Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

See Other Mortgage Types

| Avg. Days on Market | Home Costs as % of Income |

|---|

Methodology A healthy housing market is both stable and affordable. Homeowners in a healthy market should be able to easily sell their homes, with a relatively low risk of losing money. In order to find the big cities with the healthiest housing markets, we considered the following factors: stability, affordability, fluidity and risk of loss. For the purpose of this study, we only considered U.S. cities with a population greater than 200,000.

We measured stability with two equally weighted indicators: the average number of years people own their homes and the percentage of homeowners with negative equity. To measure risk, we used the percentage of homes that decreased in value. To determine housing market fluidity, we looked at data on the average time a for-sale home in each area spent on the market – the longer homes take to sell, the less fluid the market. Finally, we calculated affordability by determining the monthly cost of owning a home as a percentage of household income in each city.

Affordability accounted for 40% of the healthiest markets index, while each of the other three factors accounted for 20%. When data on any of the above four factors was unavailable for cities, we excluded these from our final rankings of healthiest markets.

Movement Mortgage Best For Quick Closing

Overview

The South Carolina-headquartered Movement Mortgage was founded in 2008. Its a licensed mortgage lender in all 50 states and has over 650 branches nationwide.

What to keep in mind

It offers all of the most popular types of mortgages from conventional loans to FHA loans, and niche options, such as reverse mortgages. But if you want any type of home equity loan or line of credit, youll have to go with another lender.

Movement Mortgage prides itself on quickly closing loans, and claims that 75% are closed within seven business days. It also gives a large amount of its profits to charity.

You May Like: Is Quicken Loans A Mortgage Broker Or Lender

Our Mortgage Rate Methodology

Moneys daily mortgage rates show the average rate offered by over 8,000 lenders across the United States the most recent business day rates are available for. Today, we are showing rates for Friday, November 5, 2021. Our rates reflect what a typical borrower with a 700 credit score might expect to pay for a home loan right now. These rates were offered to people putting 20% down and include discount points.

How To Calculate Mortgage Payments

For much of the population, buying a home means working with a mortgage lender to get a mortgage. It can be difficult to figure out how much you can afford and what youre paying for.

You can use a mortgage calculator to estimate your monthly mortgage payment based on factors including your interest rate, purchase price and down payment.

To calculate your monthly mortgage payment, heres what youll need:

- Home price

Recommended Reading: How Are Interest Rates Calculated On A Mortgage

How Much Mortgage Can I Afford

There are many ways to determine how big a mortgage you can afford. However, there are some guidelines Canadian lenders use when evaluating your eligibility for a mortgage.

Your down payment: How much you are able to put down upfront will inevitably impact how big a mortgage you can afford. This is because there are minimum requirements for a down payment in Canada, depending on the cost of the home.

On a home thats $500,000 or less, youre required to put down at least 5% upfront. On a home thats between $500,000 and $1 million, youre required to put down 5% of the first $500,000, and 10% of the rest of the principal. On a $1 million home, youre required to put down at least 20%.

Down payments that amount to less than 20% of a propertys value are called high ratio mortgages and homebuyers need to purchase insurance to guarantee their mortgage. The price of the insurance premium is added to the monthly mortgage payment. Down payments that are at least 20% or more are called conventional mortgages and not require insurance.

Having a down payment that exceeds 20% will help you pay off your loan sooner and save you money in the long run. However, interest rates on high-ratio mortgages tend to be lower than the rates on conventional mortgages. Thats because the added insurance reduces the risk of the bank losing its investment.

What Is The Difference Between A Fixed And A Variable Interest Rate At Td

A fixed interest rate means your interest rate, along with your principal and interest payments, will stay exactly the same during your mortgage term.

With a variable interest rate, your interest rate can fluctuate based on changes in our TD Mortgage Prime Rate. While your payments will remain the same, the amounts from each payment that go toward the principal and interest can vary.

You May Like: Is A Timeshare Considered A Mortgage

Is A Variable Rate Better

If youre comparing a variable rate and a fixed rate at the same point in time, a variable rate will almost always be lower than a fixed rate. Just as how a longer term mortgage will have a higher rate when compared to a shorter term mortgage, borrowers will pay a premium for locking-in a fixed rate.

