Average Mortgage Interest Rate By Year

Mortgage rates are constantly in flux, largely affected by what’s happening in the greater economy. Generally, mortgage interest rates move independently and in advance of the federal funds rate, or the amount banks pay to borrow. Things like inflation, the bond market, and the overall housing market conditions can affect the rate you’ll see.

Here’s how the average mortgage interest rate has changed over time, according to data from the Federal Reserve Board of St. Louis:

| Year |

What Is The Difference Between Apr And Interest Rate

The mortgage APR is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.

Round Up On Your Mortgage Payment Every Month

If youve got enough of a cash flow, and its within your budget, round up to the next hundred dollars on your mortgage every month. Be sure that you notate you want the payment to go towards the principal.

Because mortgages are amortized, this will help lessen the amount of money you pay interest on and by employing this strategy, you can cut months off of your mortgage.

Read more: 3 Totally Doable Mortgage Hacks That Can Save You Money

Read Also: What Is A Va Mortgage Rate

Make Upgrades Easy To Find

Your lender will order an appraisal to make sure that your home’s value matches up with your new loan. One of the factors that influences the value of your property is the type of upgrades youve added to your home since you bought it. Certain upgrades might be a bit difficult for an appraiser to spot on their own.

Be present for your appraisal and give your appraiser a list of all permanent upgrades youve made to your property. Include receipts from contractors, as well as estimates and permits if applicable. Dont be afraid to walk through your home with your appraiser and point out all the additions youve made. This will help increase the overall value of your property.

Be Prepared For Closing Costs

There are transaction fees involved in buying a home. You’ll usually pay them at closing, when you transfer money to the seller and the seller transfers ownership of property. Closing costs can add up to 2% to 5% of the value of your home loan. This guide to closing costs explains what’s included in these fees.

Follow these tips and you’ll give yourself a solid start to home ownership. If you’d like even more information on the home-buying process, look into local first-time home-buyer courses, which can walk you through the process and offer regional tips.

Read Also: What Is The Mortgage On A 3 Million Dollar Home

Read More On Mortgages:

- Which reverse mortgage is right for me?Two lenders in Canada offer reverse mortgagesand while their offerings are similar in many ways, there are key differences you should understand if youre considering one. How much can you borrow? What rates do they charge? Can you pay back the loan at any time? Read on for answers.

