How To Avoid Paying Pmi

If a homebuyer doesn’t have the funds for a 20% down payment, it’s possible to avoid PMI by taking out two loansa smaller loan to cover the amount of the 20% down, plus the main mortgage. This practice is commonly known as piggybacking.

Although the borrower is committed on two loans, PMI is not required since the funds from the second loan are used to pay the 20% deposit. Some borrowers can deduct the interest on both loans on their federal tax returns if they itemize their deductions.

Another option to avoid PMI is to reconsider the purchase of a home for which you have insufficient savings to cover a 20% down payment and instead look for one that fits your budget.

Understanding What Is Fha Mip Its Cost And Mip Vs Pmi

By Cheryl LockOctober 18, 2019

Make sure you understand what is FHA MIP, how an FHA mortgage insurance premium works and the difference between MIP and PMI before you buy your house.

In this article:

Finding the right mortgage is one of the most important first steps to landing your dream home, and a Federal Housing Administration loan may help you get there. This type of mortgage is funded by traditional banks but insured by the U.S. government. Borrowers may qualify with lower minimum credit scores and can make smaller down payments when compared to conventional loans.

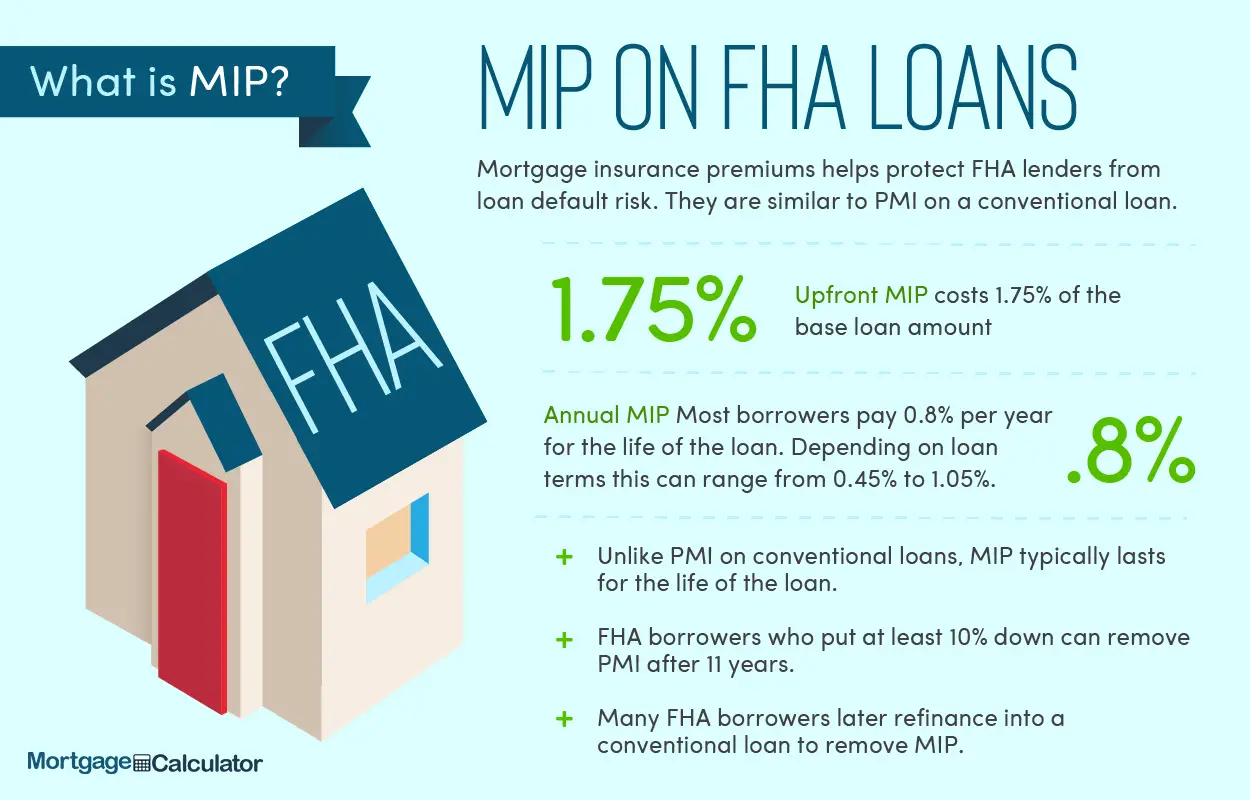

Despite the positives, the FHA does have some downsides. All FHA borrowers must purchase mortgage insurance, which protects the lender in case the borrower defaults on the loan. This insurance allows more lenient lending guidelines and lower overall interest rates than conventional mortgages. Heres what you need to know about an FHA MIP to ensure you get the best rate.

