What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

What Is Mortgage Preapproval

Before you buy a house, its a good idea to get preapproved. When you have mortgage preapproval, it means the lender evaluated your personal qualifying factors and determined you can afford the loan.

But, a preapproval doesnt mean youre ready to close on the loan. It simply means you are qualified to borrow the money based on the documents youve provided up to that point.

What Paperwork Do You Need To Get A Mortgage

Before the underwriter can approve your mortgage, they’ll need to know you have the income to pay for the loan, that your finances are not overstretched by existing debts, and that you have assets to cover any closing costs. And in case your economic circumstances change, theyll also want to see that youve got enough of a financial cushion to cover your expenses until youre back on track.

To verify your income, lenders typically need:

-

1 or 2 years of personal tax returns

-

1 or 2 years of business tax returns

-

1 or 2 years of W-2s or 1099s

-

1 or 2 months of bank statements

-

Access to your credit score and credit report

-

Proof of any alimony or child support payments

To verify your debts, lenders typically require:

-

A monthly bank statement of any new accounts youve opened

-

Release documents confirming any derogatory events on your credit report have been settled

-

If youre refinancing, a mortgage statement and your homeowners insurance policy

-

If youre divorced, a full copy of your divorce decree to verify any payments that form part of your ongoing debts

-

If you own other property, mortgage statements, your homeowners insurance policy, and confirmation of the homeowners association dues

To verify your assets, lenders typically want to see:

You can explore a detailed list of all the documents youll need here.

Read Also: How To Apply For A House Mortgage

Your Land Title Registry Offices Role

Land title registry offices are part of your provincial or territorial government. These offices register official property titles. They have processes to make changes to a propertys title.

You, your lawyer or your notary must provide your land registry office with all the required documents. Once it receives the documents, your land registry office removes the lenders rights to your property. They update the title of your property to reflect this change.

Preparing To Apply For A Mortgage

Youve found a new home and now youre ready to apply for a mortgage. Or, youve decided to stay where you are and refinance. Its perfectly natural to be a little apprehensive about the mortgage application process, especially if you are a first-time home buyer.

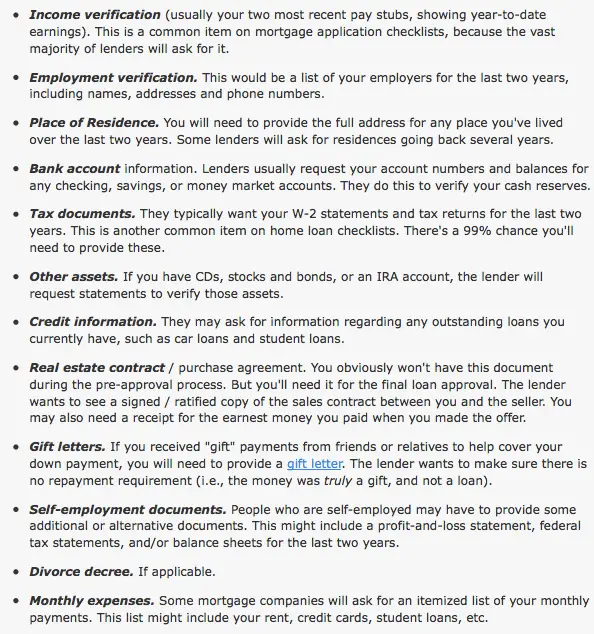

Rest assured, your loan officer at Maple Tree Funding will help make applying for a mortgage or refinancing your home as stress-free as possible. Listed below are the types of documents you will generally need when applying for your loan. It can vary depending on the lender, but this should give you a good sense of the documentation you will need.

Recommended Reading: How Much Is The Mortgage On A $300 000 House

A Final Mortgage Loan Documents Checklist

As you locate and organize your documents, cross-check your stack of paperwork against this checklist to make sure your lender will have all the information they need:

- 2 years of tax returns

- W-2s from the past 2 years

- Recent pay stubs

- 1099 forms and profit and loss statements for self-employed individuals

- Divorce decrees verifying alimony and child support payments

- Proof of social security or disability income

- Bank account statements

- Stock or bond account statements

- Retirement account statements

- Proof of gift funds and gift letters

- Documents for the sale of assets

- Proof of outstanding, long-term debts

- Letters of explanation for credit mishaps

- Documented rent payments for current renters

Of course, youll also need to assemble your actual mortgage application, which will include additional information about your current financial standings and the real estate youre looking to purchase. Similar to other large purchases, your lender will likely verify your identity with a photo ID, so its a good idea to have one readily available with the rest of your documents.

