Does Refinancing Hurt Your Credit Score

However, the credit hits from applying for and opening a refinance loan are very small often less than five points, according to FICO.

The savings youre likely to see from refinancing should far outweigh any negative impact on your credit. So dont let that be a concern when you apply.

In this article

Dont Refinance When Your Spending Is Out Of Control

As mentioned above, refinancing credit card debt and then charging up your balances again will only land you in worse trouble than when you began. So if your spending is still out of control, hold off on refinancing.

A better approach is to shred the credit cardsor at least get down to one for emergencies. Then, get onto a budget that keeps you from overspending and needing to use credit cards. As you find ways to save money, start consistently paying down your credit card debts.

If you can sustain these habits for a few months then you can look at refinancing. At that point, youre getting on track financially, and youre less likely to run up those balances again. So refinancing, or moving debts to 0% introductory APR cards, could help you reach your goals more quickly.

How To Prevent Refinancing From Hurting Your Credit

If you plan ahead, you can make efforts to limit how much refinancing negatively impacts your credit and overall financial health.

Before you begin the refinancing process, see if theres anything you can do to boost your credit score so you can secure a better rate. Perhaps you can pay off one of your smaller loans or credit card debt.

Try to prepare by reading your credit reports closely, and make sure there are no errors that could keep your credit application from being approved at the best possible rate. Stay one step ahead of any errors, so you still have time to dispute them.

If refinancing makes sense for your situation, you shouldnt be concerned about it hurting your credit. Refinancing is very common and, most of the time, its relatively easy for your credit score to bounce back.

As long as youre prioritizing your overall financial health through smart decision-making and budgeting, refinancing shouldnt adversely hurt your credit in the long run.

Read Also: How To Get A Mortgage Preapproval

Mortgage Rate Projection For 2023

Mortgage rates started ticking up from historic lows in the second half of 2021 and increased over three percentage points in 2022.

But many forecasts expect rates to begin to fall this year. In their latest forecast, Fannie Mae researchers predicted that 30-year fixed rates will trend down throughout 2023 and 2024.

But whether mortgage rates will drop in 2023 hinges on if the Federal Reserve can get inflation under control.

In the last 12 months, the Consumer Price Index rose by 6.5%. This is a significant slowdown compared to where inflation was earlier this year, which is a sign that mortgage rates may start coming down soon as well.

If the Fed acts too aggressively and engineers a recession, mortgage rates could fall further than what current forecasts expect. But rates probably won’t drop to the historic lows borrowers enjoyed throughout 2020 and 2021.

Why Credit Scores Matter For Mortgage Rates

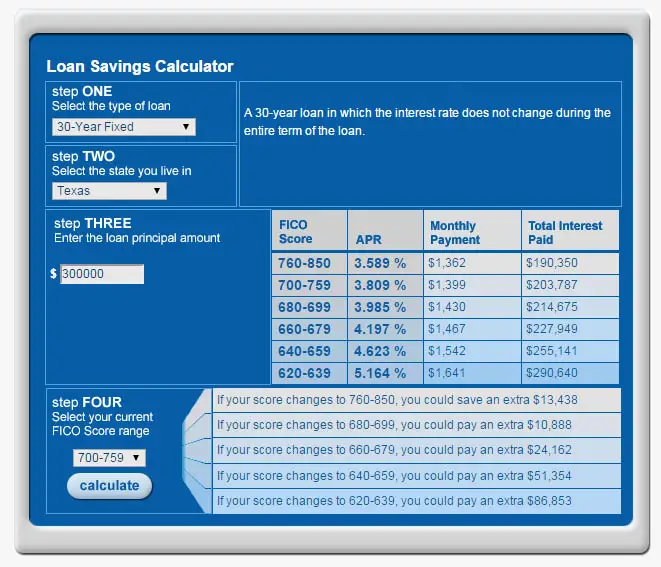

When it comes to determining your mortgage rate, your credit score is a critical factor.

Think about it from the bankâs perspective. They are lending you money for 30 years. Over that time frame, youâll likely change jobs, face tough times, watch your neighborhood change, and go through multiple market cycles. Your current financial picture â including down payment, assets, and income â are important. But a credit score gives the bank an idea about whether youâre likely to make payments responsibly even if things change.

Yet, it isnât just low credit score borrowers that pay the price. The difference between a good and great score can still add up over the life of a loan. Assuming nothing in a mortgage application changes except the credit score, someone with a score in the 680-699 range would have a mortgage rate approximately 0.399 percentage points higher than a person with a 760-850 score. Thatâs a difference that may sound minuscule, but isnât.

In 20-years, someone with a 680-699 score will still pay over $20,000 more in interest on a $244,000 mortgage than a person with a high score.

So, what score do you need to consider before applying for a mortgage?