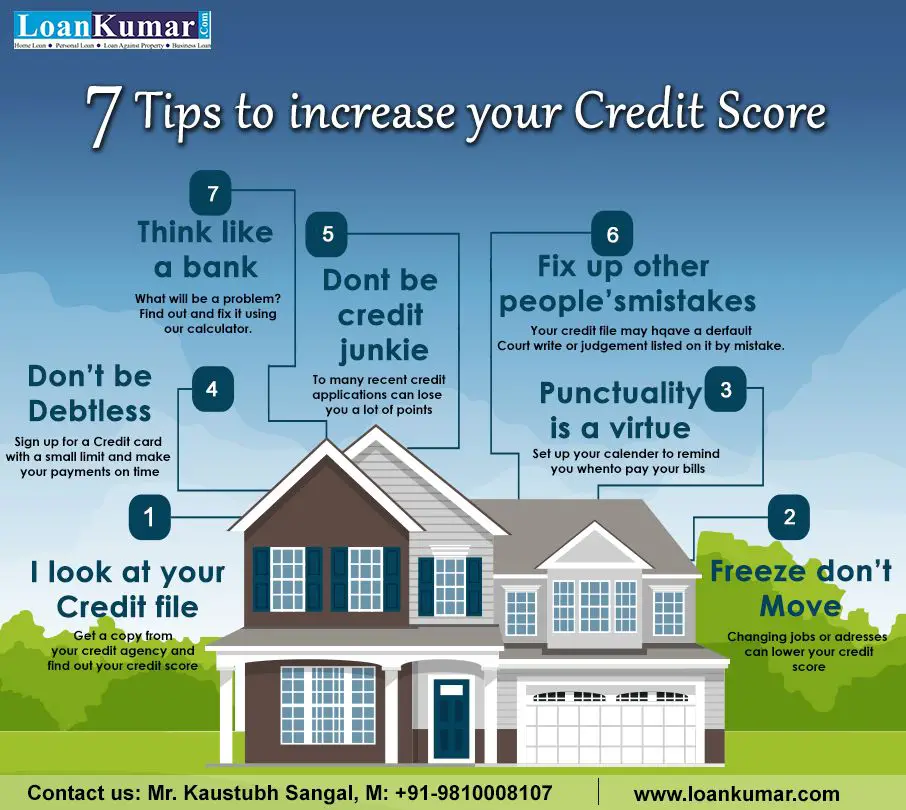

Check And Strengthen Your Credit

Your credit score will determine whether you qualify for a mortgage and affect the interest rate lenders will offer. Take these steps to strengthen your :

-

Get free copies of your from each of the three credit bureaus Experian, Equifax and TransUnion and dispute any errors that could hurt your score.

-

Pay all your bills on time, and keep credit card balances as low as possible.

-

Keep current credit cards open. Closing a card will increase the portion of available credit you use, which can lower your score.

-

Track your credit score. NerdWallet offers a free credit score that updates weekly.

Getting ready to buy a home? Well find you a highly rated lender in just a few minutes.

Enter your ZIP code to get started on a personalized lender match.

