How Does Equifax Beacon 90 Calculate Your Score

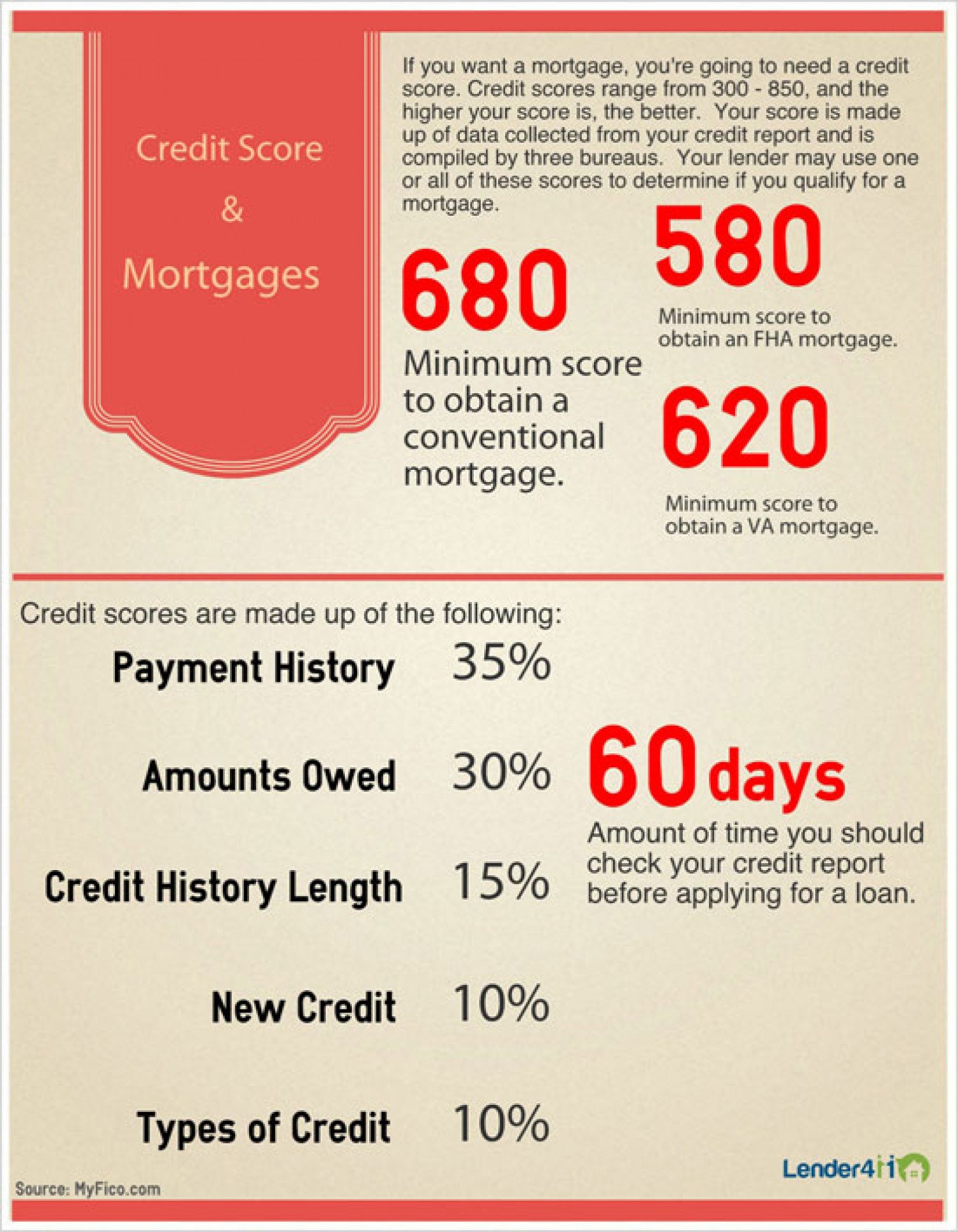

There are 5 Factors that are taken into account when providing a Beacon 9 Score:

- Payment History 35% of the score: this takes into account your payment history

- this takes into account how much percentage of your credit is currently being utilized. The lower the percentage of utilization the better.

- this takes into account how long you have had credit reported on the Bureau and how many active trade lines.

- this looks at different types of credit used and mix. revolving credit , installment loans, mortgages, telecom providers, lines of credit, and student loans are examples. Having a good mix helps this score.