Recommended Reading: Is Meridian A Good Mortgage Company

Late Or Missed Payments

When youre in the process of refinancing and replacing one mortgage with another, it can be hard to keep track of how much longer you need to keep making payments on your old mortgage and when to start making payments on the new one. That confusion can result in delinquent payments, which affect your credit score in a big way payment history counts for 35 percent of your FICO. Regular communication with your lender can help you stay on top of when your payments are due.

How Does Refinancing A Mortgage Affect Your Credit Score

The pandemic has impacted the finances of many Americans some good, some bad.

Focusing on the positive here, national mortgage refinance rates have dropped to near-record lows. Since March 2020, the Federal Reserve has cut interest rates twice to help the economy. The result is that mortgage rates have dropped to the lowest seen since the 1970s.

If you’re looking to save a lot of money over the term of your loan, you may want to refinance your mortgage. Credible can help you compare mortgage rates and lenders for free.

If you’re considering a refinance option, research the impact it could have on your personal finances . Here’s what you need to know.

Recommended Reading: Does Mortgage Insurance Pay Off My House If I Die

Modifying An Existing Home Loan

Modifying a loan may have less of an effect on your credit score, either way, than refinancing the debt with a new lender or loan. Thats because modification generally wont change your balance or the accounts opening date.

When you modify a loan with the same lender, you generally just get better terms than you have right now. For instance, if your credit score is significantly better than it was 10 years ago when you bought your home, you may be able to approach your lender to ask for a better interest rate.

This loan modification may affect your score slightly, since the lender will pull a credit report to check your creditworthiness. But the overall effect of this move will likely be slight and short-lived.

Changes To Loan Balances And Terms

How much your credit score is impacted by changes to loan balances and terms depends on whether your refinanced loan is reported to the credit bureaus. Lenders may report it as the same loan with changes or as an entirely new loan with a new open date.

If your loan from refinancing is reported as a new loan, your credit score could be more prominently affected. This is because a new or recent open date usually means that it is a new credit obligation, therefore influencing the score more than if the terms of the existing loan are simply changed.

Read Also: Can I Get A Mortgage Based On Rental Income

What Are Todays Refinance Rates

Refinance rates are still at historic lows. But not all lenders offer the same rates. To find the best deal, youll need to shop around with at least 3-5 mortgage lenders.

The good news is, getting multiple refinance rate quotes wont hurt your credit score.

As long as you get all your quotes within a few weeks of one another, they count as a single inquiry on your credit report. So dont let credit worries stop you from shopping around and finding the best rate.

When Refinancing Makes Sense

Refinancing your mortgage can be a wise move for many reasons, most notably lowering your interest rate or your monthly payments. It can also help you pay down your mortgage sooner, access your homes equity or get rid ofprivate mortgage insurance .

But there are closing costs associated with refinancing, so it probably makes more sense to refinance if you know youll be keeping your home for some time. You can determine the break-even point for a potential refinance, or how long it will take for savings from a new mortgage to surpass any closing costs. Find out what those costs will be and divide them by the monthly savings youll realize with the new mortgage.

The Forbes Advisor mortgage refinance calculator can help you run the numbers to see if its a good time for you to refinance.

Recommended Reading: How Often To Refinance Home Mortgage

Mortgage Payments Vs Rent

Paying a mortgage on time can make a big difference in your credit score and paying the same amount in rent on time typically does not.

Rent payments are considered in some scoring models if they are reported .

But mortgage payments are typically reported without any special effort on your part and are routinely factored into credit scores.

About the authors:Teddy Nykiel is a former personal finance and student loans writer for NerdWallet. Her work has been featured by The Associated Press, USA Today and Reuters.Read more

Bev O’Shea is a former credit writer at NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Space Out Your Refinancing

Hard inquiries can remain on your credit reports for two years, but FICO scores only take into account inquiries from the last 12 months.

So if you refinanced recently, consider waiting at least a year before you refinance again. That way, the new round of credit inquiries wont accumulate with the first time you refinanced.

Keep Reading: Just How Often You Can Refinance Your Home

You May Like: What Is A Mortgage Advisor

When Is Refinancing Not Worth The Credit Hit

When is it not worth it to refinance? Here are a few situations in which you might want to avoid refinancing.

- Youre About to Take Out a Bigger Loan: Hard inquiries will likely impact your credit score, so you might hold off on refinancingor even filing an application for refinancingif you plan on taking out a second loan. For example, if youre about to apply for a mortgage, you may not want to refinance your auto loan. The drop in credit could affect the rates youre offered on the mortgage.

- You Have Federal Student Loans: When you refinance federal student loans, youll lose federal loan benefits like lower rates or income-based payment plans.

- Youre Satisfied with Your Loan Term: If youre happy with your loan term, then you might not want to refinance if its going to change the repayment schedule.

