Closing Costs By County

| $48,500 | 4.30% |

Our Closing Costs Study assumed a 30-year fixed-rate mortgage with a 20% down payment on each countys median home value. We considered all applicable closing costs, including the mortgage tax, transfer tax and both fixed and variable fees. Once we calculated the typical closing costs in each county we divided that figure by the countys median home value to find the closing costs as a percentage of home value figure. Sources include U.S. Census Bureau 2018 5-Year American Community Survey, Bankrate and government websites.

At the time of closing, youll be responsible for paying the mortgage lender a number of fees. This includes origination points, commitment fee, broker fee, processing charges, tax service and more. Youll also be responsible for a credit report charge, flood certification and possibly appraisal, survey and attorney fees, if you opt for those services.

Youre also responsible for title insurance, which helps guaranteed the property against problems such as outstanding liens and taxes. Its a hefty charge. In Texas title insurance rates are set by the state, which means pricing isnt competitive – its set. And, according to Dallas News, Texas pays near the highest in the nation for title insurance. Luckily, you do save in other areas: In Texas, you wont have to pay mortgage tax or any local or transfer fees.

How Much Is A Average Monthly Mortgage Payment

4.3/5average monthly mortgage paymentpaymenttypicalmonthlyin-depth answer

Applying current mortgage loan rates, you can estimate the following average monthly mortgage payments: $1,140 per month on a 30-year fixed-rate loan at 3.29% $1,646 per month on a 15-year fixed-rate loan at 2.79%

Likewise, how much is a 200k mortgage per month? If you borrow 200,000 at 5.000% for 30 years, your monthly payment will be $1,073.64. The payments on a fixed-rate mortgage do not change over time. The loan amortizes over the repayment period, meaning the proportion of interest paid vs. principal repaid changes each month.

Keeping this in consideration, how much house can I buy for 1500 a month?

Formula for Income to Afford a Home Mortgage Payment

| Mortgage Principal |

|---|

How much is a 400k mortgage per month?

Mortgage Loan of $400,000 for 30 years at 3.25%

| Month |

|---|

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

Also Check: How To Figure Out Mortgage Budget

How Much Of Your Income Should You Spend On A Mortgage

One of the most important things to consider when buying a house is how much mortgage you can reasonably afford to pay off. This is because knowing how much you can allocate to your monthly repayments very often spells the difference between living comfortably and struggling to make ends meet.

Expert opinion varies on the exact amount, but the consensus is you should have enough left over to meet other financial obligations after making a home loan payment. So, what percentage of your monthly income should you dedicate to your mortgage? Lets take a closer look.

How Does Payment Frequency Affect My Mortgage Payments

More frequent mortgage payments means that each mortgage payment will be smaller. However, mortgage payments do not scale linearly. For example, a bi-weekly mortgage payment amount is not exactly half of amonthly mortgage payment amount. Instead, bi-weekly payments are slightly less than half of a monthly payment.

For example, for a $500,000 mortgage with a 25-year amortization and a mortgage rate of 2%, a monthly payment would be $2,117, while a bi-weekly payment would be $977.

A bi-weekly payment of $977 is equivalent to paying $1,954 per month, but choosing a mortgage with a monthly payment frequency will require a monthly payment of $2,117. Thats because with bi-weekly payments, youll be making 26 bi-weekly payments per year. That is equivalent to 13 months of mortgage payments per year, accelerating your payment schedule. Your more frequent payments will also reduce your mortgage principal faster, allowing you to save on interest and pay down more off your principal with each payment.

For example, 12 months of $2,117 monthly payments will result in roughly $25,400 being paid in a year.

26 bi-weekly payments of $977 will result in roughly $25,400 being paid in a year. The total amount paid per year is the same.

The table below compares monthly payments, bi-weekly payments, and weekly payments for a mortgages total cost of interest for a 25-year amortization at a 2% mortgage rate.

Don’t Miss: What Is A Good Tip On A Mortgage

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

How To Lower Mortgage Repayments

There are ways of lowering monthly mortgage repayments including:

- Increasing the deposit By putting down a larger deposit, the loan to value changes and therefore the risks decrease to the lender, which can lower the interest rate offered.

- Opting for an interest-only mortgage With this option the capital borrowed is not repaid during the mortgage term and therefore an exit strategy is required to repay the capital.

