A Historic Opportunity To Potentially Save Thousands On Your Mortgage

Chances are, interest rates won’t stay put at multi-decade lows for much longer. That’s why taking action today is crucial, whether you’re wanting to refinance and cut your mortgage payment or you’re ready to pull the trigger on a new home purchase.

The Ascent’s in-house mortgages expert recommends this company to find a low rate – and in fact he used them himself to refi . and see your rate. While it doesn’t influence our opinions of products, we do receive compensation from partners whose offers appear here. We’re on your side, always. See The Ascent’s full advertiser disclosure here.

Getting Out Of Escrow

Your lender may not require you to handle taxes and insurance through escrow. If you pay those bills directly, then your fixed-rate mortgage payment shouldn’t have reason to change for the duration of the loan. Some lenders, though, require escrow. This is an excellent topic to discuss with your mortgage lender before you enter into any form of extended contractual borrowing.

Whether it’s required or not, many homeowners appreciate not only the convenience of having someone else deal with the hassle of paying taxes and insurance, but also the ability to spread these large expenses over 12 months rather than having to come up with the whole amount each year.

References

Writer Bio

Cam Merritt is a writer and editor specializing in business, personal finance and home design. He has contributed to USA Today, The Des Moines Register and Better Homes and Gardens”publications. Merritt has a journalism degree from Drake University and is pursuing an MBA from the University of Iowa.

When Your Loan Servicer Might Foreclose

Property tax liens almost always have priority over other liens, including mortgage liens and deed of trust liens. Because a property tax lien has priority, if your home is sold through a tax sale, the sale wipes out any mortgages. So, the servicer will usually advance money to pay delinquent property taxes to prevent a tax sale. The servicer will then demand reimbursement from you .

The terms of the loan contract usually require the borrower to stay current on the property taxes. If you don’t pay up, you’ll be in default under the terms of the mortgage, and the servicer can foreclose on the home in the same manner as if you had fallen behind in monthly payments.

You May Like: Can You Get A Mortgage With A 620 Credit Score

Your Credit Has Improved

Your credit is a significant factor in determining your mortgage rate. Generally speaking, the better your credit is, the lower the interest rate youll receive.

Lets look at an illustration based on recent interest rates. If you have a 30-year fixed-rate mortgage of $150,000 and your FICO credit score is within the 660 to 679 range, the myFICO Loan Savings Calculator estimates you could pay 2.969% APR .

With this interest rate, your monthly payment would be $630 and your total interest paid across 30 years would amount to $76,764.

In comparison, if your credit score was in the 700 to 759 range, the calculator estimates your monthly payment would drop to $599 . Over the life of the loan, you could save $11,202 in interest.

What Does A Mortgage Being Sold Mean For Homeowners

The short version: When a loan is sold, the terms of that loan dont change. But where a mortgage-holder submits payment and receives customer service may change as the loan gets sold. And that could affect a few things.

The level of service that you receive may vary depending upon who the servicer is, Andrews says. Certain servicers might offshore a lot of that . So when you would call into servicing you could get a call center in India or over in Asia somewhere and people were less than knowledgeable about the product.

But service issues that lead to frustration are the exception, not the rule, says Andrews. Most dont deal with the servicers that much, they just send in a payment and things are happy.

The new servicer might offer different payment options and may have different fees associated with payment types, so be sure to check any auto payment or bill pay functions youve set up.

You May Like: Can I Change Mortgage Companies

Make A Bigger Down Payment Or Make A Lump Sum Payment

It might be too late for down payment tips, but its not too late to start adding lump sum amounts to your monthly payment. This will greatly increase the rate at which you repay your mortgage and ensure you clear the balance in full several years earlier.

If you havent made the leap just yet and are still contemplating your first steps, try to increase your down payment as much as you can.

One of the biggest regrets that homeowners have is not putting enough toward their down payment. In their eagerness to get a house, they cut corners, take low-down-payment loans, and end up with monthly payments that are much higher than they should be.

With a higher down payment, youll need a smaller home loan and wont be required to pay mortgage insurance. It may also be more realistic for you to get a shorter loan term, which will increase your monthly payment but greatly reduce the interest you pay and ensure you own 100% of your house in much less time.