- New Credit Enquires 10% of the score: this scores the number of credit applications you have been inquiring on. Please note that different types of businesses such as mortgage providers and auto loan providers have different rules associated with them than just a one-off inquiry from a credit company.

With mortgage providers, banks, and brokers, all credit enquiries in a 45-day period are counted as one inquiry as Equifax expects to see multiple inquiries when applying for a mortgage.

With auto loan providers, its typically counts all inquiries within a 30-day period.

Where To Check Your Fico Score Before Applying For A Mortgage

Many free credit services dont use the FICO scoring model, which is the one your mortgage lender will be looking at.

To be sure the score you check is comparable to what a mortgage lender will see, you should use one of these sites:

- AnnualCreditReport.com This is the only official source for your free credit report. Youre typically entitled to one free credit report per year, but the site is offering free reports each week during the coronavirus pandemic

- MyFico.com

Whether its free, or you pay a nominal fee, the end result will be worthwhile.

You can save time and energy by knowing the scores you see should be in line with what your lender will see.

As long as you continue to make your payments on time, keep your credit utilization relatively low, and you dont go shopping for new credit you dont need, over time your score is going to be pretty high for every credit scoring model.

How To Improve Your Credit Score For A Mortgage

Mortgage interest rates have sunk so low that some banks and building societies are offering homeowners rates of less than 1%. But to get your hands on the cheapest mortgage deals you need to be an attractive financial candidate. This means you may need to improve your credit score.

If you are thinking about buying a house and you want the best mortgage rates, youll need an A-star credit score to be considered. A credit score is a number that lets lenders know how good you are at managing your personal finances, debts and bills. Your score will fall within one of five categories: poor, fair, good, very good and excellent or exceptional.

The main credit agencies, Experian and Equifax, use different scoring systems so theres no magic number that indicates what a good or excellent credit score is. Equifax has recently updated its scoring range from 0 to 700 to 0 to 1,000. To land an excellent score youll need 811 or more. Experian is in the process of changing its scoring system. Currently its score goes from 0 to 999. If you score between 961 and 999 youll rank excellent.

Having a bad or fair credit score not only means youll be offered a higher rate of interest, but may also result in you being asked to stump up a bigger deposit. Thats because the lender thinks you pose a higher risk of not paying your mortgage back.

You May Like: Does Prequalification For Mortgage Affect Credit Score

Preparing Your Credit For A Mortgage

If youre planning to purchase a home or refinance your mortgage, its smart to keep a close eye on your credit reports and credit scores. You can purchase the same FICO scores used by mortgage lenders at FICOs website, myFICO.com.

You can also monitor the health of your credit reports, which are the sole basis of all of your credit scores, at no cost. Federal law gives you the right to claim a free copy of your three credit reports once every 12 months at AnnualCreditReport.com.

However, through April 2021, you can access a free copy of your three reports once a week on the same website. This move was announced by the three credit bureaus in in response to the COVID-19 pandemic.

These free weekly credit reports dont include your credit scores, but they will show you the information upon which your credit scores are based.