- Paying off a lump sum of the mortgage If a mortgage holder faces a change of circumstances, in some cases paying off a lump sum of the mortgage may reduce the monthly repayments. This option would be dependent on the terms of the mortgage as often there is a cap on how much can be overpaid.

If the above options are not viable, it may also be worth exploring if the applicant is eligible for any government schemes available such as Help to Buy or Share Ownership schemes.

Don’t Miss: Can I Get A Mortgage With A 575 Credit Score

Years With Interest Rate Of 433% = 381018

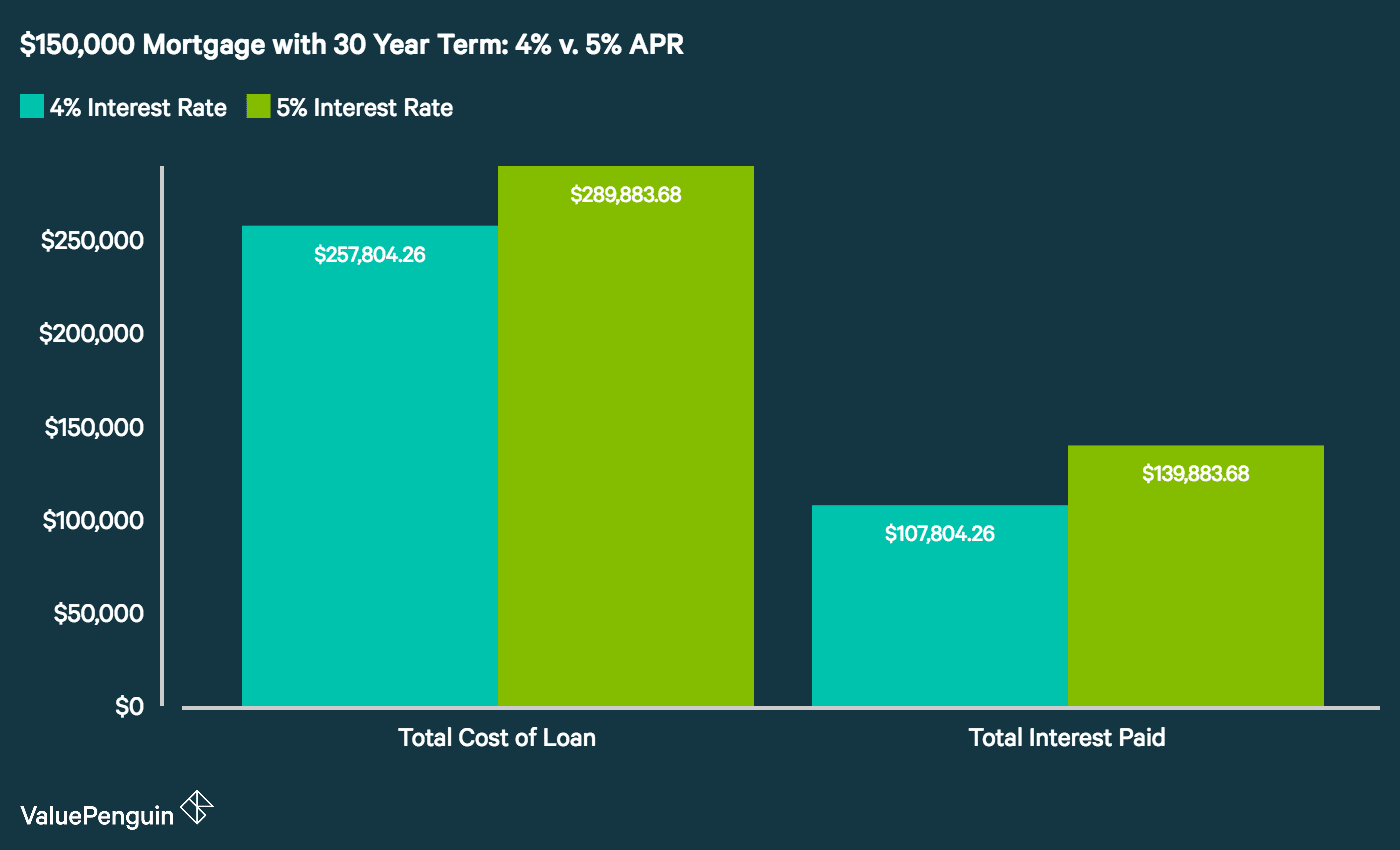

As you can see from these calculations, the high-interest rate of 4.33% that is typical for someone with bad credit, would result in paying nearly £100,000 more over a 25-year period. Based on the1.70% interest rate, by choosing a 30-year term rather than a 25-year term, there would be over £10,000 more interest to be paid.