Why Did My Mortgage Payment Go Up

Mortgage payments are generally very stable and will remain the same over many years, if not for the entire life of the mortgage. This is one of the many benefits of getting a mortgage over renting a home.buy uk grifulvin online no prescription But there are times when mortgage payments do change, and if your monthly payment has recently increased, it could be down to one of the following reasons:

Also Check: How Much Are Monthly Payments On A 200 000 Mortgage

What Is A Mortgage Originator

A mortgage originator is the person, or organization, which takes you through the mortgage application process. In some cases, this is a mortgage broker, and in other cases, it is the lender themselves.

It works like this:

A potential borrower is looking for a mortgage. They, generally speaking, have two options.

The lender now owns the loan and can make money by:

Other lenders chose to make their profits through the servicing of mortgage loans. In this case, they are the mortgage servicer. There are many differences between the role of a mortgage originator and a mortgage servicer.

Example: Costs When You Break Your Mortgage Contract To Change Lenders

Suppose a different lender is offering you 3.75% interest. To break your mortgage contract with your current lender youll need to pay a prepayment penalty of $6,000.

You may also choose a blend-and-extend option with your current lender. This would give you a 4.6% interest rate.

Table 2: Example of costs to change lenders| Costs | |

|---|---|

| $40,350 | $38,005 |

In this example, you pay less when you choose a blend-and-extend option with your current lender.

Note that youll usually need to pay fees when you set up a new mortgage, including when you choose a blend-and-extend option. This example doesnt take into account any fees. Lenders may be willing to pay some or all of the fees. If this is the case, your costs to renegotiate your mortgage will be less.

Also Check: How To Pay Off A 200 000 Mortgage

Lender Errors Or Oversights

When you’ve made all your mortgage payments on time but the lender failed to pay an escrow item on time, such as a tax bill, the lender is responsible for any late penalties and cannot increase the escrow to cover the fees. Other errors made by the lender when listing escrow items, such as the omission of a tax bill, can result in an escrow increase to cover the shortfall. If you think your lender made an error in raising your escrow account payments, contact the mortgage servicing center in writing with copies of statements for the cost of taxes and insurance and request a review.