Historically, variable rates have performed better than fixed rates, as found in a 2001 study by theIndividual Finance and Insurance Decisions Centre. Thats because interest rates have generally fallen over the past few decades, meaning that borrowers with a variable mortgage rate would have benefited from falling interest rates.

In todays low interest rate environment, its not certain if interest rates can continue to decrease further. While the focus can be on the direction of the change, you should also pay attention to how large the interest rate changes can be.

Since variable rates are often already priced at a discount to fixed rates, variable rates would be a better choice if interest rates dont move at all. Variable rates might still be a better choice if interest rates only increase slightly and later on in your mortgage term.

A fixed mortgage rate would be better if you think interest rates will significantly rise in the near future. Many borrowers also place value on the peace of mind that a fixed mortgage rate gives. The slightly higher mortgage rate might be worthwhile in exchange for not having to worry about interest rate fluctuations.

How To Navigate Your Finances In Uncertain Times

The economic outlook has brightened considerably in recent months, but the U.S. economy remains on shaky footing. Heres what you can do to prepare your finances for the next crisis:

- Make a plan. Get your financial life in shape. Determine how much youll spend, how much youll save and how youll tackle high-interest debt. If you plan to buy a home in the future, factor a down payment into your savings plan. Now can be a good time to shore up those funds while you wait for housing inventory to open up or decide where you want to live. Having a bigger down payment can help you get more favorable loan terms and afford more house for your money.

- Build a rainy-day fund. Youll sleep better once youve amassed an emergency fund equal to about six months worth of your expenses. Stash the cash in a liquid and accessible vehicle, such as a high-yield savings account. Shop around for the best rate, and for an account that fits your needs.

- Consider refinancing debt. Mortgage rates have risen slightly from record lows, but millions of homeowners still could shave hundreds of dollars from monthly payments by refinancing. If youre carrying high-cost credit card debt, check if a balance transfer card is right for you.

