How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Can I Get A Mortgage With A Low Credit Score

Typically, if your credit score is less than 600 or even 650 in some circumstances, getting approved for a mortgage that you can afford, may be a challenge. Each lender has its own formula for determining the level of risk they will assume when evaluating your mortgage application, so it is difficult to provide a one size fits all answer. There are also companies that specialize in mortgages for purchasers with weak credit histories, who may charge a higher interest rate or insist on a higher down payment. As each purchaser’s situation is different, you should speak with a range of potential lenders and choose the one that best meets your needs.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How To Shave Years Off Your Mortgage

Home Sweet Home: Buying Can Be Trying

Buying a new house is a major life achievement. From the perfect condo to the picket fence, the purchase of a new home is a personal milestone in your journey toward security, stability and independence. TransUnion can help you avoid unwanted setbacks by providing you with mortgage information on credit scores, fees, and more as you move to close the deal.

How Do Different Credit Issues Impact Credit Score

If youre worried about previous credit issues, then gaining the right advice before applying is really important, so this would be a great time to talk to one of the expert advisors we work with.

Just because youve had previous issues with credit, it doesnt necessarily mean you cannot get a mortgage.

The following credit issues are ranked in increasing severity weve also included the likelihood of finding a mortgage lender in each particular scenario.

Multiple issues at once can further affect the decision but doesnt make it impossible:

- County Court Judgements Same as defaults, although some lenders are less accepting of CCJs mortgages

- Mortgage arrears If you have been in a situation where youve faced mortgage arrears then the bad news is these are considered more severe than late payments for unsecured accounts .However, there are lenders who will accept you if the arrears were over 3 years ago, some lenders are happy if the arrears were over a year ago, a few are happy within the last 12 months, and a small amount even consider current arrears!