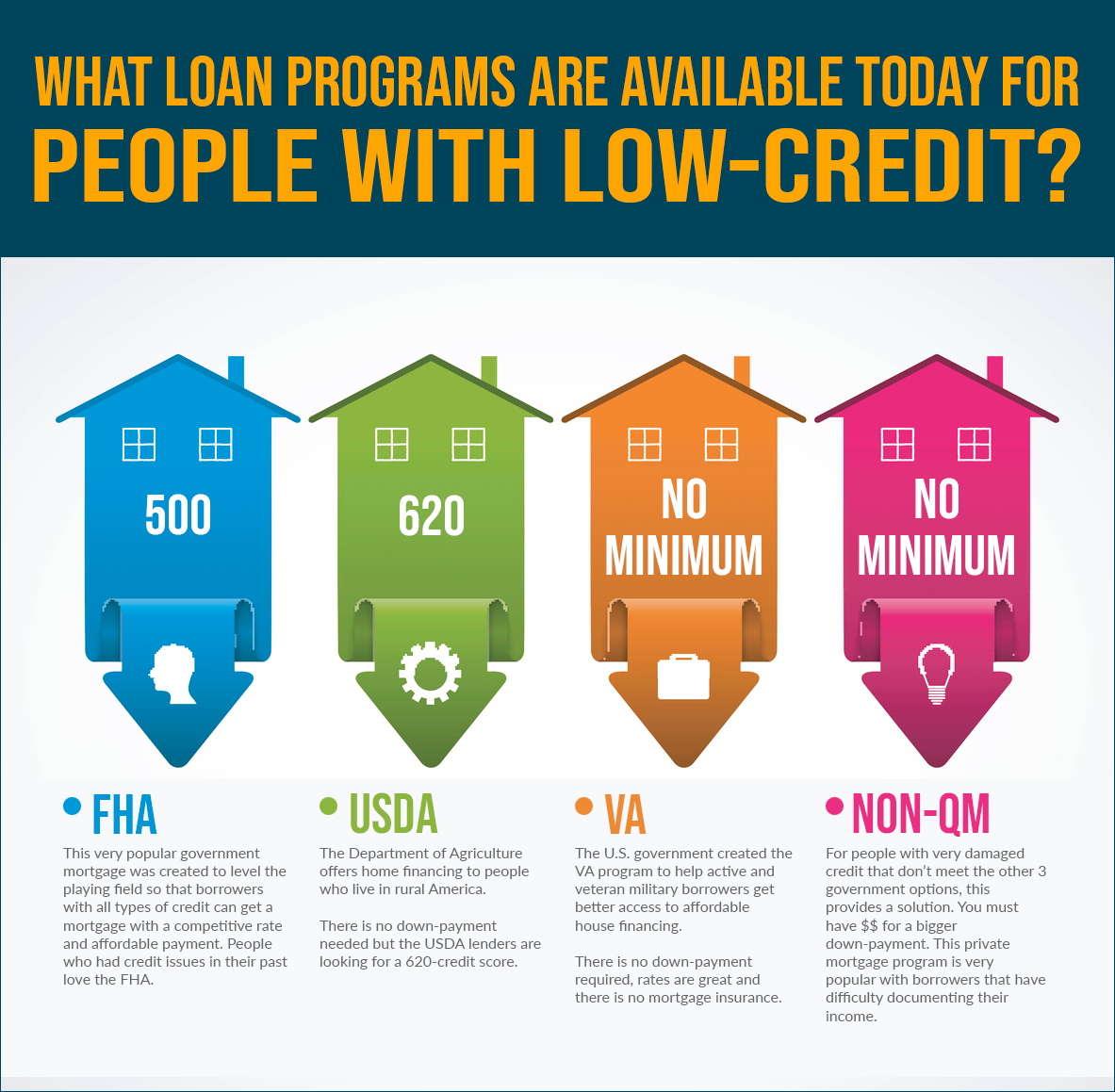

Recommended Reading: Can I Get A Mortgage With A Fair Credit Score

Build A Bigger Deposit As A First

Boris Johnson may be puffing promises of 95% mortgages, but right now there are few available with a deposit that small, leaving many first-time buyers struggling to find loans.

Brace yourself for flash sales, when lenders offer 90% loans for less than a day but potentially with restrictions such as limits on parental contributions, long fixed rates or not lending on flats or new-builds.

If you can scrape together at least 15% of the property value, youll find lower rates and a wider choice.

Find out more: Best mortgage lenders

How Parents Can Help Get Their Child Onto The Property Ladder

Parents and grandparents have been handing over hefty sums to help offspring with property purchases.

Nearly a quarter of homebuyers will rely on the Bank of Mum and Dad during 2020, according to research by insurer Legal & General with family and friends gifting an average of £20,000 towards deposits.

If you want to avoid an outright gift, look out for springboard mortgages, where a parent or grandparent puts money in a savings account linked to the child or grandchilds mortgage. You cant touch the savings for a set period of, for example, three or five years. Afterwards, provided the mortgage repayments are kept up, you can get your money back, often with interest added.

Similarly, depositing savings in an account linked to a family offset mortgage will shrink the interest paid by your child, and therefore increase their chances of passing affordability checks, although you wont earn any interest.

Alternatively, with a joint borrower, sole proprietor mortgage, your income is included when calculating the amount borrowed, but your name stays off the property title. This means you can avoid triggering extra stamp duty now and potential capital gains tax in future.

Just remember that with a joint mortgage, if your child stops paying, youll be on the hook for the payments instead.

Sign up to our newsletter

Receive regular articles and guides from our experts to help you make smarter financial decisions.

Don’t Miss: Can I Get A Mortgage With No Credit

What Is The Total Interest Percentage On A Mortgage

The Total Interest Percentage is a disclosure that tells you how much interest you will pay over the life of your mortgage loan.

You can find the TIP for your loan on page 3 of your Loan Estimate or page 5 of your Closing Disclosure. The TIP is most useful as a comparison point between different Loan Estimates.

The TIP tells you how much interest you will pay over the life of your mortgage loan, compared to the amount you borrowed. The total interest percentage is calculated by adding up all of the scheduled interest payments, then dividing the total by the loan amount to get a percentage. The calculation assumes that you will make all your payments as scheduled. The calculation also assumes that you will keep the loan for the entire loan term.

For example, if you have a $100,000 loan and your TIP is 50 percent, that means you will pay a total of $50,000 in interest over the life of the loan, in addition to repaying the $100,000 that you borrowed. If your TIP is 100 percent, that means you will pay $100,000 in interest over the life of the loan.

