Be Conscious Of Changes In Employment

If you lose your job, how will you pay your mortgage? When you apply for a mortgage, your lender ideally will want to see a 2-year work history before they grant approval. If you choose to take the largest loan you qualify for, will you be able to make those higher monthly payments during a period of unemployment?

Mortgage Payments Arent Your Only Homeownership Cost

Theres more to homeownership cost than your monthly payment. More on that later. But what makes up your monthly payment itself?

Mortgage professionals use the acronym PITI to cover some of the main ones. That stands for:

- Principal: The amount by which you reduce the amount you borrowed each month.

- Interest: The cost of borrowing.

- Taxes: The property taxes you have to pay.

- Insurance: Homeowners insurance. Plus, depending on where you buy, possibly flood, earthquake or hurricane cover.

None of these is optional and if you fall far behind on any of them, youll be in breach of your mortgage agreement and subject to action by your lender.

How Credit Score And Down

Every lenders priority is to maximize its chances of getting its money back with as little expense as possible. They want to be as sure as they can that borrowers are ready, able and willing to make timely monthly payments.

Luckily, this protects most borrowers from taking on mortgages that they cant afford or are incapable of maintaining.

Recommended Reading: Can You Get A Mortgage With A Fair Credit Score

Use Our Mortgage Calculator To Determine Your Home Budget

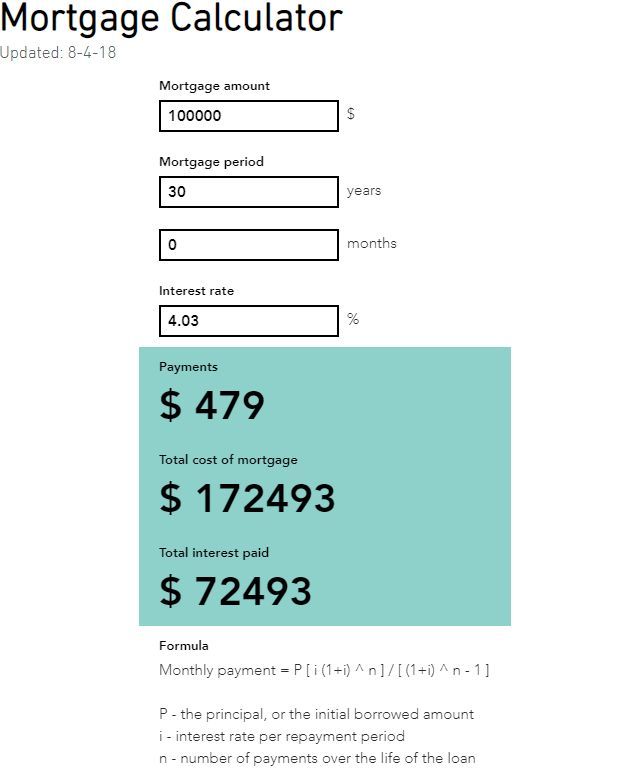

Sure, you could crunch the numbers yourself by dividing a home price by 180 months and then multiplying the decreasing monthly principal balance by your interest rate. But if you’re anything like us, you probably broke a sweat just reading that formula.

To save yourself the time and headache of doing a ton of math, we built a mortgage calculator to do that for youphew!

Sticking with our example of an income of $5,000 a month, you could afford these options on a 15-year fixed-rate mortgage at a 4% interest rate:

- $187,767 home with a 10% down payment

- $211,238 home with a 20% down payment

- $241,415 home with a 30% down payment

- $281,650 home with a 40% down payment

Remember: This is just a ballpark! Dont forget that grown-up stuff like property taxes and home insurance will top off your monthly payment with another few hundred dollars or so . And if you think youll be buying a home thats part of a homeowners association , youll need to factor those lovely fees in as well.

For example, if you plug in a mortgage amount of $211,238 with a 20% down payment at a 4% interest rate, youll find that your maximum monthly payment of $1,250 increases to $1,515 when you add in $194 for taxes and $71 for insurance. To get that number back down to a monthly housing budget of $1,250, youll need to lower the price of the house you can afford to $172,600.

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

Don’t Miss: How Much Is Average Mortgage Insurance

Follow The 25 Percent Rule

Theres a straightforward way to make sure you can afford your mortgage while managing your other goals, according to Eve Kaplan, a certified financial planner in New Jersey. Housingincluding maintenanceideally shouldnt consume more than 25 percent of a household budget. This goes for folks who rent, too, Kaplan says.

