How To Get Your Bank Statements From Macquarie Bank

Bank statements:

1. Log in to Macquarie Online from the Macquarie Bank homepage.

2. To download your statement from the last 6 months, select Accounts & Statements then Statement Files.

3. A list of available statements will generate. Download the most applicable file by clicking Download statement file. This will download to your computer as a PDF where you will be able to print it.

Transaction history:

1. Log in to Macquarie Online from the Macquarie Bank homepage.

2. Select Accounts & Statements then Account List.

3. A list of accounts will generate. Tick the box of the account you wish to generate a transaction history for, then click Find & view transactions.

4. You will be asked to fill in the search criteria. Fill in the date period and any other details you wish to specify for then click Find transactions.

5. A transaction list will be generated.

Can I Accept My Mortgage Offer Online

Yes, youll need to log on to continue your application. You can accept your offer by selecting Review offer now and following the onscreen instructions to enter your acceptance code.

Once youve accepted your offer, make sure you select Save and continue then Exit application to register your acceptance.

If youre part of a joint application, both parties will need to complete these steps.

How To Get Your Bank Statements From Ing

Bank statements:

1. Log in to ING online banking via the purple login button at the top right of your browser.

2. Select Statements and select your preferred account and statements period.

3. Click find.

4. The search will generate a list of available statements. Click on one to download, view and/or print.

Transaction history:

1. Log in to ING online banking via the purple login button at the top right of your browser.

2. Go to Transaction History.

3. Select the transactions you wish to save and click Share as PDF. Once the PDF is downloaded to your computer you will be able to print.

Recommended Reading: Reverse Mortgage Manufactured Home

How Long Should You Keep Your Mortgage Documents

The amount of time that you want to retain your mortgage documents depends on the item.

You should keep monthly statements for the shortest amount of time. Because the information on these statements gets outdated quickly, you dont need to keep them for long. Hold onto them until you know that each of your payments is on record usually a few months. You may want to keep each one for a longer period of time if you notice a mistake on one of your statements. Rocket Mortgage® clients can access their statements online as well.

You should hold onto your Closing Disclosure, deed and promissory note as long as you have a mortgage loan. These documents tell you important information about your loan and property you may want to refer to them later. If you really want to get rid of your personal copy of your deed, make sure that you have a document labeled release or certificate of satisfaction. You can verify this with your title insurance company.

There are some documents that you should keep indefinitely. Hang onto your purchase contract, records of any renovations you make on your home and your home inspection. These contain important information on your propertys condition and can be invaluable when you sell your home or do maintenance. Keep your warranty until it expires.

How Are Early Repayment Charges Calculated

Your early repayment charge is 1% of the amount paid over your annual overpayment allowance for each remaining year of the fixed or discount rate period. This amount reduces on a daily basis.

Example:

You exceed your annual overpayment allowance by £10,000 with 493 days remaining on the fixed rate

£10,000 x 1% ÷ 365 x 493 = £135.07 early repayment charge

You May Like: Rocket Mortgage Loan Requirements

The Benefits Of Managing Your Mortgage Online

- View your current mortgage details, including interest rate, outstanding balance, monthly payment amount and next payment date, and transaction history.

- Explore and secure a new deal for your existing mortgage.

- Make single overpayments and set up regular overpayments start the process to change your mortgage term or repayment method and apply to borrow more money after getting an instant decision in principle.

- For flexible offset mortgages, you can also increase or decrease your payments, make a one-off payment, request a payment holiday and withdraw money from your mortgage.

- If you have a Santander current account, credit card or investments with us, youll also be able to see them in Online Banking and carry out some transactions.

Pick your mortgage in the account summary screen

From here, you can see your mortgage details and manage your mortgage

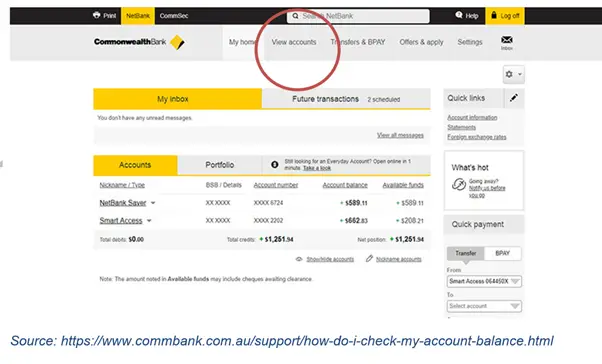

How To Get Your Bank Statements From Commonwealth Bank

If you have a Commonwealth Bank account, you can use NetBank to access the required documents.

Bank statements:

1. Log in to NetBank using your client number and password. Contact Commonwealth Bank if you dont know what these are, as you may need to register for online banking.