You May Like: Can You Get A Mortgage With A Fair Credit Score

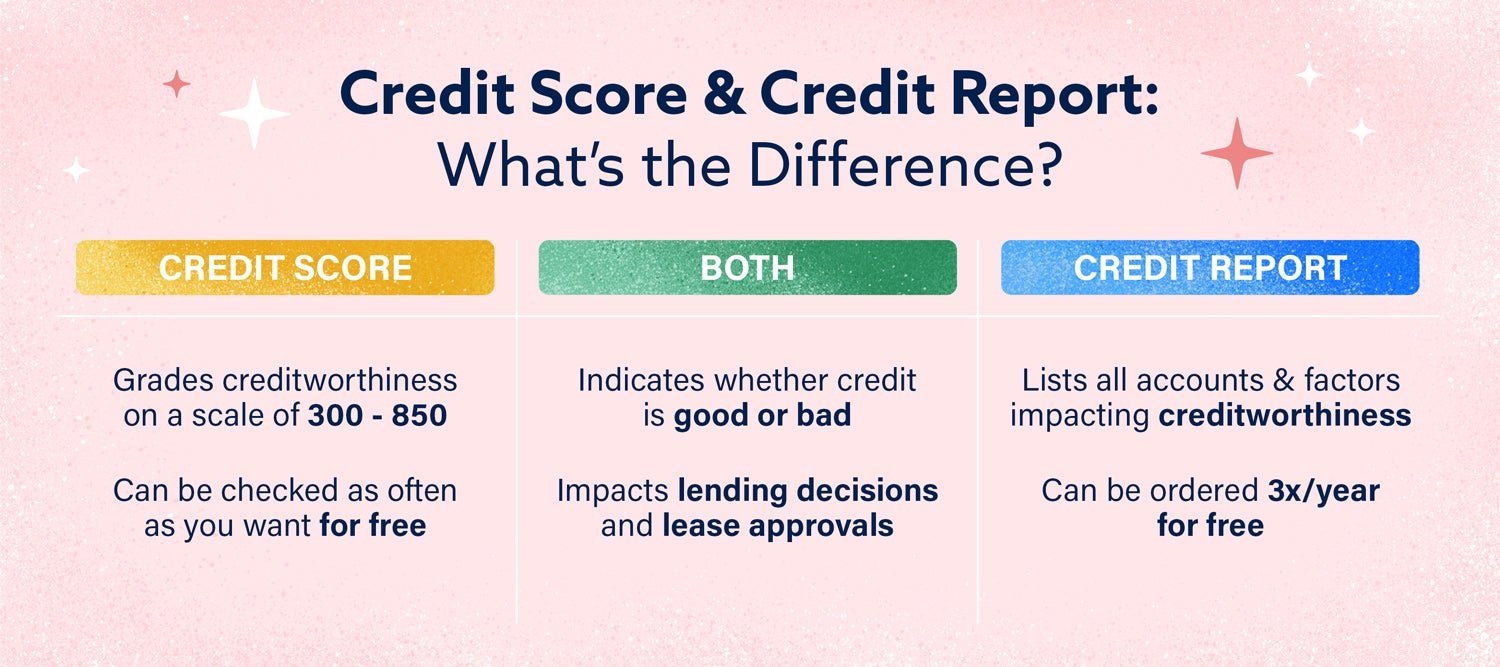

What Is A Credit Score

Your credit score is a number that illustrates your financial health at a specific point in time. It also serves as an indicator of your financial past, and how consistently you pay off your bills and debts. This is one of the factors mortgage professionals consider in qualifying you for a mortgage.

Want A Mortgage The Credit Score Used By Mortgage Companies Will Surprise You

Shutterstock

If you are applying for a mortgage, your credit score will be a critical part of the process. You could get rejected with a credit score that is too low. And once approved, your score will determine the interest rate charged. Someone with a 620 might have to pay an interest rate that is as much as 3% higher than someone with a 740. But what credit scores do mortgage lenders actually use? The answer might surprise you.

Much Older Versions Of FICO

Fannie Mae and Freddie Mac are government-agencies that purchase the majority of mortgages originated in the country. These agencies set the rules and underwriting criteria for the loans that they purchase, including what credit scores should be used. Surprisingly, the agencies require much older versions of the FICO credit score. According to a review of the agency Selling Guides by MagnifyMoney, these are the scores that matter:

- From the Equifax credit bureau: FICO Version 5

- From the Experian credit bureau: FICO Version 2

- From the TransUnion credit bureau: FICO Version 4

Even though FICO has just recently introduced Version 9 of its score, most mortgage lenders will still be using a much older credit score.

Watch on Forbes:

Which Older Version Of FICO Will Be Used?

How Do I Get A Good Credit Score ?

What If My Mortgage Is Not Purchased By Fannie Mae or Freddie Mac

Also Check: Is A Timeshare Considered A Mortgage

What Types Of Credit Cards Are There

Banks, credit card companies, stores, gas stations and even phone companies offer credit cards. Standard credit cards usually have no fee or a low annual fee. Some of the benefits of a standard credit card include convenience, security, the ability to extend payments over time, low interest on balance transfers, cash back, savings on purchases and loyalty points and of course, the ability to build a good credit history over time. Premium credit cards charge higher annual fees and may offer more valuable rewards programs, access to airport lounges, insurance benefits and a broad range of other benefits. With rewards cards, you earn points based on the amount you spend, provided your payment history is up to date.

Why Do Fico Scores Fluctuate

There are many reasons why your score may change. The information on your credit report changes each time lenders report new activity to the credit bureau. So, as the information in your credit report at that bureau changes, your FICO® Scores may also change. Keep in mind that certain events such as late payments or bankruptcy can lower your FICO® Scores quickly.

FICO® Scores consider five main categories of information in your credit report.

