details from multiple credit bureaus.

Instead, they may use a residential mortgage credit report, which may include other details about your financial life, such as rental history or public records. These reports reveal the borrowers credit details from multiple bureausTransUnion, Experian, or Equifaxor all three.

In many cases, the credit score you see as a consumerpossibly through your bank or credit card companyis different from what a potential mortgage lender would see.

Ways To Improve Your Credit Before Applying For A Mortgage

Whether you have good credit or bad credit, its a good idea to improve your credit score before applying for a mortgage. A good credit score will not only help you get approved for a mortgage, but it will help you get the lowest mortgage rates too! Here are some steps you can take to make sure your credit is in good shape when youre ready to buy a house.

Also Check: What Information Do You Need To Prequalify For A Mortgage

How To Increase Your Credit Score

There are a host of ways for improving your credit score. The first step requires obtaining copies of your credit reports to identify any potential errors that may need correcting, for creating a baseline or starting point and setting a goal.

Clearly identify the due dates for all monthly payments as an extra reminder. Consistently making the monthly payments on time is critical in improving your credit history.

Begin by paying down credit cards and other forms of debt, which will improve your credit utilization rate or ratio. This calculation simply reflects the percentage of debt currently owed relative to your overall credit limitstrive for less than 10%.

Keep in mind that canceling old credit card accounts without a balance will potentially increase your credit utilization rate by lowering your overall credit limit.

Avoid applying for too many new types of credit accounts in a short period. When lenders make a credit inquiry this activity is noted on your credit report and may temporarily hinder your credit score.

Tips To Get Approved For A Mortgage

If youâre looking to dive into homeownership, itâs important to be prepared at every step. Besides tracking interest rates and hunting for the perfect home, applying for a mortgage is the biggest step in the process. While it might seem stressful, it can be made much easier if you get your financial affairs in order ahead of time. Here are 7 ways to help get your mortgage application approved.