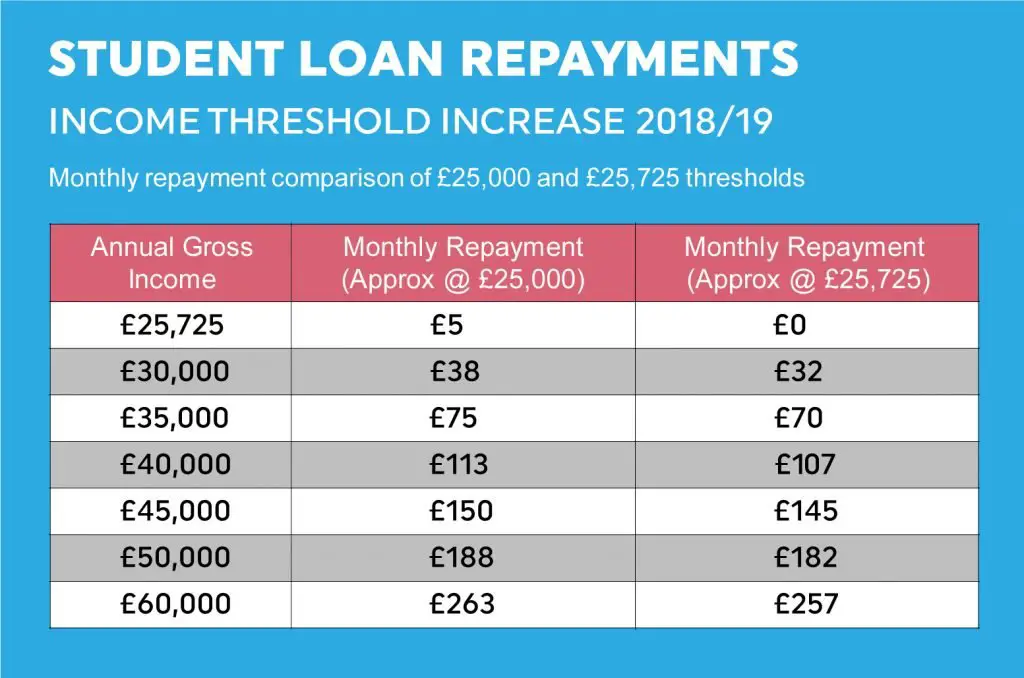

Mortgage bankers would disagree. They use various calculations to figure out how much you can afford, and the amount is often much higher than financial planners recommend. A common measure that brokers use is the debt-to-income ratio , which, for a qualified mortgage, limits your total debt payments, including your mortgage, student loans, credit cards, and auto loans, to 43 percent.

Lets say you and your spouse make a combined annual income of $90,000, or about $5,600 per month after taxes. Based on your DTI and depending on your other debts, you could be approved for a mortgage of $600,000. That might sound exciting at first, but with a monthly payment of about $3,225, it would eat up more than half your take-home pay.

Following Kaplans 25 percent rule, a more reasonable housing budget would be $1,400 per month. So taking into account homeowners insurance and property taxes, youd be better off sticking to a mortgage of $240,000 or less. If you have enough for a 20 percent down payment, the maximum house you can afford is $300,000.

Increase Your Credit Score

The higher your credit score, the greater your chances are of getting a lower interest rate. To increase your credit score, pay your bills on time, pay off your debt and keep your overall balance low on each of your credit accounts. Don’t close unused accounts as this can negatively impact your credit score.

Also Check: Is The Property Tax Included In Mortgage Payments

Ways To Lower Your Total Monthly Debt Payments

The key to reducing your debts is to create a budget and debt payment plan. By creating a list with your total monthly income on one side and all of your expenses on the other, you can quickly identify unnecessary expenditures, eliminate them and allocate extra funds to paying off your loans early. After coming up with your budget, you can use one of the following debt payment plans to chip away at your debts.

Although you can choose to focus on either increasing your monthly income or lowering your debts, its recommended that you do both simultaneously. Doing so will enable you to improve your DTI faster and ensure you can qualify for a mortgage when its time to apply.

Understanding Gross Income Net Income And Mortgages

Before you can calculate the income percentage for your mortgage, youll need to understand what defines gross income, net income, and mortgages.

As such, lets break these definitionsone-by-one.

Gross Income

Gross income for individuals is the total payment you receive from your employer before any taxes or other deductions. Gross income is not limited to cash payments it includes services received and property. Your gross annual income is the amount of money you earn in a year before tax and includes all your income sources.

