Risks Of A Higher Ltv

- A loan to value ratio that decreases or stays the same over time may put you in a difficult position when you want to sell up or remortgage.

The content on this page is for reference and does not constitute financial advice. For impartial financial advice, we recommend government bodies like the Money Advice Service.

Understanding The Impact Of Your Down Payment

The LTV ratio happens to be one of the main factors that go into determining your ability to obtain a mortgage so how can you ensure youre a good candidate for a home loan? For starters, be sure you understand the impact of your down payment. With a number of loan options available, in some cases, qualified buyers can put down as little as 3.5% toward the purchase price of a home.

While it may sound good , know that the smaller the down payment youre able to put forward, the higher your LTV ratio will be.

This may mean youll end up with a higher mortgage rate, or in some cases, the inability to qualify for a mortgage.

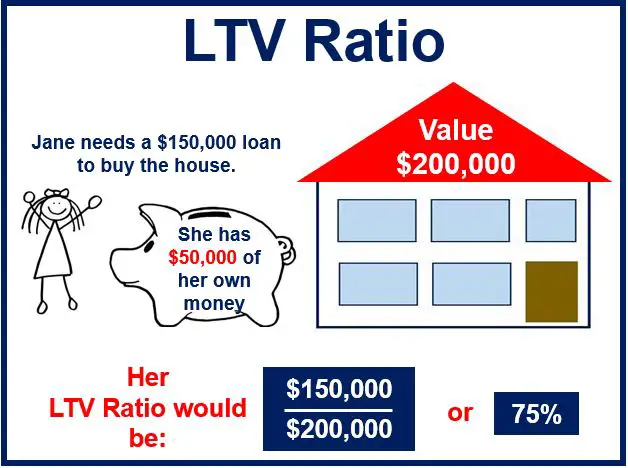

How Is Ltv Calculated

LTV is a relatively straightforward concept with massive implications for borrowers. Want to know your LTV ratio? Just use this simple formula:

* 100 = LTV

In this case, LA refers to your loan amount and PV is the property value. Lets quickly walk through each step you need to take to figure out LTV:

How does that work in a real-world scenario? Heres how itd look if you were buying a $500,000 house with a 10% down payment option:

Read Also: How Much Is Mortgage On 1 Million

What Is 65% Ltv

LTV means loan-to-value â itâs the size of your mortgage as a percent of the total property value. In other words, how much of the value of the property that youâre borrowing. A 65% LTV mortgage is 65% loan, 35% deposit or equity.

Say you want to buy a property worth£250,000. A 65% LTV would mean you have a deposit of£87,500, so the amount youâre borrowing is £162,500.

What Is A Good Ltv On A Mortgage

What is a good LTV on a mortgage? What Is a Good LTV? If youre taking out a conventional loan to buy a home, an LTV ratio of 80% or less is ideal. Conventional mortgages with LTV ratios greater than 80% typically require PMI, which can add tens of thousands of dollars to your payments over the life of a mortgage loan.

What does 60% LTV mean? As the name suggests, LTV is the maximum amount that the lender will consider loaning to you as a percentage of the value of the property. For example, a mortgage with a maximum Loan to Value Ratio of 60% would probably be offered with a lower interest rate.

Is higher LTV better? The loan-to-value ratio is an assessment of lending risk that financial institutions and other lenders examine before approving a mortgage. Typically, loan assessments with high LTV ratios are considered higher risk loans. Therefore, if the mortgage is approved, the loan has a higher interest rate.

What does up to 80 LTV mean? The loan-to-value ratio is the amount of the mortgage compared with the value of the property. It is expressed as a percentage. If you get an $80,000 mortgage to buy a $100,000 home, then the loan-to-value is 80%, because you got a loan for 80% of the homes value.

Also Check: How To Become A Mortgage Broker In Massachusetts

Lower Down Payment = Mortgage Insurance

Perhaps youve determined that putting less than a 20% down payment is the right choice for you and thats OK! However, you should know that in addition to a higher mortgage interest rate, youll also likely be required to pay mortgage insurance either private mortgage insurance or a mortgage insurance premium if you take out an FHA loan) to mitigate the risk you pose to your lender.Keep in mind, some loan options, like a VA loan, do not require mortgage insurance, even if you put no money down.

How To Calculate Loan

To calculate LTV, you would divide the mortgage amount over the property value. If you are purchasing a home, the property value would be the purchasing price of the home, while the mortgage amount would be the purchasing price subtracted by the amount of your down payment. If you are refinancing or switching mortgage lenders, you may be required to have a home appraisal to get an up-to-date home value. Appraisal fees are typically paid by the borrower.

Read Also: Can You Get A Second Mortgage With Bad Credit

How To Compare 50% Mortgages

Look for the lowest interest rate using this comparison, but check how long it lasts for. Most lenders offer initial rates for a fixed term, such as 1 or 2 years then put you on their SVR.