2. In the top menu, select View accounts, then Statements.

3. Click on the account you need a statement for, then select the option for the most recent statement and click Next.

4. Your bank statement should now be downloaded as a PDF, which you can email to your lender or broker.

Transaction history:

1. Log in to NetBank using your client number and password. Again, contact Commonwealth bank if you dont know what these are.

2. In the top menu, select View accounts, then Statements.

3. Click on the account you need a transaction history for, then select Go.

4. Find Transaction Search, then enter the date range you want to view. Click Search.

5. Instead of exporting the transactions , press Print Page on the top right-hand side of the screen to print the page or convert into a PDF to email to them. 6. You may need to scroll to the bottom of the page and press print on each individual page if your transaction history is particularly lengthy.

Don’t Miss: Are Discount Points Worth It

Tax Slips For Trust Units Limited Partnerships And Mutual Funds

Tax information for trust units and limited partnerships are provided to CIBC Investors Edge by each issuer on a staggered schedule. Once we receive the tax information from each issuer, we will mail you a separate tax slip for each investment that you held in 2020.

For mutual funds, you will receive a T3/Relevé 16 and NR4 slips, as required, directly from the mutual fund company.

Can I Ask For A Quote To Redeem My Mortgage Online

You can get a redemption figure quote by logging on to online banking and from your mortgage account, selecting ‘Manage’ and Select changes. From here, youll then be able to ask for a redemption quote.

Your redemption figure will be generated within a few seconds, and will be available to download and print immediately.

This quote is for your indicative purposes only. Your solicitor will have to ask for an official redemption statement if necessary.

You can get a redemption figure quote by logging on to online banking and from your mortgage account, selecting ‘Manage’ and Select changes. From here, youll then be able to ask for a redemption quote.

Your redemption figure will be generated within a few seconds, and will be available to download and print immediately.

Also Check: Rocket Mortgage Requirements

Contact Customer Service With Issues

Your monthly statement should include the contact information for the customer service department of the mortgage company. It’s generally the direct line to the department that can help you with any issues or questions about your loan. Keep it handy in case you need to get answers in a hurry when you dont have your mortgage statement available. If youre viewing your mortgage statement online, there may be a direct link to a chat or email where you can get answers fast. If you dont see the customer service information on the front of your paper mortgage statement, check the back, since some companies list the customer service details there.

How Do I Get A Tax Certificate For My Mortgage Account

Youll need to send a message online. Make sure your request includes the tax year you need this to cover. Or, if you need this annually, let us know and well post it at the beginning of each UK tax year unless you request otherwise.

Once we receive your request, we will post this to you within 7 working days.

Read Also: Reverse Mortgage For Condominiums

Whatare Lenders Looking For In Your Bank Statements

Your bank statements and transaction history give mortgage lenders an insight into your spending behaviours, how much you earn, your expenses and any debt obligations. Generally, the things they will be keeping an eye out for include:

Overdraftfees

This is a fee charged by your bank when you spend more money than whats actually in your account. This can include dishonour fees from bills or transactions that have been scheduled to automatically go through, despite the money not being there.

Dishonour fees can indicate to lenders that youre financially irresponsible, so its best to avoid them. If you have any overdrafts on your account, its best to wait a few months before starting your mortgage application. You should also set reminders for when your direct deposits will come out to prevent it happening in the future.

Large,irregular deposits

These can be a red flag to mortgage lenders, as it can indicate that youre receiving money from external sources like parents. This can give a lender an inaccurate view of how responsible you are as a borrower, so all gifted deposits must be accompanied by a note from your parents.

Excessiveor irresponsible spending

A Breakdown Of A Mortgage Statement Template

The Consumer Financial Protection Bureau created a mortgage statement sample on its website, which LendingTree adapted in the image below to explain how to read your home loan statement. Each number in the graphic corresponds to an item in the list below.

#1 Mortgage servicer information

First up on your mortgage statement will be information about your loan servicer. This is the bank or company that sends your monthly mortgage statement and handles the payments. The companys name, address, website and phone number are typically displayed here. Use this contact information if you have any questions about your mortgage.

#2 Account number

Your mortgage loan account number is what identifies the mortgage as yours. If you need to contact your loan servicer with a question or an issue, youll need to provide your account number.

#3 Payment due date

This is self-explanatory: the date by which you need to make your mortgage payment. Generally speaking, most lenders offer a grace or courtesy period usually two weeks before your payment is .

#4 If received after

Your payment is late if you dont pay it by the due date. But, as noted above, youll usually get a two-week grace period. The if received after date refers to the end of the courtesy period, at which point youll incur a late fee. Youll usually find this date grouped along with the payment due date and the amount due.