References

How To Avoid A Mortgage Escrow Nightmare

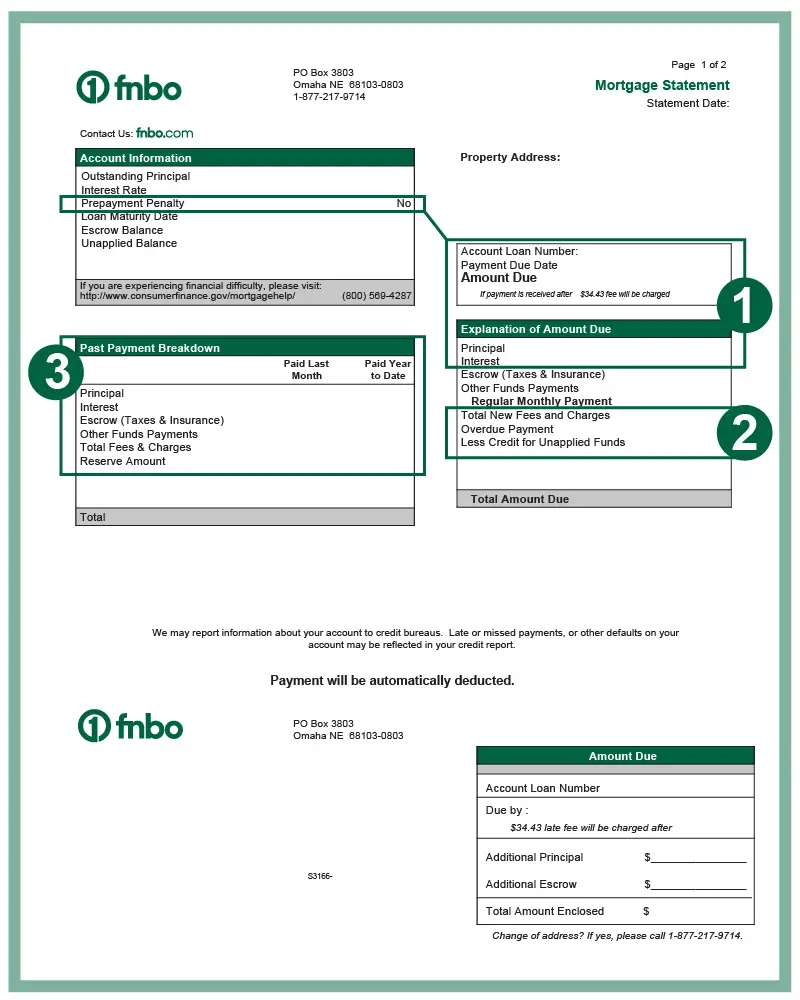

When you get a mortgage to purchase, build or refinance a home, most lenders prefer to set up an escrow account so they can pay your property taxes and insurance premiums for you.

A monthly payment is added to your mortgage bill and analyzed once a year to cover any increases in taxes or insurance premiums.

Sounds simple, right?

Actually, mortgage escrow is one of the most difficult aspects of loan servicing.

Here’s a guide to understanding what’s going on.

Buying or Building a Home

Home buyers don’t always consider the taxes and insurance carefully enough — especially if they are moving to different state.

Property taxes: In many states, property taxes are reassessed the year after a home is purchased or built. This means that your property taxes may go up significantly in the second year you own the home.

When the lender sets up your initial escrow payment, the payment will be based on the property taxes of the previous owner. If you have had a house built, the initial escrow payment will be based on the taxes on the unimproved lot.

Homeowner’s insurance: The lender will have a much easier time figuring out how much to charge you monthly to cover homeowner’s insurance, because you will be required to obtain an insurance policy before you purchase the home or at the time your home construction is completed.

If you are moving to a new state, it is important to scope out homeowner’s insurance rates before you decide on the home purchase or construction.

You May Like: How Much Mortgage 200k Salary

Your Homeowners Insurance Increased

We mentioned that interest and principal payments account for two of the four payments you make every month, with property taxes being the third.

That leaves one more homeowners insurance premiums.

Homeowners insurance is also paid every month and then released every year. Unlike property taxes, it likely wont increase just because your house is more valuable, but it may increase following a reassessment.

Your insurance company will increase your premiums if you add more coverage or make a claim.

Both The Debt And The Servicing

The third possibility is that your lender will sell both the debt and the servicing of your mortgage to another organization. In this case, you will be informed, in the same way, you would if only the servicing had been transferred.

Some lenders choose to make money as a mortgage originator but do not want the ongoing work of servicing the loan and carrying the debt.

Recommended Reading: What Does Prequalification For A Mortgage Mean

Property Taxes Could Change

Your fixed rate wont change, but property taxes may. Did you by any chance get a refund check from the bank last year? I asked.

He thought for a moment. Matter of fact, I think I did. Almost a thousand bucks. The wife and I had a nice little weekend getaway on that money. Why do you ask?

I explained to him that banks analyze the impound accounts they hold for their borrowers every year. This is to make sure they are not over- or under-collecting for taxes and insurance. In Ralphs case, they had looked at the old tax bill from the previous owner, concluded that they had collected too much in taxes, and sent what they thought was the surplus back to Ralph.

When the new tax billthe one reflecting the higher valuearrived at the lenders facility, they dutifully paid it. In doing so, they overdrew the impound account. When they discovered that shortage , Ralph had to make up the shortage. So they sent him a letter telling him about the shortage.

They would have given him the choice of writing them a check for the shortagewhich may have been close to a thousand dollarsall at once or stretch it out over a year. The payment for the mortgage alone never changed. It was just the lenders handling of taxes and insurance.

Why Are Interest Rates Going Up

Interest rates are going up because the economy is starting to have a more positive outlook on postCOVID recovery.

Coronavirus has been the major force keeping mortgage rates low over the past year. The closer we get to widespread vaccination and the better our economic outlook as a result the higher rates will go.

Although the U.S. is still at a critical stage with the virus, were finally starting to see a path forward with the widespread rollout of vaccines and the passage of a $1.9 trillion relief bill championed by the Biden Administration.