How Much Does Fha Mortgage Insurance Cost

- FHA Upfront MIP: 1.75 percent of loan amount

- FHA Annual MIP: 0.45 percent-1.05 percent of loan amount each year, based on amount borrowed, loan-to-value ratio and loan term

Upfront mortgage insurance premiums can be, and often are, financed into the loan amount, explains Peter Boomer, a mortgage executive with PNC Bank. Annual premiums are included in the borrowers monthly mortgage payment.

If you borrow $100,000 and roll the cost of FHA Upfront MIP into your loan, your loan amount will increase to $101,750 .

Naturally, that increases your monthly payment, as well. On a $101,750 30-year fixed-rate FHA loan at 4 percent, your monthly mortgage payment would be $485, compared to $477 without financing the MIP.

Tack on the annual premiums, too, and your monthly payment will rise further, adding another $72 per month, bringing the total to $557. Thats assuming you make a minimum down payment of 3.5 percent, in which case youll be charged an annual MIP rate of 0.85 percent.

Recommended Reading: What Does Qc Mean In Mortgage

How Do Pmi Payments Work

PMI is usually included in your mortgage payment. You may choose to pay PMI in one lump sum at the start of your loan. Or, you can opt for your lender to cover your PMI, but that means a higher interest rate on your mortgage. Understand that if you select the lender-paid option, you may pay more interest on your loan than you would including PMI in your monthly mortgage payment or paying in full.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How Long Does It Take To Get A Mortgage Commitment

How Much Is Fha Mip

The amount and duration of your FHA mortgage insurance premium will be based on a number of factors, including the overall loan amount, the loan term and how much of a down payment youre able to put down at the close of escrow. All loans require an upfront mortgage insurance premium of 1.75%, said Guy Troxler, a residential mortgage loan originator, real estate agent and specialist in FHA home loans for FedHome Loan Centers. This is usually rolled into the loan instead of being paid out of pocket. More specifically, mortgages that were either originated or refinanced after May 31, 2009, abide by the following general guidelines:

What Does The Federal Housing Administration Do

Congress created the Federal Housing Administration in 1934 during the Great Depression to stimulate the housing market. The FHA guarantees home loans issued by approved lenders. The loans are designed for borrowers with lower-than-average credit scores and who dont have the cash to come up with a big down payment.

You May Like: What Credit Is Needed For A Mortgage

Homebuyers Can Avoid Paying Pmi If Their Down Payment Is Large Enough

When you apply for a mortgage, the lender will typically require a down payment equal to 20% of the home’s purchase price. If a borrower can’t afford that amount, a lender will likely look at the loan as a riskier investment and require that the homebuyer take out PMI, also known as private mortgage insurance, as part of getting a mortgage.

PMI protects the lender in the event that you default on your primary mortgage and the home goes into foreclosure.

Mortgage Insurance Protects The Lender Not You

Mortgage insurance, no matter what kind, protects the lender not you in the event that you fall behind on your payments. If you fall behind, your credit score may suffer and you can lose your home through foreclosure.

There are several different kinds of loans available to borrowers with low down payments. Depending on what kind of loan you get, youll pay for mortgage insurance in different ways:

Also Check: How Is Mortgage Amount Determined

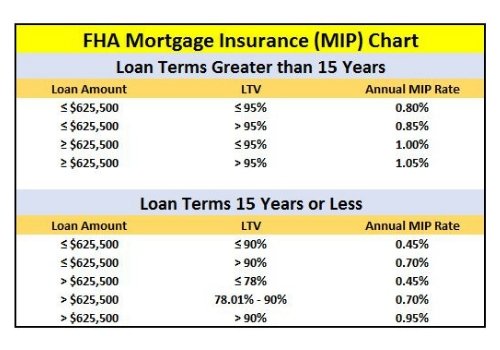

Terms Greater Than 15 Years

Heres what you can expect to pay if you have a loan term for longer than 15 years. The most common example of these types of loans is the 30-year term. Lets say you:

- Borrow less than or equal to $625,500 for your home purchase and you have a down payment of 5% or more. Youll pay 0.80% each year. On a $150,000 home loan, thats $1,200 per year or $100 per month.

- Borrow less than or equal to $625,500 for your home purchase and you have a down payment of less than 5%. Youll pay 0.85% each year. On a $150,000 home loan, thats $1,275 per year or $106.25 per month.