#5 Outstanding principal amount

#6 Interest rate

#7 Current mortgage payment breakdown

Also Check: Rocket Mortgage Payment Options

Look At The Big Picture

Your mortgage statement allows you to assess the big picture. Buying a home is the largest purchase most people ever make. And taking on the accompanying mortgage is a huge commitment. You need to be well-prepared to make the monthly payments for several years. Unfortunately, many people take on more than they can handle. If you see that you are always struggling to pay your mortgage, you should consult with a financial advisor who may recommend a second mortgage or modifying your existing loan to make payments you can more comfortably afford.

What Is The Standard Monthly Mortgage Payment And How Is It Calculated

Your standard monthly mortgage payment is the amount you pay each month as a contractual payment. Its calculation is based on your repayment method.

For interest-only mortgages, the standard monthly payment is equal to the interest that has accrued on the capital balance of your loan. Its based on the total interest payable over the term of your mortgage, divided by the number of monthly payments.

For capital repayment mortgages, the standard monthly payment includes both the interest that has accrued on the capital balance of your loan and part of the capital. Its calculated to make sure that, if you make all of the required payments in full and on time, your mortgage will be repaid by the end of the term as shown on your mortgage offer.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Lines open Monday Saturday 08:00 20:00, Sunday 09:00 18:00. Calls may be monitored and recorded. Opening hours within the mortgage departments may vary.

Also Check: What Does Rocket Mortgage Do

How Can I Send A Message Online

Sending a message online is a quick and easy way to get in touch and we usually respond within 1 working day.

Log on to online banking, and select the envelope at the top of the page to send us a message.

Make sure you select Home buying for the message to come straight through to the mortgage department.

Low Savings Account Balances

If you lose your job or get an unexpected medical bill, will you still be able to afford your mortgage payments? Lenders need to know that you have more than enough money in savings to cover your home loan. Each lender has an individual standard for how much you should have in savings, but most want to see at least a few months worth of payments in your account. They also want to see that you can pay your down payment and closing costs without help.

Recommended Reading: Reverse Mortgage On Mobile Home

How Do I Change Owner And/or Borrower Details

If you want to change the owner and/or borrower details, youll need to apply to change these details. There are a few ways you can choose to do this:

You can log on to online banking and from your mortgage account, select ‘Manage’ and ‘Make other changes’.

If youre not registered for online banking, you can register now.

You can also go to our Apply now page. Select Get started and once you confirm youre eligible to apply, youll need to select Changing existing HSBC mortgage. This will allow you to submit an application to change these details.

How To Get Your Bank Statements From Amp

Bank statements:

1. Log in to My AMP via the log in button on the top right-hand corner of the homepage.

2. Once logged in, from the I want to menu select View statements and correspondence.

3. Click View next to your account to see all available statements.

Transaction history:

1. Sign-in to My AMP via the blue log in button on the top right-hand corner of the homepage.

2. Use the I want to menu to view your transaction history.

3. Use the print page feature on your browser or the type the command Ctrl + Print to open up the print dialogue box.

4. From here select Print to PDF to download. Note: this might need to be done a number of times depending on the length of your transaction history.

You May Like: How Much Is Mortgage On 1 Million

Your Mortgage Information At Your Fingertips

Use your dashboard to get a clear snapshot of your mortgage and where you stand, all in one place.

Its filled with easy-to-use tools:

- Understand your loan balance, start and end dates

- Get a real-time view of your escrow balance, your homes estimated value, and an amortization schedule

- Set goals to own your home sooner or to manage your homes equity

- Search neighborhood home values and trends

- Use the education center to understand loan terms, and much more

How To Make A Mortgage Payment

Most lenders provide multiple ways of making your mortgage payments, including:

- Online: The simplest way to make payments is online through your loan servicers website. Consider setting up automatic payments to ensure you pay on time.

- : Your mortgage statement will probably have a portion that you can detach and return by mail with your payment. If paying by mail, allow enough time before your mortgage due date. If youre close to the due date or the end of the grace period, get a receipt from the post office or consider using next-day delivery.

- : Some lenders provide an option to call and make your mortgage payments over the phone. Just make sure your loan servicer doesnt charge a fee for this service.

- In person: If your lender or bank has brick-and-mortar locations, you can make your mortgage payments in person. Be sure to get a receipt. The law requires lenders to credit a payment the day you make it, so if your servicer charges a late fee, then the receipt will prove you paid on time.

Also Check: Reverse Mortgage On Condo

How To Get Your Bank Statements From Westpac

Bank statements:

1. Sign in to Westpac Online Banking.

2. Select the account you need a statement for.

3. In the top menu, select eStatement.

4. Click View then Save or print a high-quality version of this statement. This should download the statement as a PDF you can email to your lender or broker.

Transaction history:

1. Sign in to Westpac Online Banking.

2. Select the account you need a Statement for.

3. Click Transaction List in the top menu, then select and search for the required date range.

4. Rather than exporting your transactions, print the page or convert them to a PDF ready to attach to an email.