How Can Credit Scores Affect Mortgage Interest Rates

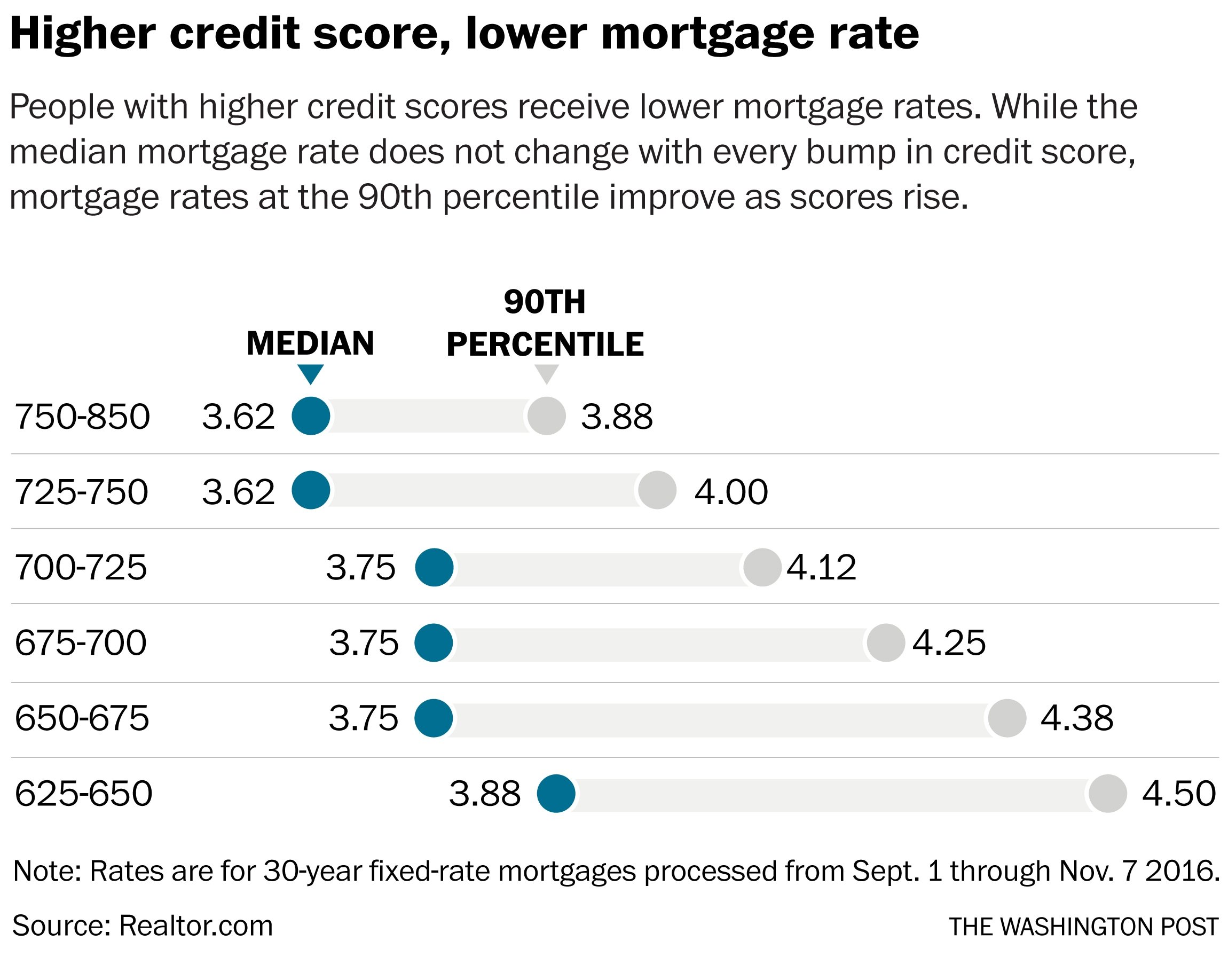

The CFPB points out that your credit scores are a key ingredient in the mortgage qualification process and that higher credit scores generally help you qualify for lower interest rates. To see the potential impact of credit scores on mortgage interest rates, it helps to look at this example:

Letâs say two borrowers apply for a 30-year fixed mortgage for $200,000. Borrower A has a credit score in the 620 to 639 range, while Borrower B has a score between 760 and 850. According to FICOâs home mortgage rate comparison tool, the borrowersâ potential mortgage rates could differ by about 1.5%.

While that may not sound like much, according to the results of that tool, the borrower with the lower credit scoreâBorrower Aâpays $173 more every month. And that extra $173 every month adds up over time.

Also Check: Rocket Mortgage Payment Options

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

You May Like: Can I Get A Reverse Mortgage On A Condo

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

What Is A Good Credit Score To Buy A House

If only it were that simple. When trying to answer the question, What credit score is needed to buy a house? there is no hard-and-fast-rule. Heres what we can say: if your score is good, lets say higher than a 660, then youll probably qualify. Of course, that assumes youre buying a house you can afford and applying for a mortgage that makes sense for you. Assuming thats all true, and youre within the realm of financial reason, a 660 should be enough to get you a loan.

Anything lower than 660 and all bets are off. Thats not to say that you definitely wont qualify, but the situation will be decidedly murkier. In fact, the term subprime mortgage refers to mortgages made to borrowers with credit scores below 660 . In these cases, lenders rely on other criteria reliable source of income, solid assets to override the low credit score.

If we had to name the absolute lowest credit score to buy a house, it would likely be somewhere around a 500 FICO score. It is very rare for borrowers with that kind of credit history to receive mortgages. So, while it may be technically possible for you to get a loan with a score of, say, 470, you would probably be better off focusing your financial energy on shoring up your credit report first, and then trying to get your loan. In fact, when using SmartAsset tools to answer the question, What credit score is needed to buy a house?, we will tell anyone who has a score below 620 to wait to get a home loan.