- Your payment history

- Types of credit in use

Don’t Miss: How To Get Approved For Mortgage With Low Income

I Opted In But It Says No Score Is Available Why

The most common reasons a score may not be available:

- The credit report may not have enough information to generate a FICO® Score

- The credit bureau wasnt able to completely match your identity to your Wells Fargo Online® information. To keep your information current, sign on to Wells Fargo Online®, visit the Profile and Settings menu, select My Profile and then Update Contact Information. Make sure your email addresses, phone numbers, and mailing addresses are current.

- If you’ve frozen your credit with the credit bureau, you may not immediately receive a credit score. A score should become available for you to view after the next monthly update. Contact Experian® with further questions.

What Numbers Do Mortgage Lenders Look At

Lenders use credit scores to determine a borrower’s level of risk.

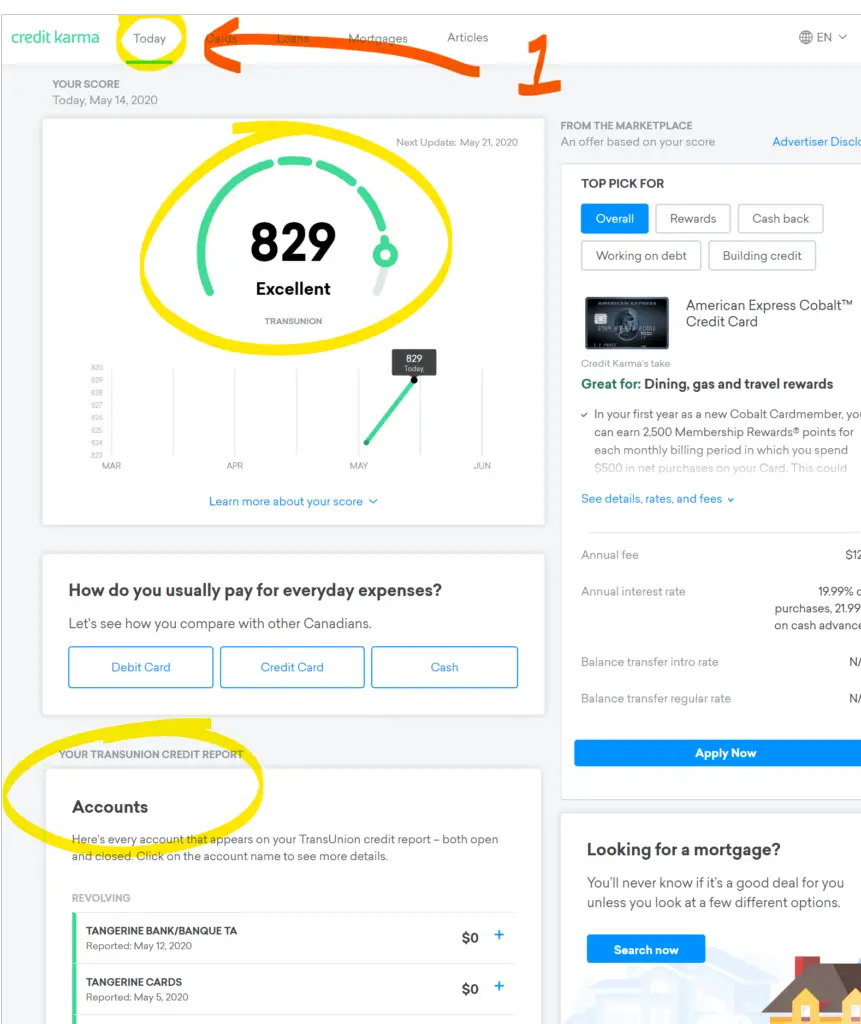

Three credit bureaus Equifax, Experian, and TransUnion calculate an individual’s credit score. The higher your credit score, the better interest rate you’re likely to get which also means you’ll have a lower monthly mortgage payment. Before you apply for a mortgage, it’s a good idea to check your credit score and review your credit report to make sure everything is correct.