Recommended Reading: Does Rocket Mortgage Sell Their Loans

What Credit Score Do You Need To Buy A House

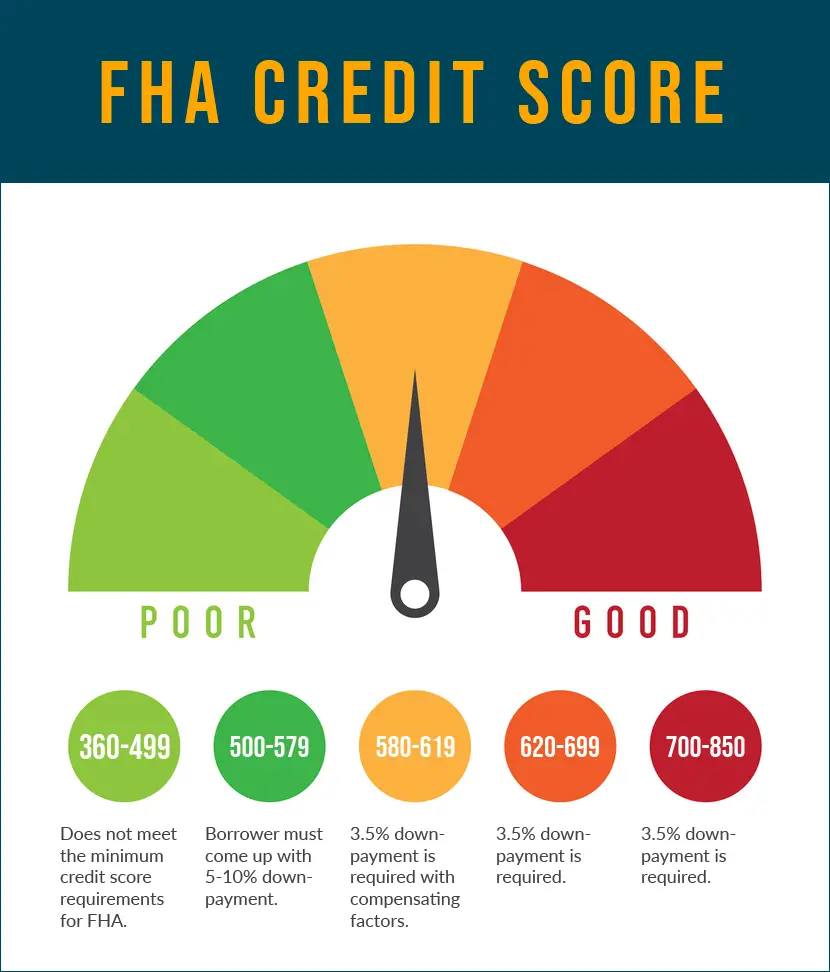

Its possible to get an FHA loan with a credit score of 580 or 500, depending on the size of your down payment. VA, USDA, and conventional loans do have a set minimum credit score but lenders will generally require a credit score of at least 620.

Of course, remember that the minimum square will tell you whats required to qualify, but a lower credit score also usually means higher interest rates.

This table outlines the minimum credit scores typically needed to buy a house based on the type of loan: conventional, FHA, VA or USDA.

| Loan Type |

- Co-borrowers who do not plan to live in the home

- Down payment gift money, but no down payment of their own

- Properties that are in need of repair

Without FHA, millions of homeowners would be stuck renting years longer than they should. Yet, there is still room for FHA to expand its capacity to serve more aspiring homeowners.

You Should Have A Steady Source Of Income

One thing that a mortgage lender will look at is your income stability. If youve only just begun working at your job, this could be a strike against you when it comes to mortgage approval. You also might have difficulty getting approved for a mortgage if youre self-employed or work for cash a lot. What your mortgage provider is going to want to see is a steady income for as long as possible. If youve just begun a new job, perhaps waiting a short period of time is in your best interest before applying for a mortgage. If youre self-employed, try to do everything by the books and have all your revenue accounted for in your bank statements.

Read Also: Reverse Mortgage Mobile Home

How Your Credit Score Impacts Your Apr

Your credit score has a major effect on the APR of your loan. The APR of any installment loan, such as a mortgage, reflects the cost of interest expense and fees over the life of the loan. The higher the APR, the more the borrower will have to pay.

If you apply for a $250,000, 30-year mortgage, you can wind up paying wildly different amounts depending on your credit score, as shown below.

Bad Credit Score Home Loans

A bad credit score is usually one thats lower than 640. While you might be able to get a home loan with bad credit, the potential drawbacks include:

- Needing a larger down payment

- Paying a higher interest rate

- Spending more money on mortgage insurance premiums

Why would you spend more money on mortgage insurance?

With bad credit, you might be able to secure an FHA loan, a VA loan, a higher down payment conventional loan, or a USDA Loan:

Find Out: Can You Buy a House with Bad Credit?

Also Check: Does Prequalification For Mortgage Affect Credit Score

Minimum Credit Scores By Mortgageprogram

The credit score needed to buy ahouse depends on the type of loan you apply for.

Minimum credit requirements forthe five major loan options range from 580 to 680.

- Conventional loan : 620 minimum FICO score

- FHA loan: 580 minimum FICO score

- VA loan: 620 minimum score is typical

- USDA rural housing loan: 640 minimum FICO score

- Jumbo loan : 680 minimum FICO score

Note that FHA loansactually allow credit scores as low as 500. But if your score is below 580, youneed a 10% down payment to qualify. Borrowers with credit scores above 580 onlyneed 3.5% down for an FHA mortgage.

Other requirements to buy a house

Theres more to know than just credit minimums, of course .

In addition to credit scores, lenders evaluate borrowers based on:

- Down payment: Most loan programs require at least 3% down

- Income and employment history: Most lender want to see at least 2 years of steady income and employment

- Savings: Youll need cash to cover the down payment, closing costs, and often cash reserves

- Existing debts: Your debt-to-income ratio compares pre-existing debts like student loans, auto loans, and credit card minimum payments against your monthly gross income. The lower your DTI, the better

- Loan amount: If you have lower credit, your loan amount will likely need to be within FHA loan limits or conforming loan limits

If your credit scoreis weak but you have stable income, a large amount ofsavings, and a manageable debtload, youre more likely to get mortgage-approved.