- Borrow more than $625,500 for your home purchase and you have a down payment of 5% or more. Youll pay 1% each year. On a $700,000 home loan, thats $7,000 per year, or about $583.33 per month.

- Borrow more than $625,500 for your home purchase and you have a down payment of less than 5%. Youll pay 1.05% each year. On a $700,000 home loan, thats $7,350 per year, or about $612.50 per month.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

How To Remove Conventional Private Mortgage Insurance

You have more options to cancel mortgage insurance if you have a conventional loan with PMI.

You can simply wait for your PMI coverage to drop off. By law, lenders must cancel conventional PMI when you reach 78% loantovalue.

Many home buyers opt for a conventional loan because PMI drops while FHA MIP does not go away on its own unless you put down 10% or more.

Keep in mind most mortgage lenders base the 78% LTV on their last appraised value and not the original value at the time of purchase.

If your property value has gone up substantially, contact your current loan servicer and check its requirements to cancel early.

The servicer may require a new appraisal, or rely on its own internal valuation tools to determine your homes uptodate value.

You can also cancel conventional PMI with a refinance.

The appraisal for your refinance loan serves as proof of current value. If your loan amount is 80% or less of your current value, you do not incur new PMI.

Recommended Reading: What Required To Refinance A Mortgage

Tax Implications Of Qualified Mortgage Insurance Premiums

Every year, your lender is required to send Form 1098 Mortgage Interest Statement to both you and the Internal Revenue Service . This form lists your mortgage payments over the past year and can affect your income tax. The total amount of the MIP or PMI premiums will be in box 5 of the form. To claim a deduction for either type of mortgage insurance, you must itemize your deductions using Schedule A under the interest paid section.

The deduction for these premiums expired on Dec. 31, 2017, thanks to the passage of the Tax Cuts and Jobs Act of 2017. However, the Further Consolidated Appropriations Act, 2020 passed, and Congress extended the deduction through Dec. 31, 2020. That means that the deduction was available for the 2019 and 2020 tax years, and retroactively for 2018 taxes.

Mortgage Insurance Premiums Defined

MIP is an insurance policy required on all FHA loans. Borrowers must pay upfront MIP at closing and will also have their annual premium added to their monthly mortgage payments.

UFMIP is equal to 1.75% of the loan amount. Annual premiums can range between 0.45 1.05% of the loan amount, depending on how much you borrow, how much you put down and your loan term. The one exception to this is if youre doing an FHA Streamline refinance on a loan that was endorsed prior to June 1, 2009. Well get more into all this in a minute.

On a conventional mortgage, mortgage insurance is referred to as private mortgage insurance . Borrowers with a conventional mortgage will pay PMI if they make a down payment less than 20%. This differs from FHA loans, on which youll pay mortgage insurance regardless of the size of your down payment.

Whats the purpose of mortgage insurance? Mortgage insurance helps offset the lenders risk when a borrower makes a low down payment, as lower down payments increase the amount of money your lender loses if you default . MIP and PMI insure the lender from this loss.

You May Like: What Is Refinancing Your Mortgage

How Much Is The Fha Mortgage Insurance Premium

Borrowers who put down 10% or less, the PMI is .85%. If a borrower puts down more than 10%, then the MIP goes down slightly to .80%.

For example, if you buy a $200,000 home and put in a 3.5% downpayment.

The LTV is 96.5%, so you have to pay a mortgage insurance premium of .85%, roughly $1700 per year. You can figure the amount you will have to pay for mortgage insurance using the FHA MIP chart below.

What Is The Federal Housing Administration

The term Federal Housing Administration refers to a U.S. agency that provides mortgage insurance to FHA-approved lenders. The FHA was established in 1934 by the U.S. government and became part of the U.S. Department of Housing and Urban Development in 1965.

The FHA funds its operations with income generated through mortgage insurance premiums . FHA loans require lower down payment minimums and lower . The mortgage insurance protects lenders against losses from mortgage defaults, so if a borrower does default, then the FHA pays the lender.

You May Like: How To Figure Mortgage Payment

What Are Fha Mortgage Insurance Premiums

FHA loans are guaranteed by the Federal Housing Administration which reduces the risk for mortgage lenders allowing them to lower their credit score and down payment requirements. The FHA program is funded by mortgage insurance premiums.

|

⢠Down payment of 10% or more MIP duration is 11 years |

|

⢠Down payment of less than 10% MIP is required for the life of the loan |

The MIP rate depends on the down payment, loan amount, and loan term. For most FHA borrowers with 3.5% down the MIP rate is 0.85%.

