The Most Popular Credit Score

According to a report in Fair Isaac, an overwhelming majority about 90 percent of the top lenders in the United States use the FICO score to determine consumer risk. But noting this, its important to keep certain things in mind when it comes to the FICO score there are more than 60 different types of it, so one FICO scoring formula may not necessarily come up with the same number as another scoring formula.The report goes on to state that the most popular FICO score used is FICO Score 8. Mortgage lenders typically use FICO Scores 5, 2 and 4 when determining whether or not to approve a loan. Additionally, one type of credit score to keep an eye on moving forward is the VantageScore, a score that was developed by the three main credit bureaus and currently serves as a competitor to FICO. Theres some speculation that VantageScore will continue to gain traction in the future. VANTAGE 3.0 is the latest score from this family of credit scores.

Check Your Vantagescore For Free

One of the many perks of being a BlueOx Credit Union member is we provide you with your updated VantageScore* four times per year, completely free. These quarterly updates are done through soft pulls of your credit, so rest assured they have absolutely no impact on your score. Checking your VantageScore is as easy as a few clicks of a mouse on a desktop computer within Online Banking, or a few taps on your connected device in our Mobile App.

*Loan rates are not solely determined based off of your VantageScore credit score. A full credit report will need to be pulled to determine the rate you are qualified for.

Do You Need To Track All Of Your Credit Scores

Consumer credit behavior has changed over the years. In order to offer credit scores that are as accurate and competitive as possible, both FICO and VantageScore update their scoring systems from time to time. Releasing new credit score versions also gives FICO and VantageScore new products to sell and more ways to make money.

Yet just because FICO or VantageScore releases a new credit score doesnt mean that every lender will upgrade and use it. Instead, different lenders may use different credit score versions. The concept is similar to the idea that all PC owners dont automatically update their computer software when Microsoft introduces a new operating system.

Because there are so many credit scores on the market, tracking all of them would be virtually impossible. But you dont need to track all of your credit scores either. Its far better to keep tabs on the information that influences your credit scores. In other words, you need to review your credit reports. Clean credit reports should equal solid credit scores under any FICO or VantageScore brand scoring model.

Also Check: What Does Prequalification For A Mortgage Mean

Vantagescore Vs Fico Score

FiCO scores are the most widely used scores used by lenders to determine the creditworthiness of consumers. This means more institutions use FICO over any other scoring model to decide if someone should get a loan, mortgage, or any other credit product. Most lenders require consumers to meet minimum FICO scores before advancing any credit.

Like the VantageScore, FICO uses a combination of factors based on a consumer’s credit file to determine a score. These includefrom most influential to least:

- Payment history

- New consumer credit files opened

- Mixture of credit

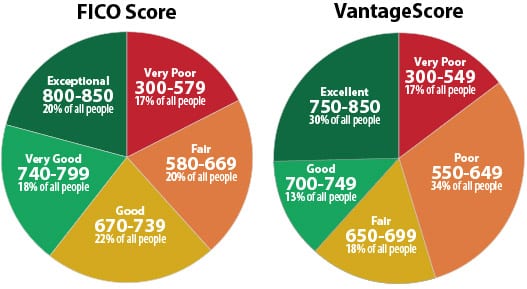

FICO generates scores between 300 and 850. Any score that falls below 580 is considered poor. Scores between 580 and 669 are deemed fair, while those between 670 and 739 are good. Scores from 740 to 799 are very good. Anything over 800 is considered exceptional.

What Else Do Mortgage Lenders Consider

Your credit score is a key factor in determining whether you qualify for a mortgage. But its not the only one lenders consider.

Income: Lenders will also look at your income. They want to make sure you make enough money each month to afford your payments.

Debt-To-Income Ratio: Lenders also look at your monthly debts. Lenders vary, but they generally want your total monthly debts, including your estimated new mortgage payment, to consume no more than 43% of your gross monthly income. If your debt-to-income ratio is higher, you might struggle to qualify for a mortgage.

Down Payment: The bigger your down payment, the more likely it is that youll qualify for a mortgage with a lower interest rate. Thats because lenders think you are less likely to stop making your payments if youve already invested a significant amount of your money into your loan. A higher down payment, then, makes your loan less risky for lenders.

Savings: Lenders want to make sure that you have funds available to make your mortgage payment if your income should unexpectedly dry up. Because of this, most will want to see that you have enough money saved to cover at least two months of mortgage payments.

Employment History: Lenders vary, but they usually like to see that youve worked at the same job, or at least in the same industry, for at least 2 years. They believe youre less likely to lose that job, and that stream of income, if youve built up a longer work history.

Recommended Reading: How Do I Apply For A Usda Mortgage

Do Any Lenders Use Vantagescore

LendersareuseVantageScoreareVantageScore

The Fair Isaac Corporation introduced the first FICO® scoring model to lenders in 1989. According to the company, FICO® scores are used today by 90% of top lenders to make lending decisions. The VantageScore model wasn’t introduced until 2006.

