Closing Costs Are Usually 2 To 5 Percent Of Your Loan Amount

The average cost to refinance your your mortgage is generally 2 to 5 percent of the remaining amount left on your loan. It also depends on where you live.

“If you live in a relatively rural location with low property rates, you’re going to pay less than someone living among million-dollar homes,” says Cliff Auerswald, president of All Reverse Mortgage. While the amount varies based on location and loan amount, the average closing cost of refinancing your mortgage is about $5,000 according to Freddie Mac.

“For example, you can expect your closing costs to be around $2,000 to $6,000 for a $100,000 mortgage refinance,” says Leonard Ang, GEO of iPropertyManagement, an online guide for real estate investors, landlords, and tenants. You can use this mortgage refinance calculator by Freddie Mac as a starting point to calculate your estimated refinancing costs.

How Do You Calculate The Break

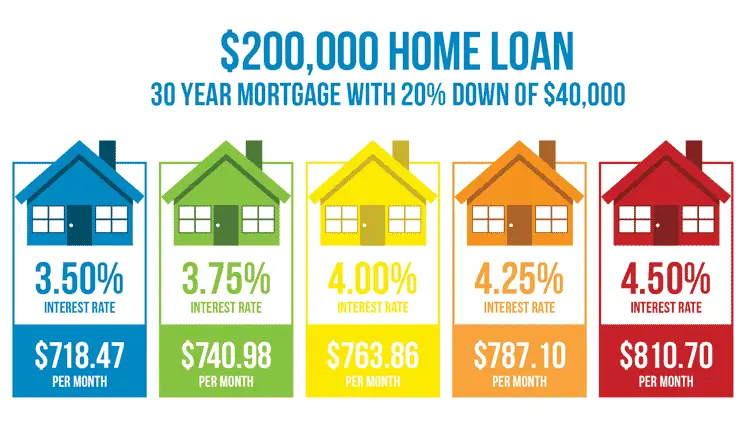

Use the step-by-step worksheet below to give you a ballpark estimate of the time it will take to recover your refinancing costs before you benefit from a lower mortgage rate. The example assumes a $200,000, 30-year fixed-rate mortgage at 5% and a current loan at 6%. The fees for the new loan are $2,500, paid in cash at closing.

|

|

$1,199 |

|

|

– $1,073 |

|

|

$ 126 |

|

|

|

|

|

126 x 0.72 |

|

|

$ 91 |

|

|

$2,500 |

|

|

$2,500 / 91 |

What Is A Cashout Refinance

A cashout refinance lets you access your home equity and refinance your mortgage at the same time.

When you use a cashout refinance, your new loan will be larger than what you currently owe on the home.

With the new loan, youll pay off the old loan and then keep the additional cash you didnt need to pay off the old loan.

The lump sum you keep is your cash out, and you can spend it on a variety of financial needs.

A few important notes on cashout refinancing:

- Cashout refinance rates are slightly higher than traditional mortgage refinance rates

- Your refinance rate depends on your credit profile and how much cash you take out

- You can typically cash out up to 80% of your home equity

- Your new loan will be larger than your old one, so youll pay more in mortgage interest in the long run

- Since mortgage rates tend to be lower than personal loan or credit card rates, cashout refinancing can be a better way to finance larger expenses

There are no rules about how you can or cant use the funds from a cashout refinance.

These additional funds can be used for many purposes, including home improvements, consolidating debt, and other consumer needs or wants, says Tom Trott, branch manager at Embrace Home Loans.

But because the loan is secured by your home, you typically want to spend your funds on something with a good return on investment like home renovations or consolidating higherinterest debt.

See a few more good examples of how to use a cashout refinance here.

Recommended Reading: Can You Get A Mortgage With A Fair Credit Score

Cashout Refi Vs Personal Loan

A personal loan is a fixed sum of money that provides funds for just about any purpose, including consolidating higherinterest debt and making big purchases.Lenders apply widelyvarying interest rates to personal loans that are generally determined by your creditworthiness. However, borrowers are usually expected to repay personal loans with monthly installments, similar to a mortgage loan.On the downside, personal loan interest rates tend to be significantly higher than mortgage, home equity loan, or HELOC rates.

Consider The Term Of Your New Loan

Before you decide to refinance, calculate your break-even point and how the overall costs including total interest of your current mortgage and your new loan would compare.

Take note that refinancing usually makes more sense earlier into your mortgage term.

In the early years of your mortgage term, your payments are primarily going toward paying off interest. In the later years, you begin to pay off more principal than interest, meaning you start to build up equity the amount of your home that you actually own.

Once you refinance, its like youre starting over. Say youve been paying off your old mortgage for 10 years, and you have 20 years to go. If you refinance into a new 30-year mortgage, youre now starting at 30 years again.

Don’t Miss: Is The Property Tax Included In Mortgage Payments

How Much It Costs To Refinance Your House

Refinancing closing costs typically come to 3% to 6% of your loan principal, according to the Federal Reserve. That’s $3,000 to $6,000 for every $100,000 borrowed.