If your Loan Estimate is for an adjustable-rate mortgage , the TIP is calculated using current interest rates. The actual amount you pay could be more or less, depending on how rates change in the future.

Start To Shop Around Early

Just how soon can you renew a mortgage? Sure, you may be a few months away from your mortgage maturity date, but they say the early bird gets the worm! This phrase rings especially true with the mortgage renewal process.

While your current lender will likely send you that renewal slip some time in the last 30 days of your mortgage term, you can usually start negotiating as early as 120 days before your maturity date. To ensure youre ready, find the maturity date on your mortgage contract and count 120 days back on a calendar.

If you cant negotiate a better offer with your current lender, this gives you time to start considering switching providers. You may not be able to switch your mortgage over until your actual renewal date arrives, but this gives a mortgage broker time to give you mortgage renewal advice and find the best product. It also allows time to get the paperwork ready, so youre not left scrambling at the last minute.

Recommended Reading: Does Chase Allow Mortgage Recast

A Tip Is Now Required With Your Home Mortgage Loan

Minneapolis, MN, October 3, 2015

Effective immediately, by consumer demand, a TIP is now required when you obtain a home mortgage loan. Borrowers knew that obtaining a home mortgage loan was expensive, but effective October 3rd, 2015 the cost is magnified. Regulations have placed a magnifying glass over the cost of borrowing. Those changes have helped borrowers see the cost of borrowing in a new, clearer way using total interest percentage.

Previous home buyers may remember a big, scary number on their mortgage loan paperwork. That number is officially known as Finance Charge. Finance Charge is defined as: The dollar amount the loan will cost you. Now Finance Charge is being utilized in a new way.

Shop Quickly Review Slowly

Mortgage pricing changes continuously, like stocks, bonds and other financial products.

This means a rate quote from Lender A on Monday morning cant reliably be compared with one from Lender B on Tuesday afternoon. Round up your quotes quickly so that youre making valid comparisons, then take your time reviewing offers.

Mortgage shopping does not have to be a tedious process. Getting written quotes from just three lenders is usually sufficient.

Also Check: Is 3.99 A Good Mortgage Rate

Find The Right Real Estate Agent

Most home buyers work with a real estate agent, especially first-time buyers. As your advocate throughout the home-buying process, they will help you in so many ways, including finding properties and negotiating a fair price.

When you’re ready to find a real estate agent:

- Look for an agent who is familiar with first-time buyers.

- Make sure they work in the area where you’re purchasing your property.

- Check the number of past sales they’ve had in your price range.

And make sure you ask about fees. As a buyer, you do not have to pay a real estate agent. The seller will pay the agent a commission that’s usually equal to 3% to 6% of the value of the home you purchase. For more information, check out our guide to finding the best real estate agent.

Ask For A Better Mortgage Rate

With those little mortgage renewal slips, lenders make it too easy for you to answer the should I renew my mortgage now? question, by providing a quick and easy way to renew. They know youre busy and that youll pay for this convenience. On average, mortgage providers only offer their existing customers a discount off their posted rate on a renewal slip. But this isnt the lowest possible rate, even from your current lender. On top of that, there are usually lower rates available from other lenders.

Negotiating mortgage renewal for a better rate becomes even more important in a rising rate environment. Heres a chart outlining how much you could save by asking for a better rate on a $300,000 mortgage with a 20-year amortization.

| Current Rate | |

| +$358.04 | +$56.57 |

Lets say your mortgage matures next month and that you had previously agreed to a five-year fixed rate at 2.74%. Your current lender may offer you a discount of 0.25% off the posted rate for a new rate of 4.89%.

That would mean monthly payments of $1,953.60. However, shopping around could mean securing a much better rate for the next five years. Maybe youll secure a five-year fixed rate at 2.94%. If you were to qualify at that rate, your monthly payments would be a much more manageable $1,652.13, saving you $301.47 per month.