Also Check: What’s The Average Mortgage Payment

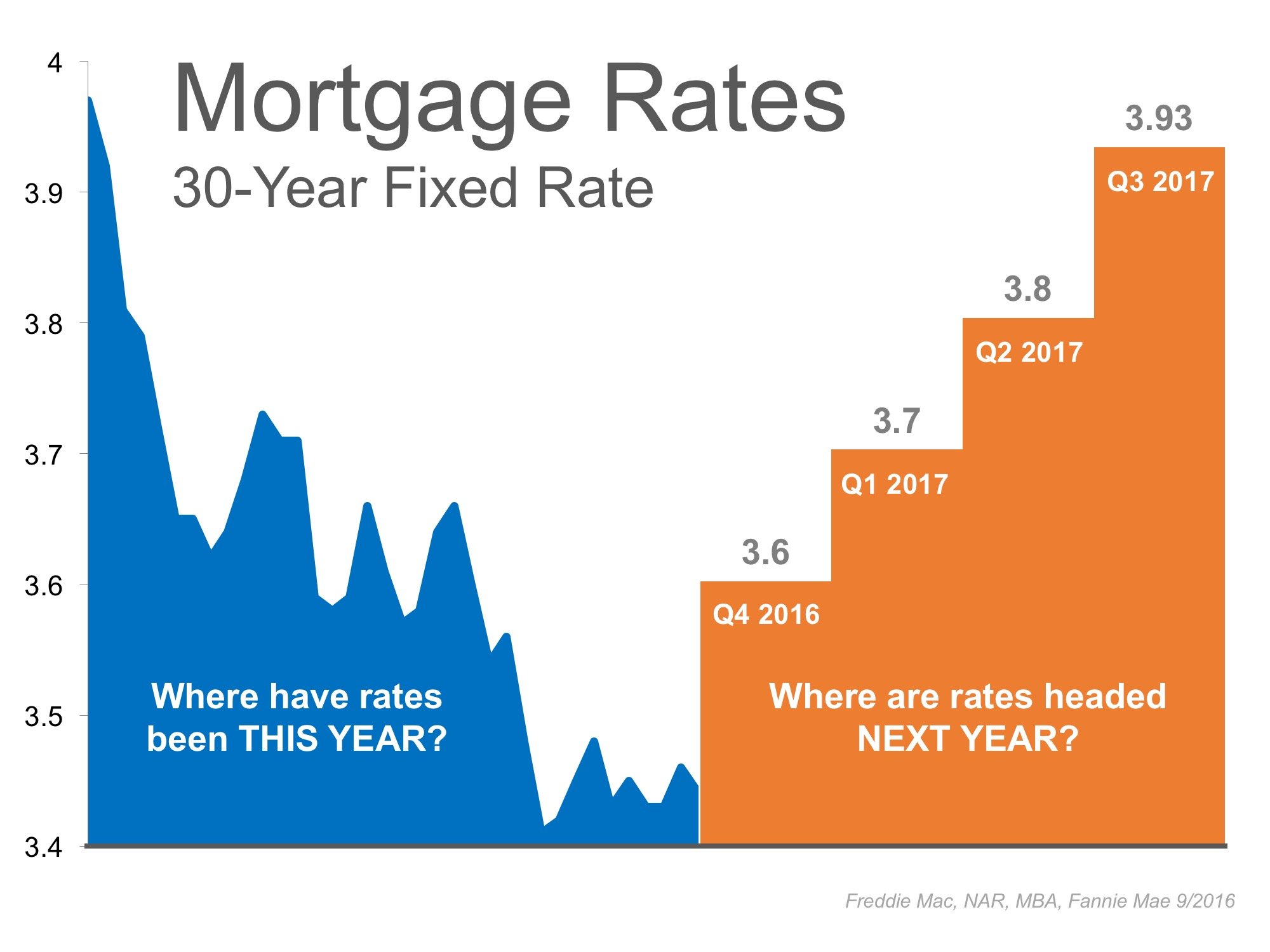

What Are The Mortgage Rate Trends For 2021

The expectation for mortgage rates in 2021 is that they will grow as the economy recovers. However, our economic recovery is unlikely to follow a straight line, so there will be ups and downs along the way.

To start the year, the average 30-year mortgage rate climbed to 3.18% by the end of March. That was followed by a month-long retreat for rates all the way back down to under 3%, before mortgage rates returned to 3% in late May. So even though the long-term overall trend will be rising rates, there will be ups and downs from month to month. But overall, rates are expected to remain historically favorably for months to come.

Comparing Current Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youâll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whoâs suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you donât have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wonât show up on your credit report as itâs usually counted as one query.

Finally, when youâre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

Also Check: What Documents Are Needed For Mortgage Pre Approval

Benefits Of Selecting A 30

Compare 30 Year Fixed vs Other Loans

Estimate fixed monthly payments with this free calculator, or compare loans side by side.

Selecting a 30-year over other options comes with many benefits. Some of the benefits are:

- Fixed Payment â The first benefit of selecting a 30-year fixed mortgage is that it comes with a fixed payment. Many borrowers in the past few years have been enticed to select an ARM which offers a very low initial interest rate. Once these ARMs adjust, many homeowners have found themselves in trouble because they didnât realize how high their payment would be, and the new adjusted payment was unaffordable. With a 30-year, you know exactly what your required payment will be over the course of the loan.

- Build Equity â Another advantage of selecting a 30-year is it allows a homeowner to build equity. Each month, a portion of the payment goes towards paying down the loan, which in turn builds a homeownerâs household equity. Other products, such as interest only loans, do not allow a homeowner to build equity.

- Increased Cash Flow â Another benefit of selecting a 30-year is that it increases your cash flow. While a 15-year comes with a lower interest rate, the monthly payments can be significantly higher than a 30-year. By selecting a 30-year, a borrower could save hundreds of dollar each month which could be invested in higher yielding investments, or spent elsewhere.

Homeside Financial Best Overall

Homeside Financial, which also does business as Lower , offers 30-year mortgages and other types of loans in 42 states and Washington, D.C. It has closed more than 34,000 mortgages and funded more than $7 billion in loans to date.

Strengths: Homeside Financial offers not only conventional and jumbo loans but also FHA, VA and USDA loans. The lender has options for seamless communication throughout the process, either by call, email or text, if you have questions about your 30-year mortgage.