Don’t Miss: How Long Is A Mortgage Rate Good For

What Else Do Mortgage Lenders Look At To Determine Mortgage Terms

Your credit scores can be an important factor in getting approved for a mortgage and the rates you’re offered. However, mortgage lenders also go beyond your credit scores when evaluating a potential borrower’s application.

They’ll also take a close look at the information within your credit reportsnot just your scores. For example, even if you have a good credit score, the lender might deny your application if you recently filed for bankruptcy or had a home foreclosed on. Or if you owe too much money to collection agencies.

Mortgage lenders may also request various financial records, including recent bank statements, investment account statements, tax returns and pay stubs. They can use these to determine your income, debts and debt-to-income ratio, which can be an important factor.

Other factors, such as the loan amount, the home’s location, your down payment and loan type can all play into whether you’ll be approved and your mortgage’s terms. Lenders may also have unique assessments, which is one reason shopping for a mortgage can be important.

Why Is This Fico Score Different Than Other Scores Ive Seen

There are many different credit scores available to consumers and lenders. FICO® Scores are the most widely used credit scores and are the only credit scores used in over 90% of U.S. lending decisions. Its important to know that there are also several different versions of FICO® Scores. Different lenders may use different versions of FICO® Scores. In addition, your FICO® Score is based on credit report data from a particular credit bureau, so differences in your credit reports may create differences in your FICO® Scores. The FICO® Score Wells Fargo is providing you for free is for educational purposes. When reviewing any of your credit scores from any source, take note of the date, bureau credit report source, version, and range for that particular score. For more, see Understanding the difference between credit scores.

Also Check: How Much Mortgage Can I Afford On 200k Salary

How Will I Know If My Fico Score Is Available

If your account is eligible, the link to View Your FICO® Credit Score will automatically display on your Account Summary screen. Just select the link to opt in and view your FICO® Score.

Note: You can also access your FICO® Score in Spanish with your smartphone.

- Direct your mobile browser to wellsfargo.com or download the Wells Fargo Mobile® app.

- You can update your setting any time on the Language Preference screen. Just sign on to your account, go to the Profile and Settings menu, and select Language Preference.

How Credit Scores Affect Mortgage Rates

A loan savings calculator, such as the one offered by myFICO, can demonstrate the impact of credit scores on mortgage rates. Enter your state, mortgage amount, and credit score range, and get an idea of what your mortgage terms would be. Such calculators provide only estimates. Your mortgage lender can give you exact terms after reviewing your complete financial details and down payment.

Enter a $200,000 principal on a 30-year fixed-rate loan, and your credit score ranges, mortgage rates, and overall costs, as of February 2020, might look something like this:

- 760 to 850: APR of 3.199% with a monthly payment of $865. The total interest paid on the mortgage would be $111,337.

- 700 to 759: APR of 3.421% with a monthly payment of $889. The total interest paid on the mortgage would be $120,145.

- 680 to 699: APR of 3.598% with a monthly payment of $909. The total interest paid on the mortgage would be $127,264.

- 660 to 679: APR of 3.812% with a monthly payment of $933. The total interest paid on the mortgage would be $135,981.

- 640 to 659: APR of 4.242% with a monthly payment of $983. The total interest paid on the mortgage would be $153,860.

- 620 to 639: APR of 4.788% with a monthly payment of $1,048. The total interest paid on the mortgage would be $177,237.

You can experiment with your own numbers, including down payment amount, loan term, and property taxes, using our mortgage payments calculator.

Also Check: How Much Money Should You Spend On Mortgage

Private Mortgage Lenders For Bad Credit

There are plenty ofprivate mortgage lendersthat offer bad credit mortgages in Canada. A few examples include Alpine Credits, Prudent Financial, Clover Mortgage, Canadalend, and Guardian Financing. Forprivate mortgage lenders in Ontario, a few examples include Castleton Mortgages, MortgageCaptain, and MortgageKings. You might be required to go through a bad credit mortgage broker in order to access some private lenders, as some may only work through brokers.