The mortgage LTV is in your favour with a 50% mortgage, so you should have your pick of some of the best mortgage rates on the market.

Most SVRs are higher than what you could get by switching to a better deal with the same lender, or if you were to remortgage with another.

Make sure you switch to a better deal when you move to the SVR, so you can keep your monthly repayments as low as possible for the entire mortgage term.

Is 65% Ltv A Good Ratio

LTV is important to think about because it determines the mortgage rate, and affects how lenders calculate whether the mortgage is affordable for you. The lower your LTV, the lower the rates, and the more mortgage options youâll have.

A 65% LTV mortgage is at the low end of the typical range â usually, lenders offer LTVs between 50% and 95%. With a 65% LTV, lenders are taking on less of a risk, so youâll have a wide range of competitive options to choose from, with better deals and a lower total cost than you would with higher LTVs.

Don’t Miss: What Is The Hiro Mortgage Program

What Is Ltv And How Do You Calculate It

LTV measures the amount of a loan against the value of the thing it will purchase. An LTV can be used in any type of secured loan situation, but is most commonly used when talking about mortgages.

In the context of buying a new home, your LTV is the mortgage amount divided by the total value of the home. Lets say you want to buy a home that costs $400,000. If you have a 20% down payment of $80,000, youll need a mortgage of $320,000.

The LTV is then determined by dividing the mortgage amount by the cost of the home. In this example, thats $320,000 / $400,000, which equals 0.8 or 80% LTV.

» MORE:How much do I need for a down payment on a house?

What Is A 90 Percent Mortgage

With a 90% LTV mortgage, you borrow 90% of the cost of the home you want to buy and put down the remaining 10% as your deposit, which will most likely either be from cash savings or home equity. For example, if youre buying a £400,000 property, youd need a deposit of £40,000 to have an LTV of 90%.

Don’t Miss: How To Determine What You Qualify For A Mortgage

Find Out If You Qualify For A Mortgage

Loan-to-value is the ratio of how much youre borrowing compared to your homes worth. Its a simple formula, but its the basis for most mortgage lending.

Once you know your LTV, you can figure out which mortgages youre likely to qualify for and which lender offers the best rates for your situation.

Popular Articles

Why Ltv Is Important

The higher your LTV ratio, the higher the mortgage rate youll be offered. Why? With a higher LTV, the loan represents more of the value of the home and is a bigger risk to the lender. After all, should you default on the loan and your home goes into foreclosure, the lender will need the house to sell for more to get its money back. Put another way, in a foreclosure, your down payment is the haircut the lender can take on the sale price of your house. So the smaller the haircut , the less likely the lender will get all of its money back.

Additionally, when your LTV is high and your down payment is relatively small, you have less to lose if you default and walk away from the loan . In other words, youre more likely to stick around if you put down 20% down than a 3%.

You May Like: How To Recruit Mortgage Loan Officers

Ltv Ratios In Commercial Real Estate

Loan-to-value ratios are applied in commercial real estate as well. However, banks andSBAs require LTVs lower than 80 percent when a property is intended to be an investment. It is one ofthe three primary ratios that commerciallenders typically use to determine a borrowers credibility.

In this instance, the of a property is often based on its commercial appraisal, but in thecase of residential properties, the purchase value is used, if its low. Themortgage is divided by the appraisal amount, calculating up to 80 percent. Thisshould ideally suffice to get the required amount however, this entirelydepends on the lender.

As a general rule, commercial lenders dont approve loans that have LTVs higher than 80 percent. But there are a few lenders who provide non-conforming mortgage programs that tend to go higher than the determined value. In the case of residential real estate, a lower LTV ratio is usually aligned with more favorable loan terms and rates.

Va Loan: Up To 100% Ltv Allowed

VA loans are guaranteed by the U.S. Department of Veterans Affairs.

VA loan guidelines allow for 100 percent LTV, which means that no down payment is required for a VA loan.

The catch is, VA mortgages are only available to certain home buyers, including:

- Active-duty military service persons

- Members of the Selected Reserve or National Guard

- Cadets at the U.S. Military

- Air Force or Coast Guard Academy members

- Midshipman at the U.S. Naval Academy

- World War II merchant seamen

- U.S. Public Health Service officers

- National Oceanic & Atmospheric Administration officers

Learn more about the benefits of 100% LTV VA financing here.

Read Also: How Do You Know If You Can Get A Mortgage

What About Combined Ltv

If you already have a mortgage and want to apply for a second one, your lender will evaluate the combined LTV ratio, which factors in all of the loan balances on the property the outstanding balance on the first mortgage, and now the second mortgage.