To see how the numbers break down, take a look at this chart:

Popular Articles

| $150 – $400 |

You may pay some additional fees, depending on certain factors:

- Discount points: You can pay a fee at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your new mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%. You don’t have to pay for discount points when you refinance, but it’s an option.

- Prepayment penalties: A mortgage prepayment penalty is a fee you pay the lender if you sell, refinance, or pay off your mortgage within a certain amount of time of closing on your initial mortgage usually three to five years. The Federal Reserve states that prepayment penalties usually cost one to six months’ interest, but it varies by lender. Also, not all lenders charge this fee.

- Mortgage insurance: If you’re refinancing your conforming mortgage and don’t have 20% equity in your home, you’ll keep paying private mortgage insurance. The Fed estimates PMI to cost 0.5% to 1.5% of your principal. FHA mortgage insurance costs 1.75% at closing, plus an annual premium. You’ll pay a 0.5% funding fee to refinance a VA loan, and a 1% guarantee fee with a USDA mortgage.

Boost Your Credit Score

The better your credit, the lower the interest rate youll qualify for when refinancing. To get the best rate you can, work on improving your credit before you start applying to refinance. Check your credit report at AnnualCreditReport.com and review it for errors. If you spot a mistake, you can dispute it by contacting the credit reporting agencies . Maintain your credit by paying all of your bills on time, keeping your credit card balances well below the limit and paying more than the minimum amount, if possible.

Also Check: How To Get A Mortgage On A Foreclosure

The Cost To Refinance Mortgage

Whether you buy a house or want to refinance it involves certain expenses. It costs to refinance your mortgage, they come with a list of expenses in line with what you paid when you got your original home loan.

But its important to understand the cost to refinance and find ways to lower your mortgage refinance fees even before you decide on a new mortgage.

Closing Costs Vary By Lender

In addition to being different in every state, closing costs will of course be different for every lender as well.

As noted above in the page from the Federal Reserve, shopping around can have its advantages. What this means is that you would meet with different mortgage refinance lenders in your area for a quote.

Not only could this allow you to find a better interest rate, it could also give you leverage. If your current lender thinks you will take your business elsewhere, they may consider negotiating your current mortgage.

The more you shop around, the better chance you have of finding the best rate.

You May Like: What Is The Government Refinance Program On Home Mortgage

Use Figure’s Mortgage Refinancing Option

If youre looking for a simple way to refinance your mortgage, Figure can help. Our process has no paperwork since you apply for our mortgage refinance online. This ensures our application process only takes minutes to complete. Another benefit of our mortgage refinance process is that, instead of waiting an average of 39 days, you can see your refinancing application close in days, so the mortgage can fund more quickly. Lastly, our dedicated support team will help you through the process, answering any questions you have. You dont have to keep visiting the bank, or calling to make appointments, to receive assistance.Our at-home refinancing process is simple, clear, and streamlined. If you want to learn more, head over to our mortgage refinancing information page.

How Often Can I Apply To Refinance My Mortgage

While you should only ever refinance your home with good reason, there are no rules that limit how often you can refinance. Lenders, however, will typically set a limit. Keep in mind that your credit report will be pulled each time you refinance, and when this happens too frequently it can negatively affect your credit score. Since your credit score is also a factor in a lenders decision to approve your refinancing, a lower score would also lower your chances of approval.

You May Like: Can I Get Preapproved For A Mortgage More Than Once

How To Save Money When Refinancing A Mortgage

If youre concerned about the cost of refinancing your mortgage, there are things you can do to save money during the process and ensure that the process is worth your while:

- Shop around for the best rate: One way that you can save money when refinancing your mortgage is to shop around with different lenders to get the best rate. Many people automatically assume that they have to refinance with their current lender. And while this may be the convenient choice, it may not be the cheapest one. Generally speaking, you should inquire with four to five different lenders and choose the one that offers the best terms and rates.

- Pay closing costs upfront: Another way that you can save money when refinancing your mortgage is to bite the bullet and pay your closing costs upfront. Some lenders may offer no-closing-cost refinances that make it seem like youre getting a great deal. However, the closing costs are just included into your loan amount — raising it, your monthly payments, and your interest costs.

- Boost your credit score: The last way that you can save money when refinancing your mortgage is to boost your credit score to get the best rates. Maybe you didnt have the best credit score when you initially bought your home, but now you can secure favorable interest rates by raising your credit score above 700.

Your Current Mortgage Has A Prepayment Penalty

A prepayment penalty is a fee that lenders might charge if you pay off your mortgage loan early, including for refinancing. If you are refinancing with the same lender, ask whether the prepayment penalty can be waived. You should carefully consider the costs of any prepayment penalty against the savings you expect to gain from refinancing. Paying a prepayment penalty will increase the time it will take to break even, when you account for the costs of the refinance and the monthly savings you expect to gain.