Some private lenders have no minimum credit score requirements, and some even allow you to make interest-only payments on your mortgage. This can help you keep up with your payments if you are having cash-flow issues. Making regular mortgage payments to a private lender can also help improve your credit score, making it easier to eventuallyrefinance your mortgageat a lower mortgage rate with another lender.

Check Your Credit And Monitor Your Progress

While you’re working your way toward the credit score needed to buy a house, check your progress with a free score some credit cards and many personal finance websites offer them.

Free credit scores often are VantageScores, a competitor to FICO. Either type of score can be used to track your progress they both emphasize the same factors, with slight differences in weighting, so they tend to move in tandem.

Mortgage lenders check older versions of the FICO score . If you want to see where you stand on those so you know exactly what mortgage lenders will see, youll have to purchase a comprehensive FICO report. You can do that at myFICO.com, then cancel the monthly service rather than pay an ongoing fee. Be sure to cancel before the next billing cycle starts the monthly subscription fee will not be prorated.

However, if youre near or in the excellent credit score range on a free score source, you dont need to pay to check your FICO scores. You almost certainly have good enough credit to qualify for the best rates.

About the authors:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Kate Wood writes about mortgages, homebuying and homeownership for NerdWallet. Previously, she covered topics related to homeownership at This Old House magazine.Read more

Don’t Miss: Do You Have To Pay Fees To Refinance A Mortgage

Will A Mortgage In Principle Affect My Credit Rating

This is a common question, and many people also want to know, does mortgage preapproval affect credit scores?

As mentioned, if the search is a soft-search, then no. If hard search, then it is recorded on your file and can impact your credit score with some agencies and lenders, depending on how recent and how many searches are recorded.

How Do Fico Scores Consider Loan Shopping

In general, if you are loan shopping – meaning that you are applying for the same type of loan with similar amounts with multiple lenders in a short period of time – your FICO® Score will consider your shopping as a single credit inquiry on your score if the shopping occurs within a short time period depending on which FICO® Score version is used by your lenders.

You May Like: How Big A Mortgage Can I Get With My Salary

Fill Out Some Details About Yourself

Websites that specialize in free credit scores typically request similar details from their users. Their requests may vary in a subtle manner, though. These websites in general ask for information such as your full name, your social security numbers last four digits, your birthdate and, last but not least, your mailing address. Fill these fields out in a slow and alert manner. Avoid making information mistakes. Try to avoid making any typing mistakes, too. You want to make sure that the information you provide is as precise and accurate as possible for obvious reasons. It isnt uncommon for credit score sites to request that users manage a couple security questions. The site may pose a question to you that involves a prior street address to verify that its really you requesting the information. Thats really all there is to it. Its much simpler than it was just a few years ago so you can easily check your FICO score monthly to watch for changes and to monitor that what you are doing is improving your score and not making it worse.

What Other Factors Can Affect A Mortgage Application

Below are additional issues that can come up when applying for a mortgage. If youve had bad credit and also fall into one of the following categories then youll need expert advice thats tailored to your financial situation to find a specialised lender:

- Buy to Let the rules and deposit amounts for Buy to Let properties can be different from a typical residential mortgage.

- Higher Loan to Value- If youre a first-time homeowner, or simply havent got a large deposit to contribute towards finding a mortgage, then you will need a higher LTV.We can find specialist lenders to help you.

- Unique Properties Mortgages for unique properties are considered higher risk which generally means fewer lenders.This term covers listed buildings, high rise buildings, properties of non-standard construction and properties that are uninhabitable.

- Older borrowers Older borrowers can struggle because many mortgage lenders can apply a maximum age at the end of the term or cap applications at a certain age.Some have no restrictions on end of term age and its therefore important to find the right lender for your needs.

- Large loans if youre taking on a large loan then your affordability, income and credit history may make finding a lender more restrictive.

Ask us a question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Don’t Miss: What Percentage Of Mortgage Is Interest