Weaknesses: Homeside Financial isnt available in all 50 states at this time, and it can be tricky to find mortgage rates advertised on its website youll have to contact the lender directly for current rates.

Read Also: What Questions Do Mortgage Lenders Ask Employers

What Are Mortgage Points

Also known as discount points, this is a one-time fee or prepaid interest borrowers purchase to lower the interest rate for their mortgage. Each discount point costs one percent of your mortgage amount, or $1,000 for every $100,000 and will lower the rate by a quarter of a percent, or 0.25. For example, if the interest rate is 4 percent, purchasing one mortgage point will reduce the rate to 3.75 percent.

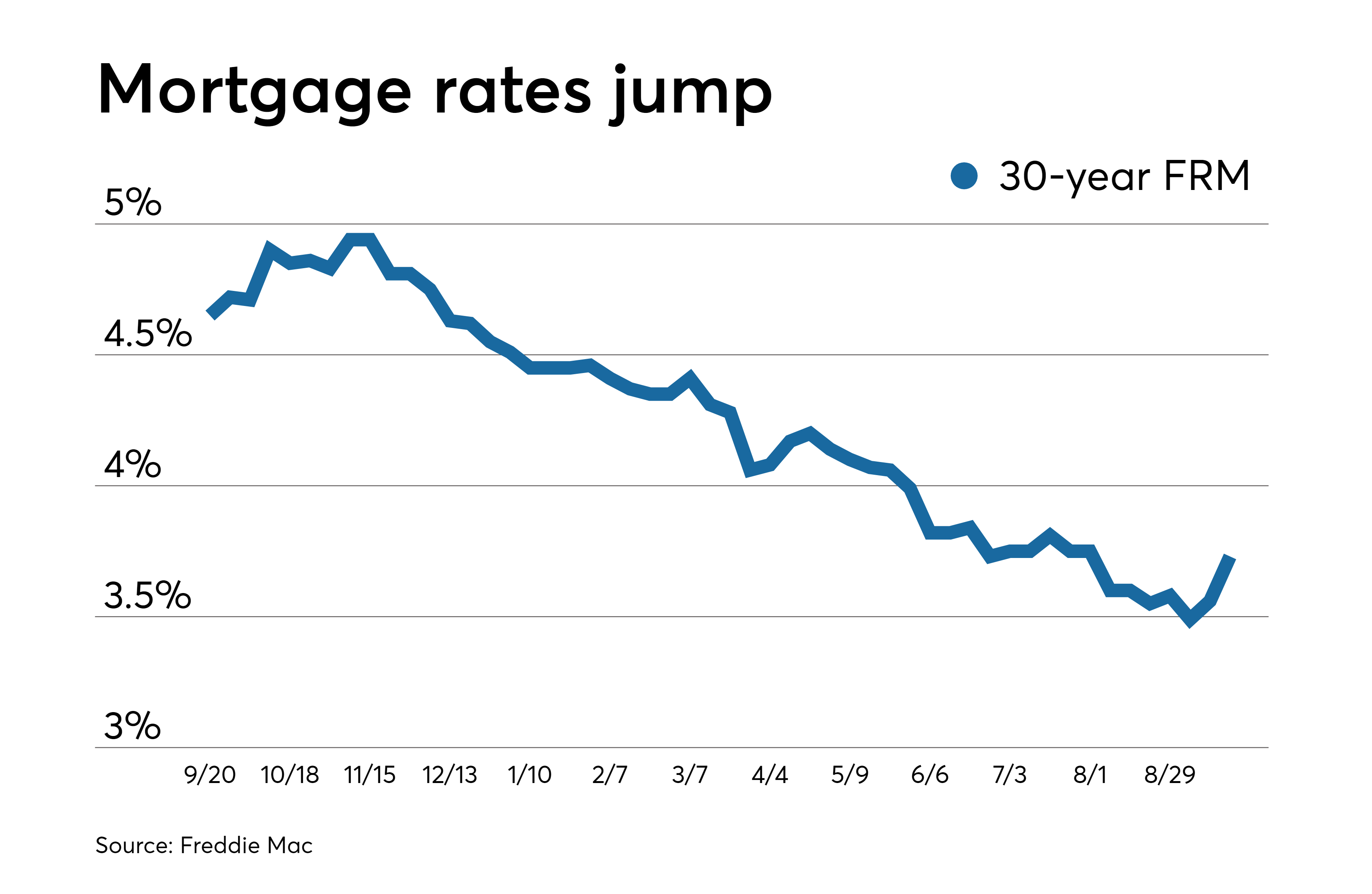

The Best Time To Get A 30

The best time to get a 30-year mortgage is when interest rates are low. Interest rates tend to fluctuate significantly over time. In late 2020 average 30-year rates were below 3%. Prior to the Great Recession rates were above 6% and were as high as 18.45% in October of 1981.

Rates depend on various economic factors, including the following:

Read Also: Can You Get A Mortgage On A Condo

What Does The Future Hold For Mortgage Rates

Mortgage rates plumbed new depths in January 2021, setting all-time lows south of 3 percent. Rates have climbed a bit since then, and their trajectory for the rest of the year depends on the strength of the economic recovery. Given the robust rebound, the Federal Reserve has indicated it will ease back on its stimulus. That sets the stage for rates to rise. However, increases are likely to be gradual rather than sudden. Many mortgage experts expect rates to climb above 3.5 percent by the end of 2021.

Learn more about historical mortgage rate trends.

What Is A Mortgage Interest Rate

Mortgage interest rates reflect lenders cost of money, a cost that they pass on to you in the form of an interest rate. Your rate sets the amount of interest you pay over the life of your mortgage.

Even though nearly all mortgages come with fixed rates these days, small differences in interest rates can drive your monthly payments up or down. Over a 30-year term, that difference can add up. Just $50 a month equals more than $18,000 over the loans term. Knowing how interest rates factor into your loan pricing, as well as how your rate is determined, will help you evaluate your options and make the best decision for your situation.