Don’t Miss: How Do You Buy Down A Mortgage Rate

Average Cost Of A Mortgage Refinance: Closing Costs And Interest Charges

See Mortgage Rate Quotes for Your Home

The average closing cost for refinancing a mortgage in America is $4,345. These costs may vary depending on the lender and location of the mortgaged property. Additionally, the amount you borrow will impact the cost of the refinance. Refinances advertised with “no closing costs” or “no fees” often fold those charges into the interest rate, amount borrowed, or monthly payments of the new mortgage.

How A Cashout Refinance Works

A cashout refinance works by taking out a new, larger mortgage loan to pay off your existing loan.

The money remaining after paying off your original mortgage is paid to you in the form of a check at closing. This is the cashout component.

Heres an example of how a cashout refinance works:

- Home value: $350,000

- Refinanced loan balance: $280,000

- Cash-out at closing: $30,000

In the example above, the new loan first has to be used to pay off the existing mortgage.

The remainder of the loan amount $30,000 is the sum youre cashing out.

Youll also have to pay closing costs on a cashout refinance, which are usually 35% of the loan amount.

The good news is, when you refinance, its possible to roll closing costs into your loan balance so you dont have to pay them upfront.

But rolling closing costs into your loan does mean youll pay interest on them over time so consider the longterm costs before deciding to do so.

Read Also: What Documents Do I Need To Get A Mortgage

How Long Does It Take To Get Approved For Refinancing

Refinancing should take anywhere from 30 to 45 days on average, although that can stretch to 60 days if you hit any snags along the way.

Is it easier to refinance with current lender?

These are some possible benefits of refinancing through your current lender: The process may be quicker and easier. Your current lender already has your information in its system and knows your history. Your lender may waive or cut some closing costs.

You Want A Lower Monthly Payment

If youre considering refinancing to make your monthly mortgage payments more manageable, its a good idea to weigh that convenience against the costs, as well.

Add up your specific closing costs and make sure that, even with paying those, your lower monthly payment is still worth it. If the amount you would save each month ends up going toward closing costs anyway, it might not be the right decision for you.

For example:

However, if that takes some of the pressure off your budget, and the interest savings over time are still large enough, theres a good chance its worth it.

Carefully consider your situation and run the numbers to see if refinancing makes sense for you. In the end, its about finding a solution that works for you.

Recommended Reading: Can You Refinance To A 10 Year Mortgage

Typical Mortgage Refinance Fees

When you refinance, youre getting a new mortgage, so many of the closing costs are going to be familiar from when you bought your home. Its important to note that not everything will carry over from the first time around. Heres a table of some of the common costs that may be associated with refinancing. The costs are ranges or averages.

|

Refinancing Fee |

|

Varies |

Lets give a little bit more of a breakdown of these refinance fees:

There are a couple of other fees that may come into play depending on the loan type you have. If youre refinancing into an FHA loan, theres an upfront mortgage insurance premium of 1.75% of your mortgage balance that can either be paid at closing or rolled into the loan. If youre doing an FHA Streamline, the upfront funding fee is 0.01% of the loan amount.

Instead of mortgage insurance, VA loans have a funding fee of between 1.4% 3.6% that applies to most clients. The amount of the fee depends on whether its your first time using a VA loan and the amount of your down payment, among other factors. If its a VA Streamline refinance , the funding fee is 0.5% of the loan amount.

How Much Does It Cost To Refinance Your Mortgage

Your Closing Disclosure tells you exactly what you need to pay at closing. Here are a few of the closing costs you might see when you refinance:

- Application fee: Some lenders charge an application fee due when you apply for your refinance. You must pay your application fee even if the lender rejects your refinance request.

- Appraisal fee: Most lenders require appraisals before refinancing. Most appraisers charge $300 $500 for their services.

- Attorney fees: In some states, an attorney must review and file paperwork for your loan. Attorney fees can vary widely by state.

- Title search and insurance: Your lender may require another title search when you refinance your loan.

Expect to pay 2% 3% of your loan balance in closing costs. You may be able to roll your closing costs into your loan balance, depending on your lenders requirements.

Get approved to refinance.

Also Check: What Is A Good Dti For A Mortgage

How Our Mortgage Refinance Calculator Works

To use our refinance calculator, youll need to enter details about your current mortgage and the potential new loan. Once you put in the information, the refinance calculator will show you what you stand to save each month and your potential lifetime interest savings.

Our mortgage refinance calculator also factors in refinance fees. Youll even see your break-even period, which is how long youll need to remain in your home to recoup the refi costs.

Shop Around For Lenders

You can refinance with the same company that gave you your original mortgage, but you don’t have to. All mortgage lenders charges different fees, so pick your lender carefully.

Choose your top three or four lenders and ask each for a loan estimate, which is an itemized list of fees that make up your closing costs. You’ll be able to compare how much you’d pay with each lender.

Don’t Miss: What Percent Down Payment To Avoid Mortgage Insurance