- Cant Handle the Fees: Just like with a standard loan, youll have to pay origination fees, application fees, and other costs when you refinance. You might want to hold off on refinancing if youre not prepared to cover these costs.

Before you refinance, think carefully about why youre refinancing and how it will benefit you. Refinancing is a common practice, but you dont have to do it just because so many other people are doing it. Its not a financial rite of passage.

When To Refinance A Student Loan

The best time to refinance a student loan depends on whether its a federal or private loan. For example, refinancing a student loan usually makes more sense for private student loans because they dont come with the benefits of federal student loans. That said, there are several situations where you may want to work with a student loan refinance lender:

- Your interest rates are high and/or variable so that you may accrue unpredictably high interest down the road

- Your credit score has improved enough to qualify for a more competitive interest rate

- Youll qualify for a lower rate that will save you money over the life of the loan

- Your student loans are private, so you wont sacrifice any federal loan programs like income-driven repayment or Public Service Loan Forgiveness

- Interest rates are lower than they were when you originally applied for the loan

Read Also: What Fees Are Associated With Refinancing A Mortgage

How Refinancing Affects Your Credit Score

Refinancing might lower your credit score by just a few points, but thats inevitable when shopping for a new loan or credit account.

There are two reasons refinancing affects your FICO score:

Also note that Experian, one of the Big Three credit bureaus, says many credit scoring technologies will continue to consider the payment history on your old mortgage even after you close it.

That can minimize the negative effects of closing your old loan. But be sure your current loan is in good standing when you refinance. More on that below.

For most, refinancing should have few, if any, lasting effects on your credit score.

Common Types Of Refinancing That Can Impact Your Credit

If you have a current loan that doesnt have a decent interest rate and your credit score has gone up, it may be in your best interest to refinance now, even if it will slightly hurt your credit. Refinancing could help you pay off your loan quicker, which could then improve your credit score in most cases.

Its crucial to know how common types of refinancing can factor into your credit.

Recommended Reading: Is It Worth It To Refinance To 15 Year Mortgage

Does Refinancing A Car Loan Hurt Your Credit Score

Refinancing can temporarily impact your credit, but potential benefits outweigh the cons.

If youre hoping to lower your car loan payment, youre probably considering refinancing. And why not? On average, borrowers saved about $97 per month after refinancing their auto loans last year. Thats more than $1,100 per year.

Before you get too excited thinking about how youll spend that extra cash, there are a few things to consider before hitting that apply button like how much auto loan refinancing can help or hurt your chances of qualifying for other credit down the road.

From application to funding, heres what you should know about auto loan refinancing and your credit score.

2022 Auto Refinance Rates

Is A Refinance Loan Right For You

Black suggests using an online mortgage calculator to compare the costs of a new loan with your current loan. She points out that there might be new fees to worry about including new closing costs so youll need to calculate whether the savings will outweigh the costs. Even though you might end up with a lower credit score temporarily, it could be a smart move.

Remember, the purpose of earning good credit is so that you can use it to your advantage, Black says. Using your good credit to qualify for a more attractive loan could help you save money on interest and perhaps even pay off your debt faster.

You May Like: How Soon Can You Lock In A Mortgage Rate

When You Apply: Hard Credit Inquiries

Whenever you apply for credit, including a mortgage, the lender conducts a hard credit inquiry to see if you qualify for the product. The inquiry is recorded on your credit reports and may temporarily affect your credit scores.

New credit accounts for 10% of your FICO score. The credit-scoring company says one inquiry may lower your credit scores by five points, but multiple hard inquiries may have a larger impact.

How Mortgage Rates Can Vary By Credit Score

Let’s see how a 100-point difference in credit scores affects one womans mortgage payment.

For example, suppose a borrower looking to buy a home worth $300,000 has a 20% down payment and applies for a 30-year fixed-rate loan of $240,000. She has a 780 FICO credit score, which gets her a 4% rate. Thats around $1,164 a month, not including taxes, insurance or homeowners association fees.

If this borrowers score dropped by about 100 points to between 680-699, her rate might increase to about 4.5%. At that interest rate, her monthly payment would increase to $1,216, an extra $62 a month, or $744 per year.

The effect of the difference in the rates may not seem significant at first, but added up over years, it could be a lot. In this example, a 100-point-drop has the borrower paying an additional $25,300 over 30 years.

At the same time, its important not to go crazy gaming your mortgage rate. If your score is already good, you should consider taking the rate you qualify for.

Industry professionals advise against taking too long to fine-tune an already-good credit score as rates could go up in the meantime and offset any benefit of a slightly higher score.

» MORE: Use our tool to see how mortgage rates differ by credit score

Also Check: Will Mortgage Interest Rates Rise