Lets say you have an outstanding balance of $250,000 on a home that is appraised at $500,000, and you want to borrow $30,000 in a home equity line of credit to pay for a kitchen renovation. Heres a simple breakdown of the combined LTV ratio:

$280,000 / $500,000 = 56 percent CLTV

If you have a HELOC and want to apply for another loan, your lender may look at a similar formula called the home equity combined LTV ratio. This figure represents the total amount of the HELOC against the value of your home, not just what youve drawn from the line of credit.

How To Calculate It

A loan-to-value ratio is easy to calculate. Simply divide the loan amount by the purchase price or, in the case of refinances, the appraised value. Lets say you want to buy a home valued at $300,000 and are able to put down 15% which is $45,000. Take $300,000 minus $45,000 to get $255,000 as the loan amount. To calculate LTV, divide $255,000 by $300,000 to get 0.85. Loan-to-value is always expressed as a percentage, so a result of 0.85 would translate to an LTV of 85%. In general, the higher your down payment, the lower your loan-to-value.

You May Like: What Mortgage Can You Afford Based On Salary

Maintaining And Increasing The Value Of Your Property

By keeping your house ‘in order’ you will minimise any loss of value if house prices go down. You can even increase your property’s value by carrying out home improvements like replacing the windows and doors with uPVC, upgrading the kitchen or bathroom and adding things like an en-suite. These may well increase the value of your property and give you a bigger equity in the process. This could, in turn, help lower your LTV when it’s time to remortgage.

Do You Want A High Or Low Ltv

An LTV of 80% or lower will help you avoid paying for private mortgage insurance and will allow you to qualify for a wide range of loan options. A higher LTV means more risk for the lender for a couple of reasons: The lender has to lend more money on the purchase. If home values decline, the lender loses more money.

Read Also: Is It A Good Idea To Pay Off Your Mortgage

Costs Of Mortgage Insurance

Generally, a higher loan amount and LTV ratio coupled with a lower credit score will mean higher mortgage insurance premiums. Costs vary depending on a number of factors, but if youre required to pay these premiums, be prepared for your monthly mortgage payment to jump in price. Also, youll find that if you have private mortgage insurance, it may be canceled once your balance reaches 80% LTV. However, if you have a mortgage insurance premium on your FHA loan and the LTV was 90% or more, youll owe this premium for as long as you have the loan.

Ltv And Refinance Loans

Unless you’re applying for a cash-out refinance, there may not be such a thing as a “good” or “bad” LTV here. Although the federal Home Affordable Refinance Program requires an LTV of at least 80 percent, many other refinance loans don’t include LTV as an eligibility factor. This is especially helpful if you have little equity in your home or are “upside” down, meaning the current balance of your existing mortgage is higher than the value of your home.

For a cash-out refinance, a good LTV can be as high as 90 percent, depending on the loan.

Recommended Reading: What Salary Is Required For A Mortgage

Improving Your Loan To Value Ratio

There are some ways you can improve your loan to value ratio. These may apply if youre a first-time buyer or remortgaging.

Either way, try to increase the amount of equity in your home so you dont need to borrow as much.

You can do this by:

- Saving more towards your deposit

- Pushing for a lower price on a new home than the seller is asking

- Adding value to your current home by making home improvements

Benefits vs Risks

Fha Loan: Up To 965% Ltv Allowed

FHA loans are insured by the Federal Housing Administration, an agency within the U.S. Department of Housing and Urban Development .

FHA mortgage guidelines require a downpayment of at least 3.5 percent. Unlike VA and USDA loans, FHA loans are not limited by military background or location there are no special eligibility requirements.

FHA loans can be an especially good fit for home buyers with less-than-perfect credit scores.

Read Also: Does Bank Of America Do Mortgage Loans

How To Calculate Ltv

To determine your LTV ratio, divide the loan amount by the value of the asset, and then multiply by 100 to get a percentage:

LTV = × 100

If you’re buying a house appraised at $300,000 and your loan amount is $250,000, your LTV ratio at the time of purchase is: x 100, which equals 83.3%.

In other words, the LTV ratio is the portion of the property’s appraised value that isn’t covered by your down payment. If you put 15% down on a loan that covers the rest of the purchase price, then the LTV is 85%.

Lenders and federal housing regulators are most concerned with LTV ratio at the time the loan is issued, but you can calculate LTV at any time during the loan’s repayment period by dividing the amount owed on the loan by the property’s appraised value. As you repay the loan, the amount owed decreases, which tends to lower LTV. If the value of your property increases over time, that also reduces LTV. But if the property’s value drops , that can push LTV higher.

When an LTV ratio is greater than 100%, a borrower is considered “underwater” on the loanthat is, when the market value of the property is less than the balance owed on the loan. LTVs greater than 100% are also possible early in the repayment period, on loans with high closing costs.