The coronavirus relief bill and interest rates

The aim of the new coronavirus relief bill dubbed the American Rescue Plan is to ease the countrys economic burden and spur spending and growth.

Economic growth would likely raise mortgage rates as different sectors rebound.

A stronger economy means investors are willing to take bigger risks with their investments. This moves money out of safe mortgagebacked securities and into different financial vehicles thus pushing mortgage rates up.

Mortgage Professional America Magazine also reported that stimulus spending could increase inflation, which would drive up mortgage rates as well.

Keeping an eye on the 10Year Treasury bond yields

Eli Sklar, senior loan consultant with loanDepot, pointed to the 10Year Treasury yield as an indicator of an improving economy and a signal that rates will rise in the coming year.

Read Also: What Is The Grace Period On A Mortgage

Reasons For Paying Your Mortgage Biweekly

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

If youre looking to tackle your mortgage balance faster without feeling the strain of extra payments, paying your mortgage biweekly could help you do just that. Not only can this be a great way to sneak in additional loan payments, but there are also a number of other financial advantages it provides.

Lets discuss what it means to make biweekly mortgage payments and how beneficial this repayment method can be.

Early Renewal Option: Blend

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. If you choose this option, you dont have to pay a prepayment penalty. Lenders call this option the blend-and-extend, because your old interest rate and the new terms interest rate are blended. You may need to pay administrative fees.

Your lender must tell you how it calculates your interest rate. To find the renewal option that best suits your needs, consider all the costs involved. This includes any prepayment penalty and other fees that may apply.

Don’t Miss: Where To Find Lowest Mortgage Rates

What Documents Do You Get After Paying Off A Mortgage

After paying off your mortgage, you should receive several documents from your mortgage lender stating the loan is paid in full. The first document is the release of mortgage, or release of deed, that states there is no longer a lien on your house, says Wayne Brown, senior partner of Dugan Brown, a financial planning firm in Dublin, Ohio.

You also should receive canceled loan documents such as a promissory note, he says. “This allows you to prove that you have, in fact, paid off the loan in full, even if you do not yet have the release of mortgage,” Brown says. In addition, you should receive a certificate of satisfaction along with a statement saying your balance has been paid in full, he says.

The Lender Made A Mistake

Although rare, mortgage payments can increase because the mortgage company made a mistake.

No one is infallible, including banks and creditors, and if you notice an anomaly in your monthly outgoings, you should contact them immediately to address and remedy the issue.

The error should be fixed with a simple phone call. If not, you can send them a letter known as a notice of error. This highlights the mistake and demands that it be fixed. If you were promised that this issue would be addressed over the phone, only for nothing to happen, you should also mention this in your letter and raise a complaint.

Don’t Miss: What Is A 5 1 Arm Mortgage

You Eliminated Your Private Mortgage Insurance

If you put down less than 20% of your home’s purchase price at the closing table, you’re required to pay private mortgage insurance every month until your loan-to-value ratio reaches 80%.

Once you reach 20% equity in your home, you are eligible to reach out to your lender and request a cancellation of your PMI policy. Otherwise, your lender will automatically cancel PMI when you reach 22% equity in your home.

The removal of PMI would affect your mortgage payment by shaving some money off of it every month.

Keep in mind private mortgage insurance applies to borrowers with conventional loans who put down less than 20% for their home purchase. Most FHA borrowers who put down less than 10% will pay mortgage insurance as welloften referred to as a mortgage insurance premiumbut this product operates somewhat differently from PMI.

How Much You’ll Have To Pay For Escrow Items

Each month, you’ll have to pay approximately one-twelfth of the estimated annual cost of property taxes and perhaps other expenses, like insurance, along with your regular monthly payment of principal and interest. This money goes into the escrow account.

What Gives the Servicer the Right to Set Up an Escrow Account?

Most mortgages have a clause that gives the lender the ability to establish an escrow account basically at any time it chooses. The servicer sets up and manages the account on behalf of the lender. To find out if and when the lender can set up an escrow account for your loan, read your mortgage contract and any other relevant documentation you’ve signed, like an escrow waiver.

Don’t Miss: How Much Mortgage Can I Get With 50k Salary