Create Legally Binding Mortgages For Single Family Homes Free

These mortgage, deed of trust and promissory note documents are valid in every state, provided you use the correct mortgage forms for your state.

They may be used provided no charge is made for them. You will need to type in the information specific to your mortgage. Such as lender, borrower, payment terms etc.

Select the Mortgage, Deed of Trust and Promissory Note Documents you need from the FannieMae ®website. Go about halfway down the page to search for legal documents. You will need to enter the type of document, you typically will need a Security Instrument and a Note. We recommend you use the Standard Document. You also enter the State and Language.

We recommend use of these documents as they are standard throughout the USA. Every lender will be familiar with them and they do an excellent job of protecting your rights as a lender.

Reminder. These forms are provided as a service only. We are not rendering you legal or professional advice. If you dont understand what you are doing, see a local expert.

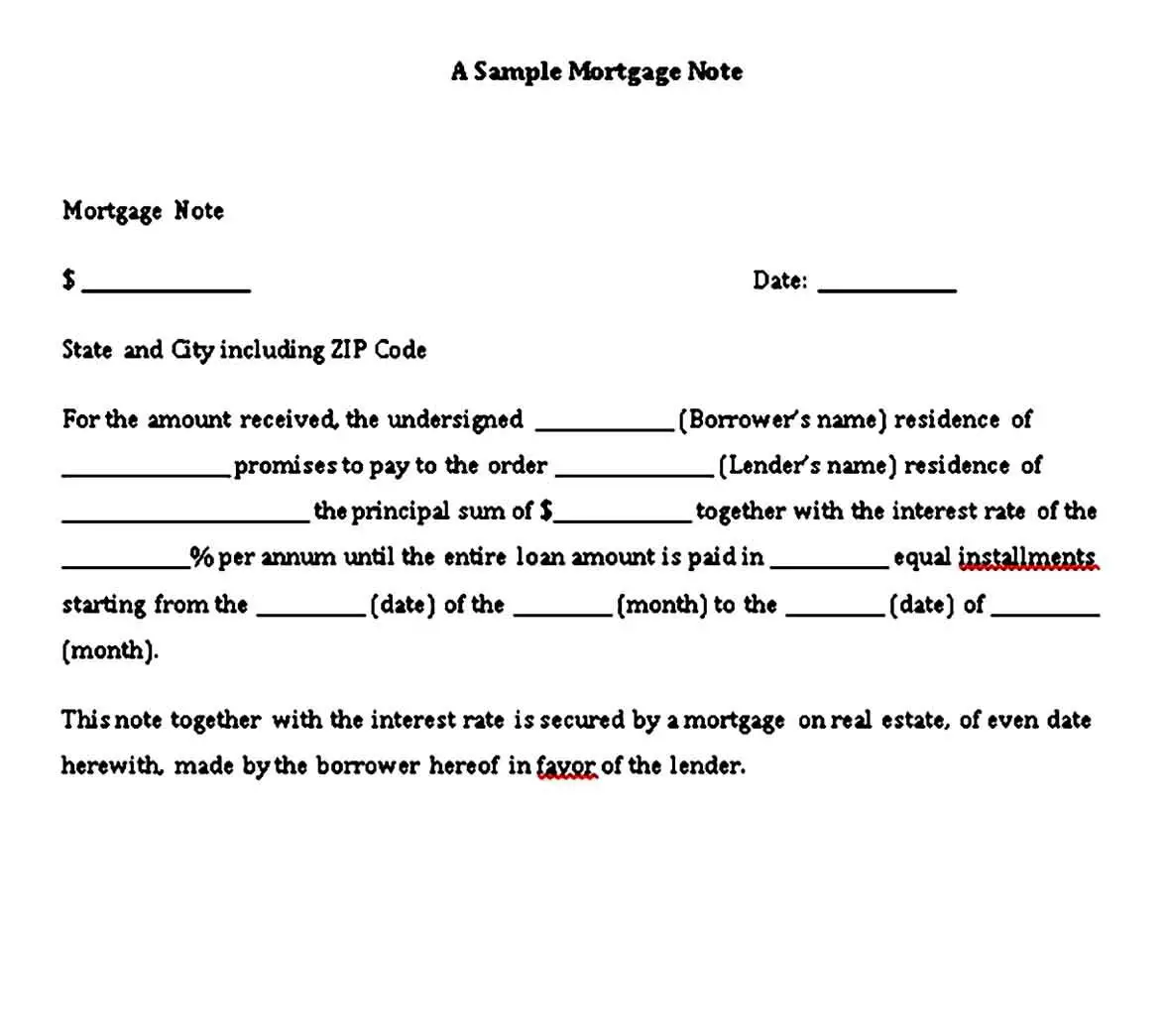

The Mortgage document typically will state the borrowers name and address, their marital status, the lenders name and address, the legal description of the property, the street address of the mortgaged property, the amount of the mortgage and when it must be repaid by.