Also, is FICO higher than Vantage? The first two versions of the VantageScore ranged from 501 to 990, but the latest VantageScore 3.0 and 4.0 use the same 300-to-850 range as base FICO® scores. However, on the 300-to-850 scale, a score of at least 670 and 700 will generally qualify as having good credit.

Likewise, do mortgage lenders use VantageScore?

According to VantageScore, more than 2,400 lenders use the model to assess consumers’ creditworthiness. Brokers can also help steer mortgage applications to lenders who exclusively use VantageScore.

What is a good vantage credit score?

The VantageScore was developed by the 3 major bureaus including Experian, Equifax, and TransUnion. The latest VantageScore 3.0 model uses a range between 300 and 850. A VantageScore above 660 is considered good, while a score above 780 is considered excellent.

How Good Is A 760 Fico Credit Score

The FICO score 760 is well above the average credit score of 675, but there is still room for improvement. For consumers with a FICO 760 credit score, the average usage is AU$760. The credit score is very good, but it could be better. As your position in a prominent area increases, you can qualify for the best interest rates and terms.

What does your credit score start at

Also Check: When To Refinance Your Mortgage Rule Of Thumb

How To Improve Your Credit Score

Your FICO credit scores are broadly based on these five factors:

- Payment history This is the biggest factor and accounts for 35% of your credit score.

- Amounts owed How much debt you have makes up 30% of your credit score. This includes factors such as, your , the number of accounts with balances, and what you owe on different types of accounts.

- Age of accounts A longer credit history results in a better credit score. The duration of your accounts is 15% of your credit score.

- When you open new accounts or lines of credit, your score will take a small and temporary dip. These hard credit inquiries can stay on your account for up to two years, but only account for 10% of your overall credit score.

- The types of credit you have make up 10% of your credit score. So having different types of loans, a credit card, and a personal line of credit can help your credit score.

The nitty gritty of how certain aspects of your credit score are calculated varies depending on the credit scoring model. You have hundreds of scores. There are three credit bureaus, there are multiple generations of scoring software made by different companies, Ulzheimer says. But you dont need to fully understand or worry about every single type of credit score to start improving your credit score. The good news is that every single credit score is all based on the same thing one of your three credit reports, Ulzheimer says.

What Can Help Increase A Low Fico Score

10 Tips to Improve Your FICO Score Pay all bills on time. One of the most important factors in determining your FICO score is your payment history. Use Experian Boost. Your creditworthiness is based solely on the information contained in one of your credit reports. Add alternate dates to other credit reports. Keep your credit cards open. Pay your credit card balance sooner.

Read Also: Can I Get Preapproved For A Mortgage More Than Once

Heres What You Should Know About The Vantagescore And Fico Credit

The Fair Isaac Corporation introduced the first FICO® scoring model to lenders in 1989. According to the company, FICO® scores are used today by 90% of top lenders to make lending decisions. The VantageScore model wasnt introduced until 2006. It was developed by the three major consumer credit bureaus Equifax, Experian and TransUnion to create a more predictive scoring model that is easy to understand and apply.

Although both models are designed to predict a consumers ability to repay a debt, they do not treat all credit data equally. Lets explore some of the differences between the two models and why they may matter to you.

FICO groups the information into five categories, with each one representing a percentage of your score.

- Payment history: 35%

- Length of credit history: 15%

- New credit: 10%

- 10%

But again, keep in mind that the exact impact a specific category will have on your credit scores can vary depending on your individual credit history and the specific credit-scoring model used.

How Can I Improve A Bad Credit Score To Fair

- Record collection accounts. If the bills are seized and you can pay them, act now.

- Fraud and controversial errors. Eliminate all false and malicious information through the credit reporting agency’s dispute resolution process.

- Increase your credit card occupancy rate.

- Take advantage of a debt consolidation loan.

Recommended Reading: Should You Buy Down Mortgage Rate

What Does Fico 8 Mean

FICO 8 was introduced in 2009. Like all previous FICO scoring systems, FICO 8 aims to demonstrate how responsible and efficient an individual borrower is with regard to debt. The scores tend to be higher for those who pay bills on time, keep credit card balances low, and only open new accounts for specific purchases.

What You Need To Know

After reading the information above, it should now be clear that you dont have just one credit score. You have many. Between the many different FICO and VantageScore versions, there are actually hundreds of different credit scores that lenders may use to evaluate youthousands if you count custom-made models.

When you learn that there are so many different credit score possibilities, its natural to have a few questions.

You May Like: How Much Is Personal Mortgage Insurance

How To Build Your Credit

Now that you are familiar with some credit score basics, lets answer the question: How long does it take to build credit from nothing?

To get started, you need to get credit accounts that report to the credit bureaus, and then pay those accounts on time.