For businesses, gross income is identical to gross margin or gross profit. As printed on their income statement, a companys gross income is the revenue earned from all sources minus the cost or services or cost of goods sold .

Net Income

Net income is the total amount earned by a person in any given period from their taxable wages, investment incomes, tips, and any other income. The amount is calculated after Social Security taxes, income taxes, Federal Insurance Contributions Act tax, 401k payments, health insurance, and any outstanding legal obligations such as child support, loan payments, and wage garnishments.

For individuals, net income is calculated using this equation:

Total amount Earned Paycheck Deductions = Net Income.

Mortgages

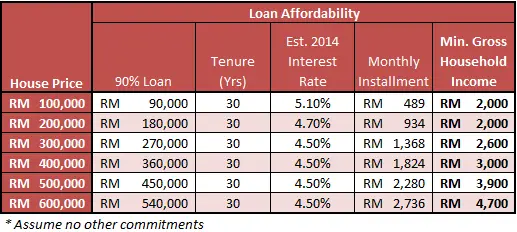

Mortgages are paid back over time, typically over 15 or 30-year terms. The property purchased acts as collateral for the money lent by an individual to buy the home.

Front-End Ratio and Back-End Ratio

You May Like: How To Find Mortgage Payment

What Is The 28/36 Rule Of Thumb For Mortgages

When mortgage lenders are trying to determine how much theyll let you borrow, your debt-to-income ratio is a standard barometer. The 28/36 rule is a common rule of thumb for DTI.

The 28/36 rule simply states that a mortgage borrower/household should not use more than 28% of their gross monthly income toward housing expenses and no more than 36% of gross monthly income for all debt service, including housing, Marc Edelstein, a senior loan officer at Ross Mortgage Corporation in Detroit, told The Balance via email.

It’s important to understand what housing expenses entail because they include more than just the raw number that makes up your monthly mortgage payment. Your housing expenses could include the principal and interest you pay on your mortgage, homeowners insurance, housing association fees, and more.

How Will My Debt

When you apply for a mortgage, lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as a percentage.

Lenders often use the 28/36 rule as a sign of a healthy DTImeaning you wont spend more than 28% of your gross monthly income on mortgage payments and no more than 36% on total debt payments .

If your DTI ratio is higher than the 28/36 rule, some lenders will still be willing to approve you for financing. But theyll charge you higher interest rates and add extra fees like mortgage insurance to protect themselves in case you get in over your head and cant make mortgage payments.

Read Also: What Lender Has The Lowest Mortgage Rates

How To Apply For A Va Loan

Obtain a certificate of eligibility: A VA certificate of eligibility shows a mortgage lender that your military service meets the requirements for a VA loan. A VA-approved lender can obtain the document for you, which is needed before the loan can close. You can also request the certificate from the VA online or by mail.

Find the right lender: Some VA lenders are tailored for borrowers with weaker credit, while others offer a larger variety of VA loan types. Get preapproved with more than one VA mortgage lender to compare their qualification requirements and mortgage rates.

Find a home: To purchase a primary residence with a VA loan, it must also meet minimum property requirements to ensure its clean, safe and structurally sound. Once you put in an offer on the house you want, the mortgage lender will evaluate your finances and order a VA appraisal to make sure the home meets all the requirements. Once your application and appraisal are approved, the final steps are to close on the loan and move into the house.

About the authors:Barbara Marquand writes about homeownership and mortgages, and is NerdWallet’s authority on insurance. Read more

Linda Bell is a mortgage writer and spokesperson for NerdWallet. She has won multiple awards, including one for a series on minority discrimination in the housing industry.Read more

Basic Mortgage Payment Calculator

This calculator requires the use of Javascript enabled and capable browsers. This script calculates the monthly payment of a typical mortgage contract. Enter the dollar amount of the loan using just numbers and the decimal. Next, enter the published interest rate you expect to pay on this mortgage. Finally, enter the number of years to pay on the mortgage. Click on the Calculate button and the monthly payment, principal and interest only, will be returned. You may click on Clear Values to do another calculation. In our example, a loan of $100,000.00 for 30 years at 6% will yield a payment of just less than $600.00 a month for principal and interest. Designation

Read Also: What Is The Biggest Mortgage I Can Get

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Much House Can I Afford Based On My Salary

To calculate how much house you can afford, use the 25% rulenever spend more than 25% of your monthly take-home pay on monthly mortgage payments.