Also Check: Chase Mortgage Recast Fee

Talking To A Mortgage Broker

A mortgage approval can take anywhere between two days to two weeks. However, working with a mortgage broker can help make the process faster and easier. If youre not sure where your overall standing is for getting a mortgage approval, they can help. They can help you see the big picture by taking in all factors, including your credit score. In addition, theyll come up with a customized plan for your mortgage preapproval and give you the right advice to get you on the right track.

Are you ready to apply for a mortgage? Contact us today to talk to any one of our experts here at The Mortgage Group Inc.

Qualifying For A Mortgage

Although credit score matters, it accounts for only part of the big picture. Throughout the mortgage preapproval process, you want to maintain a good credit score as well. If possible, wait to apply for new credit. This includes buying a new car, appliances, or any other loans because they will increase your total debt. Avoid applying for multiple mortgage applications in a short period. This could flag you as a credit seeker. A mortgage broker has access to numerous lenders and will be able to find you the lowest rate available.

You May Like: Rocket Mortgage Loan Types

Mortgage Overlays: Credit Requirements Vary Bylender

A mortgage overlay isan additional mortgage guideline imposed by a lender, which goes beyond theloans official minimum standard.

For example, FHA allows FICO scores as low as 500, but some lenders set their minimums at 620.

According to FannieMae, the majority of mortgage lenders apply mortgage overlays. The most commonoverlay relates to credit scores.

About half of lenderssurveyed apply overlays to the minimum credit score requirements of a mortgageloan. Your 500 FICO score, therefore, may not get you FHA-approved, even if theFHA allows it.

This is why its smartto re-apply for a mortgage if youve recently been denied. Your loan may havebeen turned down, but that could be because of an overlay. Theres a chance you could be approved by a lenderwith looser guidelines.

Apply at a differentbank, you may get better results.

How mortgage lenders pull credit

When you apply for amortgage, lenders pull a credit report from all three credit bureaus on you.Their decisions to lend, and the terms of your loan, depend on theresult of those reports.

Lenders qualify youbased on your middle credit score.

For example, if your scores are 720, 740, and 750, thelender will use 740 as your FICO. If your scores are 630, 690, and 690, thelender will use 690 as your FICO.

When you apply with aspouse or co-borrower, the lender will use the lower of the two applicantsmiddle credit scores.

Mortgage Lenders Pull All Three Reports But Only Use This One

According to Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,” tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

Also Check: Can You Refinance A Mortgage Without A Job

Alternate Options To Utilizing Bnpl Financing

Shoppers flock to purchase now, pay later as a result of it could provide a method to finance purchases on-line with no credit score verify, nevertheless it usually comes with late charges and down cost necessities. Nevertheless, BNPL is not your solely possibility if you happen to want money to cowl a big expense. Listed here are just a few alternate options to utilizing a BNPL service:

How The 3 Credit Reporting Bureaus Affect Your Score

As many consumers already know, there are three major credit reporting agencies.

- Equifax

- Transunion

- Experian

While its possible your scores will be similar from one bureau to the next, youll typically have a different score from each agency.

Thats because its up to your creditors to decide what information they report to credit bureaus. And its up to the creditors to decide which agencies they report to in the first place.

Since your credit scores depend on the data listed on your credit reports, more than likely you wont see the exact same score from every credit reporting agency.

Fortunately, most agencies look at similar factors when calculating your credit scores. As long as you manage credit cards and loans responsibly, your credit scores should be fairly similar to one another.

But different credit reporting agencies arent the only challenge.

There are also different credit scoring models. And, as if that didnt already complicate matters, there are also different versions of these models.

You May Like: How Much Does Getting Pre Approval Hurt Credit

How Does Having A Higher Beacon Score Affect My Mortgage Application

There are guidelines with lenders and mortgage insurers that have minimum scores that they are looking for. This will affect your ability to get an insured mortgage as well as how much down payment would be needed.

Some mortgage lenders also take into account credit scores to see what level of debt servicing would be allowed on the deal.

Having a higher score than 685 will often mean a higher qualification amount.

What If You Don’t Have A High Enough Credit Score To Buy A House

Having bad credit or no credit may mean youre unlikely to get a mortgage unless someone you know is willing to help out. Having a co-signer who has a better credit score could help you secure the loan.

Another option would be to have “a friend or more likely a family member purchase the home,” add you to the title and then try to refinance into your name when your credit scores improve sufficiently, according to Ted Rood, a mortgage banker in St. Louis.

If such assistance isnt available to you, your best bet will be waiting and working on your credit.

Also Check: Chase Recast