What To Provide To Your Lender Or Mortgage Broker

Before preapproving you, a lender or mortgage broker will look at:

- your assets

- your income

Youll need to provide the following:

- identification

- proof you can pay for the down payment and closing costs

- information about your other assets, such as a car, cottage or boat

- information about your debts or financial obligations

For proof of employment, you may have to provide:

- a proof of your current salary or hourly pay rate (for example, a recent pay stub

- your position and length of time with the employer

- notices of assessment from the Canada Revenue Agency for the past 2 years, if youre self-employed

Your lender or mortgage broker may ask you to provide recent financial statements from bank accounts or investments. This will help them determine if you have the down payment.

Your debts or financial obligations may include your monthly payments for:

You May Like: Does Rocket Mortgage Affect Your Credit Score

Retirement Or Investment Account Statements

If you are retired, you need to show proof of any retirement income. According to Wise, the best way to do so is with an award letter. An award letter is one that either the Social Security Administration gives you or that can be provided by the retirement fund that youre using. The letter shows how much youre getting paid every month.

As far as personal retirement accounts, stocks, and other investments youve made that you want to have considered in your income you will have to show the lender your investment accounts. This may include showing copies of your stock certificates and records, investment or securities accounts for the last three years .

Calm Your Mortgage Minion

It is said that music can soothe the savage beast. Well I have learned over the years to sing sweetly to many frustrated clients who were about to put their fist through the computer or throw the printer into the fire.

My song is one of common sense. Of working to understand the nature of the lenders request and to help translate that into notes that bring heart rates down and skin tones back to pink, brown, and olive. And it helps to move you from frustration to private mortgage funded.

Find out more about all of things you need to know about your Private Mortgage Made Easy

Don’t Miss: Can You Refinance Mortgage With Poor Credit

Checklist Of Documents Youll Need For A Mortgage

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you’re applying for a home loan, your mortgage lender will want to take a deep dive into your financial life. This is to ensure that you meet all of their underwriting guidelines and are in the position to easily afford your new mortgage payment. Throughout the approval process, you can expect to be asked for documents that substantiate different aspects of your income, work status, expenses and more. It’s little wonder that it can take up to 60 days to complete.

Getting your paperwork organized in advance is a great way to streamline the process and improve your odds of getting approved. Here we take a closer look at the supporting documents you’ll need if completing the uniform residential loan application . It’s the form most lenders use to determine a borrower’s mortgage eligibility.

Why Is Mortgage Preapproval Important Is It Necessary

Mortgage preapproval can help you buy the house of your dreams. Heres why.

Sellers look for preapproved buyers. They dont want to take a chance on a buyer that cant afford the home.

Anyone can walk through the home and say they want to buy it, but that letter from the bank makes all the difference.

The preapproval letter tells sellers you can buy the home and qualify for financing based on the conditions they wrote in the letter.

Can you buy a home without a preapproval letter?

Sure, but its not recommended.

If youre up against any other buyers, the seller will likely accept the offer from the buyer with the preapproval letter versus the one without one.

Also Check: How To Get Assistance With Mortgage Payments

Current Minimum Mortgage Requirements For A Usda Loan

Down payment. Borrowers that meet the USDA income limits can purchase a home with no down payment. Money needed for closing costs can come from your own funds or from a gift.

USDA guarantee fees. The USDA requires two types of guarantee fees instead of mortgage insurance. The fees are charged to offset the costs of the rural loan program to taxpayers. The first is a guarantee fee of 1% of the loan amount and is typically financed. The second is an annual guarantee fee equal to 0.35% of the loan amount, which is divided by 12 and added to the monthly payment.

. Although the USDA doesnt set a minimum score, USDA-approved lenders typically require a minimum credit score of 640.

Employment. USDA borrowers must have 12 months of stable income. If youre self-employed, a two-year history is required.

Income limits. The USDA counts the income of all adult household members to ensure the household income doesnt exceed the program limits in your area. Total household income for a USDA loan must be at or below 115% of the median household in the area youre buying. Use the income eligibility search tool to check on the limits in your state.

DTI ratio. The front-end DTI ratio maximum is 29%, while the back-end DTI ratio maximum is 41%. USDA borrowers with a credit score of 680 or higher may qualify with higher front- and back-end DTI ratios of 32% and 44%, respectively, with proof of steady income and extra cash reserves.