The first step is to open an account and begin making payments. This will cause the credit bureaus to take notice and create a credit profile associated with you.

As we mentioned above, in about 1 month you should have a VantageScore and in about 6 months you should have a FICO Score. If you have any credit history on your profile already, the process can go much faster.

Your first score may be low since your credit history is limited. Getting your first score is just the beginning. You will then start a lifelong process of improving and maintaining your credit score.

The more you can increase your score, the more financial freedom you can gain from lower interest rates, lower-cost insurance, and better financing options.

One great strategy to build your credit from nothing is to sign up for a Credit Strong credit builder account. See pricing and plans here, starting at only $15 per month.

Here are 8 websites where you can get your VantageScore for free:

Use A Mortgage Broker

A mortgage broker is a good option for credit-challenged borrowers because brokers work with many lenders, all with different approval criteria. A good broker can look at a borrower’s application and determine which lender in his portfolio best fits that borrower’s needs. If a broker’s portfolio of lenders is robust, it should include some that use VantageScore as a primary source of credit information. The borrower should ask the broker to steer his application in the direction of such lenders.

You May Like: What Documents Are Needed To Get Pre Approved For Mortgage

How Does Equifax Calculate A Credit Score

How does Equifax calculate your credit score? Equifax calculates your credit score based on the information in your credit report at the time your credit score was requested. In addition to tracking your payment history and any adverse events, such as late payments and court decisions, Equifax also considers factors such as:

Fico Score Base Ranges

| 800 to 850 | Exceptional |

FICO Scores come in two types: base scores and industry-specific scores. The lower boundary on the poor credit rating range differs slightly between the two.

Base scores are the ones that measure creditworthiness for all types of credit accounts, and their lowest possible score is 300. FICO Score 8 is the most popular base score, even though they released amore up-to-date FICO Score 9 in 2014.

Industry-specific FICO Scores measure creditworthiness for a specific type of loan, like a credit card or auto loan. Those scores can be as low as 250. Some of the most popular ones are FICO Bankcard Score 8 and FICO Auto Score 8 .

Below are the ranges for the most commonly used VantageScore, VantageScore 3.0.

Also Check: Can You Take Out Two Mortgages

Fico Score Vs Vantagescore

A Credit Card Insider study1 found that about 76% of Americans believe we have between one and three credit scores. Unfortunately, the reality is a lot more complicated.

Thanks to the scoring model variations and the modifications lenders make to them, we actually have hundreds of credit scores. Not to mention, lenders can choose to base them on the info in any of your three credit reports, which also vary.

While you dont need to know everything about all the scores out there, you should understand the two most common: FICO Score and VantageScore.

The Scoring Model Used In Mortgage Applications

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

- FICO® Score 2

- FICO® Score 5

- FICO® Score 4

As you can see, each of the three main credit bureaus use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors , but the categories are weighed a little bit differently.

It makes sense: Borrowing and paying off a mortgage arguably requires a different mindset than keeping track of and using a credit card responsibly.

The FICO 8 model is known for being more critical of high balances on revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on , have proven to be reliable when evaluating good candidates for a mortgage.

Don’t Miss: When It Makes Sense To Refinance Mortgage

Do Any Mortgage Lenders Use Vantagescore 30

Hello:

I will be applying for a home loan soon, post fc and just for kicks, through USAA I pulled my VantageScore 3.0.

It’s 50 points higher than myfico scores.

I know there is always talk about fako scores and different models being used, but does anyone know of any mortgage lenders that use VantageScore 3.0?

Thank you,

Which Credit Scores Do Mortgage Lenders Use

When you apply for a mortgage, lenders will generally request all three of your credit reports and a FICO® Score based on each report. However, the type of FICO® Scores they request are often older versions, due to guidelines set by government-backed mortgage companies Fannie Mae or Freddie Mac. It can be important to know about these different FICO® Score versions when you’re planning to buy a home.

Read Also: Can You File Bankruptcy On A Second Mortgage

Why Is My Mortgage Credit Score So Much Lower

There can be a disconnect between the credit scores you obtain for free and the ones your mortgage lender is using.

Typically banks, credit card companies, and other financial providers will show you a free credit score when you use their service. Also, credit monitoring apps can show free credit scores 24/7.

But the scores you receive from those third-party providers are meant to be educational. Theyll give you a broad understanding of how good your credit is and can help you track overall trends in your creditworthiness. But they arent always totally accurate.

Thats partly because free sites and your credit card companies offer a generic credit score covering a range of credit products.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back large debts.

For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan.

Mortgage lenders, on the other hand, are required to use a unique version of the FICO score almost exclusively.

Since mortgage companies loan money on the scale of $100,000 to $1 million, theyre naturally a little stricter when it comes to credit requirements.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back those large debts.

So theres a good chance your lenders scoring model will turn up a different lower score than the one you get from a free site.