It does NOT usually show the interest rate, the payment amounts and late charges. It is witnessed and notarized.

Mortgage Note Vs Mortgage

Because both are part of the real estate buying process, it’s often easy to confuse a mortgage note with a mortgage, also commonly referred to as a mortgage deed. At their simplest, a mortgage note is a promise to pay back the loan whereas a mortgage is a document outlining the collateral that secures the loan.

Here, it’s important to remember that mortgage notes are usually:

- Not recorded with the local government using a deed. Here, the seller holds the mortgage note, and unlike mortgage loans, the contract is not recorded with any government agency.

- Repaid on a monthly or another fixed basis. Here, mortgage loans and mortgage notes are quite similar in that they require a regular payment from the buyer until the balance of the debt is paid off. The big difference is that, with a mortgage, the property can be sold to repay the debt. With a mortgage note, the seller can take legal action against the buyer to recover the losses, but this often takes time and a lot of resources.

- May contain an acceleration clause. To reduce the risk of mortgage notes, the seller might incorporate a clause into the contract that makes the buyer liable for the total amount outstanding if one payment is missed.

With a mortgage, there is just the lender and the borrower, while with adeed of trust there is a lender, a borrower, and a trustee who holds the property’s title until the loan is paid off. The trustee is typically a title company, bank, or escrow company.

Image viaPexels by Curtis Adams

How To Create A Strong Deed Of Trust Note

So, if you or your client is creating a trust deed note:

- Obtain a good down payment. This means at least 10% for a standard house, and 20% for commercial properties, land, and mobile homes. These numbers cannot always be reached, so try to get as much as you can without putting the buyer into a financially precarious position. Two of the elements that note buyers consider are the loan to value ratio, or LTV, and the investment to value ratio, or ITV.

- If you can, sell to a buyer with decent credit. A FICO of at least 680 is preferable, though 625 or slightly lower is often adequate. You can sometimes still sell the note even if the buyers credit is below 600, but be prepared to take a larger discount, and recognize that everything else about the note will need to be solid.

- Ensure that the interest rate being charged is at least as high as comparable bank lending rates.

Other items that we consider to be positives when deciding whether to buy a note and how much to pay include:

- property is owner-occupied

- access to power, water, and roads

- in regard to commercial notes, multi-unit apartments or general purpose office buildings are easier to place than specialty businesses like restaurants. A note on a property that was previously a gas station or anything that could have adverse environmental consequences will be harder to sell due to the potential liability

- the property and surrounding area being in good condition

Don’t Miss: How To Calculate Home Mortgage Interest

When Do You Need A Mortgage Deed

The purchase of a property or home is often a significant investment that involves a substantial amount of money. Lenders will want added security before loaning large sums of money to ensure that they will recoup their investment.

A mortgage deed allows them to take possession and sell the property if the borrower stops making loan payments. It also allows buyers to borrow large sums of money and provides an incentive to make payments on the loan or risk losing their property.

How To Create The Perfect Note With 10

Hey again and thank your for visiting SellMyMortgageNoteForCash.com. Today, this blog about how to create the perfect note could be one of the best blog posts ever so pat yourself on the back for reading this one.

I know I know.. you think Im exaggerating. Well you couldnt be more wrong when it comes to selling a mortgage note.

The 10 10 10 mortgage note principle or what I sometimes like to call the Power of 10 is probably one of the most important factors in maximizing your note value. Theres even a video tutorial on what I mean.

In the meanwhile, let me explain What exactly am I talking about when I mention the power of 10 or more accurately 10 10 10?

The three 10s refer to the following 3 factors which play a crucial role in determining a mortgage notes value.

#3 Repayment Term

Heres why the number 10 is so important when it relates to those 3 factors for a mortgage note.