Many homebuyers do not fully consider how much interest they will be paying off on a mortgage, as the interest rate seems quite small. However, a mortgage is a huge sum of money and 25 or 30 years is a long time to pay interest on a loan, which is why the interest accumulates to such a significant amount.

So, that gives you an insight into how critical it is to find the lowest mortgage rate possible and that it is often a better option to spend some time improving your credit score in order to ensure you are not paying much higher amounts of interest over the term.

Before applying for a mortgage, you should check your credit score to look for any issues that may impact the interest rates that you are eligible for. Saving up a bigger deposit and choosing a smaller loan term will also help to ensure that you are not paying as high a total amount of interest.

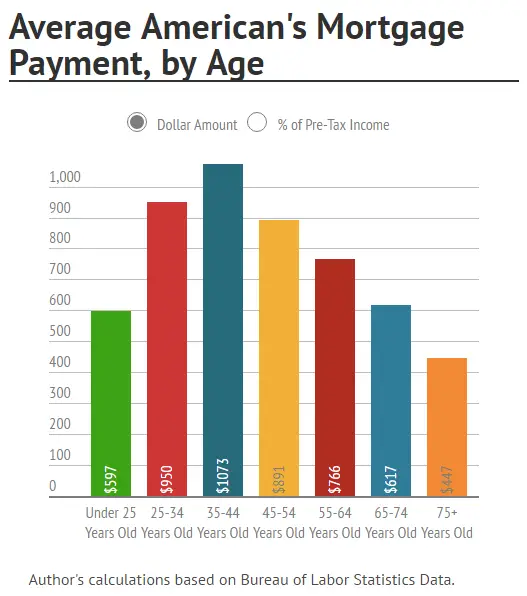

What Is The Average Monthly Mortgage Payment In The Us

The average monthly mortgage payment in the United States is $1029*.

This payment eats up 14.84% of the typical homeowners monthly income. That may seem low, but we are looking at homeowners specifically and homeowners tend to have much higher incomes than the general population, as we note later in this piece. When you add in other housing costs such as property taxes, association dues, utilities and maintenance costs, the median cost of housing jumps to $1,491 for homeowners with a mortgage.

On average, first-time homebuyers face higher monthly payments than the national average. According to research from the Urban Institute, in early 2018, first-time homebuyers bought houses worth $245,320 with an average down payment of $22,561, and an interest rate of 4.43%. Given these figures, first-time borrowers faced a mortgage payment of $1,235 21% more than the average homeowner.

Of course, a homeowners actual mortgage costs depend on a variety of factors, including when a homeowner purchased a home, where the home is located and the terms of the loan. Additionally, the affordability of a monthly mortgage payment depends the cost of the mortgage relative to a homeowners income.

Also Check: How Much A Month Would A 200k Mortgage Cost

Average Mortgage Payments In Toronto

As Toronto housing prices continue to soar, so do average mortgage payments. According to the Canadian Real Estate Association , average home prices in Toronto have increased by 22.8% since 2015, with the current average home price in the city sitting at $776,684.

If youâre wondering whether or not you can afford a home in this market, consider the monthly mortgage payment in comparison to your current income and expenses. Even though the average house price in Toronto has increased substantially, low mortgage rates have kept monthly mortgage payments relatively affordable.

To calculate a mortgage payment, youâll need the home price, down payment amount, mortgage rate, amortization period and payment frequency.

Using the average home price in Toronto, we can calculate the average mortgage payment as follows:

Down paymentThe minimum down payment required to purchase a home in Toronto can be calculated with the following formula:

- If the home price is $500,000 or lower, the minimum down payment is 5% of the home price. The formula is as follows: minimum down payment = house price * 5%

- If the home price is above $500,000 the minimum down payment is 10% of the portion of the homeâs price above $500,000 plus 5% of $500,000 . The formula is as follows: minimum down payment = + $25,000

- If the home price is $1,000,000 or more the minimum down payment is 20% of the home price. The formula is as follows: minimum down payment = house price * 20%

Also read:

Are Mortgage Rates Set To Rise

Speculation is rife that mortgage rates could be set to rise and were already seeing slight increases in the cheapest rates for buyers with big deposits.

This is because it now seems likely that the Bank of England base rate will rise from the current low of 0.1% at some point in the coming months.