Don’t Miss: What Is The Lowest Fixed Rate Mortgage

Be Ready To Show Proof Of Income

Mortgage lenders dont really care much about how you earn a living. Dog walker? Showgirl? Professional balloon artist? Cool.

How you make your money is not that important.

How much money you make is.

Mortgage lenders want to be reasonably sure that you can afford to make your future mortgage payment every month. So lenders take income verification very seriously.

Hourly wage-earners and folks with salaried jobs can use their paystubs to help verify how much they earn. But if your employer isnt tracking all of your earnings for you, then youll need to document the money youre bringing in yourself.

Tracking your tip earnings in a notebook or with a spreadsheet is a good idea. That said, your future mortgage lender is going to trust your banking records more than the Moleskine in your pocket.

So make a habit of depositing all of your tips into your bank account. Resist the urge to spend any cash tips before you have a chance to put them in the bank. Is it annoying to track every last penny you earn? Or to put money in the bank before pulling it back out? Maybe. But having good records for your income is important.

What To Consider When Getting A Mortgage

When you shop for a mortgage, your lender or mortgage broker provides you with options. Make sure you understand the options and features. This will help you choose a mortgage that best suits your needs.

This includes your:

- amortization

- payment frequency

You can find information on each of these features in the sections below. For more detailed information on each item, click on the links provided.

Recommended Reading: Who Has The Best Mortgage Loan Rates

Work With A Real Estate Agent

After you have your financing squared away and a preapproval letter in hand, your next step as a first-time homebuyer is to hire a real estate agent.

An experienced real estate agent who knows the area youre looking to buy in especially well can advise you on market conditions and whether homes you want to make offers on are priced properly. Your agent can also identify potential issues with a home or neighborhood youre unaware of, and go to bat for you to negotiate pricing and terms.

As a buyer, it costs you nothing to work with a Realtor, but they can save a lot of time and hassle , Lindsay says.

You can start by asking friends, relatives or co-workers for referrals.

Dont just pick blindly make sure its someone who works in the general area youre looking in and whom you feel comfortable with, Golden says, adding that, despite the competitive market, new listings come up every day, and a good Realtor will be on top of that and get you to see new listings as soon as they become available.

Whats The Difference Between A Loan And A Mortgage

A mortgage is a type of loan, secured with real estate, designed specifically to finance the purchase of a property. So, while all mortgages are loans, not all loans are mortgages.

Here are some of the key differences between a loan and a mortgage:

| Mortgage | ||

|---|---|---|

| Definition | A financial agreement in which the borrower agrees to repay the lender the principal amount borrowed plus interest over a period of time. | A secured loan used to buy a home or property. The home itself is used to secure the loan. |

| Secured/Unsecured | Loans can be secured or unsecured. Whereas secured loans are borrowed against the borrowers existing assets, unsecured loans do not require collateral. | All mortgages are secured loans in which the house or property is used as collateral. |

| Terms | Loans are often offered on shorter terms than mortgages, with most terms ranging from 6 months to 5 years. | In Canada, most mortgages have terms of five to 30 years. |

| Interest rates | Loans generally carry a higher interest rate than mortgages, especially when they are unsecured. | Mortgages typically carry a lower interest rate than personal loans. Several factors influence the interest rate, including the borrowers credit score, income and other debts, and the type of mortgage . |

| Amount available | In Canada, most personal loans range from $100 to $50,000. | The size of the mortgage depends on the price of the property and the size of your down payment. During Q2 of 2021, the average Canadian mortgage was $351,862. |

Don’t Miss: How To Buy A Reverse Mortgage Property

Dont Make Any Large Purchases When Youre In The Process Of Getting A Mortgage

While your home loan is being underwritten, treat your credit like a fragile item and handle it with care. That means you dont want to do anything major, like taking out a car loan or maxing out a credit card on a big vacation. Doing so before closing can affect your credit scores, which could change the terms of your loan or cause your financing to fall through altogether.