In a perfect world, you would be creating a brilliant mortgage and maximizing its value if you could pay attention to the number 10 for the above 3 factors.

Heres what I mean.

First things first, you want to create a morgage note where the buyer/borrower puts at least 10% down on the property.

Second, you would be creating a very attractive mortgage note for sale if you could get the borrower to pay a 10% interest rate.

And

Also Check: What Documents Do Mortgage Lenders Require

What Is A Mortgage Note And Why Is It Important

A mortgage is a type of contract. What makes it special is that its a loan secured by real estate. A mortgage note is the document that you sign at the end of your home closing. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it doesnt.

Read on for more information on what a mortgage note is and how your repayment plan affects who owns it.

What Is Included In A Mortgage Note

The mortgage note outlines the conditions and responsibilities of the buyer. Youll see sections like these in a mortgage note.

Borrowers promise to pay. This section includes the total amount of money youre borrowing and the name of the lender to whom you will remit payment.

Interest. The interest rate charged on the unpaid principal is listed here.

Payments. Borrowers agree to pay a monthly amount before or on a specific date. The place where borrowers can remit payment is also listed.

Borrowers right to prepay. This section specifies a borrowers ability to pay toward the mortgage principal without penalty.

Loan charges. All charges by the lender must be legal. Any amounts over the legal limit will be refunded to the buyer or applied to the principal.

Borrowers failure to pay as required. Default is clearly defined for the buyer, as are late charges and what happens in the event of default.

Giving of notices. Borrower and lender will have the details of how to contact each other for legal purposes.

Obligations of persons under this note. All people listed on the mortgage note are equally responsible for repayment of the loan.

Uniform secured note. Buyers are advised that a security instrument is signed in addition to the note that protects the note holder from potential losses by giving them the ability to foreclose in case of default.

Also Check: Is 3.625 A Good Mortgage Rate 2020

How To Find The Right Buyer

Now you know the steps of selling your mortgage note, but you may still be left wondering how to sell my real estate note for cash and find the best buyer.

Its enormously important to gauge different buyers offers for your note. After all, the value of a mortgage isnt static it can change from day to day alongside fluctuating national interest rates.

On top of that, you should ensure the mortgage note-buying company you work with has certain qualities that will make you feel at ease offloading your note.

What Is A Promissory Note

A “promissory note” is like an IOU. It contains the borrower’s promise to pay off the debt and the terms for repayment.

- The note includes the loan terms, like the interest rate , the late charge amount, the amount of the loan, and the term .

- A promissory note isn’t recorded in the county land records. The lender holds on to the note.

- The note gives the lender the right to collect on the loan if you don’t make payments.

- When the borrower pays off the loan, the note is marked as “paid in full” and returned to the borrower.

- Only those who sign the promissory note are legally responsible for repaying the lender.

Also Check: What Is A Renovation Mortgage

Find A Note Purchasing Company

Once you’ve decided to sell your mortgage note, it’s time to find a buyer. There are a few major note-buying companies out there so it’s important you consider which will be the best option for you. Depending on your needs, you can go with the company that offers the best payout or one that can close quickly and get you your cash faster.

Tips On Creating Private Mortgage Notes For Investors

The majority of Private lenders are quite experienced professionals in the real estate industry with extensive knowledge of structuring loan agreements. However, most of them do not have long-term thoughts regarding loans, particularly in the form of an exit technique such as selling to investors when drafting their mortgage notes. Some of the necessary things to take note of as a private lender when preparing mortgage notes include:

Selling mortgage notes on the secondary market is profitable to secure private lenders funds and profits. Therefore, it is essential to gather sufficient knowledge about this process. To read more, click here.

Read Also: How Much Is A Habitat For Humanity Mortgage

What If The Borrower Prepays

If a borrower makes early payments in addition to their monthly payments, they may have to pay penalties. These penalties can vary among states. People choose to prepay so that they can pay off their mortgage early or make lower interest payments.

Be sure to investigate your state and local laws to understand if there are laws prohibiting loan prepayment penalties. It may not make financial sense to make early payments or prepay your mortgage.

Getting Help With A Mortgage Note

Because mortgage notes often deal with substantial amounts of money, it’s vital that all the information in them is accurate and correctly reflects the agreement between the parties. Apart from the mortgage, its always best to make sure that other documents like apurchase and sale agreement is in order.