That 25% limit includes principal, interest, property taxes, home insurance, private mortgage insurance and dont forget to consider homeowners association fees. Whoathose are a lot of variables!

But dont worry, our full-version mortgage calculator makes it super easy to calculate those numbers so you can preview what your monthly mortgage payment might be.

Don’t Miss: How Much Should You Pay For Mortgage

Figure Out 25% Of Your Take

Lets say you earn $5,000 a month . According to the 25% rule we mentioned earlier, that means your monthly house payment should be no more than $1,250.

Stick to that number and youll have plenty of room in your budget to tackle other financial goals like home maintenance and investing for retirement.

Example Of Mortgage Payment Percentage

Based on the 28 percent and 36 percent models, heres a budgeting example assuming the borrower has a monthly income of $5,000.

- $5,000 x 0.28 = $1,400

- $5,000 x 0.36 = $1,800

Going by the 28 percent rule, the borrower should be able to reasonably afford a $1,400 mortgage payment. However, factoring in the 36 percent rule, the borrower would also only have room to devote $800 to their remaining debt obligations. Applied to your own financial situation, this may or may not be feasible for you.

You May Like: Why Is Mortgage Cheaper Than Rent

How Much Should My Mortgage Be In The Real World

All this math can come across as a bit theoretical. And your goal when deciding on your mortgage amount should be more practical. You want a loan that will fit neatly within your lifestyle, needs, and ambitions.

The fact that a lender will give you $x amount because of your DTI, credit score, down payment, and personal finances doesnt necessarily mean you should borrow $x amount.

Yes, most of us borrow up to the maximum were allowed. But that doesnt mean you should.

What are your spending priorities?

It all depends on your lifestyle and priorities. Suppose you love foreign travel or gourmet eating or sailing or shopping. Borrowing the max amount might mean youre sacrificing other luxuries for years to come.

It could be best to settle on a more modest home and a smaller mortgage if that allows you to maintain your current lifestyle.

How secure is your income?

You should also bear in mind how secure your earnings are.

You likely dont want to be saddled with the biggest mortgage possible if youre in a job where firings are commonplace or if you plan to change jobs soon and youre not sure youll earn the same amount.

Lenders have these questions in mind, too. Thats why they typically want to see two years employment history on your mortgage application. They also want to know any income youre using to qualify for the loan will continue for at least three years.

How To Calculate Your Required Income

To use the Mortgage Income Calculator, fill in these fields:

-

Homes price

-

Loan term

-

Mortgage interest rate

-

Recurring debt payments. Heres where you list all your monthly payments on loans and credit cards. If you dont know your total monthly debts, click No and the calculator will ask you to enter monthly bill amounts for:

-

Car loan or lease

-

Minimum credit card payment

-

Personal loan, child support and other regular payments

Monthly property tax

Monthly homeowners insurance

Monthly homeowners association fee

Read Also: Is 720 A Good Credit Score For Mortgage

How To Increase Your Mortgage Affordability

If you want to increase how much you can borrow, thus increasing how much you can afford to spend on a home, there are few steps you can take.

1. Save a larger down payment: The larger your down payment, the less interest youll be charged over the life of your loan. A larger down payment also saves you money on the cost of CMHC insurance.

2. Get a better mortgage rate: Shop around for the best mortgage rate you can find, and consider using a mortgage broker to negotiate on your behalf. A lower mortgage rate will result in lower monthly payments, increasing how much you can afford. It will also save you thousands of dollars over the life of your mortgage.

3. Increase your amortization period: The longer you take to pay off your loan, the lower your monthly payments will be, making your mortgage more affordable. However, this will result in you paying more interest over time.

These are just a few ways you can increase the amount you can afford to spend on a home, by increasing your mortgage affordability. However, the best advice will be personal to you. Find a licensed mortgage broker near you to have a free, no-obligation conversation thats tailored to your needs.

How Does Credit Affect Mortgage Affordability

A crucial factor in calculating your monthly mortgage payment is the loan’s interest rate. To help determine what your interest rate would be, lenders review your credit report and credit score in addition to other factors.

In general, borrowers with higher credit scores can secure lower interest rates because they’re able to show that they’ve managed their debts well in the past. In the lender’s eyes, this positive payment history lessens the risk that the borrower will default on their monthly mortgage payments.

On the flip side, a low credit score could result in a higher interest rate or even the outright denial of an application. The minimum credit score for a mortgage loan can vary based on the lender and the type of loan you’re applying for.

Also Check: What To Know About Getting A Mortgage