You May Like: How To Get Approved For Mortgage With Low Income

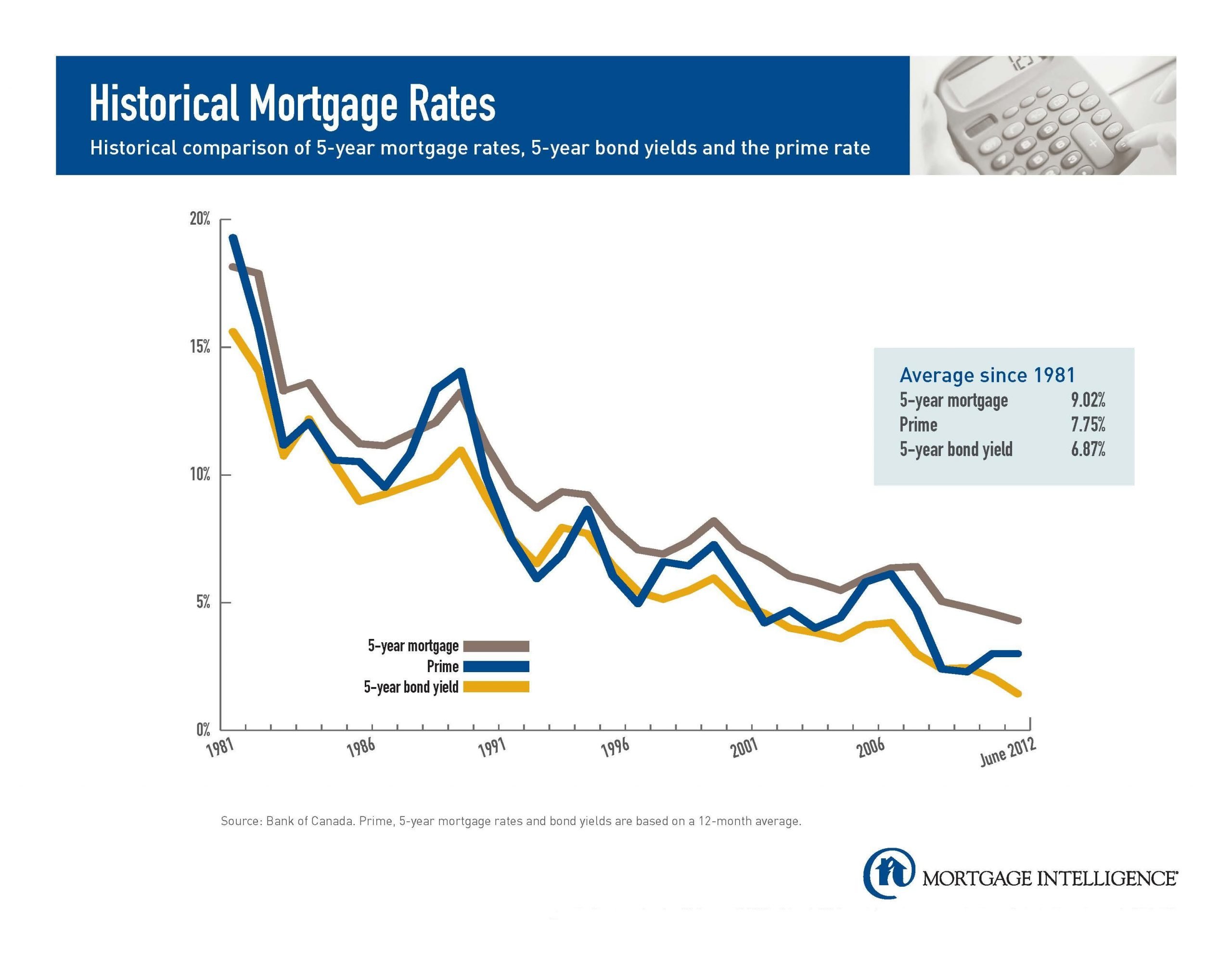

Historical Mortgage Rates: Averages And Trends From The 1970s To 2020

See Mortgage Rate Quotes for Your Home

Since 1971, historical mortgage rates for 30-year fixed loans have hit historic highs and lows due to various factors. Using data from Freddie Macs Primary Mortgage Market Survey , well do a deep dive into whats driven historical mortgage rate movements over time, and how they affect buying or refinancing a home.

How Are Mortgage Rates Set

Mortgage rates are set based on a few factors, economic forces being one of them. For instance, lenders look at the prime ratethe lowest rate banks offer for loanswhich typically follows trends set by the Federal Reserves federal funds rate. Its usually a few percentage points.

The 10-year Treasury bond yield can also reveal market trends. If the bond yield goes up, mortgage rates tend to go up, and vice versa. The 10-year Treasury yield is usually the best standard to judge mortgage rates. Thats because many mortgages are refinanced or paid off after 10 years even if the norm is a 30-year loan.

Factors that the borrower can control is their credit score and down payment amount. Since lenders determine rates based on the risk they may take, borrowers who are less creditworthy or have a lower down payment amount may be quoted higher rates. In other words, the lower the risk, the lower the rate for the borrower.

Also Check: How Much Second Mortgage Can I Afford

What Type Of Mortgage Do You Need

First-time homebuyers can walk into a mortgage brokerage office or visit an online lender without knowing what kind of mortgage they need. But it’s always better to have an idea of what you’re shopping for, especially since you can’t control other factors such as home prices and current rates.

Mortgage loan types include:

How Do I Get The Best Mortgage Rate In Canada

The surest way to secure the best mortgage rate from lenders in your area is to compare the market. Most lenders wont offer you their best rates upfront, which can mean hours on the phone negotiating your contract. At LowestRates.ca, we aggregate the best rates from banks and brokers across the country and let them compete for your business. Get started by beginning a form with us.

You May Like: How Much Is Personal Mortgage Insurance

Interesting Facts About Fixed Mortgage Rates In Canada

Current fixed mortgage rates are encouraging many people to buy homes in Canada, but there are some trends that suggest people are preferring shorter loan terms. For example, about 40 percent of all Canadian homeowners in 2012 held a loan with a 5-year term. Today, only about a third of all homeowners would consider a loan of up to 10 years. This is a change from past decades in which the 10-year loan was the most popular fixed-rate mortgage option. Clearly, many people believe that they can get the best fixed mortgage rates on loans that have terms of 10 years or less.