Luckily, manyreal estate lawyers can help buyers and sellers when it comes to buying and selling property and preparing mortgage notes. If you need any more information on mortgage notes or assistance in preparing one, feel free topost a project today in the ContractsCounsel marketplace.

You May Like: Is It Better To Get Mortgage From Credit Union

Key Elements In A Mortgage Note

A mortgage note usually includes:

- Amount of the loan, also known as the principal

- Interest rate for the loan

- Amount of money for the down payment

- Monthly payment amount

- Due dates for mortgage payments

- Repayment schedule for the loan and an estimated final payment date

- Any other relevant terms of the mortgage

How To Sell A Mortgage Note

Here are the simple steps to selling a mortgage note

I want to sell my mortgage note but where do I start? The process is actually very simple for the note seller. Before you begin the note sale process, make sure you have all of the necessary information to receive a mortgage note quote. This will include the property address, the loan amount, the interest rate, the payback period, and the name of the property owner. If you are not sure, or you are missing any information pertaining to the note for sale, please feel free to contact us and speak to a live person to answer your questions directly.

This entire process of selling a mortgage note will take anywhere from 15 days to 30 days depending on the state/property location, the availability of the local appraisers, the availability of the title companies providing the title search, etc. We pay for ALL costs associated with the purchase of your mortgage asset, including appraisal, BPO, and title fees.

Recommended Reading: Can You Add Money To Mortgage For Improvements

What Is A Mortgage

Again, by signing a mortgage, you put the home up as collateral for the loan. Here are some of the main features of a mortgage.

- A mortgage sets out your responsibilities for taking care of the property, like keeping the home in good shape and maintaining homeowners’ insurance.

- The lender records the mortgage in the county land records, creating a lien on the property. The mortgage contains the legal description of the property so that it attaches to that particular property.

- Along with standard covenants between you and the lender, the mortgage contains an “acceleration clause.” This clause permits the lender to demand that you repay the loan’s entire balance if you default, like by not making payments.

- If you don’t repay the entire loan amount after acceleration, the mortgage describes when and how the lender may foreclose.

- The mortgage doesn’t obligate you to repay the loan. You aren’t personally liable for repaying the debt if you sign the mortgage, but not the promissory note.

Some States Use a Document Other Than a Mortgage

Again, some states use mortgages, while others use deeds of trust or another similar-sounding instrument for securing home loans. In Georgia, for example, the most commonly-used contract that gives a lender a security interest in a property is called a “security deed.”

In this article, though, the term “mortgage” covers mortgages, deeds of trust, and other security instruments.

Modifying Or Adjustment Of Terms

For both the borrower and the lender, this is by far the most desirable choice. As it helps the homeowner stay in their home and the investors to gain cash passively without the hassle or cost of maintaining or selling the home. This is particularly feasible if the note is bought at a discount since the lender has more room to be flexible with the loan terms.

You May Like: How Much Mortgage Can I Get For 1400 A Month

Mortgage Notes As Investments

Another fun fact: You can buy other peoples mortgage notes. Mortgage notes can be good investments for those who want to get involved with real estate, but are not interested in the three Ts of landlording: tenants, toilets, and trash, according to real estate investment expert Joel Cone.

Mortgage notes can be purchased through mortgage note brokerages . They can also be purchased in shares of mortgage bundles through real estate investment trusts or other similar products. This is a fairly complicated venture, however, so youll want to do lots of research before you jump in.

What Is A Promissory Note: A Definition

Essentially, a mortgage promissory note is an agreement that promises that the money borrowed from a lender will be paid back by the borrower. The mortgage note also explains how the loan is to be repaid, including details about the monthly payment amount and length of time for repayment.

A mortgage promissory note is a type of promissory note a promise in writing to repay the loans principal plus interest, at a specified rate and length of time to fulfill the promise. Its recorded along with a mortgage deed, which creates a lien on the property.

A mortgage note contains all the terms and conditions of the mortgage loan that will govern the repayment relationship between the borrower and lender. Any terms not contained in the note will not be considered in case of a dispute or mortgage default.

Some states use deeds of trust instead of mortgages. If you live in one of these states, youll receive that legal document instead of a mortgage note.

Recommended Reading: How To Calculate Mortgage Eligibility