Mortgage Insurance Premiums For Fha Loans

One important difference between the mortgage insurance requirements for FHA and conventional loans is the upfront mortgage insurance premium. Every person who buys a house with an FHA loan has to pay an upfront fee which is currently 1.75% of the purchase price of the house. That means if you buy a house that costs $250,000, you have to pay an upfront premium of $4,375. Conventional loans do not have upfront mortgage insurance premiums.

Another important difference between MIP and PMI are the monthly insurance premiums. Every person who buys a house with an FHA loan must also pay monthly insurance premiums . The cost of MIP depends on the term of your mortgage, the amount of your base loan amount, and your loan-to-value ratio . While the cost of the annual premium can vary from borrower to borrower, the annual cost of MIP generally runs between 0.45% and 1.05% of the loan amount.

The same is true when you refinance an FHA loan. You will need to pay upfront and annual mortgage insurance premiums when you refinance using an FHA loan.

You May Like: What Salary Is Required For A Mortgage

Cost Of Fha Mip Vs Pmi

The speed at which you can have mortgage insurance removed is obviously very different among FHA loans and conventional loans, but the costs are another key differentiator.

The amount you pay for PMI can vary depending on your credit score and down payment amount. For borrowers with excellent or very good credit, or FICO scores of 740 or higher, PMI payments can be lower. As described above, annual mortgage insurance premiums for FHA loans vary based on the loan term and loan amount.

How Does Mip Benefit The Homeowner

The MIP protects the lender, but this fee is also what allows buyers to put as low as 3.5% down on a home. Essentially, an MIP puts homeownership in reach for many who wouldnt be able to afford it otherwise.

Lenders are much more willing to lend money for the purchase or refinance of a home knowing theyre protected against loss, Sullivan says.

Don’t Miss: How Much Is Mortgage Tax In Ny

How Long Do You Need To Have Mortgage Insurance

The good news about PMI is that in most cases, you wont have to continue paying on it for the entire length of your home loan. Most mortgage insurance plans allow you to cancel your policy once youve paid off more than 20% of the full loan amount of your home.

Typically, your lender would remove it once you have 22% equity. We suggest looking ahead to find out when youll have made it to the 20% benchmark to request a PMI cancellation and avoid paying unnecessary premiums.

Some mortgage insurance types require upfront payments that are also refundable when your mortgage insurance is canceled. Lets walk through the different types of mortgage insurance to learn more.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

How Does Mip Work

When you receive approval for a loan, the FHA will require you to pay an upfront MIP at the time of closing and an annual MIP, which is calculated every year and paid once a month.

Currently, the UFMIP rate is 1.75% of the amount of your FHA loan. For example, if you borrow $250,000, your upfront costs would be $4,375. The current annual premium rate is 0.85% for most FHA loans.

The UFMIP will be part of the total closing expenses, which include your mortgage principal, interest, property taxes, and homeowners insurance. You can also roll the cost of the UFMIP into your escrow payments.

Also Check: Is A Home Loan A Mortgage

How To Avoid Pmi

Mortgage insurance covers your lender, not you. That makes it an expense you’ll want to avoid, if possible. Below are a few ways you can avoid PMI, if you’re able:

- Put 20% or more down: If you have a conventional loan, you won’t have to pay PMI with a down payment of at least one-fifth of the home’s purchase price.

- Take a second mortgage: Often referred to as piggybacking, you can cap your first mortgage at 80% of your home’s value and use a second mortgage to finance the rest. Lenders usually require a down payment of at least 10% for this option.

- Choose a government-insured loan: If you’re eligible for a VA loan, backed by the U.S. Department of Veteran Affairs, mortgage insurance isn’t required. Same goes for USDA loans. Keep in mind, FHA loans require mortgage insurance.

- Cancel mortgage insurance when possible: Stay up to do date with your home’s market value and monitor your mortgage balance. Once the balance of your loan falls below 80% of your home’s value or purchase price, consider refinancing or contact your lender about eliminating PMI.

Related articles

How To Get Rid Of Mip On Fha Loans

You can avoid paying mortgage insurance after paying down your loan-to-value ratio on your FHA loan to 78% by refinancing your FHA loan to a conventional loan.

Contact your lender and ask them if youre eligible to have your annual insurance premium removed.

If you put less than 10% down on an FHA loan you will have to pay the MIP for the life of the loan. You can remove MIP after 11 years if your down payment is higher than 10%.

Also Check: How To Get A Mortgage Loan After A Foreclosure