Occupancy. USDA financing is for primary residences only.

If Youre Getting A Construction Loan:

Construction loans are for people who are building a new home, or making major renovations to an existing one. In these situations, you may need to provide your lender with extra documentation such as:

- Building contracts that outline the drawdown schedule and the length of construction

- The final price determined by the builder

- Council approved building plans

- Builderâs insurance documentation

- Property specifications. These include materials used , brands of appliances, number of bedrooms and bathrooms, additional features , etc.

You May Like: What Is Needed For Mortgage Application

Ask A Mortgage Banker: What Kind Of Documents Do I Need To Get A Mortgage

When it comes to getting approved for a mortgage its understood that there are lot of required documents which means a lot of gathering of information for the borrower. Weve included a list of required documents below, which you will need to provide when getting a mortgage. You can also download a printable version of our loan document checklist here.Personal Information:

- Color copy of drivers license

- Color copy of social security card

Income Information:

- Copies of most recent paycheck stubs detailing last 30 days

- Social security award letter

- Retirement pay documents

- Copies of bank statements detailing the last 60 days of activity

- Copy of most recent retirement account statement

- Copies of all 1099 s and W-2s from the past 2 years

- Copies of all federal tax returns with all schedules for the previous 2 years

Residence Information:

- Any address for the last two years

- Copy of previous year property tax bill and homeowners insurance policy

- Agent name and contact information for homeowners insurance company

Debt Information:

- Information on all outstanding loans and credit cards

- Names and account numbers of creditors

- All monthly payments and account balances

Other Information :

- Copy of divorce decree and property settlement agreement Child support documents

- Copy of bankruptcy and final discharge documents Judgment or lien releases

What Documents Do I Need For Mortgage Pre

Armed with a mortgage pre-approval, a potential home buyer can confidently approach a real estate agent as a qualified prospect and close the deal quickly. Several documents are necessary to prove your financial ability and reach a positive outcome.

Typically, 30 days of paystubs and the last two years W2s will be required but sometimes income can be verified online and those documents may not be necessary. In situations that income varies, other documents may be required.

For the self-employed, youll need Federal tax returns for two years and sometimes a Profit and Loss Statement reflecting year to date income. Any part time jobs or secondary income such as rental income, child support, or retirement benefits also need to be declared and documented.

When a pre-approval is granted, the borrower will receive a written confirmation stating the borrowing amount given and the approximate interest rate. Pre-approval letters may be subject to a variety of underwriting conditions.

Also Check: What Banks Look For When Applying For A Mortgage

How Long Does A Mortgage Pre

The pre-approval process can vary from one person to another. The process can take as little as an hour or as long as a few days. When an income stream is straightforward and your credit score isnt blemished, youll likely be approved quickly.

Self-employment or diverse income streams complicates things. It may take longer for the lender to render his decision. Whether your credit score is less than exemplary or youre financially well off, youll soon find out if youre pre-approved and for how much.

A pre-approval usually takes 1 to 2 business days, depending on the borrowers situation and the speed at which documents are supplied to the lender. Some lenders may only require your credit score, while others may want to review a complete application and additional documents. When you start thinking about homeownership, the pre-approval process is always the best first step.

History Of Mortgage Or Rent Payments

Understandably, your lender wants proof you’ll follow through with on-time monthly mortgage payments. To verify this, they might ask about your current mortgage .

Current mortgage statement

If you own a home and currently have a mortgage balance, you’ll likely need to submit your most recent statement showing how much you still owe on the home. This is especially true if you’d like the ability to close on your new home before you sell the old one.

Landlord information

If you’re currently a renter, you’ll need to provide contact information for your landlord, as well as documentation showing that you’ve paid rent.

Don’t Miss: What Is Loan To Value Mortgage

Complete These Five Simple Steps To Get To The Closing

Okay. Youve found your dream home and the seller has accepted your offer. Heres what you can expect during the mortgage process, from application to closing.

Mortgage Paperwork Rounds One And Two

Home buyers provide a slew of documents throughout the buying process. For the sake of simplicity, lets split them up into two main groups:

Definition: In case youre not familiar with the term, a real estate closing is the final step in the home buying process. This is where the buyer signs all of the finalized mortgage documents and other paperwork, and when the funds are distributed to the appropriate parties. It finalizes or closes the deal, hence the term closing.

Recommended Reading: How Much Interest Do I Pay On A Mortgage