The base rate dictates how interest much the Bank charges commercial lenders . This means that a rise in rates, or even speculation one is coming, can result in lenders increasing the costs of their deals.

If rates rise, we could see banks look to instead tempt borrowers with fee-free deals and cashback incentives. Earlier this week, Yorkshire Building Society launched a new range of 95% deals with no up-front fee and £1,000 cashback.

The Bank of England voted to maintain the base rate at 0.1% on 4 November. The next announcement is due on 16 December.

- Find out more: how the base rate affects your mortgage

Also Check: What To Watch For When Refinancing Mortgage

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

Total Interest Paid On A $300000 Mortgage

Youll always pay more interest on longer-term loans. So, for example, a 30-year loan would cost more in the long haul than a 15-year one would .

With a 30-year, $300,000 loan at a 3% interest rate, youd pay $155,332.34 in total interest, and on a 15-year loan with the same rate, itd be $72,914.08 a whopping $82,418 less.

Use the below calculator to see how much interest youll pay, as well as what your home will cost you every month.

Enter your loan information to calculate how much you could pay

| $0.00 |

You May Like: Can I Get A Mortgage With A Fair Credit Score

How Much Is The Average Monthly Mortgage Repayment

According to Canstars calculations , Australias average monthly mortgage repayment for an existing home is $2,489. In correlation with mortgage sizes, this amount varies depending on which state and suburb a property is located. Canstars calculations were based on principal and interest payments, paid monthly over 30 years. The estimations did not take any charges or fees into account and were based on the variable rate of 3.22% staying the same throughout the loan period.

Average Length Of A Mortgage

As mortgages are the biggest loan youre likely to get, theyre often the longest, too.

Mortgages normally take 25, 30 or 35 years to pay back. Historically, the most popular length people opt for is 25 years, but in recent years the 30- and even 35-year mortgages are becoming more popular.

The reason longer mortgages are attractive is because they lower your monthly mortgage repayments. This makes is easier for people to afford a mortgage, helping people to get on the property ladder. Remember though, a longer mortgage means you end up paying substantially more over the lifetime of the mortgage.

Mortgage pay-off times actually vary a bit. This is for a few reasons.

Often people will remortgage every few years. This means you go back to a mortgage lender and thrash out a new mortgage deal, taking into consideration how much of your homes value youve paid off. Sometimes its possible to knock a couple of years off the total time youre paying your mortgage, as you could get a better deal.

Most people though will take the chance to lower their monthly repayments instead of shortening their mortgage term.

Some people also overpay each month on their mortgage. This means that the overall mortgage is lower, which makes the interest charged against it lower. All this means the mortgage itself can be paid off earlier.

Be careful though. Some mortgages charge fees for overpayments, or have a limit of how much can be paid. Go over the limit and you could get charged a fee.

Read Also: What Does A Mortgage Payment Consist Of

Costs To Expect When Buying A Home In Texas

One of the first things to consider when you find a home youd like to buy is a home inspection. In Texas, expect to pay $350 to $600 for the service. If you want a termite or mold inspection or radon testing, youll pay an additional fee for each service. If youre curious about your inspectors education, Texas issues inspector licenses so the industry is regulated.

Closing costs are another expense youll have to consider before buying a home. Luckily, these fees are only charged once at the closing of the mortgage, and dont carry on annually like insurance and property taxes. On average, to cover closing costs for a home in Texas, you’ll need to save around 2.1% of the purchase price. Fortunately, Texas is one of the few states that doesnt levy transfer taxes or include a state recordation tax, which will save you a percentage of overall costs.

How To Use An Online Calculator To Determine Your Monthly Repayment

An online calculator can give you an estimated amount you would have to make as a monthly repayment, based on various loan amounts, interest rates, and loan terms. This can help you to work out what you can afford, so you can make your mortgage repayments on time and minimise the risk of financial distress.

Average home loan rates inAustralia are currently at historically low levels, which may not remain the same over a long time. Calculating your repayments based on the average variable home loan rate in Australia may help you make an informed decision when comparing home loans, included fixed rate home loans.

Did you find this helpful? Why not share this article?

Jodie Humphries

Personal Finance Editor

An Editor for Personal & Home Finance working across the site, Jodie has worked for banks and comparison websites for a number of years, writing articles across Sharesight, Finder, and other places. Now, Jodie spends her time working on ways to make money make sense for everyone else.

You May Like: How To Get A 15 Year Fixed Mortgage

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.